| Trump tariffs struck down |

| |

| The US Supreme Court on Friday followed through as expected, given oral arguments in which the justices expressed skepticism at the underpinnings of Donald Trump's so-called "Liberation Day" tariffs, and struck the president's tariffs down. Affirming a federal appeals court ruling that had found Trump's maneuver illegal, the 6-3 majority—including two of Trump's own picks (whom he attacked in very personal terms)—upended the Republican's signature economic policy. At a subsequent press conference, the 79-year-old quickly went on the attack. Trump called some of the justices a "disgrace" and "disloyal" while alluding to nonspecific foreign conspiracies hatched by—as he put it—"slimeballs" intent on influencing the court. The landmark defeat comes as Trump's approval rating has been falling over his handling of the economy and his national immigration dragnet. But while the president displayed exceptional anger at not getting his way, the administration had been preparing for a defeat, and plans to impose tariffs using other provisions of federal law. —David E. Rovella | |

What You Need to Know Today | |

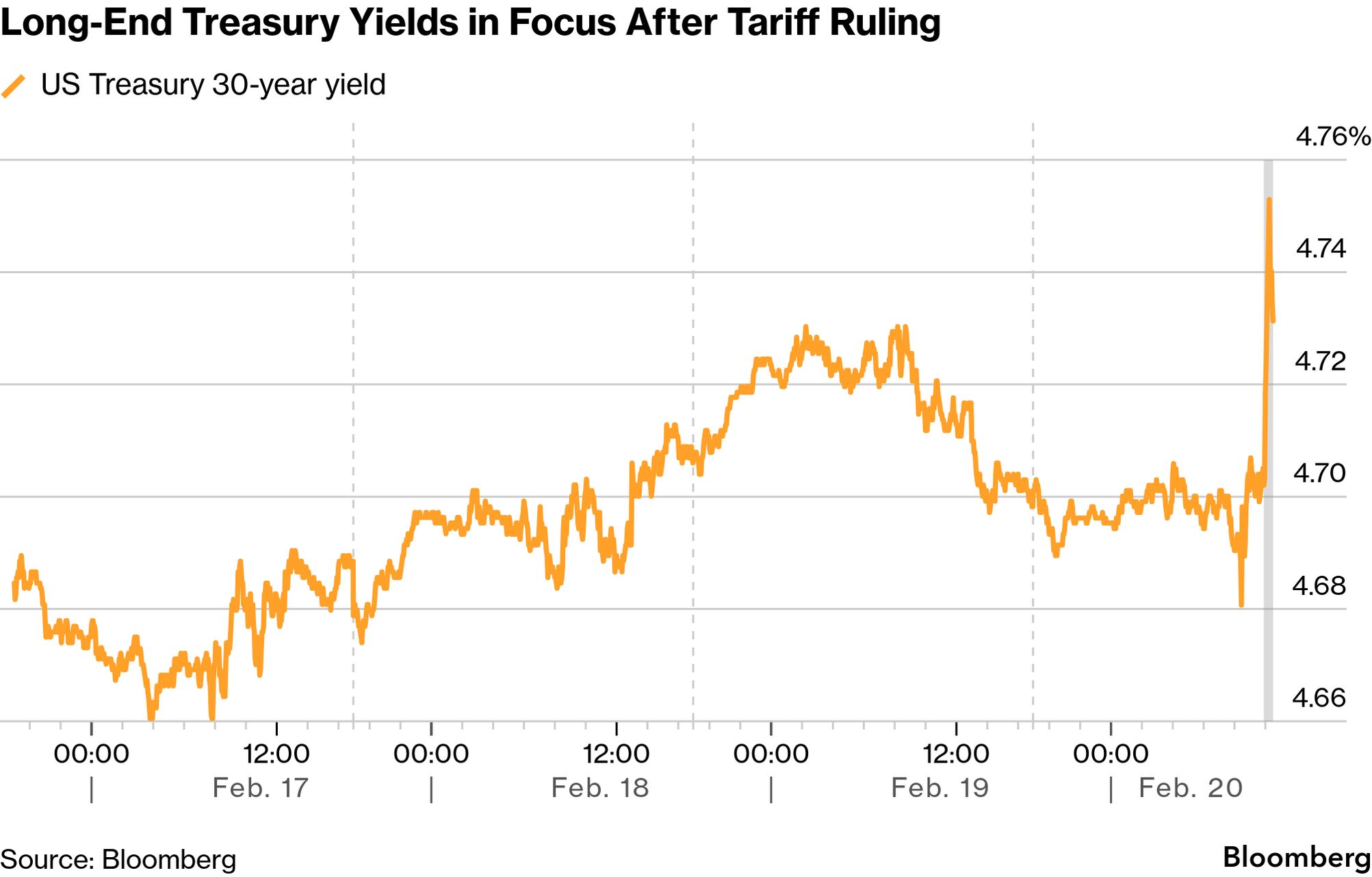

| The Supreme Court decision reverberated across the $30 trillion US bond market by threatening to increase the government's budget deficit and do more damage to an economy already contending with elevated inflation and unemployment. While Trump said he would approve a new 10% global tariff in place of the ones he just lost, the long-term outlook still remained unclear, given that the provisions of the law he invoked involve temporary duties. "It's a short-term vehicle," said Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities. "The devil will be in the details with various trade deals to date." | |

|

| |

|

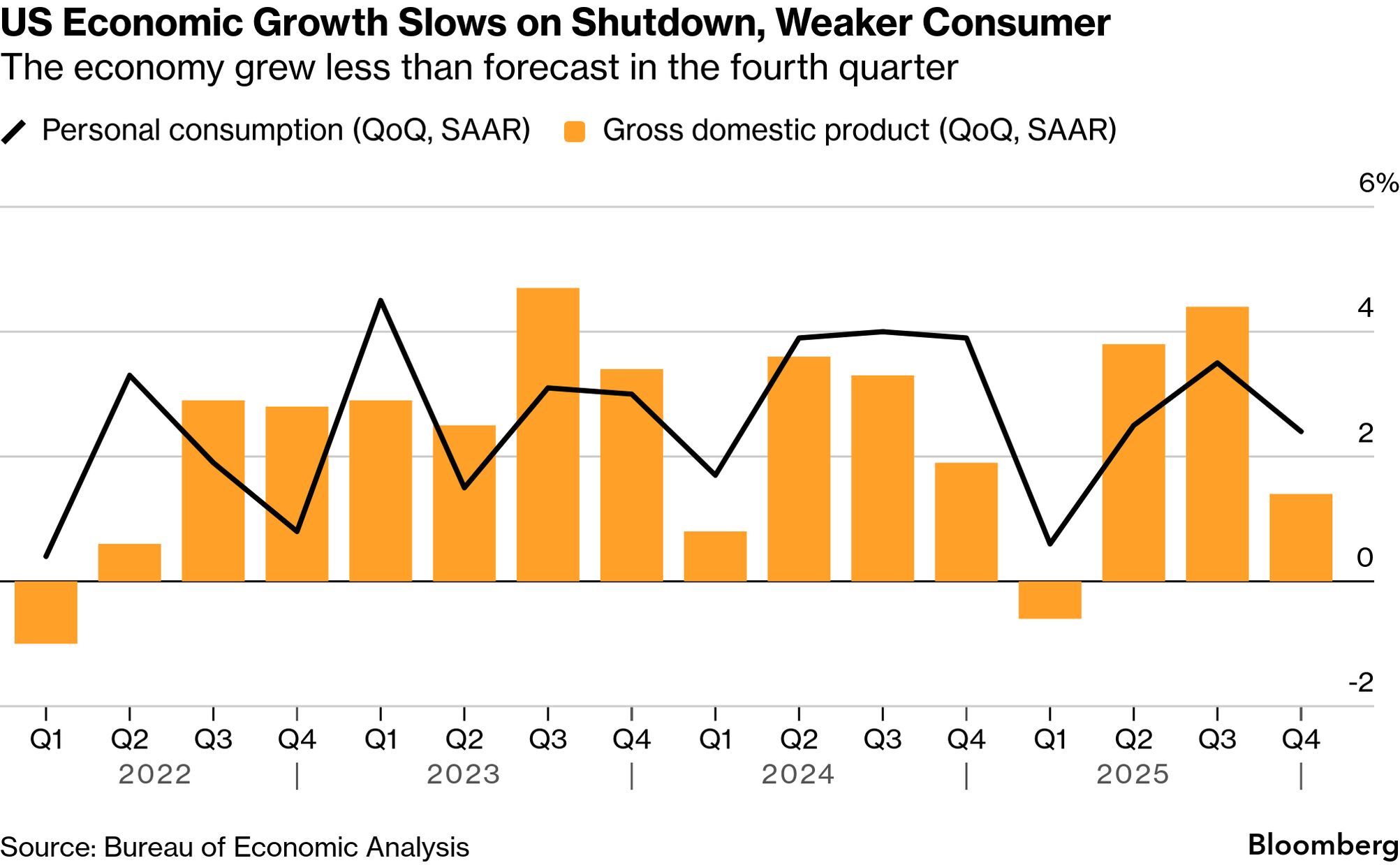

| More sobering economic news came in Friday for the administration to digest. Numbers from the US Bureau of Economic Analysis showed the economy grew less than expected at the end of last year, dragged down by a record-long government shutdown, consumer spending and trade. The weak quarterly result—which was below all forecasts in a Bloomberg survey of economists—came as the government was shut down for almost half of the three-month period. The BEA said the reduction in federal services during the shutdown subtracted about 1 percentage point from GDP, though the full impact couldn't be estimated. | |

|

| |

|

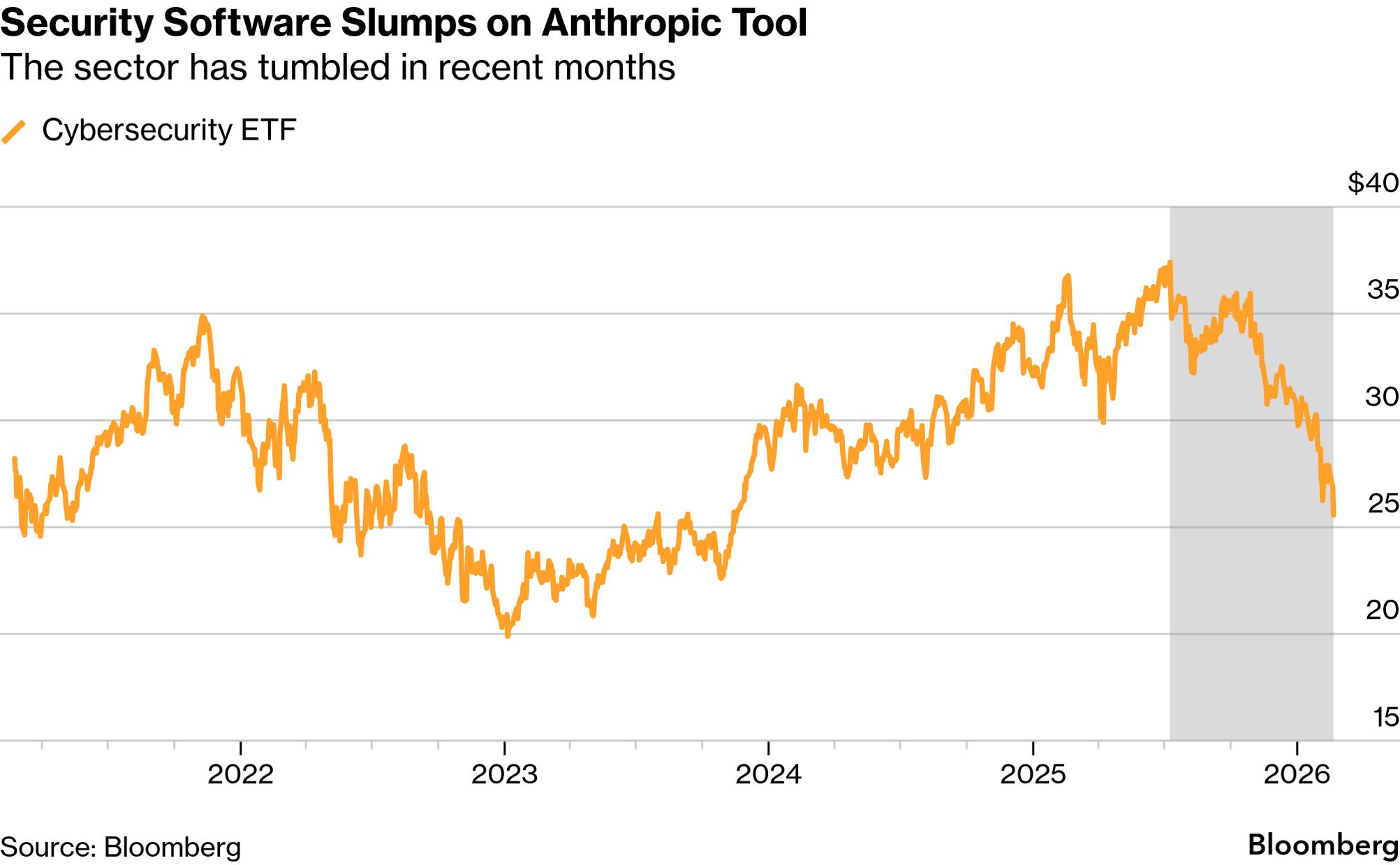

| The artificial intelligence "scare trade" is still here, in case you were wondering. This time the victim was cybersecurity software companies, which tumbled Friday after Anthropic introduced a new security feature into its Claude AI model. Crowdstrike Holdings was among the biggest decliners, falling 8%, while Cloudflare slumped 8.1%. Meanwhile, Zscaler dropped 5.5%, SailPoint shed 9.4% and Okta declined 9.2%. The Global X Cybersecurity exchange-traded fund fell 4.9% and closed at its lowest since November 2023. Anthropic said the new tool "scans codebases for security vulnerabilities and suggests targeted software patches for human review." The firm said the update is available in a limited research preview for now. | |

|

| First Citizens is said to be looking for deal targets that would help it quickly vault over a key $250 billion asset threshold. The bank has asked advisers to draw up a list of potential transactions the firm could pursue as it seeks to gain more scale to better deal with regulatory and compliance costs. First Citizens has already begun talks with regulators about the possibility of doing a major acquisition, and is said be considering pursuing a deal for Cleveland, Ohio-based KeyCorp. Regulators have been keenly focused on stability in the banking system after a 2023 bank crisis led to three failures, including the collapse of Silicon Valley Bank. First Citizens snapped up that lender at a discount after a deposit run at SVB. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment