SaaSmageddon Is Here – and Not All Software Stocks Will Survive VIEW IN BROWSER

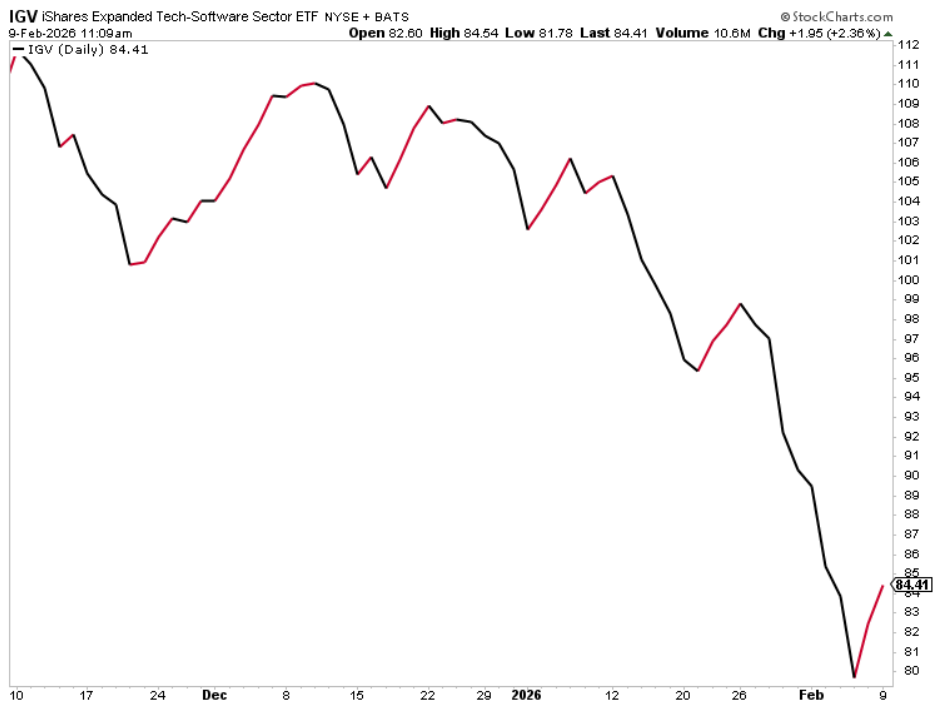

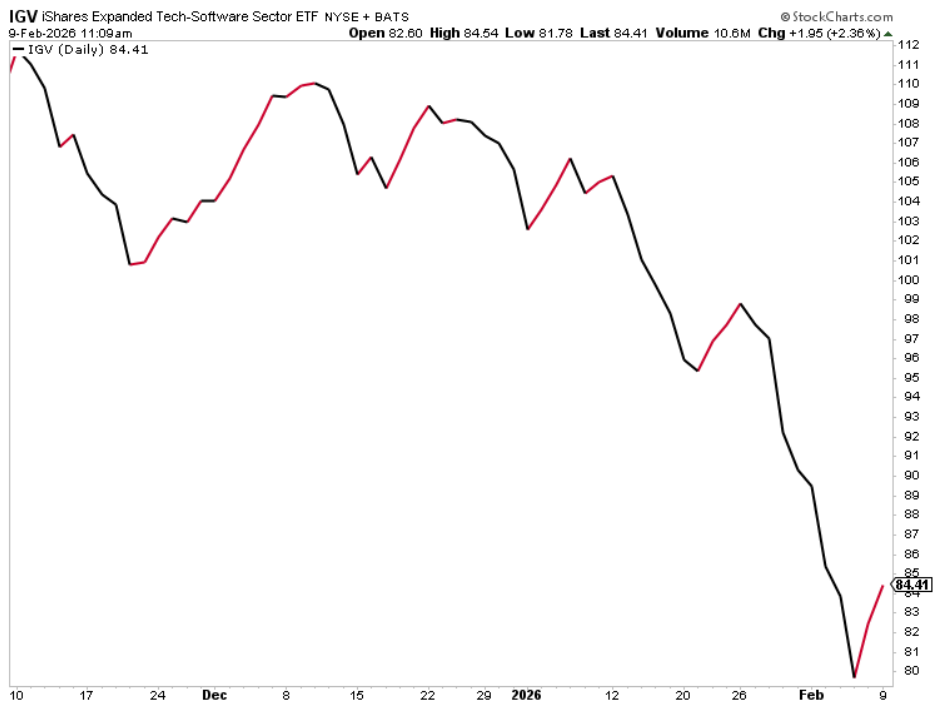

Welcome to the end of the world for Software-as-a-Service (SaaS) stocks – at least as we’ve known them. Recently, we’ve been watching those trades bleed out like a secondary character in a Tarantino film. As a group, they have dropped more than 20% since late 2025 – one of the fastest drawdowns for the SaaS cohort outside of the 2022 tech unwind and the 2008 financial crisis.

But here is the twist: This isn’t a macro problem. Unlike prior tech selloffs, this one isn’t being driven by tightening financial conditions or collapsing demand. What’s happening now is bigger than all of that. This is a displacement event – and we’re calling it SaaSmageddon. Why AI Is Collapsing Seat-Based SaaS Models For 15 years, the Software-as-a-Service business model was like the ultimate profit hack. Build an attractive dashboard, connect it to a database, and charge companies $30 to $100 per month, per human, to use it. The more workers those client companies hired, the more money SaaS providers made. But now, the market has realized that AI is beginning to erode the human input in that cash equation – and it’s happening faster than most investors expected. Unlike copilots that assist a user, agentic systems like Anthropic’s Claude Cowork are designed to complete multi-step workflows autonomously – from research to execution – without persistent human supervision. And when an AI agent can perform the work of five junior analysts or paralegals, the enterprise doesn’t just need fewer employees – it needs fewer software licenses. The “seat-based” moat is being drained. There are really three critical dynamics at play here: The Flattening of the Middle Layer Most horizontal SaaS companies function as expensive intermediaries between a human user and a structured database. Agent frameworks using tools like Model Context Protocol (MCP), function calling, and API-native execution increasingly allow models to retrieve, update, and reason over data without a graphical interface. Project Genie and the Death of Creation Moats Google’s Project Genie has turned high-fidelity creation – whether that’s a video game or complex UI – into a prompt. The “ barrier to entry” for many categories of application software is collapsing. When small teams can generate high-quality apps in days instead of months, why pay a premium for legacy tools? The “Show Me the Money” Pivot After three years of AI hype, investors have stopped asking, “What is your AI strategy?” and started asking, “Where are the profits?” While chipmakers like Nvidia (NVDA) and Micron (MU) are printing money, software giants like Salesforce (CRM) and Adobe (ADBE) are seeing their multiples compress as they struggle to monetize AI without cannibalizing their own seat-count revenue. In effect, AI is expanding margins at the infrastructure layer while compressing them at the application layer. In other words, we think it’s inevitable that AI will flatten and obsolete the middle software layer that so many SaaS stocks thrived in for 10-plus years. That doesn’t mean all software stocks are doomed. But, frankly, most are… Recommended Link | | | | Futurist Eric Fry says Amazon, Tesla and Nvidia are all on the verge of major disruption. To help protect anyone with money invested in them, he’s sharing three exciting stocks to replace them with. He gives away the names and tickers completely free in his “Sell This, Buy That” broadcast. Click to stream now… |  | |

The Three Zones Defining the Future of Software Stocks AI is commoditizing “cognition,” and the only thing that matters now is who can operationalize it inside real organizations, fast, securely, and at scale. Most “AI software” will get vaporized as models get cheaper/better. But software providers with proprietary data, high barriers to entry, sensitive workflows, and provable differentiation from large language models (LLMs) will win big. In this new era, the software sector has been split into three distinct camps. Knowing which zone your stocks live in is the difference between compounding capital – and being forced to rethink your portfolio.

Red Zone: Software Stocks Facing AI Obsolescence These companies are in the “blast radius.” Their core value proposition is either seat-based human productivity (which is shrinking) or generic content/code creation (which is being demonetized). If “Claude Cowork” or “Project Genie” work as advertised, these business models are structurally broken. - Workflow & Project Management: Asana (ASAN), Monday (MNDY), Atlassian (TEAM), Box (BOX), Dropbox (DBX) – these are the ultimate “Middle Layer” stocks. If AI agents can coordinate directly with each other, we don’t need humans manually moving cards on a Kanban board. Agent-to-agent task delegation removes the need for visual workflow orchestration entirely.

- Generic Customer Experience (CX) & Customer Relationship Management (CRM) & CX: Salesforce is the poster child for “seat compression.” AI agents will reduce the need for entry-level sales reps and support staff, decimating the per-seat licensing model that firms like Freshworks (FRSH), Zendesk (ZEN), Zeta Global (ZETA), HubSpot (HUBS) profit from.

- Content & Coding Commodities: AI coding agents (like Devin/GitHub Copilot) threaten the seat growth of DevOps tools, killing the moat for incumbents like Unity (U), Wix (WIX), Fiverr (FVRR), DigitalOcean (DOCN), GitLab (GTLB), and Elastic (ESTC). When code generation becomes cheap and continuous, DevOps tooling risks being optimized out of the stack rather than scaled across more users.

- Legacy “Band-Aids” like UiPath (PATH) and Pegasystems (PEGA): Robotic Process Automation (RPA) was a bridge technology. AI agents are the destination. You don’t need a bot to click buttons on a screen when the API can do it autonomously. RPA automated human behavior. Agentic AI replaces it.

- EdTech & Knowledge: Personalized AI tutors now adapt in real time, undercutting static, gamified content platforms like Duolingo (DUOL) and homework-reliant businesses like Chegg (CHGG), whose value proposition erodes as AI-generated explanations become ubiquitous.

Yellow Zone: Software Stocks Under Margin Pressure AI is a massive disruption, but not necessarily a death sentence if software firms can pivot. These companies have high switching costs or massive distribution, but they face severe deflationary pressure on pricing. They will likely survive – but their 100x-valuation days are over. - Giants like Adobe, Microsoft (MSFT), ServiceNow (NOW), SAP (SAP), and Intuit (INTU) are too big to fail, but priced for perfection. Adobe is terrified of “Project Genie” but has Firefly. ServiceNow acts as a system of record, which is safer than a system of engagement, but still faces seat headwinds.

- Fintech & Payments: Payments are sticky, but AI will aggressively shop for the lowest fees, compressing margins. Shopify (SHOP), BILL (BILL), Toast (TOST), Square (SQ), Paypal (PYPL), DLocal (DLO), and PagSeguro (PAGS) are great – but will “AI shopping agents” soon be able to bypass storefronts entirely?

- Human Capital: Payroll is sticky – but hiring velocity is not. If companies hire fewer people because of AI, growth for Workday (WDAY), Paycom (PAYC), and Automatic Data Processing (ADP) would stall.

- Data Infrastructure: AI needs data, which is bullish. But AI also writes code that optimizes queries, potentially reducing “consumption” revenue. This is a risk for companies like Snowflake (SNOW), Datadog (DDOG), MongoDB (MDB), Cloudflare (NET), and Confluent (CFLT).

Green Zone: AI-Resistant Software Fortresses These companies possess the only two things AI cannot generate: Real-world physical infrastructure or Proprietary, Unstructured, Regulated Data. They are the “pick and shovel” plays or the “Systems of Intelligence” that AI actually relies on. - The “AI Operating System”:Palantir (PLTR) is the only software company that actually structures the messy data AI needs to function. It’s not selling seats; it’s selling the ontology.

- Cybersecurity: AI dramatically lowers the cost of generating malware, phishing campaigns, and attack vectors – forcing enterprises to increase, not decrease, defensive spending. That’s why we see Palo Alto Networks (PANW), CrowdStrike (CRWD), Fortinet (FTNT), Zscaler (ZS), CyberArk (CYBR), SentinelOne (S), and Qualys (QLYS) winning here.

- Deep Verticals & Regulated Moats: In regulated environments, accuracy, compliance, and auditability matter more than raw intelligence – and LLMs cannot hallucinate their way past statutory rules.

- Tyler Tech (TYL): Local government software, no churn. AI can’t navigate county regulations.

- Guidewire (GWRE): Insurance claims data – massive proprietary moat.

- Cellebrite (CLBT): Digital forensics for law enforcement. Highly regulated, hardware-dependent.

- FICO: The standard for credit. Regulatory moat.

- Physical World “Bridges”:

- PTC: Industrial CAD/IoT. You can’t “prompt” a jet engine into existence without physics-based modeling.

- Samsara (IOT): Tracking physical trucks. AI can’t hallucinate a GPS coordinate.

- ServiceTitan (TTAN): Software for plumbers/HVAC. LLMs can’t repair a broken toilet.

How to Invest as Software Stocks Reprice The “SaaSmageddon” is not overdone. It is a regime shift – meaning the days of buying any stock with a “.com” or an “SaaS” suffix are over. - Stop Funding the AI Budget Indirectly: Many companies are seeing their software budgets “harvested” to pay for Nvidia chips. Don’t own the companies providing the harvest; own the ones capturing it.

- Look for “Agent-Proof” Moats: Ask yourself: Can a $20/month AI agent do this task? If the answer is yes and switching costs are low, sell the stock. Look for companies in regulated niches (like Tyler Tech) or those with hardware-dependent data (like Cellebrite).

- The “Outcome” Pivot: Only buy software companies that have successfully moved away from seat-based pricing. If they are charging based on the value delivered (e.g., $10 per insurance claim processed by AI), they are built for 2026 and beyond.

Bottom line: We are not in a tech bubble; we are in a tech reshuffle. The “Middle Layer” is being flattened, and the value is flowing to the ends of the spectrum: the Compute (Chips) and the Data/Defense (Fortresses). Choose your side wisely. The agents are coming for the rest. SaaSmageddon answers one question very clearly: who doesn’t win in the AI era. But it raises a far more important one… If software margins are collapsing, and AI budgets are being harvested to pay for chips, power, and infrastructure – who actually captures the value? Increasingly, it’s not Big Tech. It’s the U.S. government. Washington is now directing capital into the exact sectors AI depends on – from materials and manufacturing to energy and strategic supply chains. And when the government steps in as a buyer, investor, or partner, stocks don’t ease into new price levels. They reprice violently. I recently put together a briefing on what I call the President’s Market – how it works, why it’s accelerating now, and which types of companies benefit most when Washington opens the checkbook. If you’re watching SaaS stocks get flattened and wondering where the money is actually going next… this is where to look. Sincerely, |

No comments:

Post a Comment