| Read in browser | ||||||||||||||

Israel's President Isaac Herzog continues his tour of Australia today, after protests flared in Sydney overnight. Meanwhile, local data center group Firmus has locked in $10 billion in loans, as Australia has become the third-biggest investment destination for AI. The local bourse is set to open slightly in the green. - Paul-Alain Hunt, Metals and Mining Reporter. What's happening nowHerzog's visit to Australia continues today, after pro-Palestine protesters clashed with police in Sydney overnight. Twenty-seven people were arrested as thousands of people gathered near Town Hall, local authorities said. NSW Premier Chris Minns said police had done everything possible to avoid confrontations with protestors. Herzog urged Canberra to step up efforts to combat antisemitism while on a controversial tour of Australia, saying leaders must speak out clearly and consistently against antisemitism.  Police detain a protester during a protest against the visit of Israel's President Isaac Herzog in Sydney on Feb. 9. Photographer: Izhar Khan/Getty Images

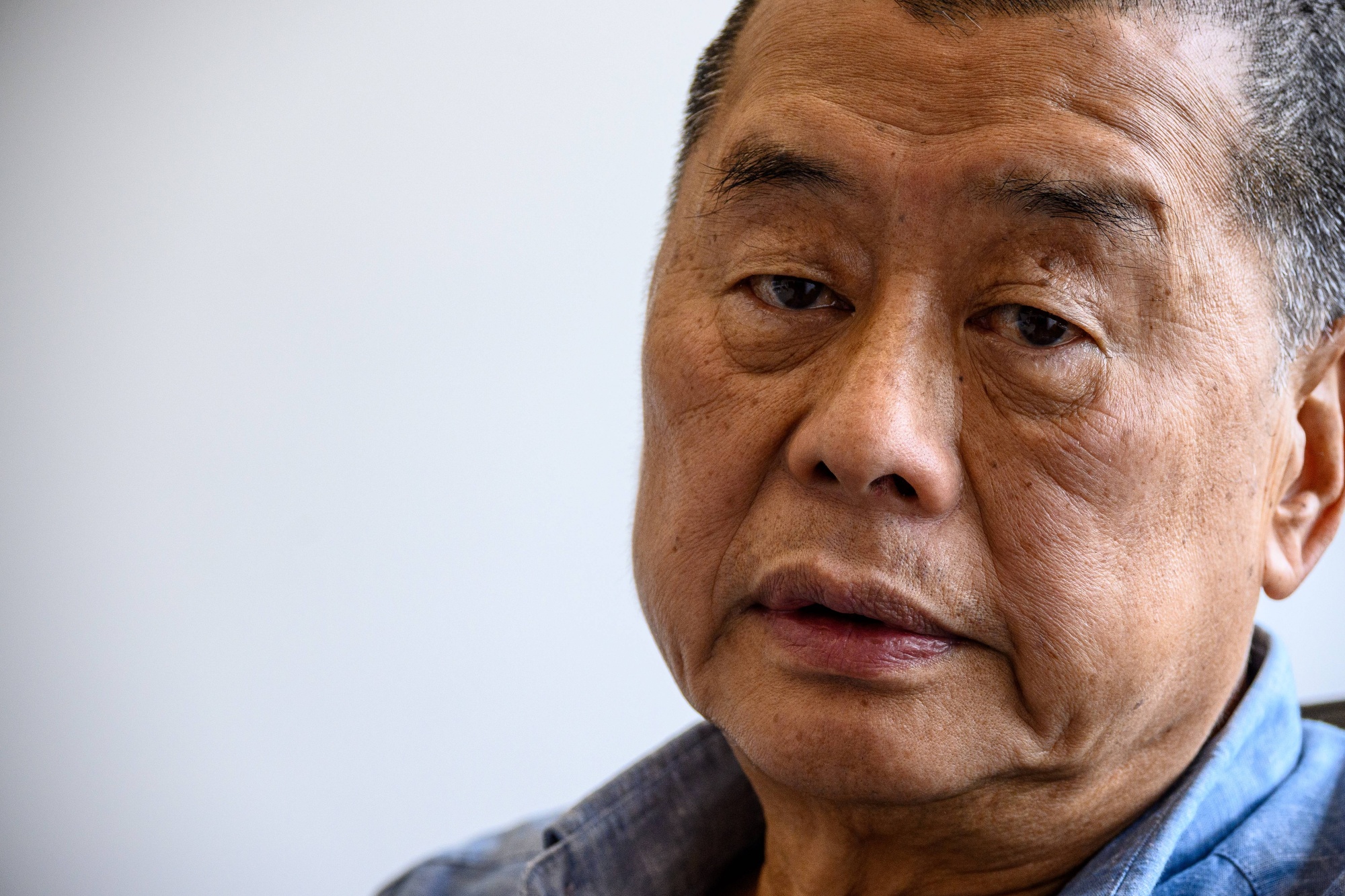

Australia's digital regulator said it's testing Roblox Corp.'s compliance with its own commitments to keep kids safe as concerns grow about potential child grooming and sexual exploitation on the platform.  Meanwhile, Australia's imposed a 10% tariff on steel ceiling frames from China, following an investigation by the nation's Anti-Dumping Commission. New Zealand is shortlisting sites for its first LNG import facility as it tries to bolster energy security and reduce reliance on dirtier fossil fuels. Household spending growth unexpectedly declined in December. And the CEO of A$101 billion Australian superannuation fund HESTA, Debby Blakey, said she will leave her role in the second half of this year after more than a decade in the top job.  Debby Blakey Photographer: Carla Gottgens/Bloomberg What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… The dollar declined across the board after Bloomberg reported that Chinese regulators have advised financial institutions to rein in their holdings of US Treasuries. Aussie and kiwi rose by default and the Swiss franc surged on haven demand. Oil gained as the US advised ships to steer clear of the Strait of Hormuz. Stocks advanced, led by the tech sector. Treasuries themselves actually rose as traders focused on key US jobs and inflation readings due this week. For today, Australia has business and consumer confidence readings due. ASX futures point to another solid start for local equities. Japanese Prime Minister Sanae Takaichi hailed her strong mandate in an election win on Monday and vowed to build trust with financial markets as concerns grow over how she'll pay for a planned tax cut. Defense stocks surged on investor expectations the leader will strengthen Japan's defense capabilities.  Sanae Takaichi Photographer: Kiyoshi Ota/Bloomberg The Epstein files are threatening to bring down not the US president who was once his buddy but a prime minister who never met the disgraced financier and sex trafficker. UK Premier Keir Starmer future hangs in the balance after the release of 3.5 million pages of Epstein-related documents by the US Justice Department. What to watch• 10:30 A.M. Westpac Consumer Confidence Data One more thing...A Hong Kong court sentenced former media mogul Jimmy Lai to 20 years in prison, handing the pro-democracy activist the heaviest penalty yet meted out under a 2020 Beijing-imposed national security law. The sentence is the heaviest penalty yet meted out under the law and has prompted intense international scrutiny.  Jimmy Lai Photographer: Anthony Wallace/Getty Images Enjoying Australia Briefing? You might also like:

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Monday, February 9, 2026

Protests flare as Herzog visit continues, Macquarie update, Firmus funding

Subscribe to:

Post Comments (Atom)

Anyone else notice prices creeping up again?

My plan for the "Second Wave" at 7PM ET To view this email as a web page, go here. To view this email as a web page, go here. ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment