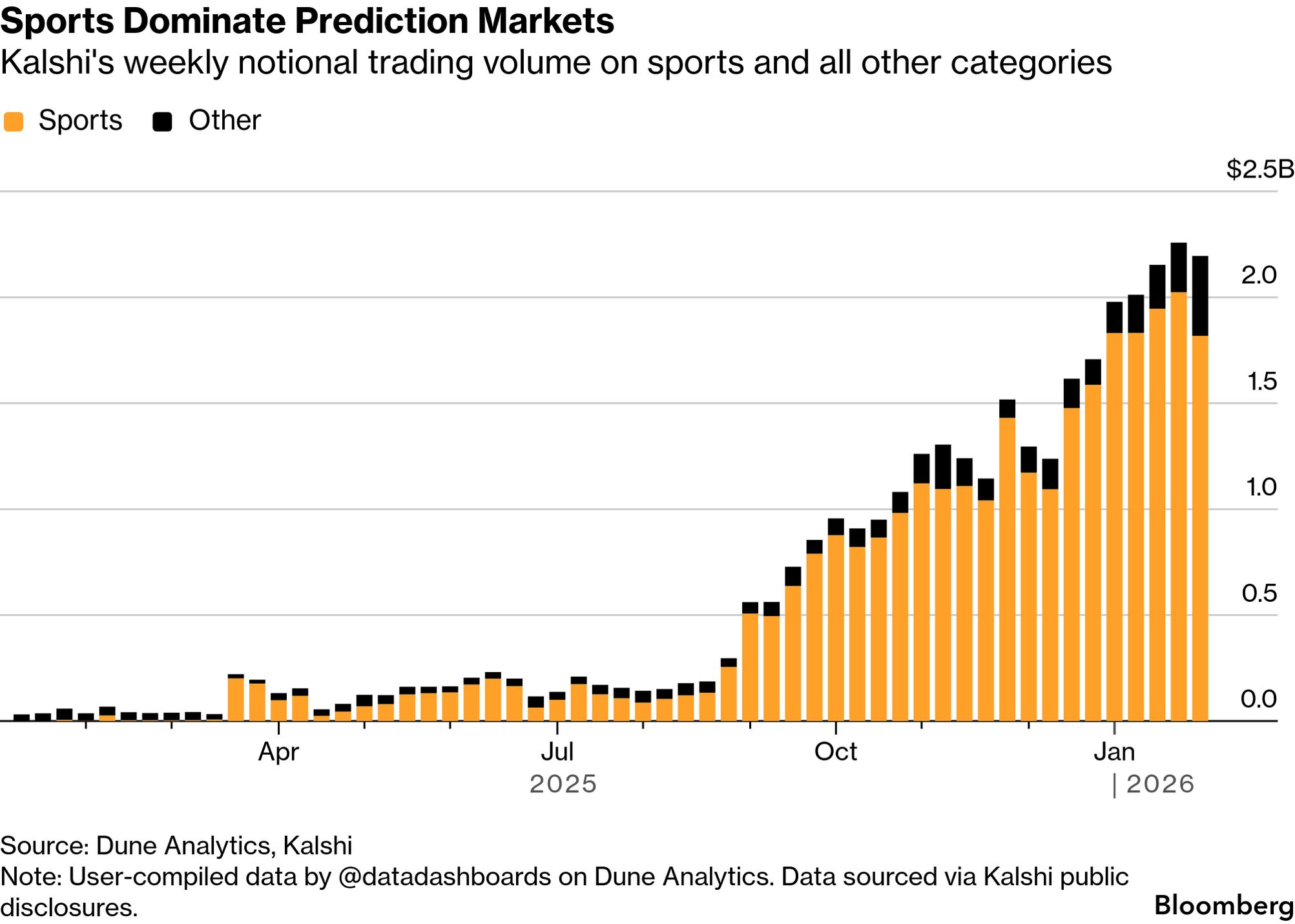

| Bitcoin fell so far on Thursday that some were wondering whether the end of crypto was upon us, despite the Trump administration's boosterism—before it recovered some by midday Friday in New York. We turned to investigative reporter Zeke Faux, author of Number Go Up, to explain what's going on. Plus: a new episode of Everybody's Business, Super Bowl bets are moving to prediction markets, and voice-to-text use is on the rise in the office. If this email was forwarded to you, click here to sign up. Normally when a financial asset craters, analysts can point to some reason for the move. But the wildly gyrating cryptocurrency market—Bitcoin is down by almost half from its all-time high in October even after rallying on Friday—has traders grasping for an explanation. Was a giant fund secretly forced to sell? Is it fear that future quantum computers could threaten Bitcoin's security? There's a more banal explanation: The price stopped going up. It's not a joke. For all the talk of blockchain technology, web3, digital gold, tokenization or whatever the latest buzzwords are, crypto's main appeal has long been getting in early and profiting when more people buy and drive up the price. Some advocates are relatively open about this. At the first crypto conference I attended, one speaker called this "number go up technology." He said: "As the price goes higher, more people become aware of it, and buy it in anticipation of the price continuing to climb." This may sound like a pitch for a pyramid scheme, but it's proved powerful over the years. Bitcoin is 17 years old, and has totally failed as an alternative currency—almost no one uses it for day-to-day transactions—and yet its price has soared as more people have bought in. As the value increases, however, generating a rising price requires an ever-greater amount of buying. In 2024, that was plausible when US regulators approved crypto exchange-traded funds, allowing regular investors to buy in without signing up for crypto exchanges. After that, Bitcoiners pitched the idea that entire countries would start a race to acquire Bitcoin before it became prohibitively expensive. "You're going to see nation-state FOMO and countries buying it to replace gold reserves," one influential Bitcoiner said in 2024. Crypto advocates came surprisingly close to achieving this, at least in the US. Donald Trump had once called Bitcoin a "scam against the dollar." But when his 2024 presidential campaign took in about $25 million in donations from Bitcoiners, he flipped to sounding like a crypto bro. "If Bitcoin is going to the moon, as we say, it's going to the moon, I want America to be the nation that leads the way," Trump said in a campaign speech at a Bitcoin convention in Nashville.  Trump at the Bitcoin 2024 conference in Nashville. Photographer: Bret Carlsen/Bloomberg Once elected, he came through. His Securities and Exchange Commission dropped a slew of lawsuits against crypto exchanges that would have put them out of business, and some people who'd been convicted of crypto-related crimes received pardons. "I got you guys out of so much trouble," Trump said in July to executives who'd gathered for a signing ceremony for a bill legalizing stablecoins. Congress is now debating a second law that the industry hopes will give it the looser rules it's wanted for years. Trump even signed an executive order for a "Strategic Bitcoin Reserve"—a plan for a US government stockpile. One of his top crypto advisers mused that the US could use the gold in Fort Knox to finance more crypto purchases, though so far the reserve is limited to crypto that's been seized in criminal cases. Some boosters—including Trump's son Eric, who's now involved in several crypto businesses—predicted that the price of a single Bitcoin would hit $1 million. But an asset that depends on an ever-rising price for its appeal is vulnerable to any fluctuations. Once the price started falling in October, even with the presidential promotion, it was hard to see where crypto would go for a new boost, or where the next, even bigger group of buyers would come from. One hope was something called "digital asset treasury" companies. These were companies listed on the stock market that accumulated large amounts of crypto. For a time, investors inexplicably drove up their market values well above their crypto holdings, allowing them to buy more and more. Some called it an "infinite money glitch." The biggest, Strategy, is led by bombastic advocate Michael Saylor, dubbed "The Bitcoin Alchemist" by Forbes. It has bought more than $50 billion worth of Bitcoin, 3% of the total supply. Eric Trump has said Saylor advised his family on its crypto investments, and the Trumps helped start another treasury company. But the "digital asset treasury" trade isn't working anymore. Many of the companies are trading at a discount to their holdings, making it hard for them to raise more money to buy more crypto. Whenever crypto crashes, some speculate that this could be the end of the industry. But it's come back from bigger disasters—like in 2022, after the collapse of Sam Bankman-Fried's FTX, when Bitcoin dropped below $16,000. Back then many big crypto companies failed due to fraud or leveraged bets on prices going up. That doesn't seem to be happening now, giving advocates time to come up with a new reason for "number go up." On Thursday, after Strategy reported a $12 billion fourth-quarter loss, Saylor reassured investors on a call that the company wouldn't be forced to unload its Bitcoins. "We have a Bitcoin president, and he's intent upon making America the Bitcoin superpower, the crypto capital of the world," Saylor added. It wasn't anything new, but the next morning, Strategy jumped 20% as the price of Bitcoin rebounded. There wasn't an obvious reason. |

No comments:

Post a Comment