| Bloomberg Evening Briefing Americas |

| |

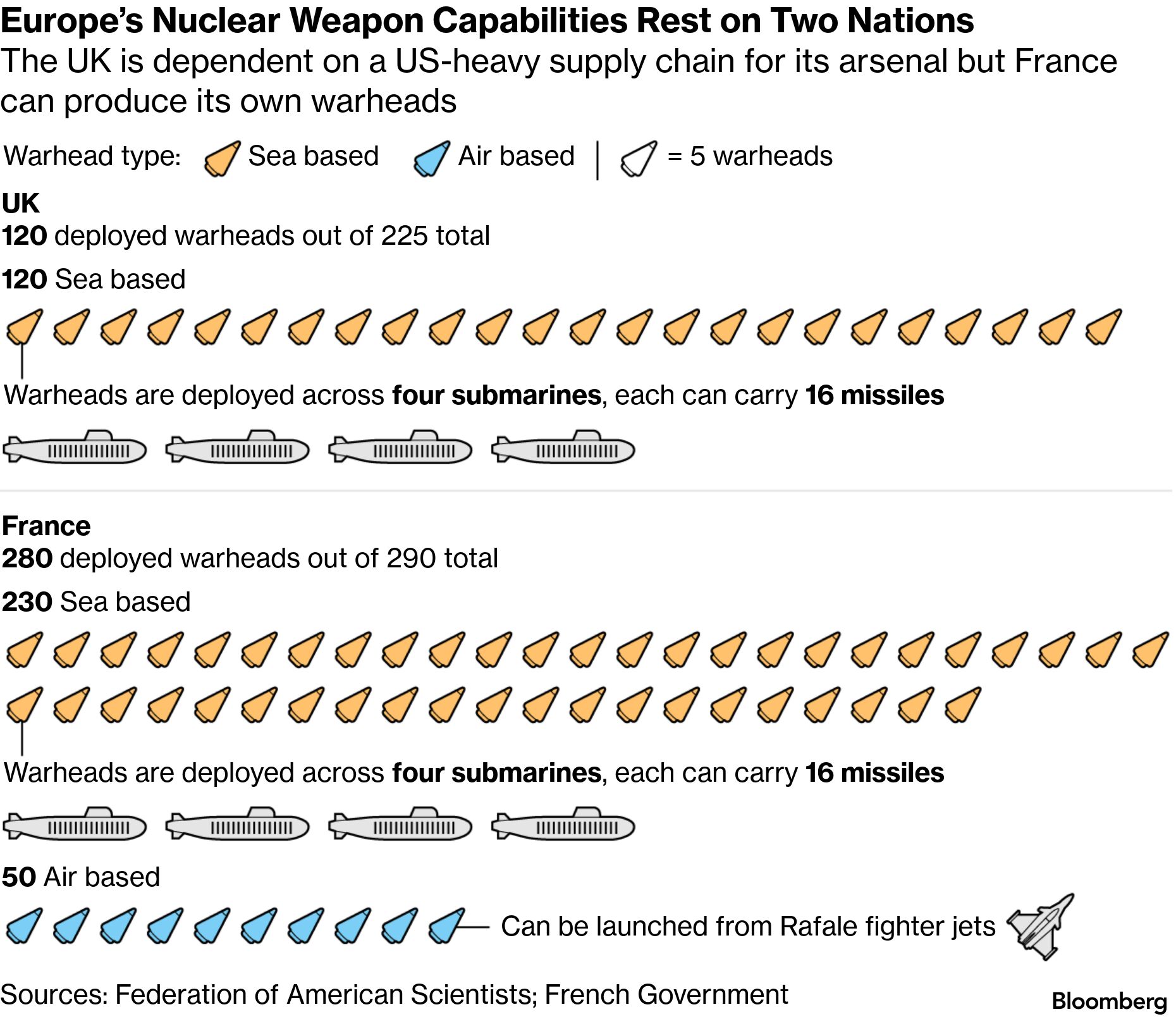

| With the US under President Donald Trump no longer seen as reliable when it comes to NATO commitments, Europe has begun to seriously reconsider its nuclear deterrent to a revanchist Russia. Rumblings started when the US briefly stopped sharing battlefield intelligence with Ukraine in March 2025: Kyiv's forces suffered immediate, decisive setbacks as its European allies watched in horror. The outage only lasted a few days, but it sent shockwaves through Europe as a new reality dawned: Washington was no longer a reliable military partner with Trump—usually friendly with Vladimir Putin and critical of NATO—in the White House. The continent needed a plan B. Europe has been fighting to keep an increasingly hostile US in the North Atlantic Treaty Organization. Meanwhile, countries have been racing to rearm. And now for the first time since the end of the Cold War, European capitals are discussing how to develop their own nuclear deterrent. German Chancellor Friedrich Merz confirmed it was a live issue in a speech on Friday at the Munich Security Conference. "I have begun confidential talks with the French president on European nuclear deterrence," he said. "We will not allow zones of differing security to emerge in Europe." —David E. Rovella | |

What You Need to Know Today | |

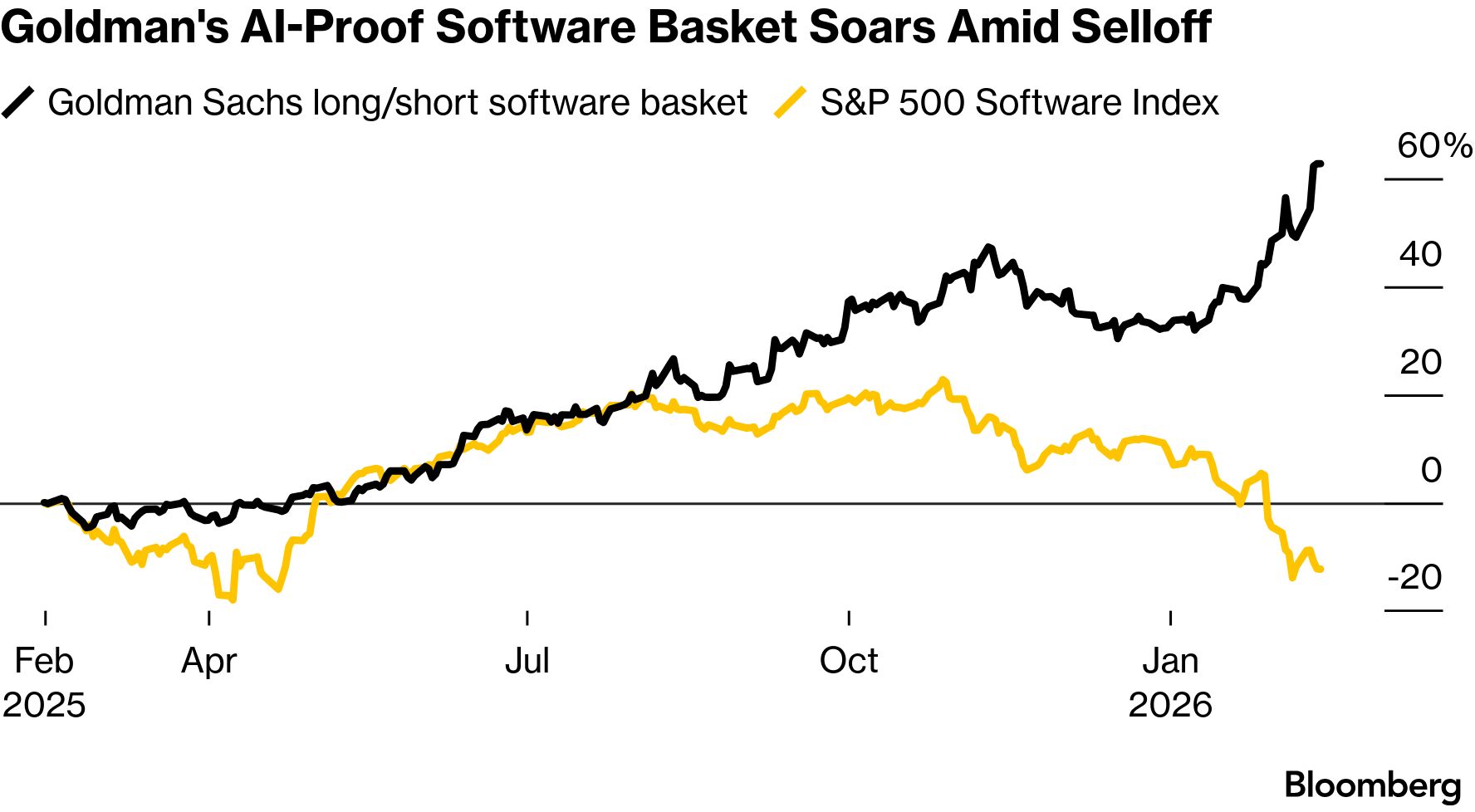

| Goldman Sachs has rolled out a new custom basket aimed at navigating the growing upheaval in software stocks, betting on companies perceived to be better insulated from artificial intelligence disruption than others. The firm introduced a basket that goes long on companies whose businesses are seen as difficult for AI to displace—either because they require physical execution, regulatory entrenchment, or human accountability—while shorting firms whose workflows AI could increasingly automate or replicate internally. The launch comes as anxiety over AI's disruptive potential intensifies. Last week, Anthropic unveiled a productivity tool aimed at in-house legal teams, triggering a sharp selloff in legal software and publishing stocks. The selloff continued after little-known startup Altruist rolled out a tax-strategy tool sending shares of Charles Schwab and LPL Financial Holdings among others down by 10% or more over the past week. | |

|

| |

|

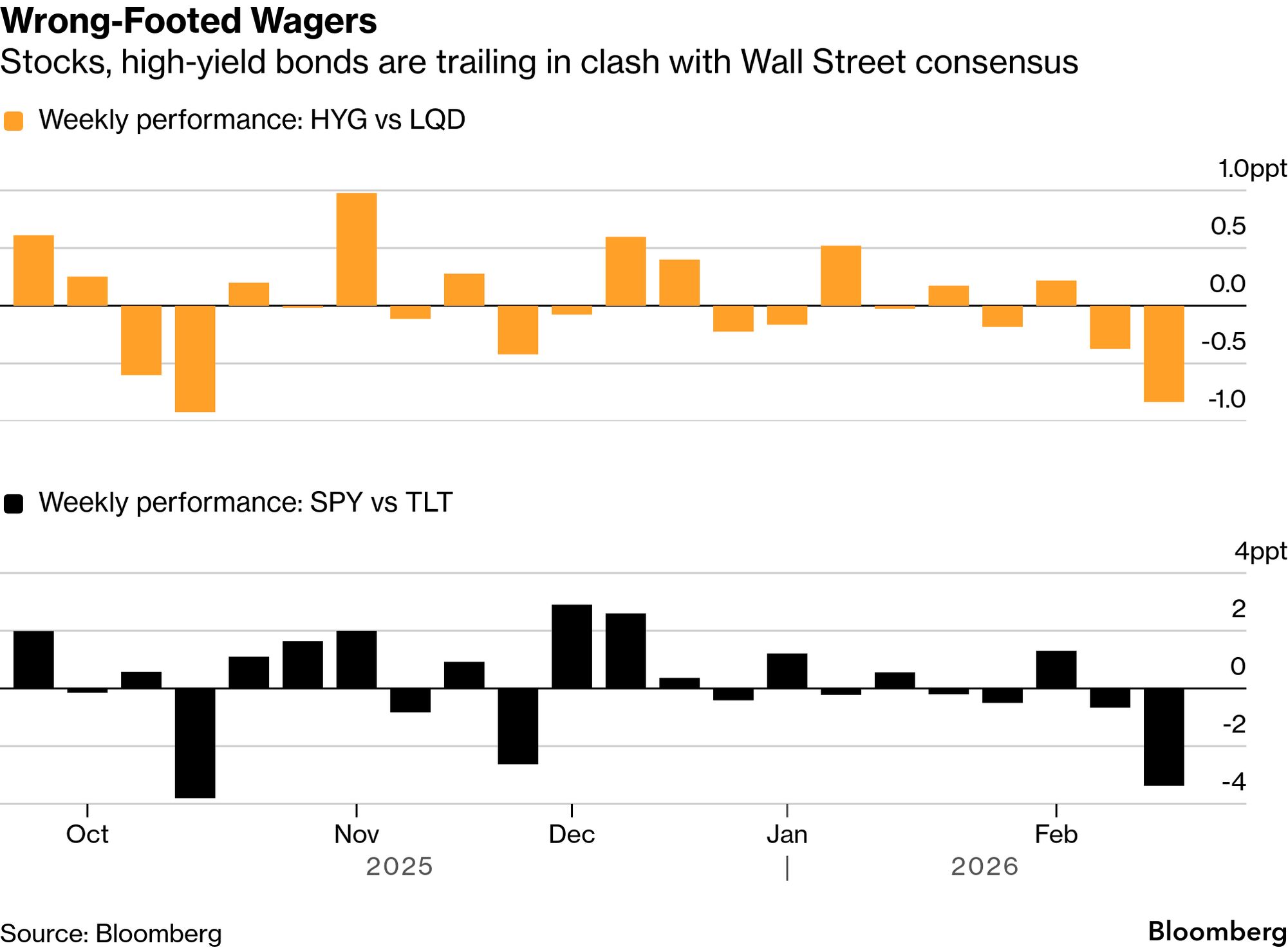

| Wall Street entered 2026 all-in—record-low cash, minimal hedging, maximum conviction. Six weeks later, a slew of consensus trades are misfiring. AI was supposed to be the can't-miss trade. Instead, it became the threat—not to the companies building it, but to the asset-light businesses it could replace. Software firms, wealth managers, brokers, tax advisers—across the white-collar world, a decade of margin expansion repriced in weeks, sending shock waves through private debt markets loaded with loans to the same companies. This week crystallized the damage. The S&P 500 headed for its worst stretch since November before Friday's rebound on a benign inflation print, with AI disruption fears cascading through markets of all stripes. | |

| |

|

| |

|

| Canada's energy minister said the government's push to build carbon capture technology in the Alberta oil sands ensures the industry is adapting to change even as the Trump administration eviscerates environmental policies to the south. Six of Canada's largest oil sands producers are part of a project that would take carbon produced from the oil sands and store it underground. Tim Hodgson made his point a day after Trump enacted a key goal of America's fossil fuel industry and its supporters in the White House. Trump said the Environmental Protection Agency was rescinding a scientific determination that greenhouse gases pose a threat to human health and welfare. Trump, who has falsely claimed climate change is a "hoax," has aggressively pursued fossil fuel development while abandoning former President Joe Biden's signature climate policies. | |

|

| The chief executive of one of Peru's largest banks is reasonably sure that the mining nation's economy can continue to ride a commodities boom in 2026, largely tuning out the noise of looming general elections and unyielding political turmoil. "We continue to have cautious optimism, but we are even a little bit more upbeat because Peru's macroeconomic indicators are performing pretty well," said Luis Felipe Castellanos, who leads Intercorp Financial Services. The company owns Interbank, Peru's No. 3 lender, and is controlled by billionaire Carlos Rodriguez-Pastor. Peru is one of Latin America's most stable economies—with low inflation and a strong currency—and a top exporter of copper and gold at a time of record-setting metal prices. At the same time, Peru is also one of the region's most politically volatile nations, having cycled through eight presidents over the past 10 years. | |

|

| |

| New Year Sale: Save 60% on your first year

Enjoy unlimited access to Bloomberg.com and the Bloomberg app, plus market tools, expert analysis, live updates and more. Offer ends soon. | | | | | | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Bloomberg Evening Briefing Americas will return on Tuesday, Feb. 17. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment