| Read in browser | ||||||||||||||

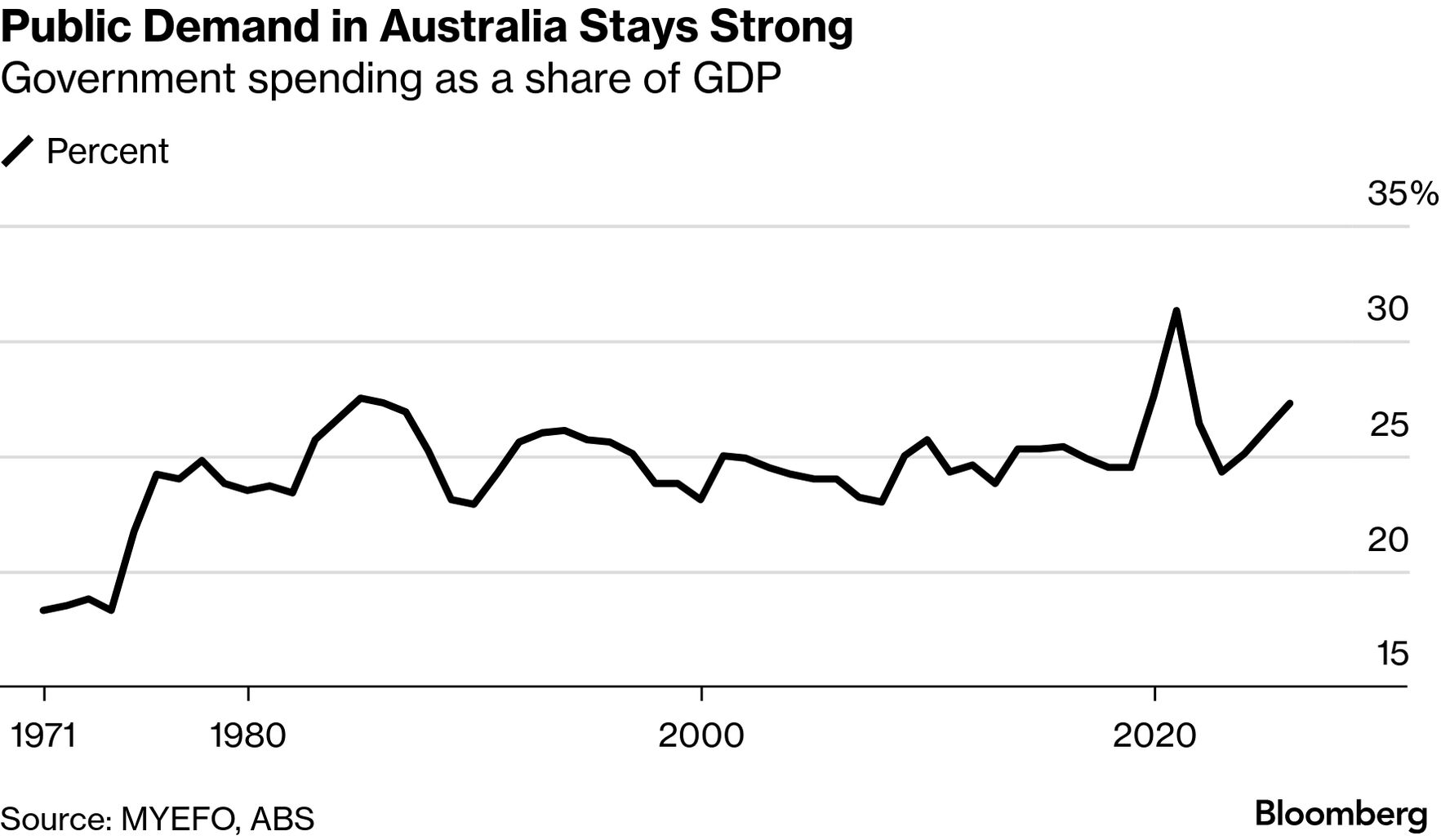

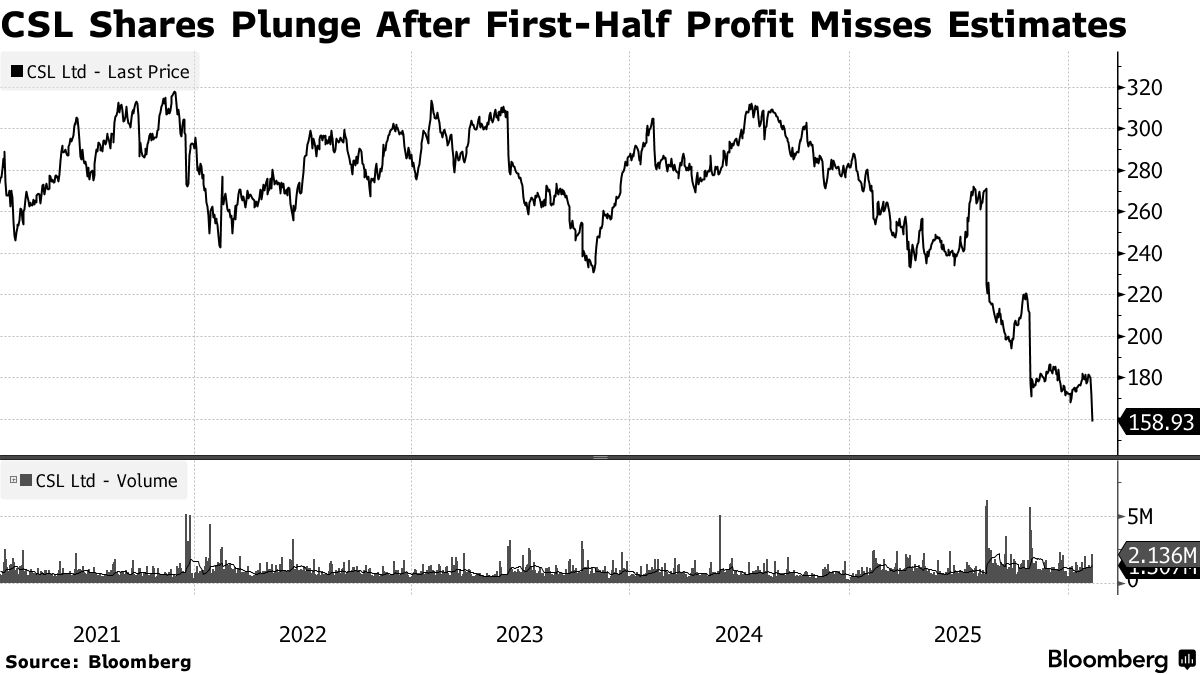

Good morning, it's Angus here in Sydney. Plenty to digest. A top official at the RBA has flagged a renewed battle against inflation. This suggests at least one more more interest rate hike is coming. Earnings season continues to wrong-foot investors, leading to strong reactions in both directions. CSL got smashed after dumping its boss. Commonwealth Bank soared after beating expectations. ANZ Bank said today that profit is up. In Canada, a mass shooting has left at least 10 people dead. — Angus Whitley, Global Business reporter What's happening nowAustralia's central bank Deputy Governor Andrew Hauser warned that inflation is still "too high" and remains a significant challenge for the interest-rate setting board, which can't allow it to go on much longer. The Reserve Bank became the first major monetary authority in the world to raise rates this year and its updated forecasts imply at least one more hike in the months ahead.  ANZ Group Holdings Ltd.'s first-quarter profit rose and expenses declined as Chief Executive Nuno Matos forges ahead with revamping the bank. "Our productivity program aimed at removing duplication and simplifying the bank is well underway, delivering a significant reduction in expenses while growing revenue," Matos said. Shares in CSL Ltd. fell to an eight-year low after the healthcare company posted an 81% drop in first-half profit. Its new interim chief executive officer is taking charge amid asset write-downs and weaker vaccine markets. CSL, the world's second largest maker of influenza vaccines, has suffered four straight years of stock market declines, wiping out more than A$61 billion ($43 billion) in market value since January 2022.  Commonwealth Bank of Australia shares climbed the most in five years after its first-half profit topped expectations, buoyed by growth in its flagship mortgage business and a push in lending more to companies. Chief Executive Officer Matt Comyn said he saw inflation ``placing further upward pressure on interest rates."  Matt Comyn, chief executive officer of Commonwealth Bank of Australia Photographer: Brent Lewin/Bloomberg Australian authorities charged a further two Chinese citizens with allegedly collecting information about a Buddhist association on behalf of the government in Beijing, in a case that raises the risk of renewed tensions between the countries.  Domino's Pizza Enterprises Ltd. shares rose after the company named McDonald's Corp. veteran Andrew Gregory as its new global chief executive officer, charging him with turning around the chain's flagging fortunes. The stock jumped as much as 5.8% in early Sydney trading Wednesday after the appointment was announced. What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… Treasury yields rose after US payrolls surged by 130,000 last month, the most in more than a year, and the jobless rate unexpectedly fell. Aussie resumed its rally after hawkish comments from the Reserve Bank. Oil gained as tensions in the Middle East outweighed concerns that there's a supply glut building in the market. Australia has some more RBA speak to digest while New Zealand has some bonds to sell. Local equities are in for a quiet open judging by ASX futures.  Wall Street parses data. Bloomberg Unexpectedly strong employment data for January reduces the chances the Federal Reserve will see a need to cut interest rates again by midyear as the most concerning possibilities for the trajectory of the labor market seem more remote. Apple Inc.'s long-planned upgrade to the Siri virtual assistant has run into snags during testing in recent weeks, potentially pushing back the release of several highly anticipated functions.  Screenshots from an Apple TV ad teasing the new Siri with actor Bella Ramsey. The world's biggest nickel mine in Indonesia has been told to slash output, as authorities step up efforts to boost global prices of the battery metal. Indonesia has been taking drastic steps to revive prices of its biggest export commodity, largely through scaling back volumes from key miners.  Weda Bay Industrial Park in Central Halmahera, North Maluku. Photographer: AFP/Getty Images A mass shooting in Canada's northeastern British Columbia has left at least 10 people dead and 25 injured, marking one of the deadliest such attacks in the country's history. Prime Minister Mark Carney appeared emotional as he addressed reporters in Ottawa, calling it a "difficult day for our nation." Nike Inc. expects its wholesale business to pick up steam across the world as it accelerates the launch of new footwear and apparel products and doubles down on its commitment to sports. Nike is already winning back the affection of retail partners in North America, Chief Executive Officer Elliott Hill said in an interview with Bloomberg TV. What to watch

One more thing...Val Vavilov was an early cryptocurrency adopter who built Bitfury into one of the biggest players in the industry by designing hardware to mine Bitcoin. In recent years the Latvian billionaire, 46, has steered his empire toward data centers. But now he says the latest crypto meltdown is a chance to buy again.  Val Vavilov Source: Bitfury Enjoying Australia Briefing? You might also like:

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Wednesday, February 11, 2026

RBA’s renewed inflation fight, ANZ Bank profit rises, CSL stock smashed

Subscribe to:

Post Comments (Atom)

This AI-Driven Crash Just Flashed Two Historic Buy Signals

These two rare signals are flashing… This AI-Driven Crash Just Flashed Two Historic Buy Signals VIEW IN BROW...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment