How Amateurs Can Beat the Pros VIEW IN BROWSER In 2003, a Tennessee accountant spent $39 to enter a poker tournament. By the end of the World Series of Poker, Chris Moneymaker walked away with $2.5 million. Along the way, he defeated players with decades of experience at the professional tables – hardened veterans who had made their living reading tells, calculating odds, and staring down opponents under the bright lights of Las Vegas. These pros had logged tens of thousands of hours at the tables. Moneymaker had never played in a major live tournament. He wasn’t a professional gambler. He wasn’t backed by any sponsors. He didn’t have years of high-stakes experience. He wasn’t supposed to win. But he did. Not because he was lucky, but because he understood something fundamental. The drama portrayed in the media about poker face-offs and big bets is misleading. Poker, at its core, isn’t about bravado or reputation. It isn’t about who’s been around the longest. It’s about probabilities. Expected value. Risk management. It’s about making disciplined decisions over and over again – especially when emotions are screaming at you to do something reckless. In 2003, when the cards were finally dealt, the “amateur” walked away the champion. That’s the power of having the right system and sticking to it no matter what. The stock market works the same way. Wall Street wants you to believe experience wins. That billion-dollar hedge funds always outmaneuver individuals. That, unless you sit on a Manhattan trading desk, you don’t stand a chance. But markets — like poker — don’t reward credentials. They reward discipline. And it’s how, in 2025, a 25-year-old art major beat the market by two-to-one. She doesn’t work on Wall Street. She doesn’t have a finance degree. She doesn’t spend her days studying balance sheets. She lives in a small New York apartment and works in the film industry. She even outpaced many professional money managers. | Recommended Link | | | | The White House just announced the next phase of its buying plan, with Project Vault, a $10 billion+ effort to stockpile critical minerals. And recently, Washington took a stake in USAR, driving it up as high as 100% in less than a month, just as I predicted months before. Today I’m here to issue ANOTHER urgent buy call. |  | | How a System Can Beat the Market Her name is Crystal Navellier. And the reason she’s beating seasoned professionals has nothing to do with talent… And everything to do with a disciplined system. Regular Digest readers are familiar with Wall Street legend Louis Navellier and the time-tested system that has helped him beat the market for decades. Louis built a quantitative system decades ago that ranks thousands of stocks every week based on two core pillars: - Fundamental strength — sales growth, earnings growth, profitability

- Institutional buying pressure — where serious money is flowing

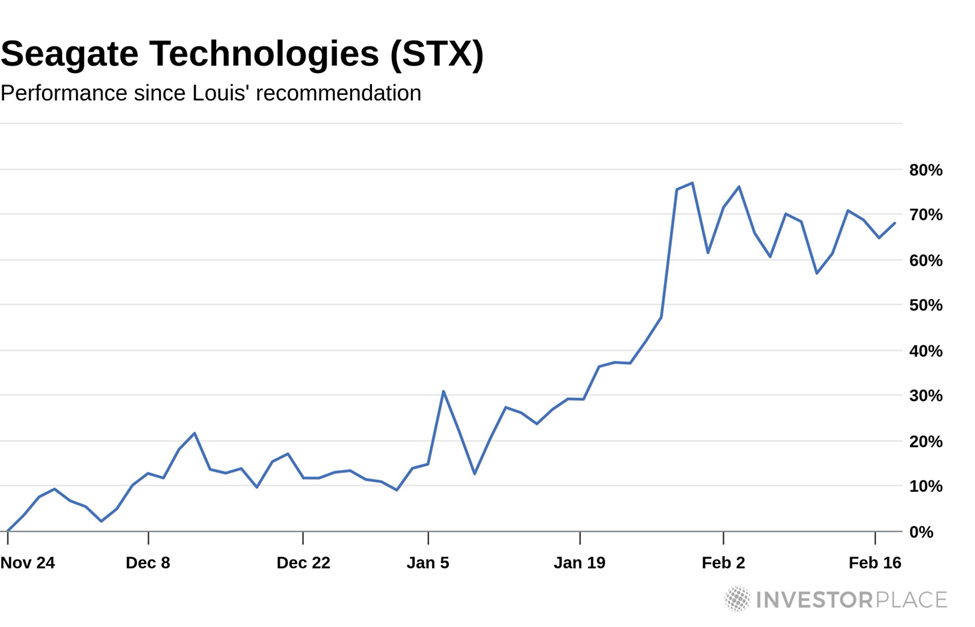

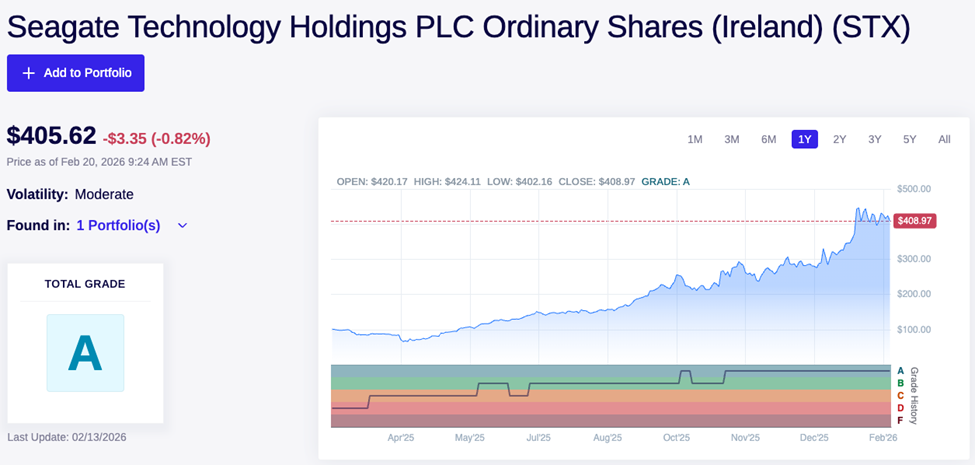

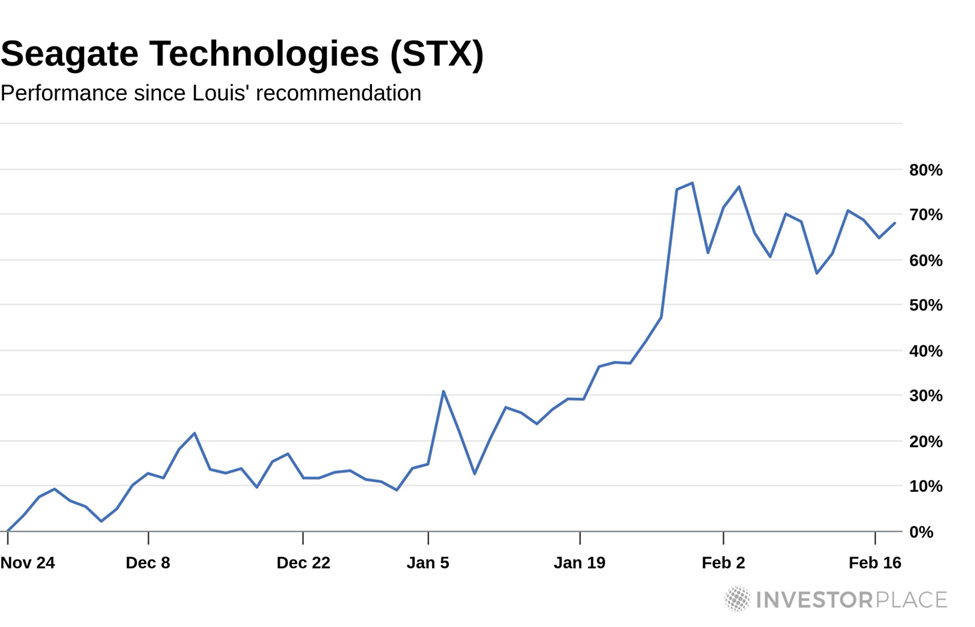

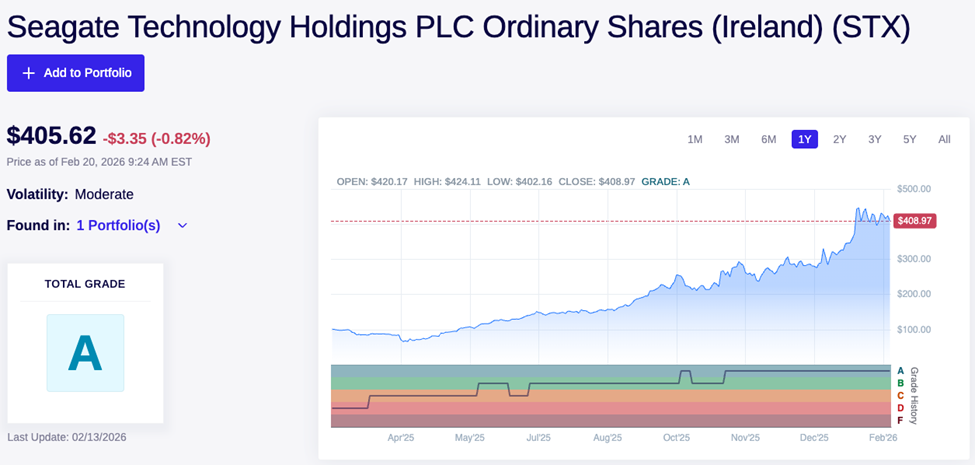

Every stock receives a simple letter grade. A’s and B’s rise to the top. D’s and F’s get avoided. It’s not emotional. It’s not political. It’s not headline-driven. It’s math. Crystal doesn’t watch CNBC all day. She doesn’t trade options. She doesn’t chase crypto trends. She doesn’t try to outguess the Fed. Instead, she logs into her account and reviews Louis’ updated Stock Grader ratings and alerts. She buys the A- and B-rated stocks. She avoids the D’s and F’s. And then she goes back to her life. No second-guessing. No emotional overrides. No, “I think I know better.” And that’s how she beat the market two-to-one in 2025. Not because she’s a stock market prodigy. Because she followed a system. An A-Rated Stock to Consider Today Here is the Stock Grader system in action… One of the stocks Louis’ system highlighted recently sits at the center of the AI infrastructure boom – the kind of quiet backbone company most investors overlook while chasing the Magnificent Seven. It’s called Seagate Holdings (STX). Hard drives have become the backbone of AI data storage, and STX develops AI-capable hard drives better than anyone else. Increasing use of AI means that data – audio, images and video – are being created at incredible speeds. Seagate is a global leader in storage and has provided more than four zettabytes of capacity, covering the cloud, the edge and endpoint devices. But the stock isn’t a pick just because of what it does. Louis’ Stock Grader – which is the quant tool he created that assigns each stock a letter grade – gave it an “A” grade and identified it as a company with strong fundamentals. Here is the update Louis provided to Growth Investor subscribers when STX announced earnings in January. Seagate Technology Holdings plc (STX) exceeded analysts’ earnings and revenue expectations for its second quarter in fiscal year 2026. Second-quarter revenue rose 21.5% year-over-year to $2.83 billion, beating estimates of $2.76 billion. Earnings increased 53.2% year-over-year to $3.11 per share. Analysts expected earnings of $2.84 per share, so Seagate Technology posted a 9.5% earnings surprise. Looking ahead to the third quarter in fiscal year 2026, Seagate Technology expects total revenue of about $2.9 billion and earnings per share between $3.20 and $3.60. That represents 34.3% year-over-year revenue growth and 68.4% to 89.5% year-over-year earnings growth. Both forecasts are nicely higher than the current consensus estimate. The stock is up more than 70% in the three months since Louis’ recommendation.

More importantly for us today, STX is still an “A” in Stock Grader and below Louis’ buy below price. So, Louis expects there is still room to run.

Seagate is just one example, but it’s not the most interesting part of this story. The most interesting part is how a 25-year-old art major is using this same grading system to outperform seasoned professionals – without options, chasing crypto, or watching markets all day. Louis recently explained exactly how his system works… why he believes index investors may be taking hidden risks… and the specific stocks he believes are positioned for 2026. Chris Moneymaker proved that amateurs can beat the pros when they trust the math and don’t act emotionally. Crystal Navellier is proving the same thing in today’s market. The question is: Are you relying on headlines… Or are you relying on a system? You can watch Louis’ full presentation here. Enjoy your weekend, Luis Hernandez

Editor in Chief, InvestorPlace |

No comments:

Post a Comment