| Read in browser | ||||||||||||||

Good morning, at its first meeting for the year, the Reserve Bank raised interest rates to 3.85%. The decision was expected, but it's still not good news for everyday Australians already struggling with cost-of-living pressures. Worse still, there may be more rate pain to come given the strength of inflation in the economy. The RBA's move may herald a global shift. Meantime, the ASX is set to open flat. - Paul-Alain Hunt, Mining and Metals Reporter. What's happening nowThe RBA raised its key interest rate on Tuesday, becoming the first major monetary authority to hike this year, as it judged domestic inflation pressures were persistent enough to warrant renewed restraint. Australian policymakers have been wrong-footed by a regathering of price strength, led by services and housing costs, against the backdrop of a still-tight labor market. Shifts may well be in the offing elsewhere, writes Bloomberg Opinion's Dan Moss. Australian households — already world leaders in the number of rooftop solar panels per capita — installed as many batteries in the second half of 2025 as they did during the previous five years combined. More than 180,000 home battery units were sold in the six months, four times more than in the same period of the prior year, the Clean Energy Council said in a report. Singapore has attracted Australian asset manager IFM Investors Pty. to set up an office in the city-state as it seeks to strengthen its presence in the private credit market. The move follows IFM Investors' partnership with the Australian government to pursue investment opportunities across Southeast Asia, and is part of a growing list of international asset managers setting up in Singapore.  European fund managers have been buying up New Zealand's kiwi in a bet that the currency will benefit from an economic revival, the prospect of interest-rate hikes and broad weakness in the US dollar. While the kiwi is benefiting from a broad slide in the dollar, several other factors are helping it build on modest gains in 2025 that followed four consecutive annual declines. New Zealand and Germany are concerned by the growing pressure on international rules and have reaffirmed a commitment to multilateralism, according to a joint statement following a meeting of foreign ministers. Last week, New Zealand turned down an invitation to join US President Donald Trump's proposed Board of Peace as many western countries expressed concerns it is a means to supplant the United Nations. Germany is also reported to have declined to participate in the board. What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… Gold and silver rebounded on dip buying after historic routs. Oil gained after the US shot down an Iranian drone. With the US shutdown set to end, the dollar edged lower, further fueling the Aussie and kiwi recovery. A renewed tech sell-off dragged down stocks from near-record levels amid a flare-up in geopolitical risks. NZ has 4Q jobs data to digest while the RBA's Brad Jones — who oversees the financial system — has a fireside chat this afternoon. Both can move currencies and rates. ASX futures point to a weak opening. Elon Musk is combining SpaceX and xAI in a deal that values the enlarged entity at $1.25 trillion, as the world's richest man looks to fuel his increasingly costly ambitions in artificial intelligence and space exploration. The acquisition of xAI was announced in a statement on SpaceX's website signed by Musk and confirming a Bloomberg News report.  Elon Musk, chief executive officer of Tesla Inc., during the World Economic Forum (WEF) in Davos, Switzerland, on Thursday, Jan. 22, 2026. Photographer: Krisztian Bocsi/Bloomberg Ukraine faced the biggest Russian missile and drone attack so far this year after the Kremlin ended a brief moratorium on strikes against energy infrastructure sought by US President Donald Trump ahead of peace talks. Russia struck with 450 drones and more than 70 missiles, Ukrainian President Volodymyr Zelenskiy said Tuesday in a post on X. Spain may follow Australia's footsteps in banning children and teenagers from using social media platforms, Prime Minister Pedro Sánchez announced Tuesday. Turkey plans to host high-level talks between the US and Iran on Friday aimed at de-escalating tensions between the two countries. The summit in Istanbul would be attended by US envoy Steve Witkoff, President Donald Trump's son-in-law Jared Kushner and Iranian Foreign Minister Abbas Araghchi, according to people with direct knowledge of the matter. Copper is a key growth pillar for Australia's big miners BHP and Rio Tinto, and China's booming demand is pushing Beijing to grow its state stockpiles, according to a senior metals industry official. Such a move would add to upward pressure on prices and highlight a growing push by governments to bolster supply security. What to watch

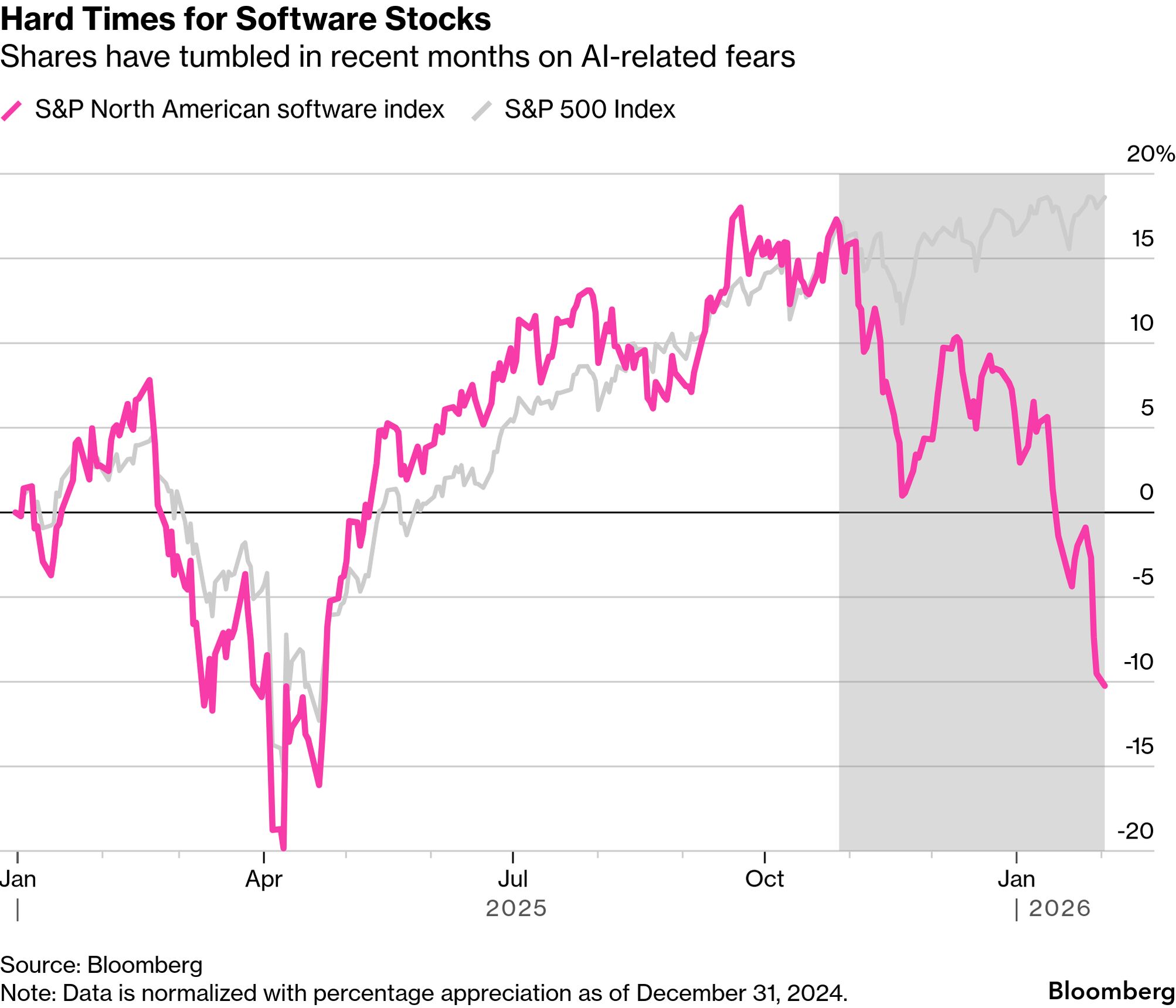

One more thing...Wall Street has been skeptical about software stocks for a while, but sentiment has gone from bearish to doomsday lately with traders dumping shares of companies across the industry as fears about the destruction to be wrought by artificial intelligence pile up.

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Tuesday, February 3, 2026

RBA hikes key rate, Australia’s battery boom

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment