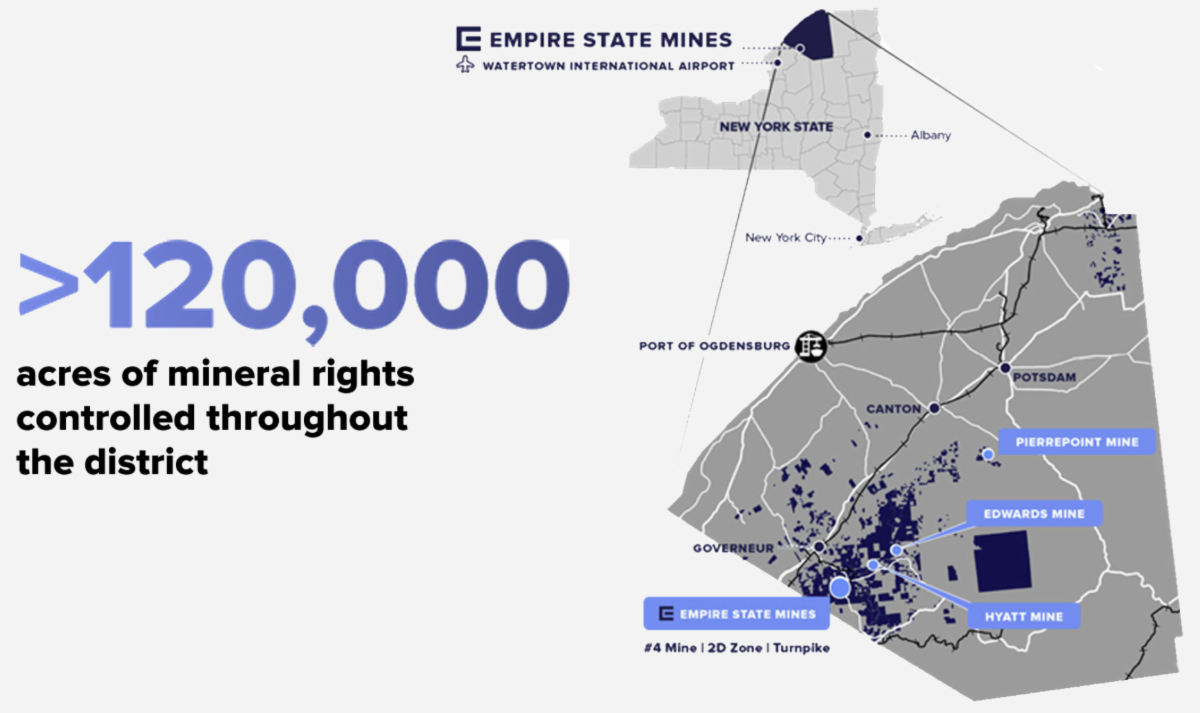

| -- U.S production base in upstate New York.

- Existing infrastructure includes 5,000 tpd mill, skilled workforce of 135 employees, rail, port, and air access.

- Cash flow positive zinc mine.

-- Existing permitted operations with state level permitting only.

-- 120,000 acres of mineral rights controlled throughout the district.

-- Regional district scale and near mine exploration potential and ability to add incremental production at low cost.

-- Significant graphite discovery at Empire State Mine’s (ESM)’s property.

-- The Kilbourne Graphite Project is a near surface discovery within 1 mile of the ESM mill.

-- Unique advantage of existing operating base creating pathway for co-production.

-- 1,200 tpa fully permitted graphite processing facility commissioning in H2 2025.

-- First end-to-end natural flake graphite production in the USA since 1956.

-- Target to be the first commercial producer of US-sourced and processed graphite.

Find Key Sources And More Here: TII Website. TII Presentation. -----

5 Key Potential Catalysts To Consider - (NYSE American: TII)

1.) Multiple Technical Indicators Are Appearing Triggered Right Now.

Over at Barchart, the website is reporting that TII has several triggered technical indicators.

As of close on Monday, there were a total of 12 with bullish signals across the short, medium, and long term.

On top of that, the Barchart website's composite "Trend Seeker" indicator is flashing as well.

2.) Titan Mining Launches Made-in-America Graphite Production as U.S. Moves to Secure Critical Minerals.

Titan Mining Corporation has begun producing graphite concentrate at its Kilbourne facility in New York, marking the revival of U.S. graphite supply after more than seven decades.

This achievement supports the White House’s new Executive Order promoting domestic critical mineral processing.

Titan is advancing financing talks with the U.S. Export-Import Bank for a $120Mn loan to expand operations.

Company CEO, Rita Adiani, emphasized that Titan’s progress and federal policy alignment will strengthen America’s secure, end-to-end supply chain for critical minerals and advanced manufacturing.

3.) Titan Mining Delivers on Planned De-leveraging Strengthening Balance Sheet for Graphite Growth.

Titan Mining Corporation has completed its final $5.2Mn payment to fully retire its credit facility with the National Bank of Canada, reducing net debt by about 60% to $9.5Mn.

Supported by a $15Mn equity financing, this move significantly improves Titan’s balance sheet and financial flexibility.

Company CEO, Rita Adiani, emphasized that the strengthened position enables Titan to accelerate its U.S. graphite development strategy, enhance operational stability, and maintain disciplined capital management—solidifying the company’s leadership in America’s critical minerals supply chain.

4.) Two Analyst Targets Suggest Strong Potential Upside From Current Chart Levels.

At this moment, two separate analyst targets are suggesting strong potential upside for TII.

An H.C. Wainwright $6.50 target forecasts a potential 50% upside from TII's closing valuation Monday.

Additionally, a Maxim Group analyst target of $6.00 highlights a potential 39% upside from Monday's close.

Could these targets be suggesting TII is undervalued from current chart levels?

5.) TII Has A Relatively Low Float (The Potential For Volatility May Be Heightened).

Sporting a float of roughly 38.13Mn shares, according to Yahoo Finance, volatility potential could pop up in a flash. -----

It's official. We're kicking-off coverage on Titan Mining Corporation (NYSE American: TII).

We'll be cranking out updates soon. Be on the lookout.

All the best, Dane James Editor Market Pulse Today

(Remember: St-ock Prices Could Be Significantly Lower Now From The Original Dates I Provided.)

*MarketPulseToday.com (“MarketPulseToday” or “MPT” ) is owned by Thousand Sun Media LLC, MPT is not responsible for its accuracy. Make sure to always do your own research and due diligence on any day and swing profile MPT brings to your attention. Any emojis used do not have a specific defined meaning, and may be used inconsistently. We do not provide personalized in-vest-ment advice, are not in-vest-ment advisors, and any profiles we mention are not suitable for all in-vest-ors.

Pursuant to an agreement between Thousand Sun Media LLC and TD Media LLC, Thousand Sun Media LLC has been hired for a period beginning on 02/09/2026 and ending on 02/10/2026 to publicly disseminate information about (TII:US) via digital communications. Under this agreement, TD Media LLC has paid Thousand Sun Media LLC eight thousand USD ("Funds"). These Funds were part of the twenty five thousand USD funds that TD Media LLC received from a third party named Goldwyn Media LLC who did receive the Funds directly or indirectly from the Issuer and does not own st-ock in the Issuer but the reader should assume that the clients of the third party own shares in the Issuer, which they will liquidate at or near the time you receive this communication and has the potential to hurt share prices.

Neither Thousand Sun Media LLC, TD Media LLC and their member own shares of (TII:US).

Please see important disclosure information here: https://marketpulsetoday.com/disclosure/tii-zfnif/#details |

No comments:

Post a Comment