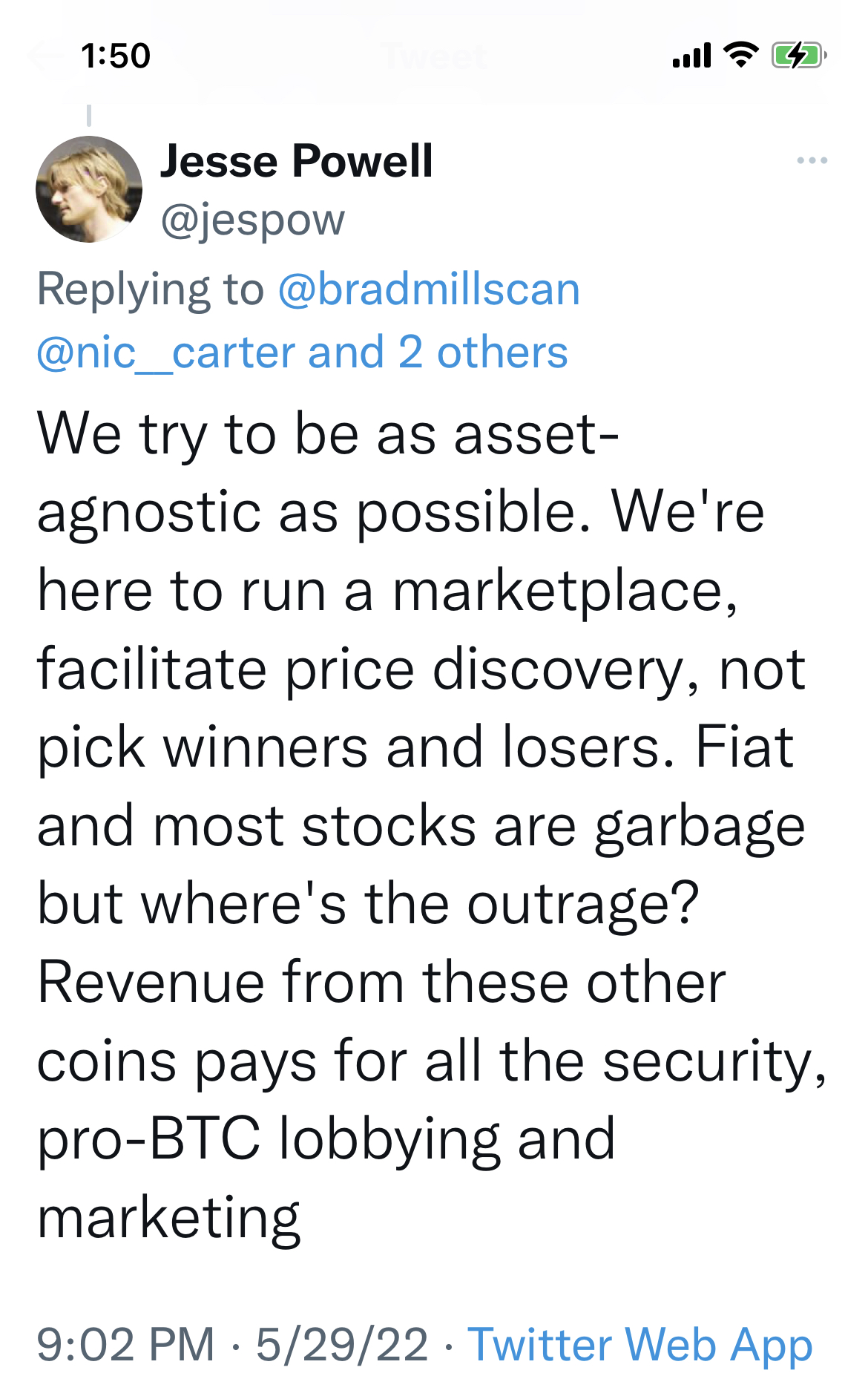

| As governments wrestle with how to regulate crypto, the return of Luna — the token supporting the reconstituted Terra blockchain — has sparked a debate about who's really in charge of protecting consumers from buying into ill-advised projects. Without hard rules in place, crypto exchanges are the industry's de facto gatekeepers because they choose which tokens to list for trading. But some critics question whether it's appropriate for these marketplaces to be deciding on such issues. A case in point, they say, is Luna 2.0 — formed from the ashes of a $40 billion project that collapsed earlier this month as a result of inherent flaws. Jesse Powell, chief executive officer of crypto exchange Kraken, took to Twitter on Sunday to defend his platform's listing of new Luna, citing client demand as the main justification. "There's a weird dynamic with exchanges," he said, adding that customers will often take their business elsewhere if they can't access every asset or service in one place. "Listing isn't an endorsement." Kraken isn't alone: Countless major exchanges also have opted to assist Luna's developers in the "airdrop" of new tokens to prior investors over the weekend. But Rohan Grey, assistant professor of law at Willamette University, told Powell that his reasons were "just punting responsibility for your own ethical choices to others."  Source: @jespow "Listing absolutely *is* an endorsement," Grey said in a reply on Twitter, echoing sentiments expressed by crypto cognoscenti including Castle Island Ventures' Nic Carter and Dogecoin co-founder Billy Markus. "If your view is it's ethically acceptable to hock shit because your customers are too fickle for you to exercise any discretion and hope to keep them, then you need to target a better customer base or up your retention game." Advocates, though, could make an ethical argument for exchanges aiding the Luna airdrop. At present, it is one of the only routes available to investors in the old Luna, now known as Luna Classic, or its sister token TerraUSD to gain some form of compensation over the money they lost when both assets went to zero. While betting on the value of new Luna to rise is a gamble, it's better than nothing — and even as trouble with the process has seen some traders not get the amount they were promised, at least it was handed to them at little extra cost. Issues with pricing across exchanges abound, however, proving the launch of a new cryptocurrency can still be highly speculative. Though crypto exchanges are petitioning regulators to reduce their role as the sentries of DeFi, their current freedom over listings might be investors' only chance at slightly sweeter future. It's not the ideal situation traders might have hoped for, but it's all they've got. |

No comments:

Post a Comment