Special Note: We're rolling out a new weekly newsletter, The Ticker by Alpha Picks, and you're among the first to get it. Not something you'd like in your inbox? You can opt out here. |

|

|

Weekly Market Recap—Read for Free |

- Pockets of strength remain in the market, but recent volatility reflects a market growing more selective.

- Rather than signaling a clean "risk-off" move, markets appear caught between sticky inflation concerns and still-resilient economic data.

- The result is a market that rewards earnings visibility, cash flow strength, and reasonable valuations while punishing crowded trades.

|

|

|

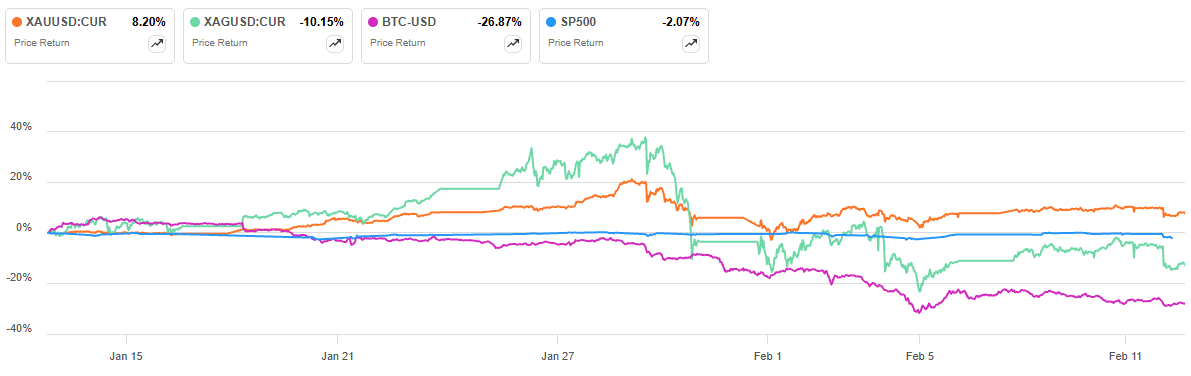

Precious Metals, Bitcoin Volatile as S&P 500 Drifts Lower

|

|

|

Dow's 50,000-Break Fades as Market Rotation Deepens

|

Markets have been volatile over the past week, highlighted by the Dow Jones Industrial Average (DJI) briefly crossing the psychological 50,000 mark before slipping back below that level in choppy trade. The milestone underscored underlying bullish momentum, but the pullback reflects a market growing more selective. Rotation into value and small-cap stocks has continued, while fewer mega-cap tech names are driving gains. Even solid earnings have not guaranteed upside, as Cisco Systems (CSCO) and Alpha Picks stock AppLovin (APP) both reported generally strong quarterly results, yet sharp post-earnings selloffs signaled elevated expectations and crowded positioning.

In contrast, strength has emerged in pockets of the semiconductor space. Alpha Pick Micron Technology (MU) continued its remarkable climb after Japan's Kioxia Holdings (KXIAY) surged 18% following robust quarterly results, reinforcing confidence in the memory upcycle. Meanwhile, rate concerns persist after a stronger-than-expected nonfarm payrolls report, leaving investors focused squarely on this week's CPI data. There's more to unpack from this week's market activity. You can find the expanded analysis in the full recap. |

|

|

We'll continue to track the trends that matter most and bring you clear, informative insights every week. Until then, wishing you a productive and profitable week ahead. - Steven Cress and the Seeking Alpha Quant Team | |

|

Scan to download the Seeking Alpha App! |

|

|

Download the Seeking Alpha App! |

|

|

*Performance between July 1, 2022 and February 13, 2026. Alpha Picks adds two stocks per month—on the closest business day to the 1st & 15th. Alpha Picks removes stocks based on rating thresholds (i.e., when a rating changes to a sell). Performance is calculated and reported daily using time-weighted returns. For more details on the performance calculation and methodology of Alpha Picks, click here. |

|

|

Past performance is no guarantee of future results. Seeking Alpha does not take account of your objectives or your financial situation and does not offer any personalized investment advice. Any content and tools on the platform are offered for information purposes only. Analysts are third-party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Any views or opinions expressed may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank. |

|

|

This email was sent to you because you are signed up to receive The Ticker by Alpha Picks. |

|

|

Sent by Seeking Alpha, 244 5th Ave, Suite 2705, New York, NY 10001 |

https://email-st.seekingalpha.com/oc/629888ce0c4303264f02dffeqa20h.af5h/d9aa297a |

|

|

|

No comments:

Post a Comment