| Read in browser | ||||||||||||||

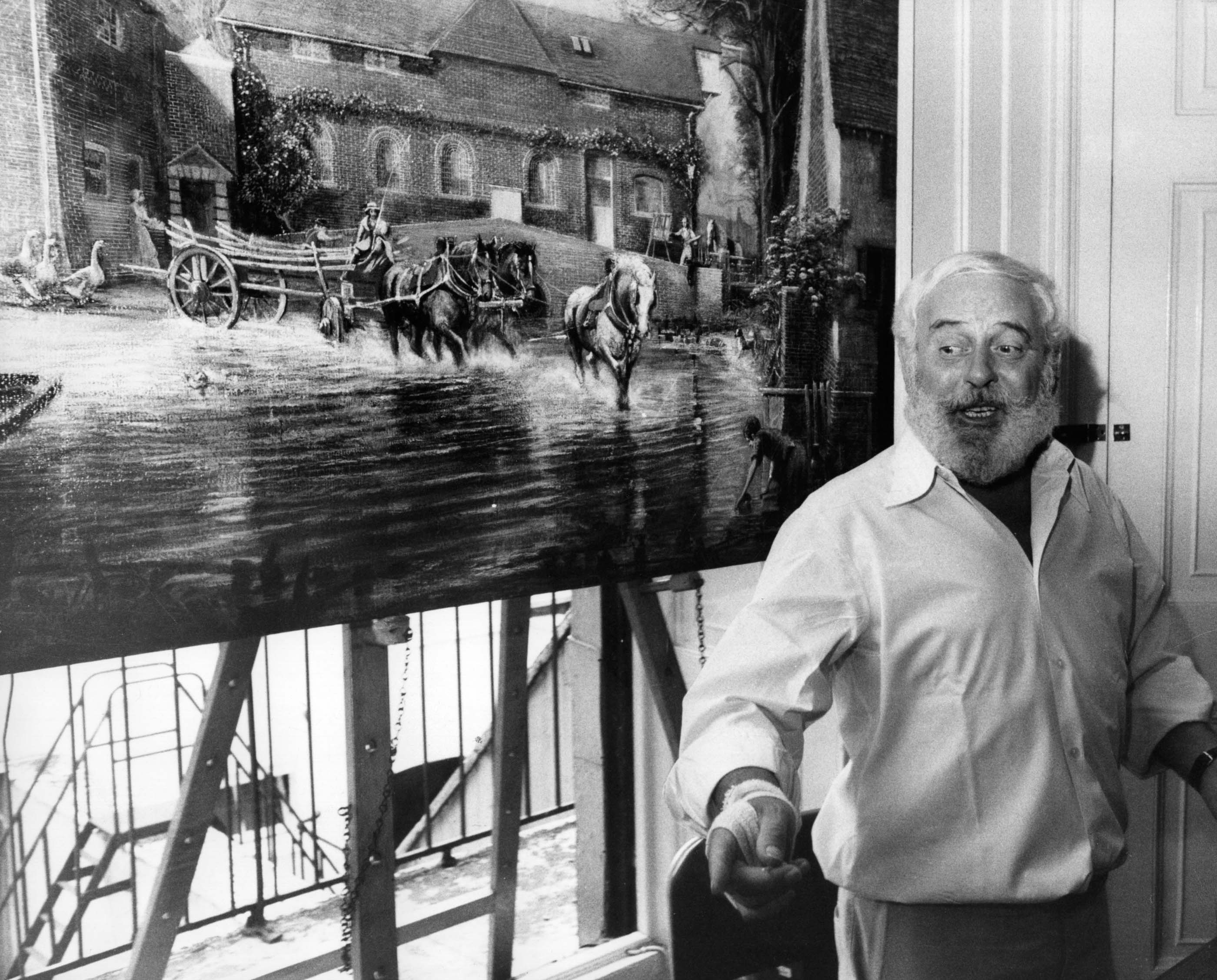

Good morning and happy Friday! Westpac just released its first-quarter numbers this morning showing that profits are up partly thanks to home loans. But those mortgage holders might not be too happy with Michele Bullock's warning yesterday, that the RBA is ready to hike interest rates again if inflation is persistent. Meanwhile, the ASX earnings season has kicked off with a bang: an exodus from the top rungs of a string of companies made for a volatile start. Ahead of its results next week, Treasury Wine Estates' new boss is rolling out a turnaround plan that focuses on fewer premium brands and new alternatives. Oh, and it looks like we have a new leader of the opposition in Canberra. - Sharon Klyne, private credit reporter What's happening nowWestpac's first-quarter profit rose thanks to gains in home loans and strong growth in institutional lending. Following results from ANZ and CBA this week, the lender's net profit came in at A$1.9 billion in the last three months of 2025. That's up about 5% on the second-half average of last year. Australia's central bank is ready to hike interest rates further if inflation proves persistent, Governor Michele Bullock said at a Senate hearing yesterday. Meanwhile, Treasurer Jim Chalmers named a new member of the RBA's rate-setting board. A string of unexpected chief executive departures at Lendlease, CSL and ASX is making for a shaky start to earnings season, in a market that harshly punishes company disappointments and poor performance. Meanwhile, ASX's and AMP's numbers didn't go down too well either.  Helen Lofthouse, chief executive officer of ASX Ltd. is leaving the company in May. Photographer: Brent Lewin/Bloomberg Blue Owl Capital-owned data center company Stack Infrastructure Inc. is seeking a loan of around A$3 billion as it accelerates development in Australia to meet surging demand for AI and cloud services. South32 plans to prioritize growth in metals such as copper and zinc over aluminum, where it has decided to shut a major African smelter.  What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… The Aussie dollar declined against major currency peers, dragging its kiwi cousin lower, as oil and precious metals fell. Silver fell 10% and gold lost 3% amid reports some of the proceeds of the liquidation were being used to offset losses in stocks - which fell across the board in the US. The Swiss franc, yen and Treasuries all rose on haven demand. New Zealand has two-year ahead inflation expectations today, then only US inflation data is between us and the weekend. ASX futures indicate a weak opening for local equities. Some Chinese economists have called for loosening restrictions on the movement of money in and out of the country, arguing a weaker dollar provides a good opportunity to boost the yuan's global appeal by increasing its convertibility.  One-hundred yuan banknotes arranged in Shanghai, China. Photographer: Raul Ariano/Bloomberg Singapore's spending plan to address high cost of living will likely benefit consumers and the retail sector, potentially giving local stocks another boost after they hit an all-time high. US President Donald Trump said he could see talks with Iran stretching for as long as a month as he seeks a diplomatic agreement to roll back Tehran's nuclear program. What to watch• Nothing major scheduled One more thing...Copies, fakes, dupes, replicas, bootlegs, pastiches, forgeries, facsimiles — these have been the engines of culture since long before the age of mechanical reproduction. As we transition from a century dominated by the US to one dominated by China, the world will have to start grappling with its attitude toward copies and fakes, which are far more accepted there than they are in the West. Might the Asian attitude be the more enlightened one?  Master forger Tom Keating standing by his fake painting of Constable's 'Hay Wain'. Photographer: Keystone/Getty Images Enjoying Australia Briefing? You might also like:

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Thursday, February 12, 2026

Treasury Wine CEO’s turnaround plan, Westpac results

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment