| Read in browser | ||||||||||||||

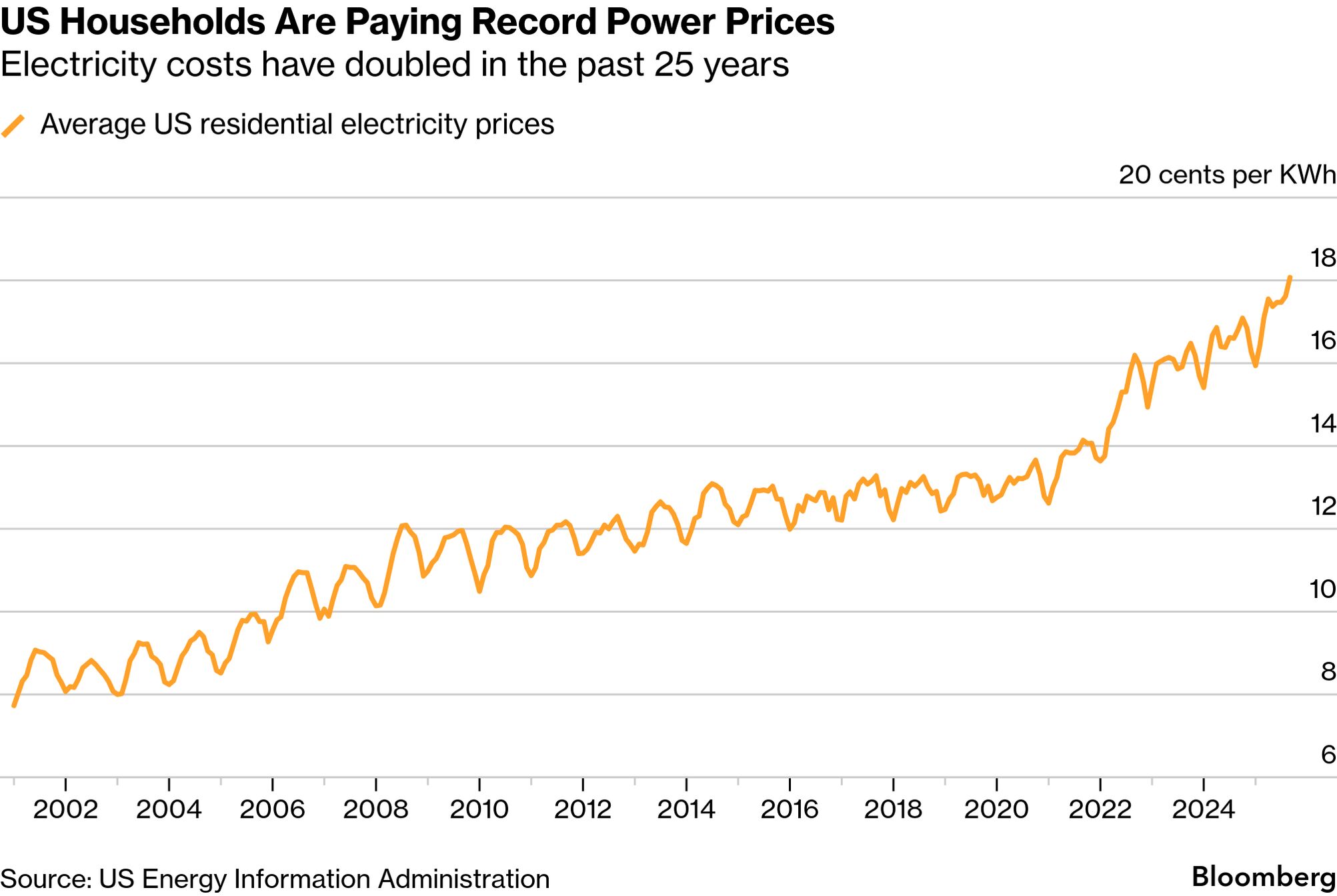

Banks in the UK are under pressure to prove they're not underestimating the problem of flooding in their mortgage books. Today's newsletter looks at the financial risks behind the country's rainy start to the year, which resulted in the wettest January on record for many places. Meanwhile in the US, President Donald Trump announced a Japanese-built natural gas plant that would be the largest in the country. His administration also extended the life of the J.H. Campbell coal plant in Michigan. Subscribe to Bloomberg for unlimited access to all our stories on climate change's impacts on the economy and on people's lives. Lending gets riskierBy Alastair Marsh and Olivia Rudgard As the prospect of flood damage haunts an ever larger number of UK homes, the country's banks are under growing pressure to prove they're not underestimating the risk in their mortgage books. Nationwide Building Society — once seen as an outlier after saying in 2024 it had stopped making loans to some homes at risk of flooding — has emerged as a prescient first-mover amid growing banker anxiety, according to Mark Cunningham, managing director at PriceHubble, a property data company. The risk is that a bank is "going to end up with mortgage prisoners" if it's the only institution "lending to stuff which everyone else says is flooding," Cunningham says. As a bank in that scenario, "you're stuffed, and your customers aren't going to be able to re-mortgage."  A house affected by flooding in the hamlet of Weycroft, on Jan. 27. Photographer: Finnbarr Webster/Getty Images Europe In England, there are already 6.3 million properties in areas at risk of flooding from surface water, coastal swells and overflowing rivers, according to the government's Environment Agency. At the same time, more properties are being built on flood-prone land, with the insurer Aviva estimating that roughly 11% of new homes built between 2022 and 2024 are in areas facing medium to high flood risks, compared to 8% over the previous decade. Adair Turner, the former head of the UK's banking regulator and current non-executive chairman of insurance group Chubb Ltd.'s European business, says there's still a fundamental "asymmetry" between how banks and insurers are approaching the issue of flood damage. And that creates "a very significant risk for the banks," he said in an interview. The new reality is largely down to climate change, exacerbated by urban landscapes that often prevent excess water from draining away. This year, floods have already wreaked havoc in Britain's southwest, with Cornwall experiencing its wettest January on record. The development threatens to upend the dynamics around real estate in Britain, not just environmentally but also financially. Banks risk seeing property values take a hit as the homes they're financing get damaged in more frequent and destructive floods. Homeowners affected by floods, meanwhile, often get inundated by additional costs that make it harder for them to meet mortgage payments. Read the full story on Bloomberg.com and subscribe for unlimited access to more stories on how climate change is impacting banks and insurers. Rising premiums£1,600 How much Flood Re charges insurers a year per house as its risk profile evolves to reflect more high-value claims A house of cards"If you are worried about flooding in London, the rivers are not your problem — you should be worried about surface water." Elizabeth Rapoport Chair of Flood Ready London, a partnership between government authorities and the local water company Gas giantBy Rob Verdonck and Naureen S Malik A massive, natural gas facility that US President Donald Trump said Japan plans to build in Ohio would be the largest in the US, with capacity to power millions of homes. Japan is expected to invest $33 billion in the project, which will be led by SoftBank Group Corp. subsidiary SB Energy, according to a US Commerce Department fact sheet outlining the plan. The site near Portsmouth, Ohio, will likely have capacity of 9.2 gigawatts, a White House official said. The Trump administration is seeking to accelerate the construction of big power plants to tame skyrocketing power bills as electricity demand is boosted by data centers, factories and the overall electrification of the economy. However, gas plants have their own challenges, including the surging global cost of turbines and lengthening average lead times.  Meanwhile on Tuesday, as part of a blitz to force a renaissance of coal, the US Energy Department issued a fourth emergency order to keep the J.H. Campbell coal-burning power plant in West Olive, Michigan open beyond its retirement date last May. The DOE says it is concerned about grid reliability. Our story earlier this week puts a number on the steep financial and health costs of the decision. Read the full story on the planned natural gas facility on Bloomberg.com and subscribe to Green Daily for more news on US energy policy. More from Green A beach in Mauritius Photographer: Jeff Overs/BBC/Getty Images Mauritius, an island nation contending with coastal erosion, drought and floods, needs $5.6 billion over the next 25 years to fund the roll out of green energy and climate-adaptation measures, according to the World Bank. Companies that fail to reduce their carbon footprint risk being excluded from the growing pool of fixed-income funds tied to the clean energy transition, according to a fresh analysis published by NatWest Group. US clean-energy dealmaking is showing signs of a comeback after last year's sharp contraction, with the possibility of BlackRock Inc.'s Global Infrastructure Partners teaming up with private equity firm EQT AB to acquire AES Corp. Photo finish Principe Island off Africa's west coast. Source: HBD Principe Mark Shuttleworth, a technology tycoon, will start paying stipends of as much as 20,000 dobras ($958) annually to the inhabitants of Principe, an island off Africa's west coast where he owns luxury resorts, to help preserve its biodiversity. The payments will benefit about 3,000 people, roughly 60% of the island's adult population, starting next week. In exchange for this so-called natural dividend, those who benefit are expected not to act in ways that harm the environment. More from Bloomberg

Explore all Bloomberg newsletters. Follow us You received this message because you are subscribed to Bloomberg's Green Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Thursday, February 19, 2026

UK banks confront flood risk

Subscribe to:

Post Comments (Atom)

Starting in 20 minutes

Last call. About to reveal everything. ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment