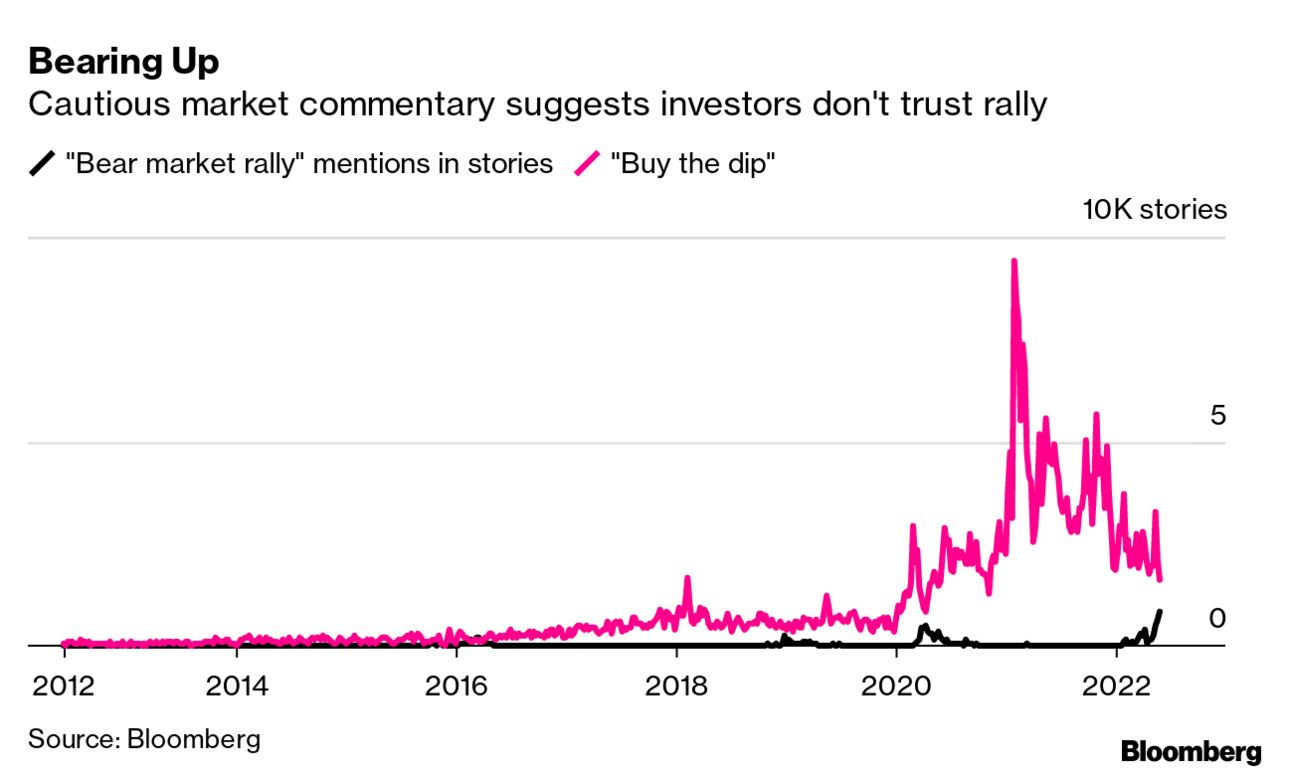

| Good morning. DWS replaces its CEO, US to send rockets to Ukraine, Biden meets Powell, and Yellen admits she was wrong. Here's what people are talking about. DWS replaced its embattled Chief Executive Officer Asoka Woehrmann just hours after a police raid in a probe of alleged greenwashing at the asset management unit of Deutsche Bank. Law enforcement officials on Tuesday morning entered the twin towers in Frankfurt where Germany's largest lender is headquartered, as well as the nearby premises of DWS. The police probe of potential greenwashing underscores the growing scrutiny of money managers as global demand for ESG investments soars. President Joe Biden said he'll give Ukraine advanced rocket systems and other US weaponry to better hit targets in its war with Russia, ramping up military support as the conflict drags into its fourth month. The package of weapons includes missiles that will allow Ukraine to strike locations as far as 80 kilometers away. World leaders including British Prime Minister Boris Johnson have publicly called for such a move in recent weeks. President Joe Biden used a rare meeting with Federal Reserve Chair Jerome Powell to declare that he's respecting the central bank's independence - while simultaneously shifting responsibility for taming decades-high inflation ahead of the November midterms. Biden seized on the Oval Office session to argue that while fighting price increases is his top priority, that work was primarily the purview of the US central bank. Treasury Secretary Janet Yellen gave her most direct admission yet that she made an incorrect call last year in predicting that elevated inflation wouldn't pose a continuing problem. "There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that at the time I didn't fully understand," Yellen said in an interview aired Tuesday on CNN. European stocks are on track to gain as Asian shares fluctuated, with investors weighing China's easing Covid curbs against inflation pressures. ECB Governing Council member Klaas Knot gives a keynote speech at the Bank of International Settlements' "Green Swan" conference. People's Bank of China Governor Yi Gang, ECB President Christine Lagarde and other central bankers also speak at the virtual event. The Fed is set to start shrinking its $8.9 trillion balance sheet and releases its Beige Book report. There's a flurry of S&P manufacturing PMI data ahead for countries including France, Germany, Netherlands and Italy. Dr. Martens, Chewy and GameStop are among firms reporting earnings. This is what's caught our eye over the past 24 hours. Distrust of any tentative rebound in global stocks is at the highest in a decade. News story mentions of ``bear market rally'' are at the most since at least 2012, while those containing ``buy the dip'' have slumped to the lowest since 2020. That's according to articles from all sources that have appeared on the Bloomberg Terminal. Risks to the global economy and corporate earnings from stubbornly high inflation are the most commonly cited reason for the pessimism, with analysts from banks and investment firms including Morgan Stanley, Bank of America and Oppenheimer expecting more losses in stocks ahead. For Gavekal's Anatole Kaletsky, Russia's invasion of Ukraine was the tipping point for triggering a new investment era, turning him ``from a permabull to an unequivocal bear,'' according to a note this week. Stock bulls will counter that ``buy the dip'' stories still outnumber ``bear market rally'' ones by about two to one. And bear-market rallies can be intense. But the wall of worry global equities need to climb looks to be rising faster than the stocks themselves.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. |

No comments:

Post a Comment