| Read in browser | ||||||||||||||

Happy Grammy Sunday and a special shoutout to those of you who also woke up early to watch the Australian Open final. I am sending this newsletter before heading over to the music industry's biggest night, and I will be in Washington this week for the Senate hearing regarding Netflix's Warner Bros. deal — more on that in a minute. If you don't already subscribe to this newsletter, fix that. Five things you need to know

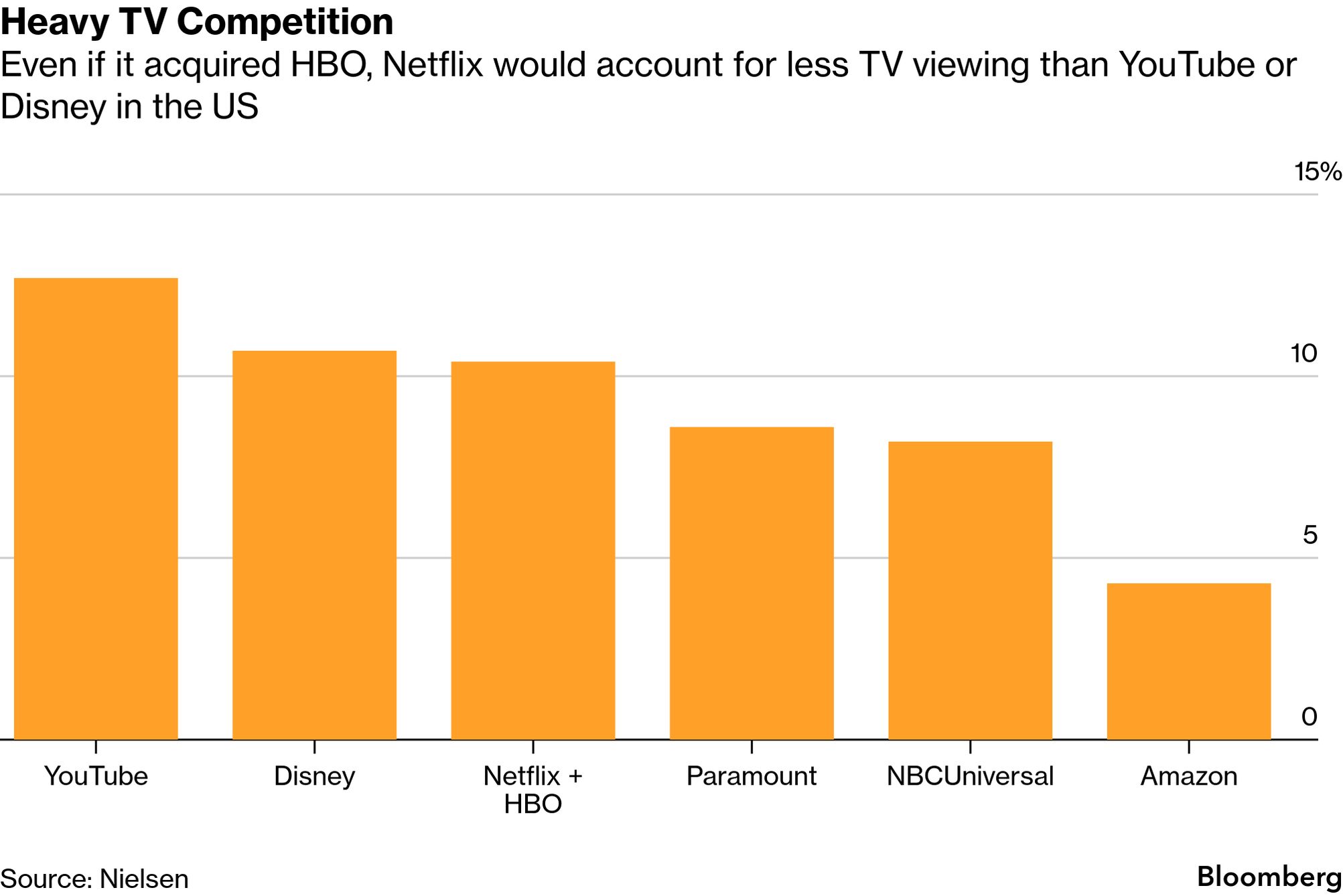

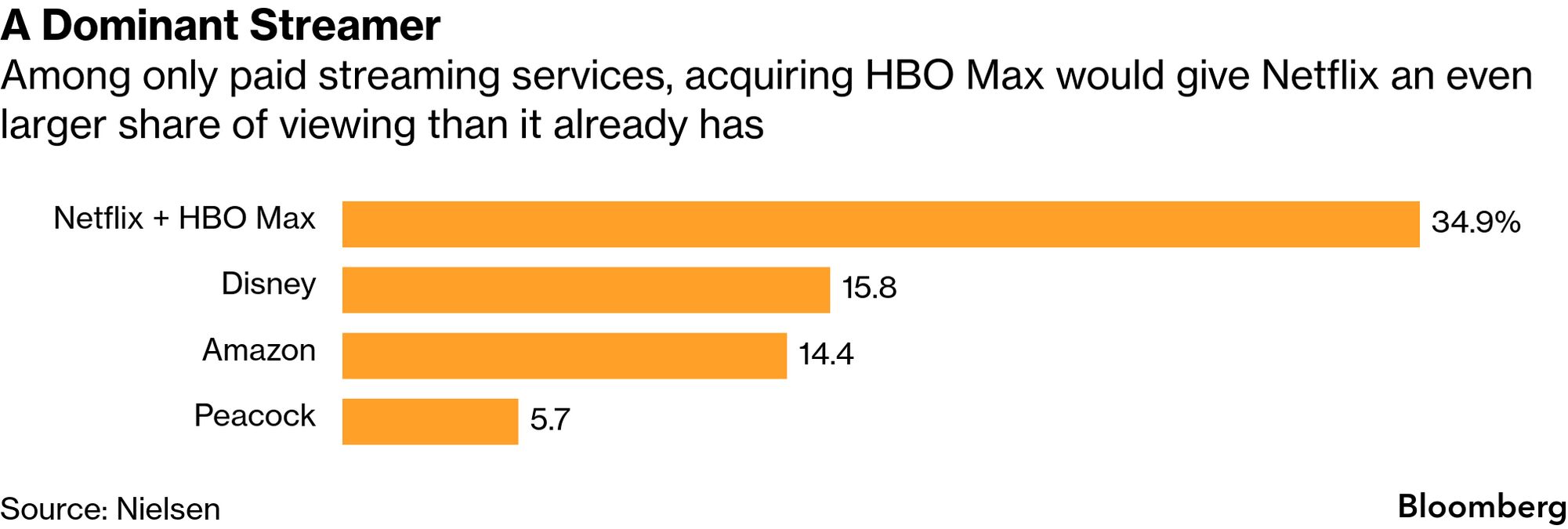

Netflix faces its first big test in Washington DCNetflix Inc. Co-Chief Executive Officer Ted Sarandos will testify before the US Senate's antitrust subcommittee on Tuesday, taking the stage to assuage politicians' concern about his company's $82.7 billion deal for Warner Bros. and HBO. While the Senate has no formal oversight of the deal, the hearing is a sign of the intense scrutiny this deal will face in the months ahead. Documentary filmmakers, art-house theaters and nonprofit organizations have lobbied state attorneys general to block the deal. European politicians are calling for a full review. Netflix has excelled at avoiding regulatory entanglements, escaping the kind of oversight broadcast networks face in most countries. It has never been subject to the antitrust scrutiny that has dogged peers in Silicon Valley or been a target of the Trump administration's war on the media, like others in Hollywood. That's about to change. Netflix is the most valuable entertainment company in the world, and it's buying one of its biggest competitors in streaming, as well as one of its biggest suppliers. Having won over the board of Warner Bros. Discovery – and with a shareholder vote coming – it must now convince regulators at home and abroad to approve the deal. Sarandos is an inveterate schmoozer who has charmed one constituency after another, wooing filmmakers and executives who have helped catapult Netflix to the top of Hollywood. Over the last several years, he's applied that same personal touch to politics. He's in regular contact with world leaders and has developed a personal relationship with President Donald Trump. While Sarandos is confident he can convince the public and politicians to see things his way, his opponents are equally confident the deal won't be approved. The case against NetflixThe traditional antitrust case against Netflix will come down to how regulators and courts define a market. Netflix will seek to define it as broadly as possible. The company has spent a decade making the case that it isn't just competing against Walt Disney and Warner Bros. It has identified YouTube, Instagram, TikTok, video games and even sleep as competition. While that last point elicits eye rolls, Netflix has been successful at arguing that it's competing for time and attention against a wide range of players. In terms of TV time, Netflix accounts for less than 10% of viewing in the US, its largest market. Even if it absorbed HBO, it would account for less than 11% of TV viewing, with a market share comparable to Disney.  Competitors will define the market as narrowly as possible. If you're looking at paid streaming, Netflix and HBO Max combined account for about 30% of viewing and an even larger share of paid subscribers. Netflix already releases a majority of the biggest streaming hits. Its opponents will argue this market share will give Netflix the power to harm consumers by raising prices and degrading its product.  The Justice Department can also investigate monopsony – whether the deal will give Netflix too much power over its suppliers. Already the biggest streaming service, buying Warner Bros. and HBO could give the company the ability to dictate the market for talent. Within hours of reaching a deal for Warner Bros.′ studio and streaming service, Sarandos reached out to talent agents, producers, filmmakers and top industry figures to address their concerns. . Sarandos knows that many in Hollywood oppose the sale of Warner Bros., whether to Netflix or Paramount Skydance. In the case of Netflix, the community worries both about the deal's potentially deleterious impact on movie theaters and the power Netflix would wield in streaming. "Consolidation in this industry results in a decline in the number of movie and theatrical releases, which directly impact movie theaters, as ticket sales, theater attendance and revenue decline," documentary makers and art-house theaters wrote in their letter to state attorneys general. Some have taken this a step further, referring to this as an extinction-level event for movie theaters. Netflix has won over many in the industry – in particular those who are more concerned about the politics of his rivals for Warner Bros., David Ellison and his father Larry. Yet he has been dogged by concerns about his plans for feature films. It isn't the federal government's job to protect a particular business in secular decline, but theaters elicit strong reactions from some of Hollywood's most influential figures. It would be damaging to Netflix's bid if an array of prominent industry forces aligned publicly against the deal. Sarandos has granted interviews and made several public remarks to reiterate that he will continue to release Warner Bros. films in theaters. "Warner Bros. films are going to be released in theaters with a 45-day window, just like they are today," he said on a call with Wall Street analysts last month. "This is a new business for us and one that we're really excited about." Still, the 61-year-old power broker has struggled to convince Hollywood that he will support theaters given his frequent comments about their growing obsolescence. The Trump wild cardSome opponents of the deal have targeted the state attorneys general because they are worried the Trump administration will fail to intervene. The first Trump administration tried to block AT&T Inc.'s acquisition of Time Warner, then the owner of Warner Bros. and HBO. But the second Trump administration seems more willing to let deals go through. Trump has both praised Netflix and warned about its potential market power. "It looks to me like one of them is very much a monopoly if they are able to do this deal," Trump said Thursday at the premiere of a documentary about his wife. "So we will see how it all works out." Trump has often used pending deals to extract concessions, but mergers and acquisitions soared last year. Netflix has historically faced its stiffest opposition abroad, where local governments have worried about a foreign company supplanting local studios and broadcasters as the dominant sources of entertainment. The company has contended with production quotas in France, tax inquiries in South Korea and censorship in Saudi Arabia. Netflix has appeased foreign governments by investing heavily in local production and opening offices all over the world. The company has developed something of a playbook. It opens an office with local leadership and announces plans to invest hundreds of millions of dollars – if not billions of dollars – in local production. Sarandos and/or co-founder Reed Hastings appears at an event alongside the local head of state, holding hands to project Netflix as a friend of the court. Co-CEO Greg Peters has joined the parade more of late, especially given his ability to speak so many languages. The best of Screentime (and other stuff)

The biggest music deal ever?German media giant Bertelsmann has held talks about buying Concord and merging it with its own BMG, a deal that would unite the two largest independent players in music. Neither BMG nor Concord are household names in the same way as Universal, Sony and Warner. But the combined company would be comparable in size to Warner. Two large independents would combine to make what would essentially be a fourth major music company. Bertelsmann has floated a price of about $7 billion in cash and stock, which would be the biggest deal in music history that I can recall. Len Blavatnik paid $3.3 billion for Warner in 2011 at the bottom of the market. That company is now worth about $20 billion, including debt. Whether this deal will actually close has been a hot topic of discussion at Grammy parties. Concord shopped itself a few years ago and couldn't fetch a price that satisfied its largest shareholder, the state of Michigan's retirement fund. BMG would be paying in a mix of cash and stock. Do Michigan retirees want a large stake in a private German conglomerate? The No. 1 TV show in the world is...Bluey. This won't be news to folks who read this newsletter a month ago. But Nielsen released its most-watched titles of 2025 this past week. Stranger Things was the most-watched original series on streaming while KPop: Demon Hunters was the top movie. Both dwarfed the competition. Deals, deals, deals

Weekly playlistLast year I listed my favorites for the top categories at the Grammys and went 4-for-4. There is no way I can do that again, but I have to try. Reminder this is who I want to win, not who I think will win. Record of the Year: Anxiety, Doechii I would expect Billie Eilish or Lady Gaga to win here. APT. by Rosé and Bruno Mars was one of the most popular records of last year. But since I am voting for what I loved, the answer is Doechii. I would be thrilled by Bad Bunny winning, but I have him winning another big one. Kendrick Lamar won this category last year with a better song so he doesn't need a repeat. Album of the Year: Debi Tirar Más Fotos, Bad Bunny The most popular artist in the world makes an album inspired by the sounds of his home island. If the Recording Academy is going to keep giving prizes to pop stars like Taylor Swift and Billie Eilish, it should recognize Benito and not "other" him as it has with rap for so long. Song of the Year: Golden I find it really weird that this song isn't up for record of the year. (Song is for writing and record is for the recording/production of that song.) It was undeniably the song of the year by every metric. Best New Artist: Olivia Dean This is such a silly category. Most of these artists have been releasing music for years. (The Marias released an EP in 2017!) There isn't one artist I love more than all the rest, but Dean gets the edge over Leon Thomas. Her performances at Grammy parties this past week put her over the top! More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Sunday, February 1, 2026

The case against Netflix, Disney CEO update, biggest music deal ever

Subscribe to:

Post Comments (Atom)

Monday Morning Focus: See Why (STEX) Just Hit Our Radar

February 01, 2026 | Read Online Monday Morning Focus: See Why (STEX) Just Hit Our Radar Any content you receive is for information pur...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment