| Bloomberg Evening Briefing Americas |

| |

| Dip buying powered a comeback for stocks Friday, following a tech rout fueled by fears of an artificial intelligence bubble. Bitcoin jumped after a 50% tumble from its peak. Silver and gold also rose. Following a plunge in some of Wall Street's most-crowded trades, the S&P 500 rose 2% and the Dow Jones Industrial Average hit 50,000. Even an exchange-traded fund tracking software firms added 3.5% while a gauge of chipmakers soared 5.7%. But no such pleasantries for Amazon, which sank 5.6% on plans to spend $200 billion on AI. The recent drop in technology stocks is a reason to buy the dip in the broader market as the US economic outlook remains robust, according to Anwiti Bahuguna at Northern Trust Asset Management. "It's clearing off some of the froth in the markets," she said. "We are actually seeing the use case for AI become clearer. From a macro sense, this is not the time to panic." —David E. Rovella | |

What You Need to Know Today | |

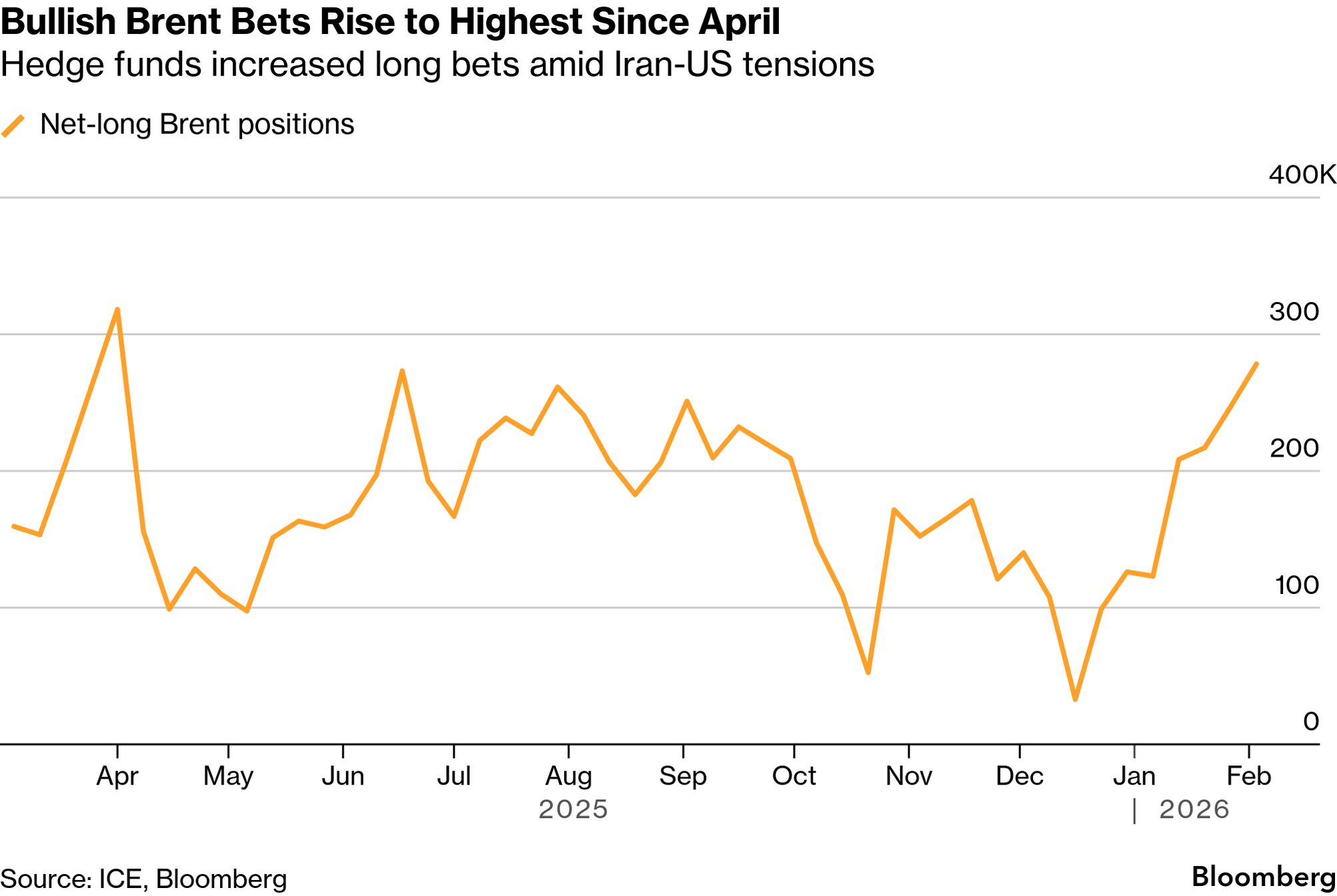

| Hedge funds turned the most bullish on Brent crude since early April as traders guarded against the risk of a conflict between the US and Iran and potential supply disruptions from the OPEC member. New American threats to attack Iran, which it bombed last June in a surprise attack, have driven investors to raise bullish oil bets for four consecutive weeks. The two countries appeared to square off at sea and in the air on Tuesday, as the Pentagon moved a group of naval vessels closer to Iran's shores, reviving a risk premium that subsequently ebbed as potential plans for talks took shape. Iran said Friday it agreed with the US to continue indirect talks to de-escalate tensions, with Tehran describing the first day as positive. Negotiations, mediated by Oman in its capital, Muscat, had a "good start," Iran's Foreign Minister Abbas Araghchi told state TV. He added that he thought the sides "can reach an agreed framework for future talks" if the process continues in the same vein. | |

|

| |

|

| |

|

| Norway's foreign intelligence service sees a growing risk of a more assertive Russia and China as Trump pulls America back from international cooperation and institutions. The weakening of the global rules-based order is "shaking the foundations of Norwegian security," Nils Andreas Stensones, the head of the service, known as E-tjeneste, said Friday. Speculation has grown that Russia may have designs on Norway's Arctic archipelago of Svalbard, which Oslo has vowed to protect. "The political behavior in Washington influences how Beijing and Moscow are thinking and maybe how they are acting in the future," Stensones said in an interview. European officials have long warned that a US seen as less willing to fulfill its treaty obligations, as it appears to be under Trump, may open the door to military adventurism that could lead to wider war. Trump once famously threatened to let NATO countries fend for themselves in the case of a Kremlin attack. And the US itself is now seen as a threat, too. A Danish intelligence agency in December for the first time described America as a potential security risk, pointing out that the US is "now using its economic and technological strength as a tool of power, also toward allies and partners." | |

