| Read in browser | ||||||||||||||

Happy Super Bowl Sunday, part of what Comcast's NBCUniversal is calling Legendary February. NBC has the Super Bowl, the Winter Olympics and the NBA All-Star Weekend all within a couple of weeks. It's part of a massive bet on sports by Comcast's co-chief executive officers, Brian Roberts and Mike Cavanagh. Hannah Miller spoke to Cavanagh, as well as his top deputies, about the company's vision for its entertainment business. Comcast just spun off a bunch of cable networks and bowed out of the bidding for Warner Bros. Discovery. PSA: Bloomberg is going to set up shop in Miami in late April for the Formula 1 Miami Grand Prix. I am debating going and doing some on-stage interviews, so give me a shout if you will be there. You can find out more here. Five things you need to know

YouTube's pitch to football fans: A sports-only TV packageOver the next few weeks, YouTube will start selling smaller, less-expensive bundles of live TV channels tailored to sports fans and news junkies. The sports plan, which will include all of the broadcast networks, as well as some programming that was previously exclusive to streaming, will be $65 a month – a 22% discount to the larger YouTube TV plan of $83 a month. There are more than 10 plans, including a sports and news plan and an entertainment plan. TV providers have dreamed of doing this for years to placate customers unhappy about paying for channels they don't watch. But it took a long time for network owners like Walt Disney and NBCUniversal to relent. The pay-TV business has lost more than 30 million customers over the last decade, according to researcher MoffettNathanson. The numbers would be worse without YouTube TV, which now has more than 10 million paying subscribers, according to MoffettNathanson. That makes it the third-largest pay-TV operator in the country behind Charter and Comcast. YouTube TV is part of a growing portfolio of paid businesses that include YouTube Premium, subscriptions to individual YouTube channels and services from others like Paramount+. Once a free way to watch Saturday Night Live clips, music videos and user-generated content, YouTube now operates one of the largest subscription media businesses. The company generates about $20 billion from subscriptions — making the business larger than Spotify. Including advertising, Google's online video unit generated more than $60 billion in revenue last year – more than Paramount, Warner Bros. Discovery, Netflix and even Disney's media businesses.  Christian Oestlien is one of the architects of YouTube's subscription strategy. A Norwegian by way of Italy, Brazil and the United Kingdom, he is the vice president in charge of subscription products – as well as podcasts and commerce. On the eve of the Super Bowl, I spoke with Oestlien about the future of YouTube TV, his company's interest in buying an NFL package and YouTube's friendly competition with Netflix. Our conversation has been edited for length and clarity. How did YouTube get people to start paying? The current version of our subscription business began about a decade ago when we launched YouTube Red, which ultimately became YouTube Premium. The investment there has largely been around building a less-interruptive version of YouTube, but also packaging in a lot of cool features. Our ambition at YouTube is really to try and be the home of all video. There was a whole portion of media consumption, in particular in the US, that wasn't on YouTube that was being distributed through traditional linear television. We made that investment in building out YouTube TV, which launched in 2017. Those two businesses have been the engines that have driven this dual-revenue model. You mentioned YouTube Red, in which you initially invested in premium, original storytelling. What did you learn from YouTube Red? It takes a lot more money than we invested at the time. We had an interesting strategy where we took creators and tried to put them in specific unique stories. We had mixed success there. One of the great things about YouTube is that our audience is much better at picking success or picking the hits than we are. That's probably the core learning. Is YouTube TV profitable? I don't think we disclose financials, but I will say if you looked at public estimates on the size of YouTube TV and then just looked at our price point, you can get a rough estimate of how the business is doing. (Analysts estimate YouTube TV will generate more than $10 billion in sales this year.) Top line, it makes a lot of money. We care quite a bit about the sustainability of that business. It's one of the reasons I think you've seen us have some more challenging and protracted negotiations, some of them that have played out in public. And then from a subs perspective, YouTube Premium is far and away our biggest success. You've more than doubled the price of YouTube TV since it launched. Why is it so hard for anyone to offer a live TV service that's considerably cheaper than peers in the marketplace? When we first started with YouTube TV, we actually approached our partners with the idea that we would just do a bundle of the broadcast networks at like a $10 to $15 price point. Our partners distribute more than just their broadcast channels. They have a large portfolio of cable networks that they package together with that. We would very much want to go in the direction of smaller packages at lower price points. This is the first opportunity we've had to give our consumers pricing relief and more tailored packages. What are the plans and how did you select the pricing and the composition? There will be just over 10 plans. They'll be based on three main categories – sports, news, and entertainment. And you'll be able to buy each one of those plans individually. One of the things that's exciting about this is finally being able to deliver a standalone sports plan. Do you feel like your sports package has enough? If you're a sports fan, can you get everything? This is the most complete sports product that's put on the market to date. We will have all of our major broadcast partners. And we're pulling a lot of the content that had been made exclusive to their [streaming] services into YouTube TV. NBC is relaunching the NBC Sports Network with us. We're going to be pulling in the entirety of the sports content that sits within ESPN Unlimited. Is it going to be enough of a discount for sports fans? $64.99 is a pretty compelling price point. It's almost $20 off. If you could pick only the networks that you actually want to carry, how many networks would be in the bundle? Fewer than today. The one-size fits-all model doesn't work anymore. It's broken. It's one of the reasons the ecosystem has had the challenges it's had. What do you make of Netflix doing deals with YouTube creators and podcasters? Just last year co-CEO Ted Sarandos said YouTube is just where people kill time. It's great for the podcasters that are on YouTube, for the creators that are on YouTube. It's a wonderful thing that they're receiving this validation about how high-quality their content is. I've always interpreted the comment that people waste time on YouTube as a bit tongue-in-cheek. You can literally go on YouTube and learn linear algebra, physics, cooking. The fact that other services are seeing the strength of our creators and investing in them is a real sign of the strength and success of the platform that we've built. So you aren't worried about particular shows or creators leaving the platform? Most creators never actually leave the platform. They go on and do new things with other partners. We would hate to see creators pull their programming from YouTube. We think it's a mistake on their part and we spend a lot of time trying to educate creators and partners on the value of always maintaining a relationship with their fan base on YouTube. Can you explain how your deals with the NFL and the Academy Awards fit into the strategy? We've been the No. 1 streaming platform now for three-plus years, and we see a lot of these opportunities emerge where we can work directly with leagues, with rights holders and create experiences that are unique to YouTube. One of the reasons we were really excited about doing the game in Sao Paulo is for the first time we were able to bring a whole new generation to the NFL by incorporating creators throughout the program while still trying to make sure for the core NFL fan base we're delivering kind of the game that they've known and loved. It's similar with the Oscars. We see an incredible opportunity to partner with the Academy to help them rethink the Oscars. The history of cinema really sits with them. We are excited about the idea that we can be complementary to cinema, get people excited about movies in the movie theaters again and use YouTube as a platform to highlight the incredible skills and talents of everyone that's involved in the Academy. You don't have to think of the Oscars anymore as constrained to a two-to-three-hour linear experience. What if it was something much bigger that lived throughout the year? I think a lot of people are worried that the Oscars on YouTube means it's going to be a five-hour show. That is not the goal. Given the growing partnership between YouTube and the NFL, would you bid for the next package when they open up the rights this year? We really value our partnership with the NFL. Everything we've done with them so far has been really successful. And so we're very excited about the idea that we could be doing more with them. A lot of Hollywood producers feel they need to figure out YouTube. Are you open to funding programming? I want the creative community, studios of all sizes – independent production, as well as the majors – I would like all of them to view YouTube as an incredible distribution and business opportunity. How can we evolve the platform to really be a place where anybody who's taking a movie to Sundance might look at us as a potential distribution platform or an opportunity to go direct to consumer? But someone who takes a movie to Sundance expects to get paid a bunch of money for the rights? But not everybody does, right? Somebody who maybe was less successful at Sundance, there's still an audience that would love and be excited to see what they've done. And YouTube has over 2 billion of those people every single day. Could you keep some of that programming only on YouTube Premium? There are a whole number of business models you could think of. Premium is one of them, but you could also think of a studio that has a very specific fan base that's very passionate about a particular category. Those types of production companies and studios have a real opportunity to build fandom on YouTube, whether they put it up there for free and monetize through our traditional advertising revenue share or behind a subscription or a rental fee. You've spoken about wanting to have as many partners as possible on the platform. Is there a partner or subscription that you don't currently offer that you wish you could? Well, I'm excited that Netflix increasingly sees the value of YouTube. Maybe one day Netflix will want to be a part of YouTube. They have a great channel and they do a lot of marketing on our platform and are really successful. What are the odds of being able to buy Netflix via YouTube in the next five years? Low, but I am eternally optimistic. The best of Screentime (and other stuff)

Disney isn't suddenly a theme park companyJames Gorman was named chairman of the Disney board to solve the company's long-festering succession problem. He did so by replicating the strategy he employed at Morgan Stanley, giving the top job to one candidate, Josh D'Amaro, while giving the runner-up, Dana Walden, a big promotion. The ascension of D'Amaro has prompted a lot of people to pronounce Disney a theme-park company. The Experiences division accounts for the largest share of the company's profit – and most of its forward-looking investment. That is a big reason D'Amaro got the top job, but far from the only one. His virtues have been extolled in several profiles over the last week. Labeling Disney a theme-park company misses the point. Disney's studio remains the engine of the business. Disney's two largest divisions – experiences and streaming – depend on the characters and stories produced by its studio. Disney is one of the only major media companies where box office performance can still influence its stock price. That studio is also now under new management. Walden previously oversaw a lot of creative output of the company, but not the classically Disney parts. Her appointment as president and chief creative officer raises a few questions. Will Alan Bergman, currently co-head of entertainment, report to Walden? How do the heads of Marvel, Lucasfilm and Pixar feel about their new boss? The good news for both D'Amaro and Walden is that most people at Disney just seem relieved the board finally made a choice and ended such a long period of uncertainty. Paramount's Warner Bros. playbookParamount Skydance is working overtime to convince regulators to approve its deal for Warner Bros. Discovery so that it can persuade Warner Bros. shareholders to reject the Netflix deal and take theirs instead. The Justice Department is investigating both deals and is just getting started interviewing rivals and business partners. Both Netflix and Paramount face regulatory reviews abroad as well. Paramount is expected to complete a step before Netflix — clearing the waiting period on the DOJ's request for information — which the company will use to woo shareholders. That clearance does come with a catch. Paramount doesn't actually have a signed deal with Warner Bros. If it changes its offer, Justice would likely need to examine that deal. President Donald Trump said last week that he will stay out of the process. Just a couple months ago he said he would be very involved. While Paramount CEO David Ellison appealed to European regulators, Netflix co-CEO Ted Sarandos took a beating from Republican senators at a hearing this past week in Washington. Most of the attacks were performative politics that had little to do with antitrust. Both Republicans and Democrats are worried about how either deal would impact employment in Hollywood. Warner Bros. CEO David Zaslav skipped the Senate hearing, but he did visit a couple of European politicians on his way to the Winter Olympics. (His team even sent photos.)  Warner Bros. Discovery CEO David Zaslav and UK Secretary of State for Culture, Media and Sport Lisa Nandy in Berlin on Feb. 5. Source: Warner Bros. The No. 1 album in the US is…Megadeth's Megadeth. The heavy metal band sold 68,587 copies of their new album in one week, which gave it the edge over Morgan Wallen and Olivia Dean. Streaming activity was very low. Deals, deals, deals

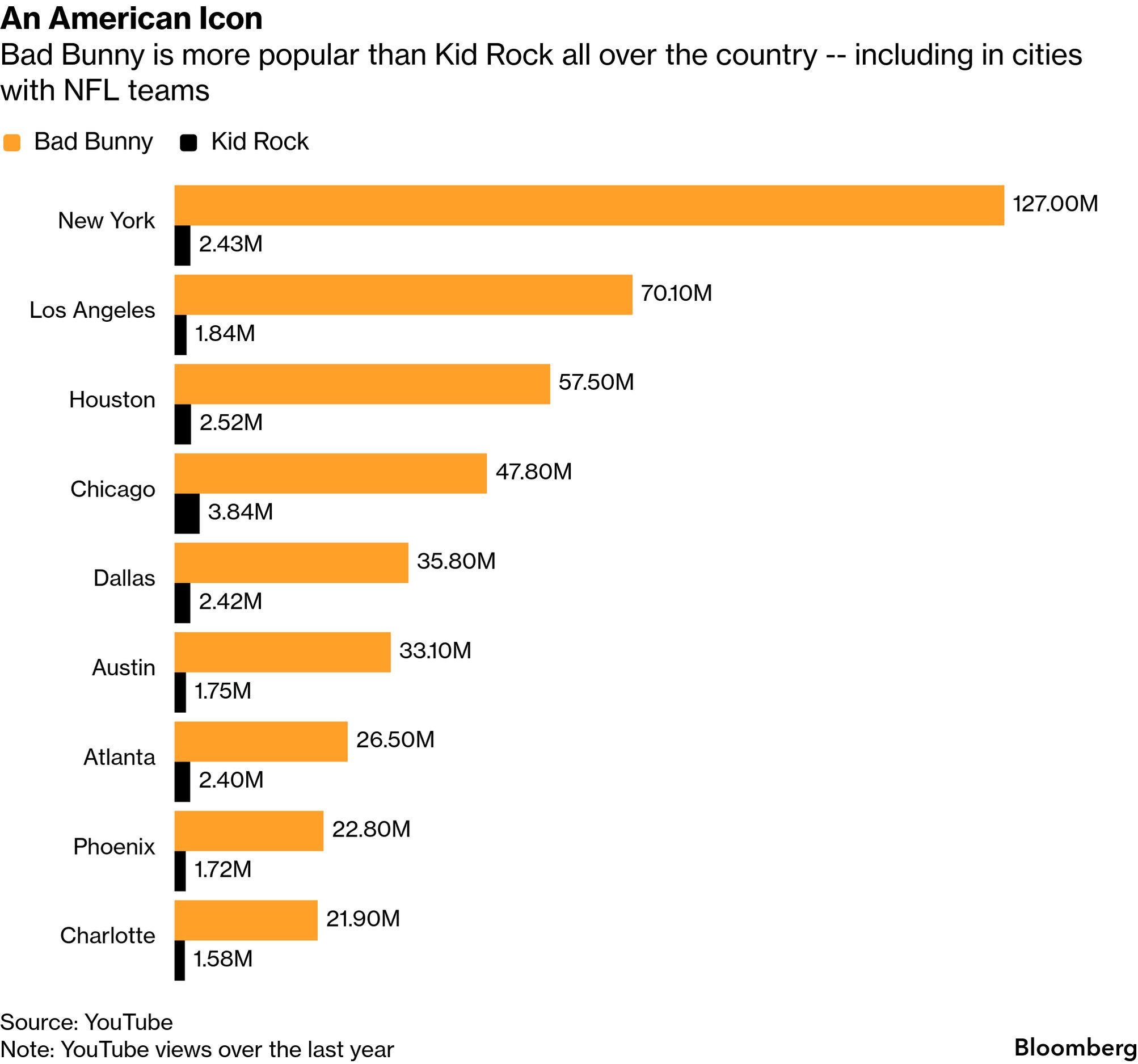

Weekly playlistI am going through a lot of old playlists and stumbling on songs I haven't heard in a while — Charlotte Gainsbourg, Caribou, Beck, Jenny Lewis and Charles Bradley all got me through a week of illness. Having written about Bad Bunny for a long time, I am eager to see his Super Bowl halftime performance. (Topping Kendrick Lamar is going to be tough.) The backlash to his performance — from people upset that someone who performs in Spanish is headlining the most American of sporting events — is confusing. He is not a niche artist, or a coastal artist. His music videos on YouTube over the last year generated 1.56 billion views — compared to 158 million for Kid Rock, who is performing the alternate halftime show. If you look at the markets where his music is most popular, it looks like a list of the biggest cities in the country: New York, Los Angeles, Houston, Chicago and Miami are the top five. The northeast (New York), mid-atlantic (Philadelphia), midwest (Chicago) and southeast (Orlando) all appear in the top 10, as do San Francisco and three cities in Texas.  Bad Bunny isn't just the most popular artist in the world (per Spotify). He's one of the most popular acts in the US — all over the country. If you don't yet subscribe to this newsletter, fix that. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Sunday, February 8, 2026

YouTube’s $20B surprise, Disney’s new CEO, Paramount ups the ante

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment