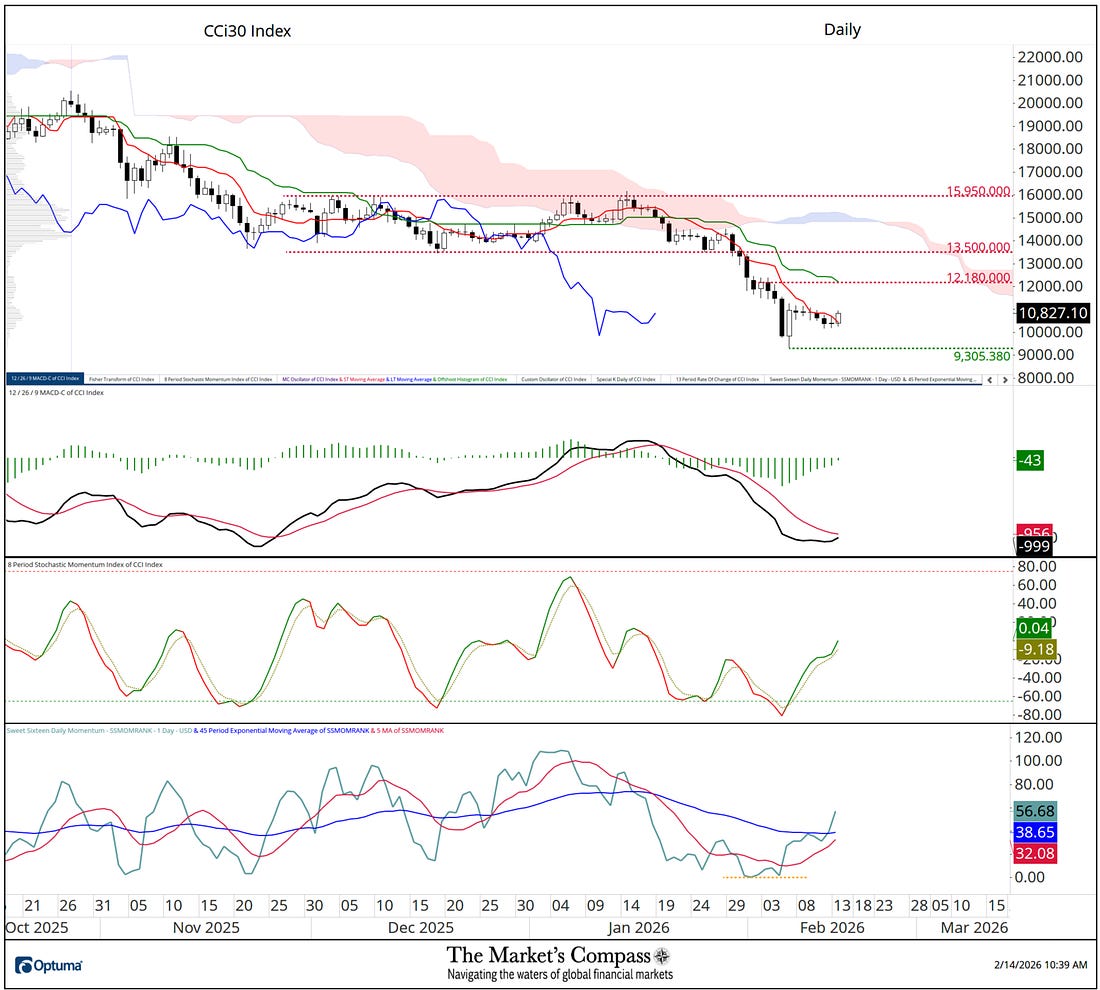

What follows is an excerpt from tomorrow’s Market’s Compass Crypto Sweet Sixteen Study that will be sent to my paid subscribers in the AM. The Daily Candlestick Price chart reflects the tight sideways trading pattern over the past week that produced the Weekly Doji seen on the previous chart. Thus far, the week ago last Friday’s lows at 9.305.38 have not been revisited. MACD has been tracking sideways with price and is stabilizing and is only one or two days away from crossing above its signal line if prices will cooperate and leave the current sideways trading pattern to the upside. The shorter-term Stochastic Momentum Index has turned higher from oversold territory and is tracking higher above its signal line. When prices fell to new lows my Sweet Sixteen Daily Momentum / Breadth Oscillator did not (yellow dashed line) and has turned high and is back above both the short-term 5-Day Moving Average (red line) and the longer-term 45 Exponential Moving Average (blue line) for the first time since mid-January when fell below both after the Oscillator did not confirm the January 14th stab above resistance at 15,950.00. I am now marking first price resistance at the Kijun Plot and price resistance at 12,180.00. Key support is at a week ago, last Fridy’s intraday low at 9,305.38. For readers who are unfamiliar with the technical terms or tools referred to in the comments on the technical condition of the SPX can avail themselves of a brief tutorial titled, Tools of Technical Analysis and an in-depth comprehensive lesson on Pitchforks is available on my website… Charts are courtesy of Optuma whose charting software allows the Technical Rankings to be calculated and back tested. To receive a 30-day trial of Optuma charting software go to… |

Saturday, February 14, 2026

The Market’s Compass Crypto Sweet Sixteen Study

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment