| Read in browser | ||||||||||||||

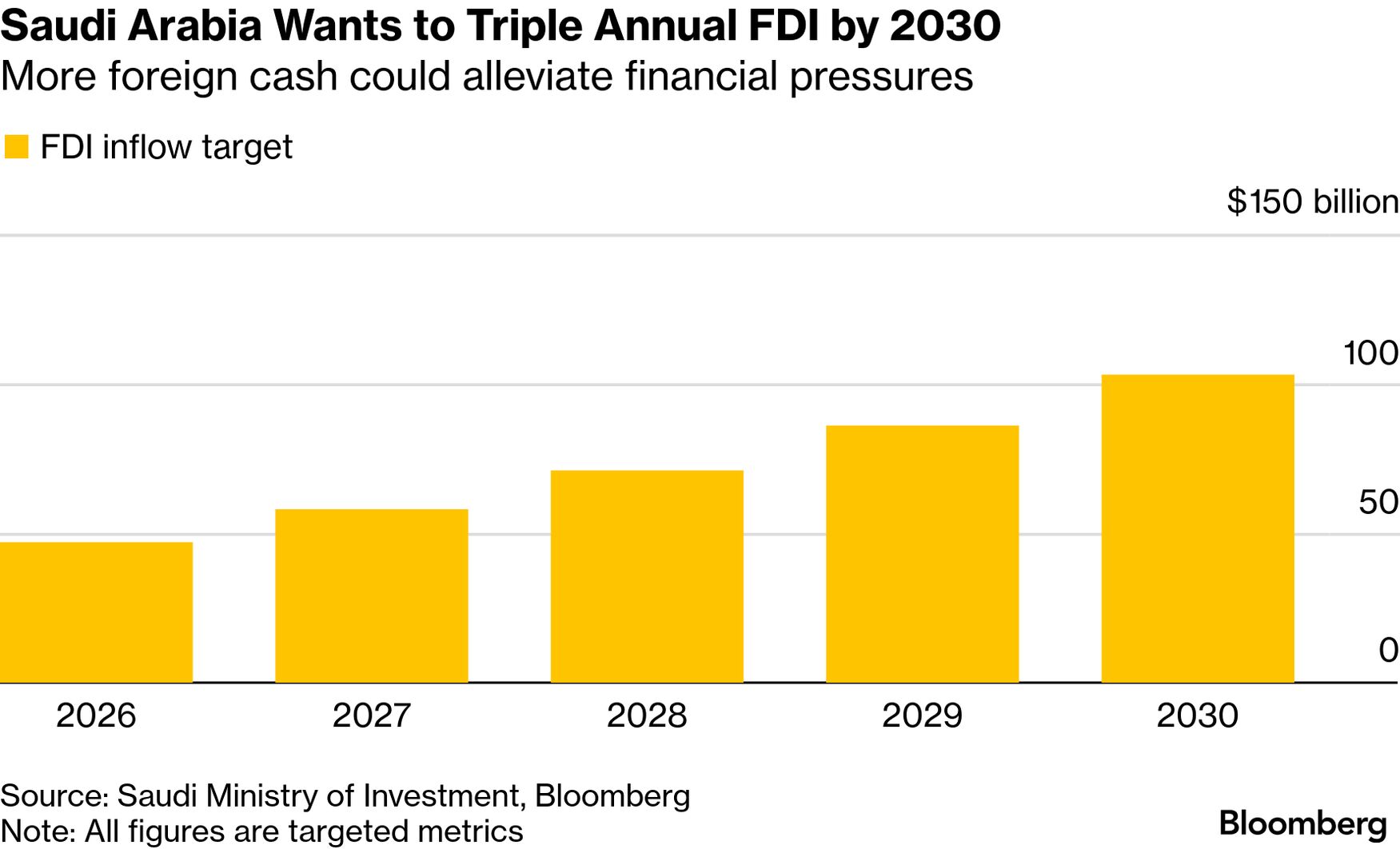

Welcome to Balance of Power, bringing you the latest in global politics. If you haven't yet, sign up here. Donald Trump's apparent embrace of a weaker dollar may be giving Xi Jinping an opening to realize a dream — making China a genuine financial superpower with a global currency. A 2024 speech by Xi published over the weekend shed light on his thinking about what constitutes a strong financial nation. Top of the list is a "powerful currency" with global-reserve status that punches its weight in international trade and foreign-exchange markets. That's a rare public revelation of the president's long-term vision for the yuan, even if the country has been striving for years to promote its worldwide appeal. It's part of a broader effort to make China's financial system more competitive and secure. That's important because rivalry with the US could bring unprecedented risks — a lesson learned in Beijing after Washington weaponized the dollar to punish Russia following its full-scale invasion of Ukraine. The timing of the speech's publication suggests Chinese authorities are looking to accelerate the internationalization of the yuan as faith in the dollar wobbles. Trump has repeatedly expressed his desire for a weaker greenback to help boost US manufacturing competitiveness. He fueled its slump last week by saying that the currency's level was "great."  WATCH: Trump said last week he didn't think the US dollar had weakened excessively, sending the currency to its deepest one-day drop since last year's tariff rollout. Tyler Kendall reports on Bloomberg TV. There's since been some pushback. Treasury Secretary Scott Bessent touted a strong-dollar policy, and Kevin Warsh's nomination as the next Federal Reserve chair lifted the currency. Nonetheless, China may be well positioned to benefit from any long-term shift away from the dollar. About a third of China's bilateral trade in goods is now settled in yuan, bringing the share back to its 2015 level. To be sure, China's central bank will likely continue to guard against any big swings. Stability is considered a key factor in a currency's international appeal. For all his America First bluster, Trump's disruptive policies may be playing into the hands of rivals like China, who are only too eager to exploit US weakness wherever they see an opening.  Trump and Xi in South Korea in October. Photographer: Andrew Caballlero-Reynolds/AFP/Getty Images Global Must ReadsIran's supreme leader warned of a "regional war" as tensions continued to mount over potential US strikes on Tehran and top Israeli military officials visited Washington. Trump signaled Ayatollah Ali Khamenei's threat didn't surprise him and said he's hopeful the two sides will "make a deal," while the Islamic Republic's foreign ministry expressed hope diplomatic efforts will bear fruit within days. Prime Minister Narendra Modi's plan to protect India's economy from Trump's tariffs came into sharper focus in an annual budget announcement. It offered support for exporters battered by US levies, backed strategic sectors like rare earths and semiconductors, and pledged new outlays on infrastructure as well as an 18% hike in defense spending — a bulwark against China and Pakistan. Japanese Prime Minister Sanae Takaichi's public support remains solid while a new opposition alliance is struggling to resonate with voters, opinion polls over the weekend showed, positioning her party for a comfortable majority in the lower-house election on Feb. 8. A survey by the Asahi newspaper even pointed to the possibility of a two-thirds majority for the ruling coalition. Separate Philippine impeachment efforts against President Ferdinand Marcos Jr. and his deputy and archrival, Sara Duterte, advanced today in a sign their feud is again set to dominate the country's politics. Two complaints were filed with the House of Representatives accusing Duterte, among other things, of misusing government funds, while a House committee declared two recent filings against Marcos met a key condition required to proceed. Both deny wrongdoing.  Sara Duterte. Photographer: Lisa Marie David/Bloomberg Trump welcomed Chinese and Indian investment in Venezuela's oil industry, after acting President Delcy Rodríguez signed off on historic changes to the country's nationalist policy that would cut taxes and allow greater ownership for foreign companies. This explainer looks at whether the US leader's plans for the country's dilapidated crude sector are realistic. The next round of trilateral meetings between the US, Russia and Ukraine in pursuit of a path to end Russia's war on its western neighbor will be held on Wednesday and Thursday in Abu Dhabi, according to Ukrainian President Volodymyr Zelenskiy. Colombians are on edge ahead of President Gustavo Petro's visit to the White House this week over fears he might antagonize Trump as much in the flesh as he has done online. Costa Ricans elected ruling-party candidate Laura Fernández in a first-round landslide after her pledge to crack down on criminals convinced voters in a nation struggling with soaring drug violence.  Laura Fernández in San José last month. Source: AFP/Getty Images UK Prime Minister Keir Starmer said he still wants Britain to join the European Union's €150 billion ($178 billion) defense fund after negotiations last year ended in failure. Sign up for the Washington Edition newsletter for news from the US capital and watch Balance of Power at 1 and 5 p.m. ET weekdays on Bloomberg Television. Chart of the Day In a matter of months, Saudi Arabia has frozen rents, opened property ownership to foreigners, relaxed liquor laws and freed its stock market to investors everywhere. It's all part of Crown Prince Mohammed bin Salman's effort to better compete with nearby Dubai in attracting investment. It's also a sign of how the Gulf nation is trying to address oil-price volatility and budget deficits that threaten to slow progress on its $2 trillion economic diversification plan. And FinallyNigel Farage's Reform UK party is appealing to a growing group of voters ahead of a special election this month: men without a job. Across Britain, men are becoming unemployed at a faster pace than women, as hiring freezes and layoffs fall particularly hard in male-dominated sectors such as construction, manufacturing and IT. Joblessness among young men stands at over 16% — rates equivalent to the height of the coronavirus pandemic.  Farage at Bloomberg House during the World Economic Forum in Davos last month. Photographer: Chris Ratcliffe/Bloomberg More from Bloomberg

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Balance of Power newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Monday, February 2, 2026

Xi’s currency dream

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment