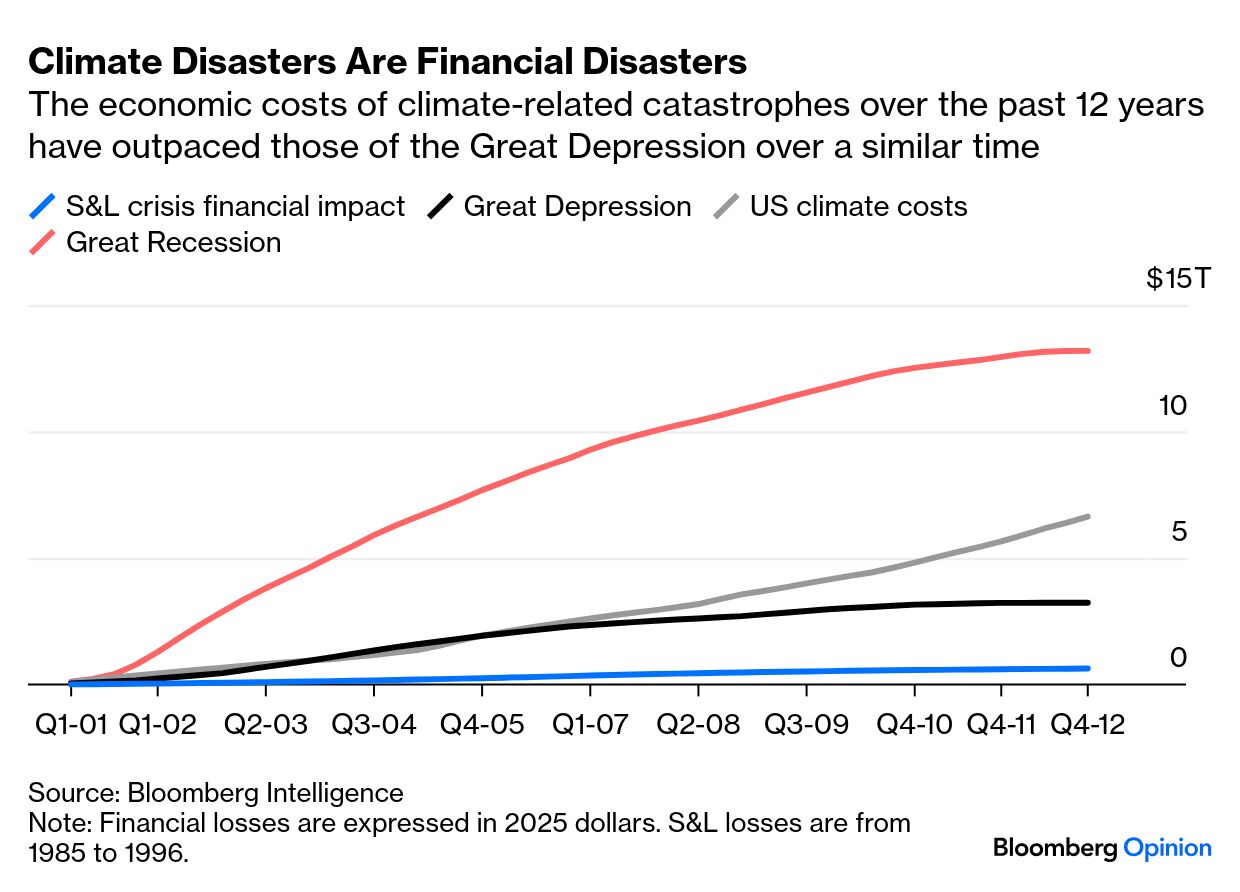

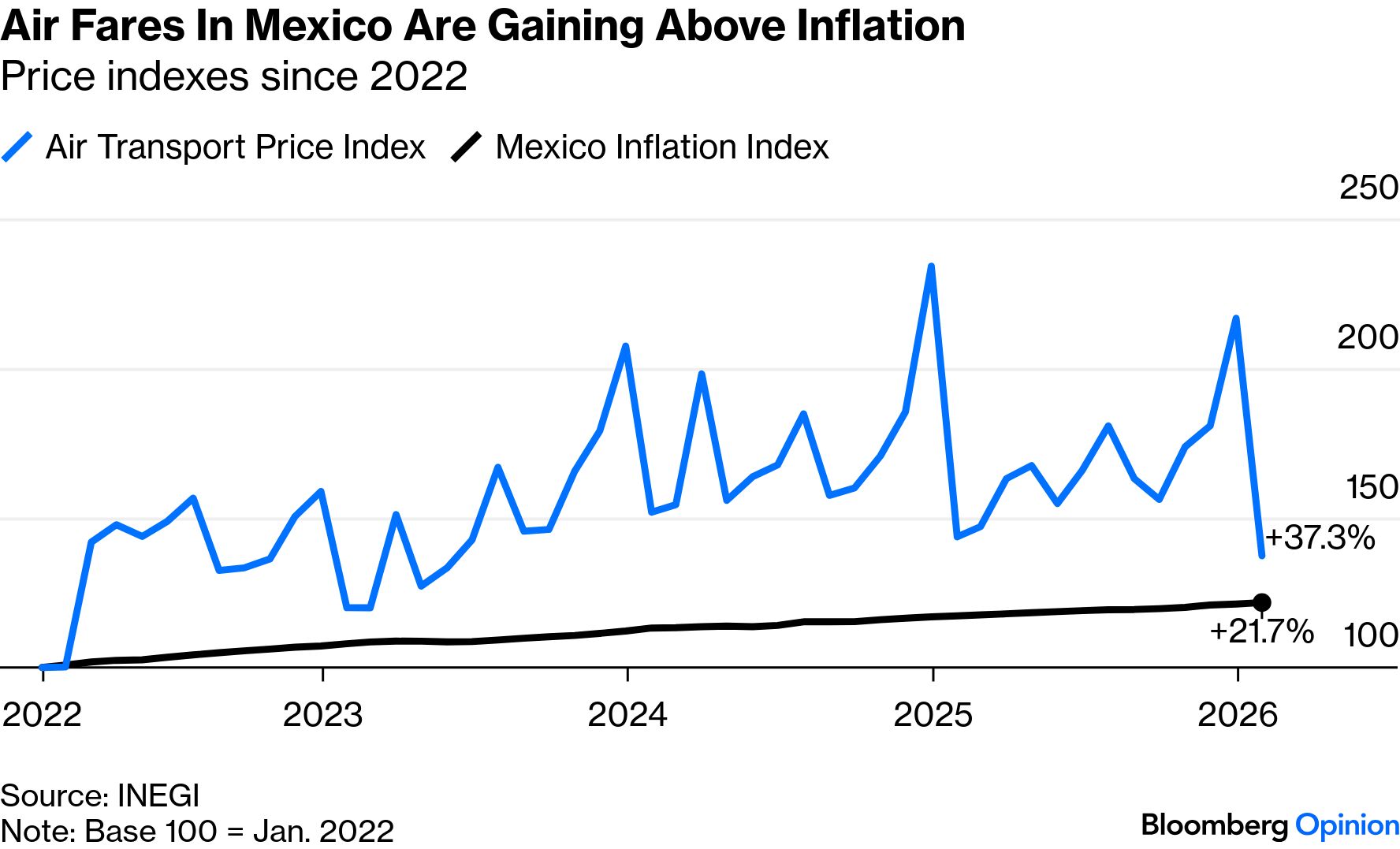

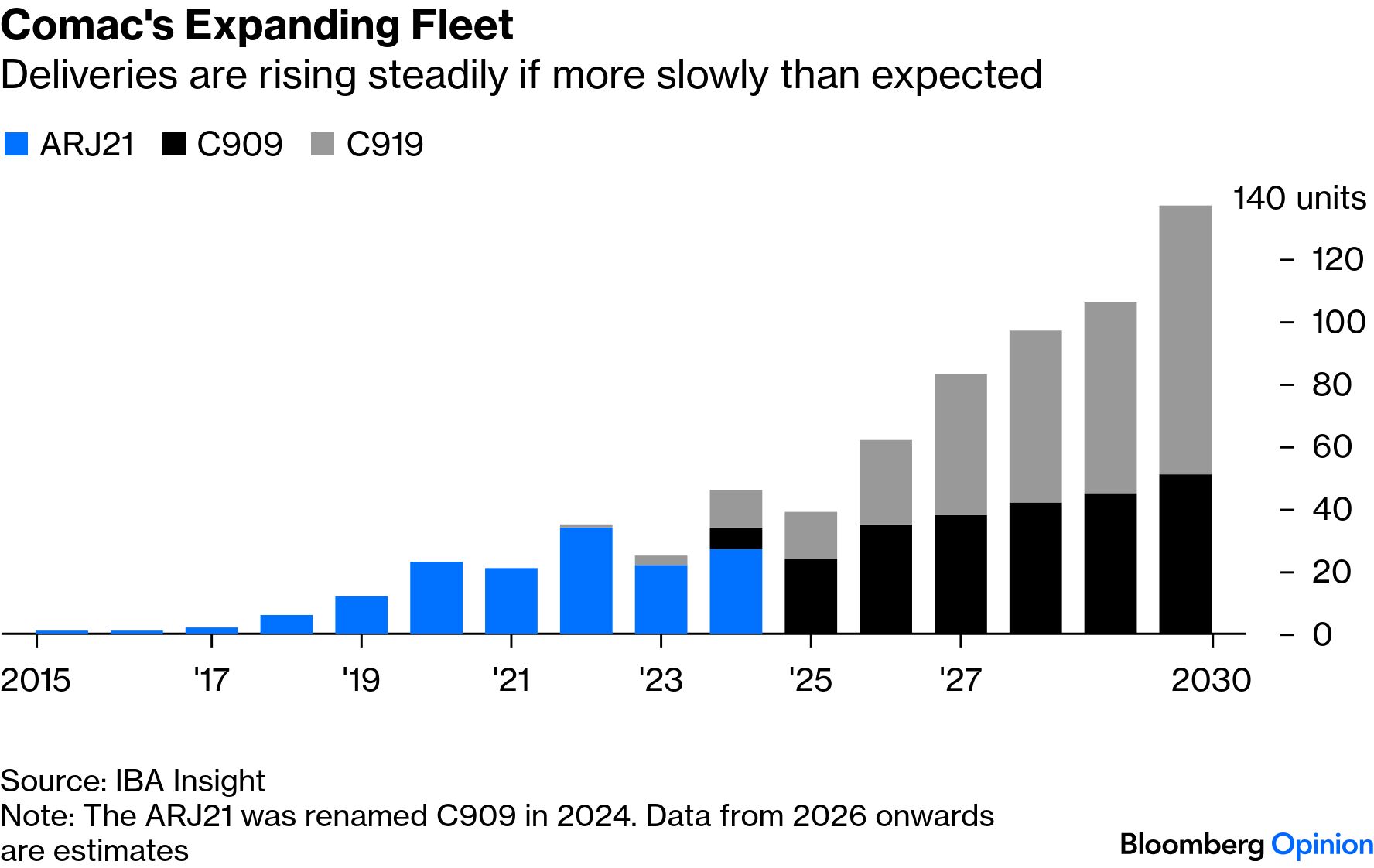

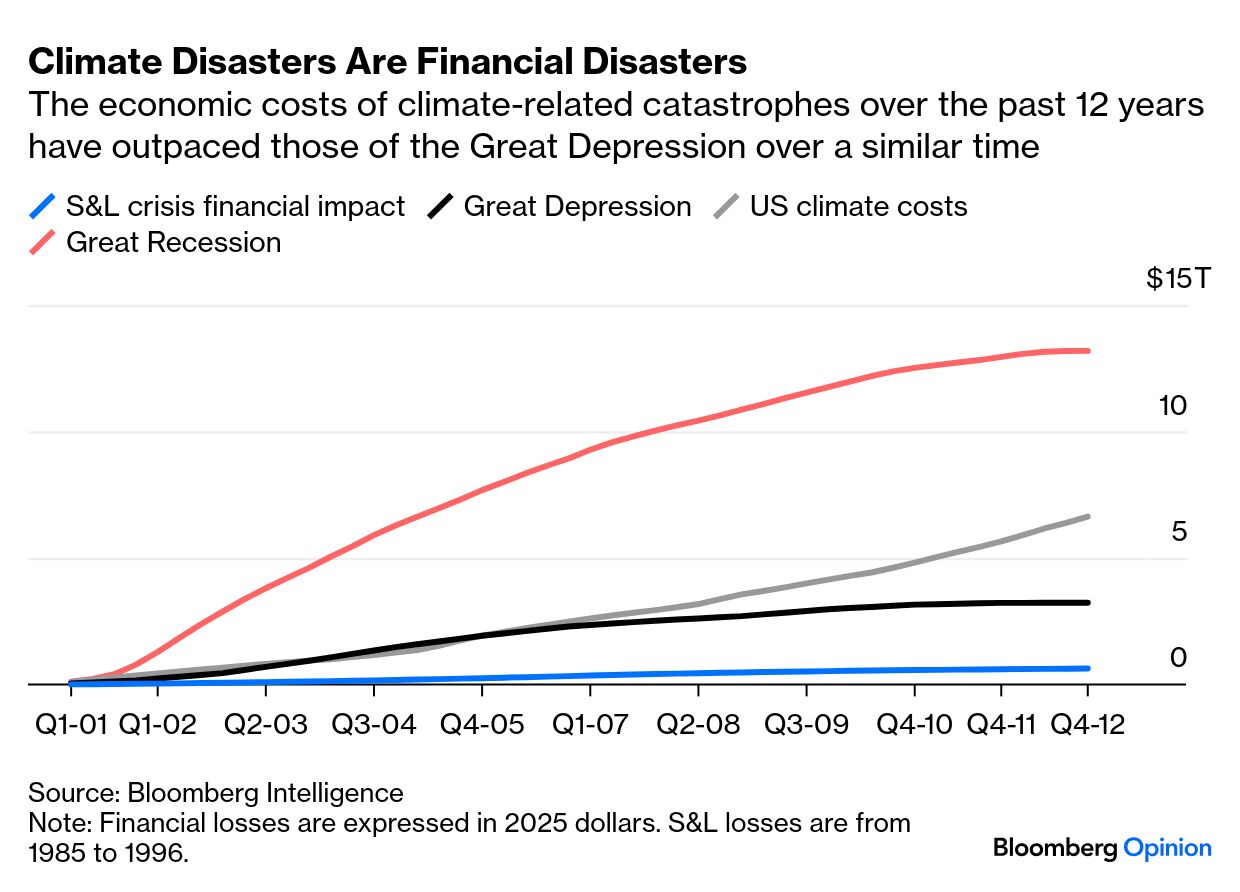

| When I was a kid, we had four gas stations in the center of my Connecticut hometown. By the time I got my driver's license in high school, there were only three. And now, there are just two. Why do they keep disappearing? It's not because all 20,000 residents suddenly started driving EVs and hybrids (though that shift likely dented the business). It's because buying gas in town is so absurdly expensive that drivers treat it like a last resort. This is basic economics. When you price yourself into oblivion, people stop showing up. But when there's a true monopoly, customers can't skirt high prices by simply driving to the next town. Take Mexico's two low-cost airlines — Grupo Viva Aerobus SA and Controladora Vuela Compañía de Aviación SAB, better known as Volaris — which are merging in a deal that would hand them roughly 70% of the country's passenger airline market. Juan Pablo Spinetto says you don't need a PhD in antitrust economics to know that this chart will get a lot worse over time: "A firm controlling 70% of a market is almost always bad for consumers, bad for competition and bad for suppliers. This deal comes with extra red flags: As regulation experts have explained, scarce landing slots at Mexico City's saturated main airport already choke off potential new entrants," he writes. President Claudia Sheinbaum's public embrace of the deal is all but certain to make the bad situation a lot worse. Meanwhile in China, Juliana Liu says Comac, a state-owned manufacturer, just wants a slice of the commercial aviation pie. "For decades, it has wanted to be the 'C' in the ABCs of aerospace after Airbus SE and Boeing Co. But to achieve that goal, it must solve an engineering puzzle that only a handful of companies have ever cracked: building a reliable jet engine." Last year, Comac ended up delivering only 15 of its single-aisle C919 jets — an 80% reduction of its original target. "With more than 1,000 preliminary orders for the C919, Comac is working through its own backlog. Last year's tussle with Washington has vindicated a longstanding push by Aero Engine Corporation of China, or AECC, to create a homegrown engine for the aircraft." The trouble is, they've been working on this thing for almost two decades: "The propulsion system called the CJ-1000A began development in 2007. A model was shown publicly for the first time in 2011," Juliana writes. In the years since then, it's been mostly crickets, save for this rare update last August on CCTV, and the engine won't be commercially available until 2030 at the earliest, she notes. By that time, who knows what the state of aviation will look like. Hopefully the field will be a bit more crowded than a two gas station-town. You know it's bad out there when the New York Metro Weather guy is cheering on "warmer" temperatures in the mid-30s: The East Coast's weeks-long deep freeze — which has claimed 18 lives in my city alone — is finally letting up. But the economic costs of icy power lines, trash-studded mounds of snow and astronomical heating bills will linger for months. Climate scientists expect the final tab to be in the billions. You'd think such a severe weather event would be a concern for Washington, but Mark Gongoff says many policymakers see climate disasters and shrug. Just look at our Fed Chair-to-be, Kevin Warsh, who has said the central bank should ignore climate change, dismissing concern about it as a "bandwagon" that is "fashionable" and "fleeting." Similarly, Treasury Secretary Scott Bessent has called it an issue that had "no clear nexus to safety and soundness" for banks. So, I guess that just means they're all gonna ignore this chart, then:  "The world has spent $20 trillion in the past 25 years on natural-disaster cleanup and higher insurance premiums, according to Bloomberg Intelligence, with annual costs rising steadily. The US alone has taken a $7 trillion hit from extreme weather in the past 12 years, making it twice as expensive as the Great Depression," Mark writes. "Home-insurance premiums have soared 69% since December 2019, according to Intercontinental Exchange Inc., far outpacing mortgage principal (23%), interest (27%) and tax (27%) costs during that time. The word for this is 'inflation,' one pillar of the Fed's dual mandate to stabilize prices and maximize employment." Much like the thigh-high crosswalk snow tunnels that are now beginning to melt in Manhattan, ignoring the issue will only make it messier down the road. Read the whole thing. |

No comments:

Post a Comment