| Read in browser | ||||||||||||||

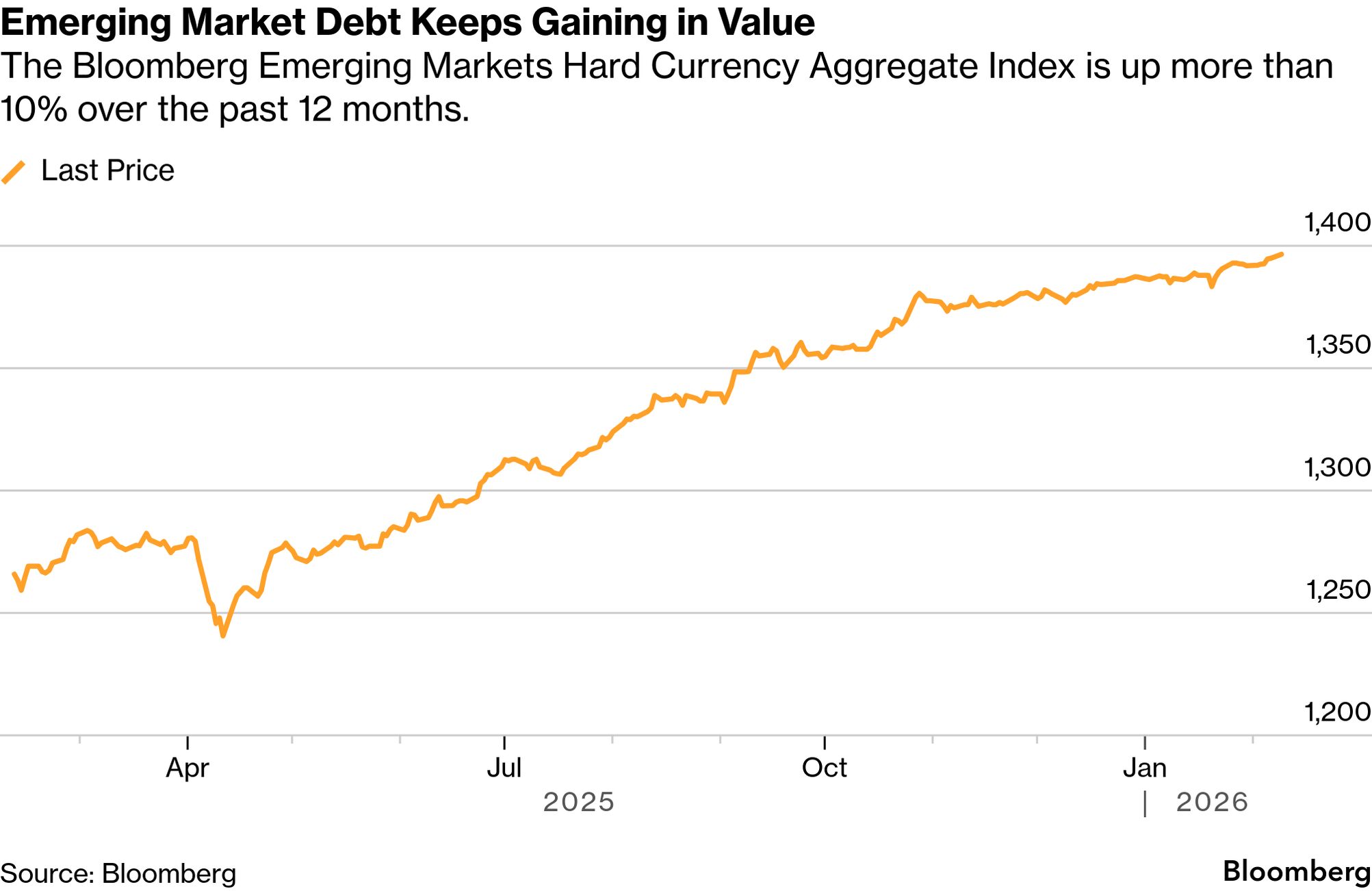

Green debt swaps could be a $1 trillion market — but they're nowhere close to reaching that size. Today's newsletter takes a look at where they're at today and what their potential realistically looks like in the coming years. Old market, new rulesBy Antony Sguazzin, Esteban Duarte, and Olivia Rudgard Bankers in the small but lucrative market for debt swaps are now struggling to complete deals. Designed to help developing nations cut their debt burdens and protect the environment in a single product, the swaps are seeing potential borrowers hit the brakes, according to bankers and consultants interviewed by Bloomberg. With emerging-market bonds rallying, such deals often no longer make financial sense, they said. At the same time, some governments are skeptical of the environmental focus the swaps have, they added. Antonio Navarro, a former Credit Suisse banker who's now a managing partner specialized in such deals at boutique credit fund ArtCap Strategies, says the gains gripping emerging-market debt mean that "a lot" of the deals initiated in the past year are now being reconsidered, and in some cases have been put "on hold."  Debt swaps, structured so as to lure private money by using risk-mitigation features such as public guarantees, have long been seen as a key plank in financing nature conservation in the developing world. As recently as May last year, BloombergNEF estimated there might be over $1 trillion of total debt eligible for such swaps. But since 2021, only about $6 billion worth of deals involving private capital have actually been completed, BNEF data show. The products, which entail switching out old — often distressed — debt at more favorable rates, require months of "preparatory work including identifying the right projects, carrying out the scientific work, seeking the guarantee from a multilateral lender," all of which comes at a substantial fee, Navarro said. And under the current market conditions, with yields on a growing number of emerging-market government bonds near or even below those of US Treasuries, "the maths simply doesn't work," he said. At the same time, issuers are growing increasingly dissatisfied with the environmental focus the deals have typically had, according to Bloomberg interviews with public finance representatives, bankers and lawyers involved in the transactions. The worry is that goals such as preserving mangroves are sidelining health and poverty-related challenges that local populations consider far more urgent, they said. The development feeds into a wider shift in tone around environmental programs. Last year, billionaire philanthropist and Microsoft Corp. co-founder Bill Gates warned against letting climate concerns overshadow issues such as healthcare in poorer communities. In a memo published ahead of the COP30 climate summit in Brazil, Gates called for a "refocus on the metric that should count even more than emissions and temperature change: improving lives." Audrey Alevina, whose Gabon-based firm Alevina & Partners worked on the country's $500 million debt-for-nature swap back in 2023, says many governments in Africa have long had an "ambivalent" attitude toward conservation finance. It's generally been viewed as less urgent than "basic services like electricity, water, education, and healthcare," all of which "remain critically deficient or entirely lacking," she said. Swaps targeting non-environmental goals are gaining ground. Kenya and Benin are in talks for development swaps, Dabalen said last month. And World Bank President Ajay Banga told Bloomberg last year the institution was looking at nine development-focused swaps across Africa and Asia. Kenya also completed a swap targeting food security in December, with the help of the DFC. And Angola's finance ministry says it's now planning swaps focused on health and education. A possible nature-related swap listed in Angola's borrowing plan in mid-2024 wasn't mentioned in the country's latest official update. Catherine Burns, managing director of NatureVest, The Nature Conservancy's investment unit, says the nonprofit is "delighted" that debt swaps are now "providing an opportunity and model to achieve other types of benefits" beyond nature conservation. "We're having to do transactions a little bit differently and with some new stakeholders," she said. "But we're still moving forward." Read the full story. Good news for green finance$947 billion The amount of green bonds and loans issued last year, setting a new record. The uncomfortable middle"Because we are a middle-income economy, the financial markets look at us differently than if we were a country that is in debt struggles." Susana Muhamad Former environment minister, Colombia Colombia has rejected debt-for-nature swaps over fears that such a deal could impact its sovereign credit rating. This week's Zero Major economies around the world are grappling with electricity grids under stress from equipment bottlenecks and workforce shortages. What can be done to solve it? This week on Zero, Akshat Rathi talks with Manoj Sinha, CEO of Husk Power Systems, about distributed energy resources and their potential to bring electricity to where it is needed most — from energy-poor regions in the Global South, to energy-hungry data centers in rich countries. Listen now, and subscribe on Apple, Spotify or YouTube to get new episodes of Zero every Thursday. More from Green Kashiwazaki Kariwa Nuclear Power Plant Photographer: YUICHI YAMAZAKI/AFP/Getty Images Japanese utility Tokyo Electric Power Co. restarted a reactor at the world's biggest nuclear power plant, after an issue last month delayed the process. The No. 6 reactor at its Kashiwazaki Kariwa Nuclear Power Plant began to resume on Monday at 2 p.m. local time, according to the company's spokesperson. The unit's power output will be gradually increased, with a goal of entering commercial operations on March 18. The utility was initially aiming for Feb. 26 before the hiccup. Tepco, the operator of the Fukushima nuclear power plant that suffered a meltdown accident in 2011, is facing public scrutiny to safely bring Kashiwazaki Kariwa back online. Its resumption also comes as the Japanese government looks to re-embrace atomic energy in an effort to curb carbon emissions, cut expensive fossil fuel imports and secure a stable source of power to meet rising electricity demand. The EPA is getting ready to scrap a landmark environmental policy. The endangerment finding allows the agency to regulate greenhouse gases and underpins rules, including emissions standards for cars and trucks. The announcement is likely to come Wednesday. Stay tuned for more details. The fashion industry is in for a nasty surprise from climate change. A new report finds that profits could drop by 34% by 2030 unless companies move to rein in their carbon footprint. Pressure points include prices on carbon, rising raw material costs and increasingly expensive energy. Solar energy got a major boost in the UK. A record 4.9 gigawatts of solar capacity was awarded at the latest energy auction. The additional capacity will help the UK make headway on clean grid plans. The government says it will also bring down bills. More from Bloomberg

Explore all Bloomberg newsletters. Follow us You received this message because you are subscribed to Bloomberg's Green Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Tuesday, February 10, 2026

The math “simply doesn’t work”

Subscribe to:

Post Comments (Atom)

$30 stock to buy before Starlink goes public (WATCH NOW!)

This $30 company could benefit most from the coming IPO. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment