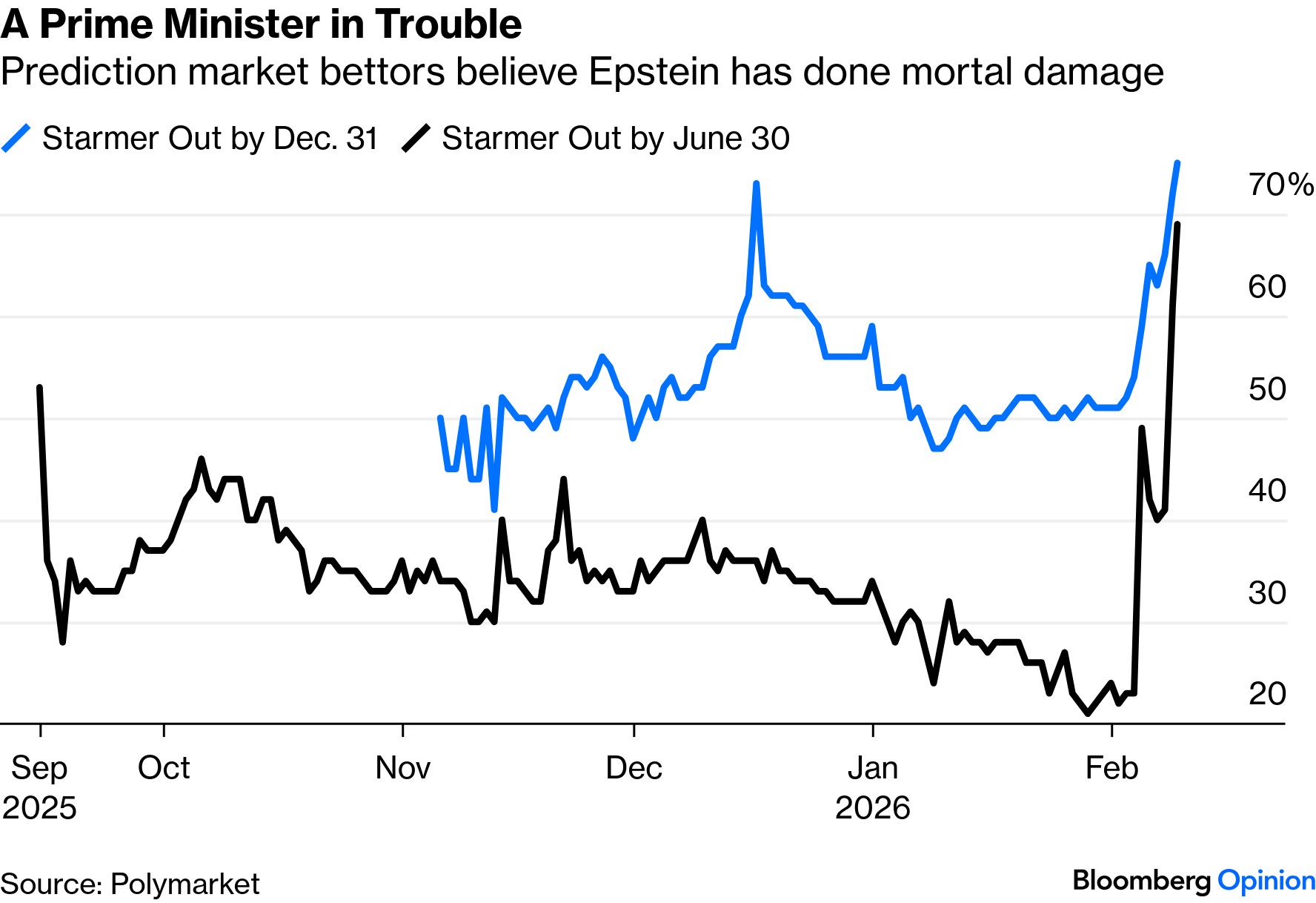

Epstein's Political Victims | The Jeffrey Epstein scandal is poised to bring down its first major political leader. That's not surprising. But it's amazing that the head to roll looks likely to be that of British Prime Minister Keir Starmer. Unlike US President Donald Trump, there is no evidence that he ever even met the convicted pedophile. Personal probity is the very least of his problems. And yet he is in terrible political trouble. His House of Commons majority is unassailable and his mandate runs until the summer of 2029, but bettors predict he will be out of office by the end of June: The catalyst was his 2024 decision to make the Labour Party grandee Peter Mandelson ambassador to the US, in the hope that he could smooth the relationship with Trump. Mandelson was fired after his gushing correspondence to Epstein came to light, and the scandal rose to a far more dangerous level last week when the latest downloads revealed emails he had sent to the disgraced financier when he was deputy prime minister, alerting him to market-sensitive policy decisions. This is extremely bad for Mandelson; but there's no suggestion Starmer knew this when he hired him. The appointment attracted much commentary at the time, but little condemnation. However, in the last two days, Starmer's chief-of-staff and head of communications have been forced to resign over the issue, with his chief civil servant now likely to follow. Monday brought a call from Anas Sarwar, the Labour Party's leader in Scotland, for the prime minister to stand down. How can a long-dead American pedophile possibly bring down a British prime minister he never met? Tina Fordham of Fordham Global Foresight offers two explanations: I can't decide is this just the latest example of the particular disease we have here in the UK, where our politicians are seemingly simultaneously comparatively cheap to bribe...and our political culture is deeply self-righteous…or if the UK government is merely the first casualty in what will become a wider Epstein-induced decapitation strike on the Western political and business establishment.

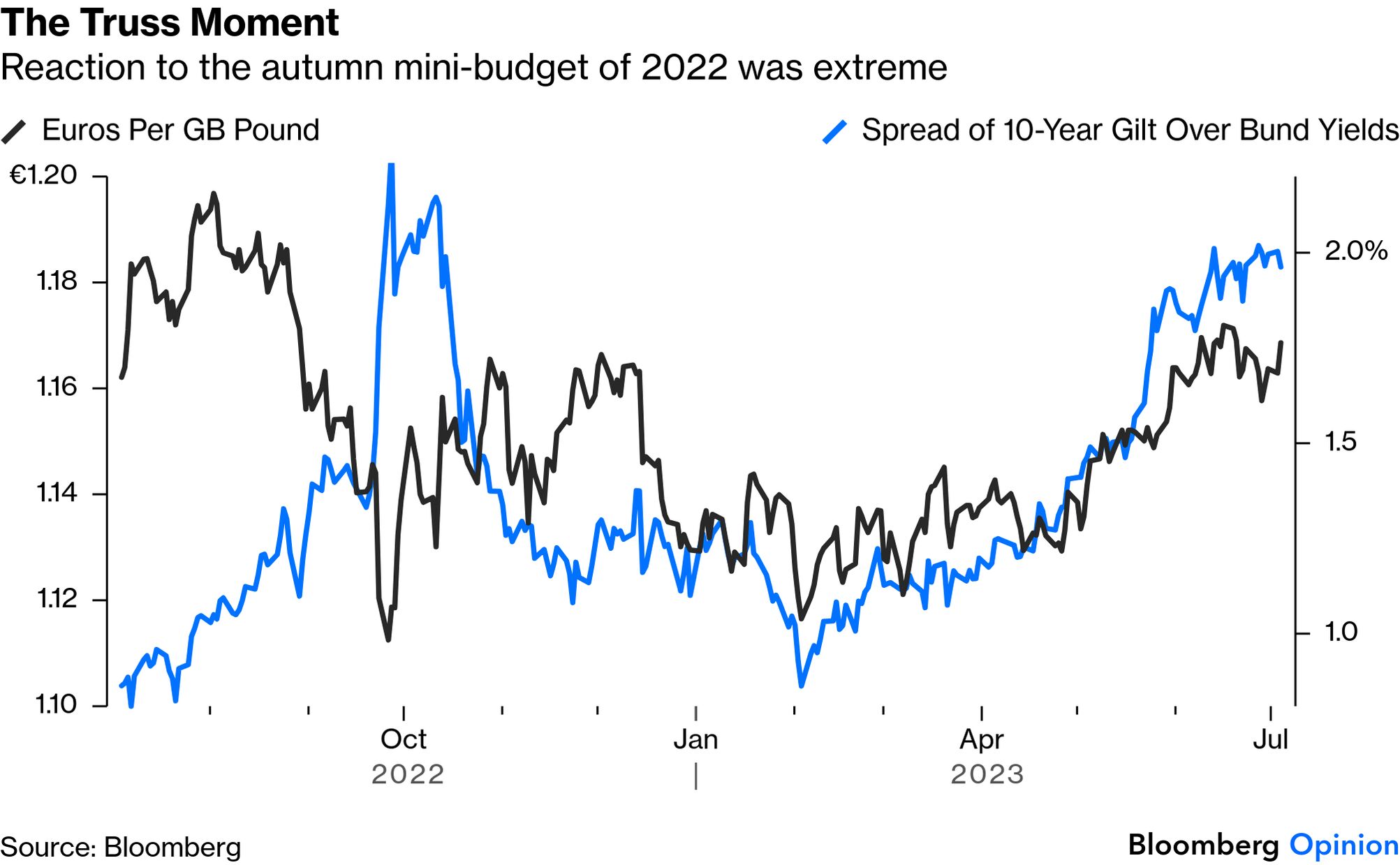

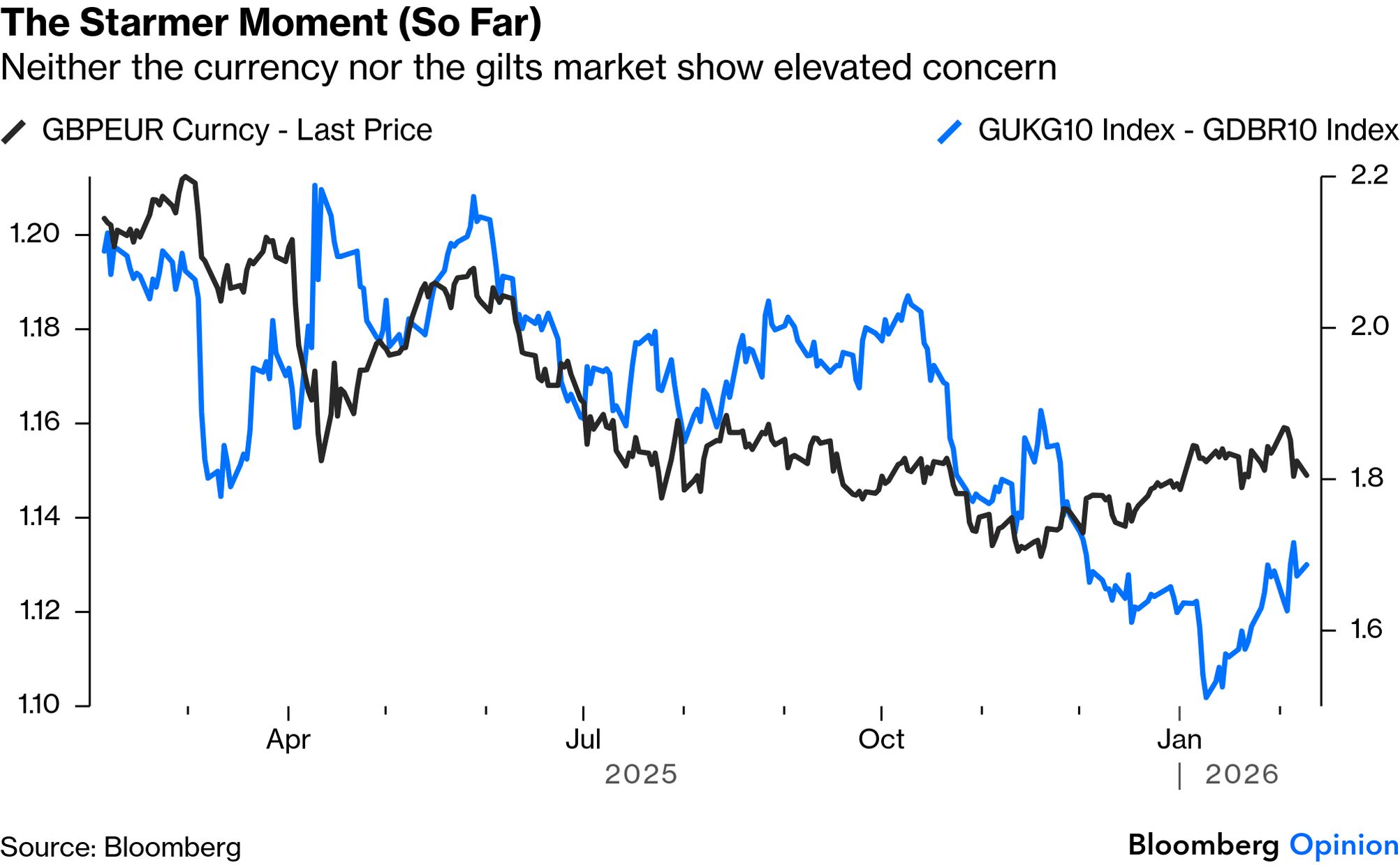

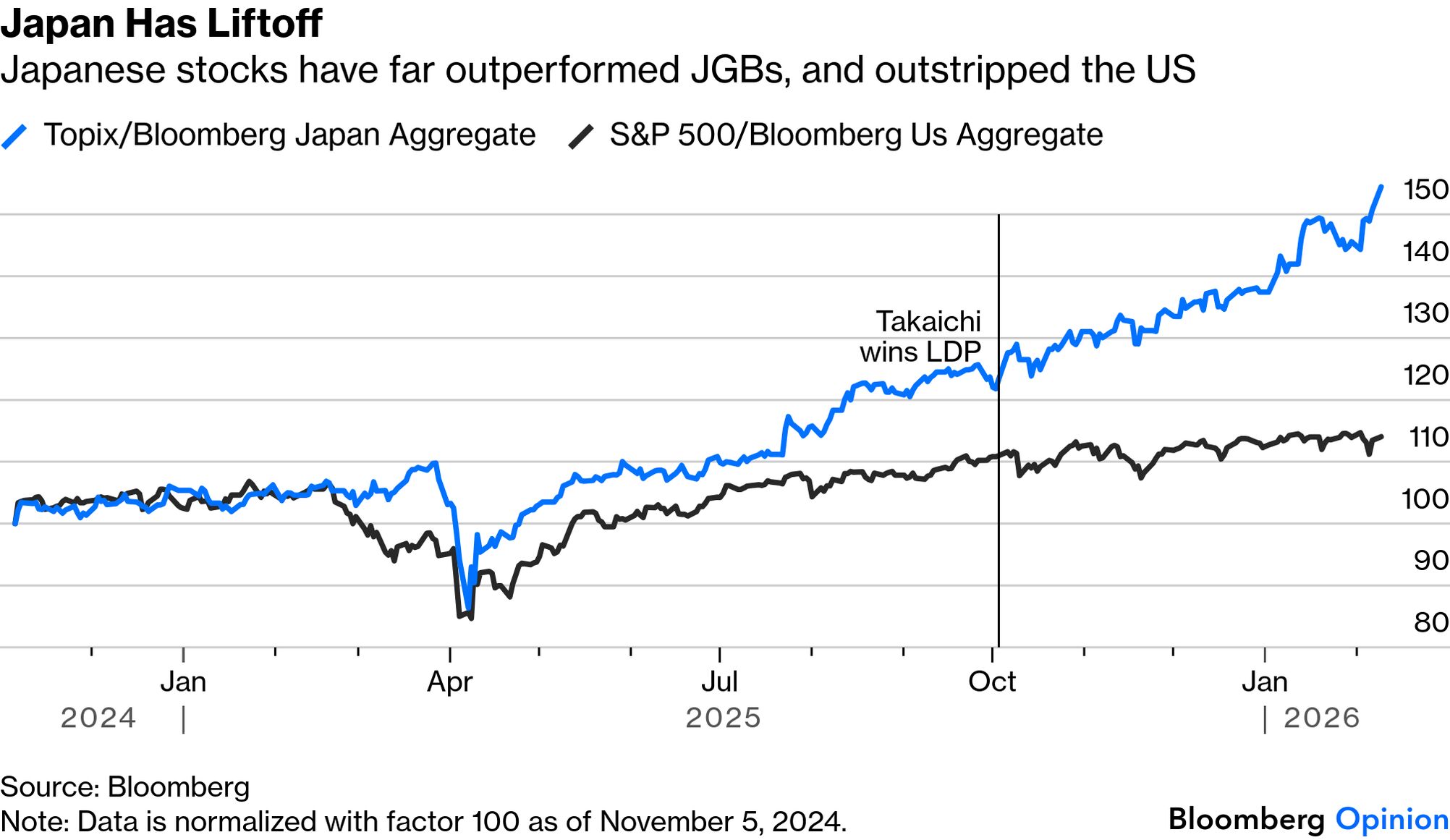

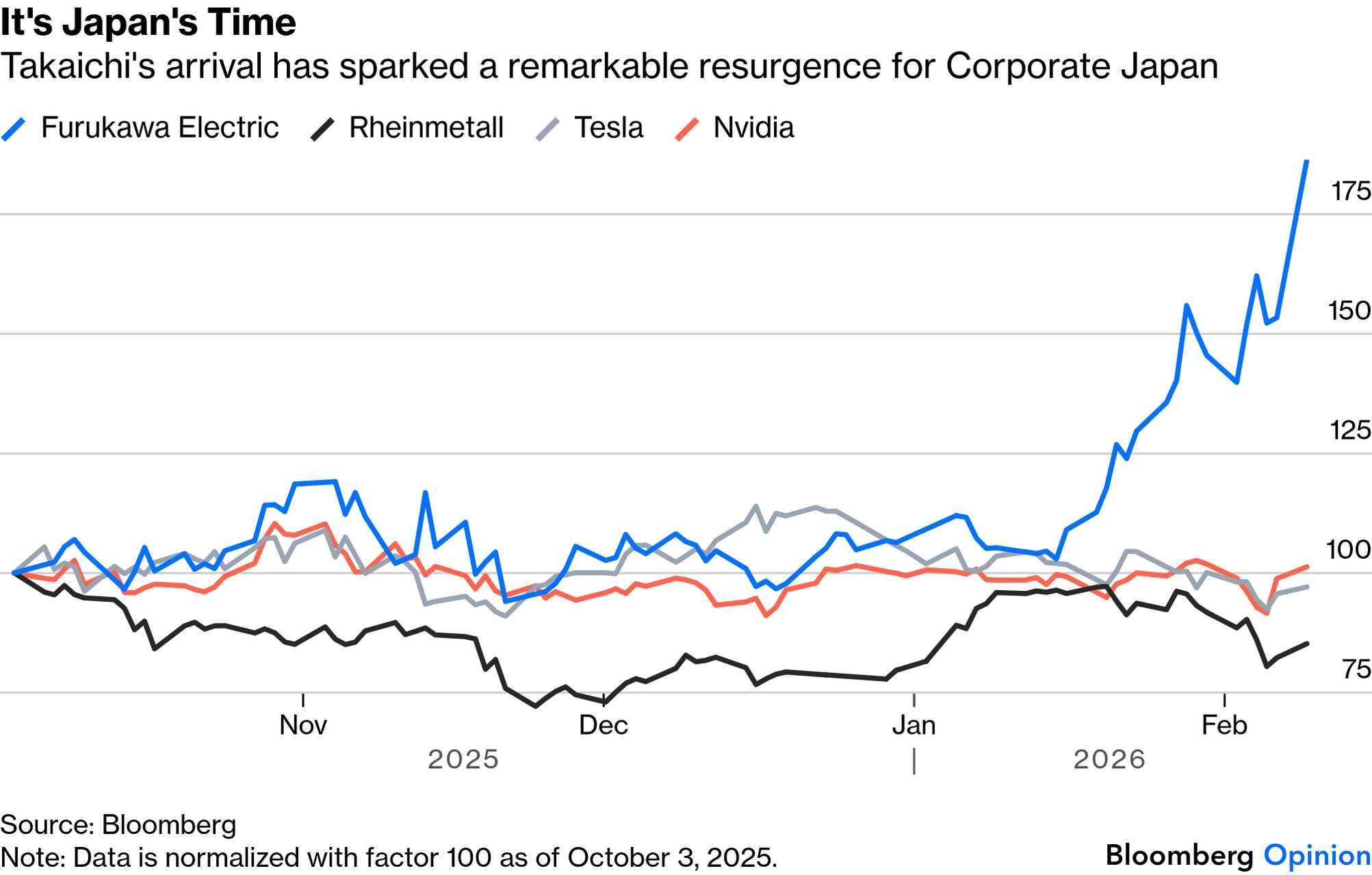

Markets must now tolerate protracted uncertainty. Labour Party elections take about two months, and there's no clear front-runner. The most plausible candidates are ideologically to the left of Starmer, and more likely to stoke fiscal problems. Gilt yields jolted up noticeably after Sarwar called for him to go. That said, there is as yet minimal sign of a repeat of the Liz Truss moment from 2022, when a budget involving unfunded tax cuts caused bond yields to surge while the pound simultaneously sank. This is what happened then: This is the same chart, showing gilts and the pound over the last 12 months. Another Truss moment remains a risk, but this is nothing close to that: By the end of the day, Starmer had made a behind-closed-doors address to Labour MPs, who then generally briefed the press that he had done well. This is unlikely to sweep him away in the next few days, and his most plausible opponents have no incentive to speed the process. Former Deputy Prime Minister Angela Rayner resigned over allegations of tax fraud, which have still not been cleared up, while former cabinet minister Andy Burnham doesn't have a seat in parliament as he is still serving as the mayor of Greater Manchester. Both would prefer a delay. But the issue will not go away. Starmer is so damaged by this because he was so weak to begin with. His approval ratings have at times dropped even lower than Truss' ever did. The latest Ipsos poll suggests Labour has only 19% support. "Ultimately, for many in the market it's just a matter of time," says Jordan Rochester of Mizuho Securities, with Labour likely to suffer in May's local elections. "It's a Damocles sword hanging above gilt traders until the question as to 'who's next?' is finally resolved." As the Epstein scandal continues to metastasize, politicians in other countries will likely also feel the sword over them. Having won over Japan's voters, Sanae Takaichi now has to win over the capital markets. That's a tougher assignment, and the Japanese prime minister is unlikely to get anything like the decisive victory she got in Sunday's election. But the initial response has gone well. Two days on, she still resembles Margaret Thatcher more than Liz Truss. The Nikkei 225 gained another 2.8% in Tuesday morning trade, following Monday's 3.9% gain, while Japanese government bond yields dropped slightly, exactly the combination Takaichi wanted. Japanese markets are now unmistakably positioned for a cyclical breakout, with stocks far outperforming bonds. The difference between Japan and the US over the period of the two countries' elections is stark: The impact on individual stocks is nothing short of extraordinary. This is how Furukawa Electric Co., a wire manufacturer, has performed compared to some of the most famous international names of the moment since Takaichi clinched the party leadership: Such optimism cannot sustain for long, and markets usually dislike any government attempt to pick winners. But they're very excited about Takaichi's evident intent to try to do away with excessive competition and create national champions. Yushu Ma of BCA Research puts it this way: Fiscal expansion will be paired with industrial policy, channeling capital toward AI, semiconductors, quantum computing, aerospace, defense, and shipbuilding. This reflects a broader push to bolster economic security and supply-chain resilience, aligning Japan's growth agenda more closely with geopolitical considerations.

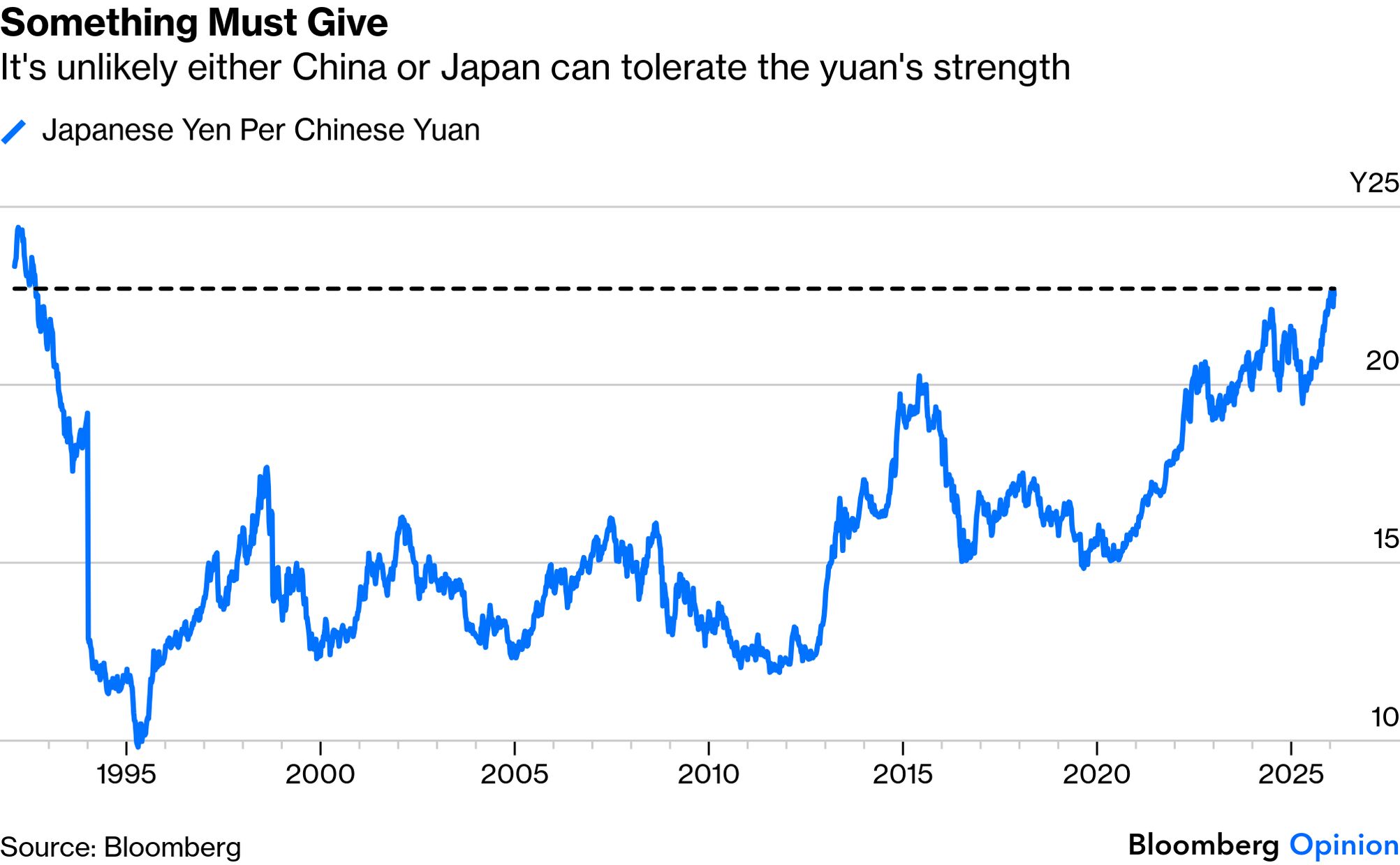

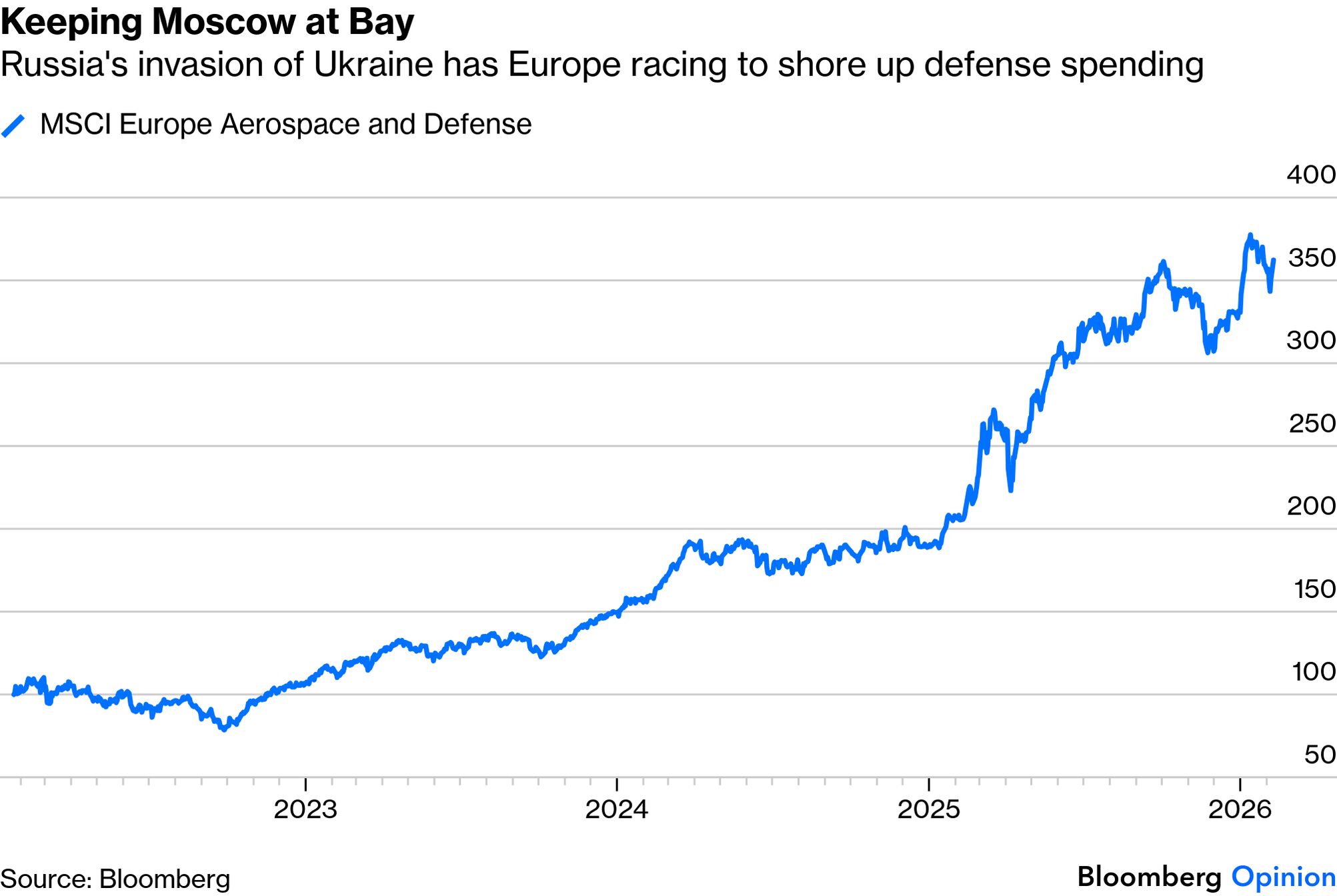

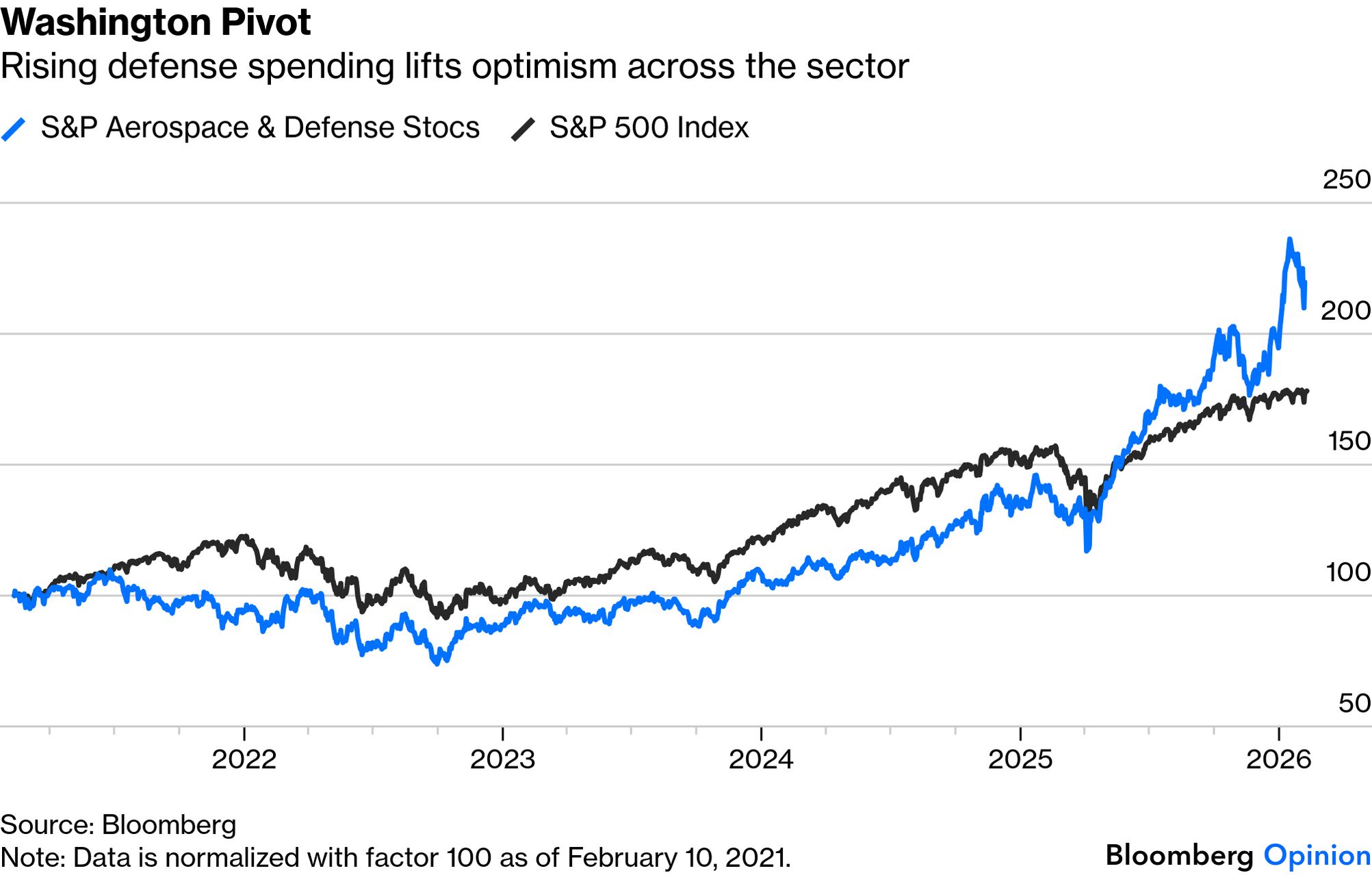

The main problem with a more assertive foreign policy is the effect it could have on China. Yen weakness could also be a critical issue, as it has encouraged Chinese tourists and investors into Japan, causing friction, while also making Japanese exporters far more competitive. It's hard to see how this can carry on much longer. In both military and economic terms, the neighbors may find it hard to get on: What Takaichi wants to do is more or less exactly what the market wants. The questions for the longer term are whether she can deliver, and how China will respond if she does. Russia's invasion of Ukraine four years ago is an ever clearer turning point for investment. It prompted European countries to ramp up defense spending. Once Trump breathed down their necks, the bloc's leadership couldn't deny that their ability to defend themselves was badly in need of an upgrade. The rearmament trade continues, ranking among the market's strongest performers, as tech giants weigh on overall returns. From the start of the war in 2022 through late last year, the MSCI Europe Aerospace and Defense index generated a total return of 236%: Across the Atlantic, the S&P Aerospace and Defense's performance beat the benchmark by a mile: This level of outperformance cannot persist indefinitely, but the rally still has legs. Heightened geopolitical tensions — from renewed US pressure on Venezuela to Trump's revived rhetoric over Greenland — have added fresh support for defense stocks. As August Gudmundsson of Gavekal Research observes, this reflects growing perceptions of existential risk: Any fear of a European reversal in the guns-and-butter tradeoff back toward peacetime defense preparedness is, however, misplaced. The "rupture" in the global order outlined by Canadian Prime Minister Mark Carney last month in Davos appears real and is already driving a structural rise in European defense spending.

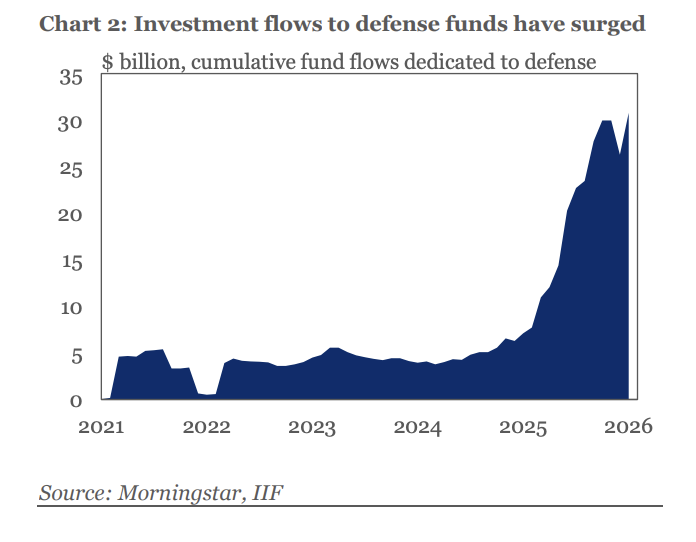

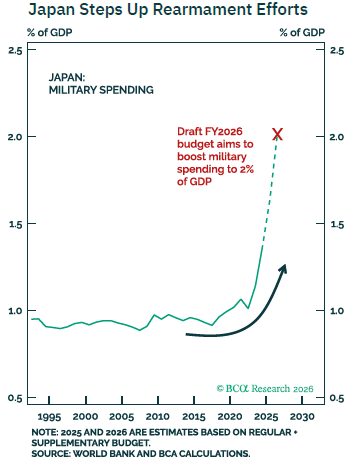

While government budgets will continue to do most of the heavy lifting in defense spending, the sheer scale and complexity of what needs to be built — especially in Europe — means the private sector will have to play a bigger role. The Institute of International Finance's Emre Tiftik notes that the challenge is less a shortage of capital than a misalignment across financial frameworks, procurement practices, and risk-sharing mechanisms. Improving this, Tiftik observes, would help scale defense funding, while preserving financial stability and regulatory integrity: The theme is gaining traction beyond Europe. Trump wants a sharp increase in US military spending, potentially reaching $1.5 trillion by 2027. Other countries, particularly those Canadian Prime Minister Mark Carney calls "middle powers," are resorting to even bigger build-ups. This chart from BCA Research shows Japan's defense spending ambitions under Takaichi: These are the returns of exchange-traded funds that track defense stocks, according to data compiled by Bloomberg Intelligence: While the fundamental backdrop for the industry remains highly supportive, Janus Henderson's Julian McManus points out that valuations are higher than a year ago. McManus argues that any de-escalation of geopolitical tensions can drive short-term volatility in European defense stocks, as happened recently after Trump's apparent climbdown on Greenland. Such swings in sentiment shouldn't, however, derail the long-term thesis. For Scott Helfstein of Global X ETFs, the sector's fundamentals are strong enough that they don't depend on any particular ongoing conflict: One concern out of the gate is valuation being a little bit stretched. But again, I think that there are good reasons. Obviously, you have to pay more as companies improve, as growth accelerates, and profitability improves. And you're getting both of those built in at the same time.

There are still risks. Governments have to convince markets they can pay for all this. But for now, the Trump 2.0 effort to get everyone to spend more for their militaries is working beautifully. Unless politics or the bond markets get in the way, investors will likely stay with defense stocks for the ride. -- Richard Abbey |

No comments:

Post a Comment