|

| Canada is working to land a Chinese-Canadian auto plant that will export electric vehicles globally, Industry Minister Mélanie Joly said. She said Canadian auto parts firms such as Magna International, Linamar and Martinrea International already have operations in China and could participate in a joint-venture assembly plant in Canada. The overtures to Chinese automakers mark a turnaround for the Canadian government as it looks to reduce dependence on the US market for cars and build a stronger domestic industry. Canada had previously said China was unfairly subsidizing its manufacturers, while security concerns have been raised over the vehicles' technology. | |

| |

|

| Nothing has changed. That's the contention from officials and residents of Minnesota who say that despite a messaging campaign from the White House following the killing of two US citizens, thousands of federal immigration agents remain on the streets of Minneapolis, with some reportedly now focusing on children near elementary schools. Meanwhile, Texas seems to be suffering collateral economic damage from Trump's deportation campaign: job growth was almost flat last year as migration to the state plunged and oil prices lagged. Employers added a mere 10,700 jobs in 2025, according to new data published by the Federal Reserve Bank of Dallas. The 0.1% increase is the state's weakest since 2020 and is reminiscent of the employment decline following the dot-com bust, said Pia Orrenius, a labor economist at the bank. "That's very, very unusual for Texas," Orrenius said Friday in a presentation at the Dallas Fed. "The immigration crackdown is really having an effect limiting labor supply."  Immigration agents arrest a protester in Minneapolis on Feb. 3. Masked and heavily armed federal paramilitaries have swept through Minnesota communities seeking undocumented migrants and confronting US citizens. Photographer: Charly Triballeau/AFP/Getty Images | |

|

| At some companies, the whispering begins with a single employee, and then spreads from there. Gooseneck microphones start appearing on desks as a growing number of workers forgo keyboards to murmur instructions to their computers instead. | |

| |

| New Year Sale: Save 60% on your first year

Enjoy unlimited access to Bloomberg.com and the Bloomberg app, plus market tools, expert analysis, live updates and more. Offer ends soon. | | | | | | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Bloomberg Invest: For more on policy and markets, come to Bloomberg Invest on March 3–4 in New York where we will gather the most influential voices in asset management, banking, private capital and wealth. Catch the Minneapolis Fed's Neel Kashkari for a firsthand view on monetary policy and the economy. Plus notable conversations with Apollo's Marc Rowan and Temasek's Dilhan Pillay Sandrasegara, as well as Dawn Fitzpatrick of Soros Fund Management and Divya Nettimi of Avala Global. Register your interest to attend here. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment