| Primary Revenue Drivers 2026

DLA Hammond (Graphite)

- IDIQ → Task Order, 5,000 MT @ $1.50/kg = ~$7.5Mn

Nevada Exchange (Reno)

- DV-serialized marketplace for critical minerals

- ~$2–3Mn revenue from graphite/CSPG + SMS registration

LAB Recycling – Phase 1

- ~$25Mn Phase 1 – battery breaking

SMS (HAWD) – Phase-1

- ~$7Mn initial inventory (copper, nickel, cobalt, titanium, Ga₂O₃, REOs, Mn oxide)

- ~$0.1Mn monetization (fees + pilot leasing) • Purpose: prove custody + Exchange integration

Learn More And Grab Sources Here: SOAR Website. M2i Presentation. -----

5 Key Potential Catalysts Hit Our Radar - (Nasdaq: SOAR)

1.) SOAR Has A Relatively Low Float (Volatility Potential May Be Explosive).

Sporting a float of roughly 6.95Mn shares, according to Yahoo Finance, volatility potential could pop up in a flash.

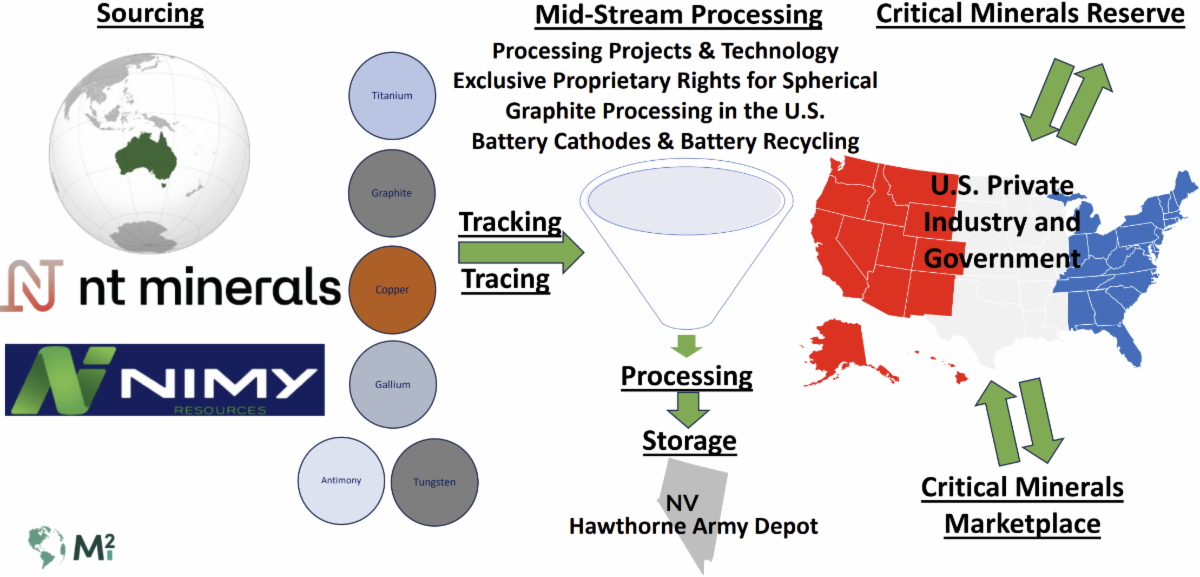

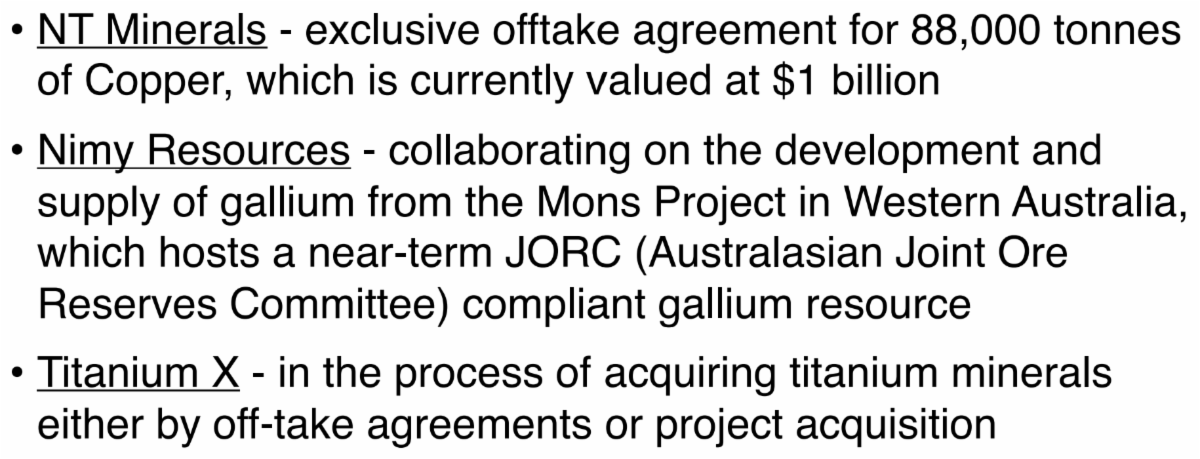

2.) M2i Global Strengthens U.S. Supply Through Titanium Collaboration and Innovation.

Volato Group, in partnership with M2i Global and Titanium X, announced a strategic collaboration to enhance U.S. critical mineral development and strengthen domestic supply chains essential to national security.

The agreement includes plans for financing, development, and commercialization of Titanium X’s mineral assets, supported by M2i’s expertise in project execution.

Together, the companies are pursuing an exclusive titanium concentrate supply agreement.

This alliance underscores Volato’s growing role in strategic, technology-driven industries that foster American industrial resilience, resource independence, and sustainable growth in critical mineral capabilities across emerging markets.

3.) Volato Expands Leadership With Veteran Finance Expert Strengthening Governance And Strategy.

Volato Group appointed Alan D. Gaines, a seasoned in-vest-ment banker and energy sector leader, to its Board of Directors as Chairman of the Audit Committee.

Gaines’ extensive experience in global finance, infrastructure, and critical mineral development brings valuable insight to Volato’s strategic growth direction and pending merger with M2i Global.

His addition enhances Volato’s financial oversight and strengthens governance as the company expands into advanced technology and mineral supply sectors.

The appointment signals Volato’s commitment to disciplined leadership, shareholder confidence, and long-term growth through expertise-driven management.

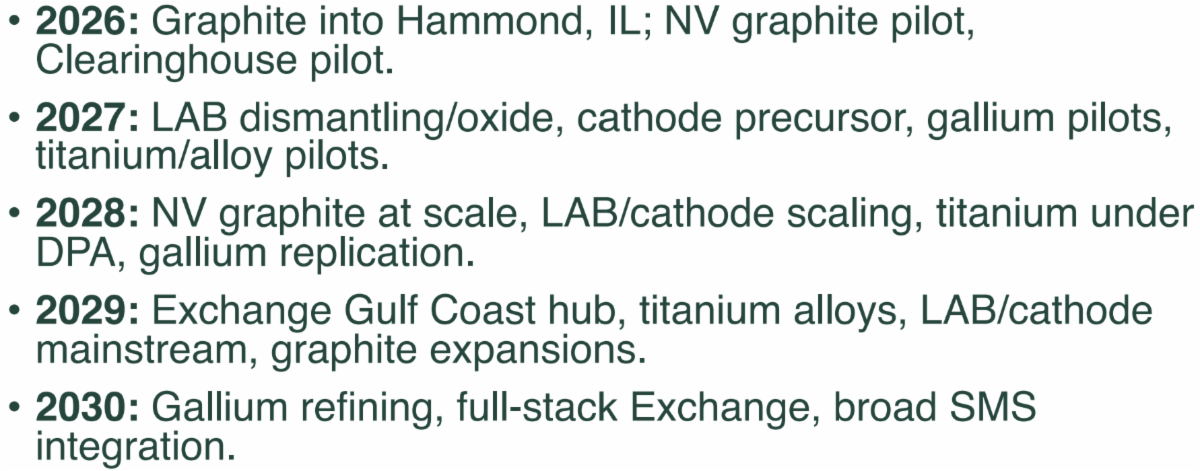

4.) Volato And M2i Outline Strategic Vision Driving 2026 Growth.

Volato Group and M2i Global issued a joint shareholder letter highlighting 2025 milestones and an ambitious 2026 roadmap.

Achievements included expanded critical mineral sourcing agreements, strengthened partnerships such as with Hawthorne Army Depot, and increased shareholder engagement.

M2i also advanced the development of a U.S. Critical Mineral Reserve alongside trusted partners like Australia’s Reforme Group.

The letter reaffirmed a shared vision for national resource independence.

For Volato, the collaboration marks continued momentum toward merging operations and capitalizing on its technology and resource integration strategy for long-term growth.

5.) Volato Delivers Strong 2025 Financial Results Strengthening Future Opportunities Ahead.

Volato Group announced robust financial guidance for 2025, forecasting $78–79Mn in revenue and $6–8Mn in net income.

The company achieved significant balance sheet improvements, reducing liabilities to $9.5Mn and completing requirements tied to its merger with M2i Global.

These solid results reflect disciplined fiscal management and strategic progress toward scalable, technology-enabled growth.

Volato’s financial performance demonstrates operational strength and sets a positive foundation for its pending 2026 merger completion, highlighting confidence in the company’s direction and its evolving leadership in critical resource integration. -----

Coverage is now officially underway on Volato Group, Inc. (Nasdaq: SOAR).

Updates will be coming out soon. Keep your eyes peeled.

All the best, Dane James Editor Market Pulse Today

(Remember: St-ock Prices Could Be Significantly Lower Now From The Original Dates I Provided.)

*MarketPulseToday.com (“MarketPulseToday” or “MPT” ) is owned by Thousand Sun Media LLC, MPT is not responsible for its accuracy. Make sure to always do your own research and due diligence on any day and swing profile MPT brings to your attention. Any emojis used do not have a specific defined meaning, and may be used inconsistently. We do not provide personalized in-vest-ment advice, are not in-vest-ment advisors, and any profiles we mention are not suitable for all in-vest-ors.

Pursuant to an agreement between Thousand Sun Media LLC and TD Media LLC, Thousand Sun Media LLC has been hired for a period beginning on 02/02/2026 and ending on 02/03/2026 to publicly disseminate information about (SOAR:US) via digital communications. Under this agreement, TD Media LLC has paid Thousand Sun Media LLC seven thousand two hundred USD ("Funds"). These Funds were part of the one hundred twenty thousand USD funds that TD Media LLC received from a third party named Xander Nexus Inc. who did receive the Funds directly or indirectly from the Issuer and does not own st-ock in the Issuer but the reader should assume that the clients of the third party own shares in the Issuer, which they will liquidate at or near the time you receive this communication and has the potential to hurt share prices.

Neither Thousand Sun Media LLC, TD Media LLC and their member own shares of (SOAR:US).

Please see important disclosure information here: https://marketpulsetoday.com/disclosure/soar-hoyaw/#details |

No comments:

Post a Comment