A Happy Sunday to You,

I've been trading, teaching, and learning about stocks off and on since 2007.

Rarely do I learn something about the basics of trading because…they should be basic.

And yet, Gianni Di Poce taught me something recently that gave me a fresh perspective.

P&Ls don't follow a smooth trajectory, regardless of your strategy, if you don't actively plan for those "ohh crap" moments.

It's a lesson I should have learned back in 2020 when I blew up one of my futures trading accounts.

For nearly four months, I managed to win 80% of my trades, take reasonable drawdowns, managing to 4x my account…

Until my birthday. Then it all went to hell in a single session.

It's not just black swans. There are individual risks that usually sit just beyond our sightline. So, we forget about them…until they slap us across the face.

I learned the hard way: give up some of those 'comeback' wins to fortify your strategy.

Accept losses and even expect drawdowns.

Don't worry about the 10 trades that you managed to bring back from the dead.

Because it only takes one disaster to wipe it out.

Reaching for trading perfection will leave you waking up in a pool of your own vomit after a heavy night of drinking at a dive bar to forget about your latest trading failures…not that I'm speaking from personal experience…of course (cough, cough).

Jordan Schneir

Editorial Director, TheoTRADE

Fun fact: Options move stocks. That's how it works.

So guess what? Bigger options trades means more movement. Crazy logic, right?

Brandon's Ghost Prints Console shows you not just the biggest trades, but HOW they were traded.

Was that 30,000 call option trade sold or bought? His Ghost Prints Console has the answer.

And tomorrow at 2PM EST, he'll show you exactly how it works. Or you can keep letting markets steamroll you. The choice is yours.

Reserve your spot for Brandon's Webinar HERE.

Don Kaufman: This Rally is Hiding Something Dangerous

Listen, I know everyone's celebrating the Dow's 900-point rally today, but something's making me genuinely uneasy about this market.

And when I get uneasy, I start looking for ways to profit from what's coming next.

Here's what I'm seeing that has me concerned — and how I'm actually trading it.

The One Thing That Always Worries Me

You want to know what scares me more than volatility? When markets start ripping themselves apart.

Today's rally looks great on the surface: Dow up 900 points, S&P gaining 1.4%, everyone talking about the "tech rebound." But look closer and you'll see what's actually happening.

The Dow's soaring because of Caterpillar and Goldman Sachs. Regional banks are catching bids. Home builders are rallying.

Meanwhile, Amazon's still down 8% and the software sector just had its worst week since 2008.

This isn't healthy rotation. This is what I call bifurcation — and when I see it, I know trouble's coming.

CLICK HERE to continue reading Don's article.

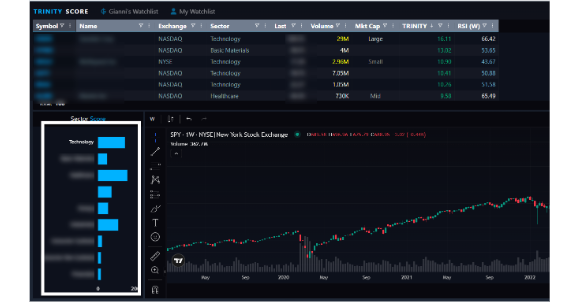

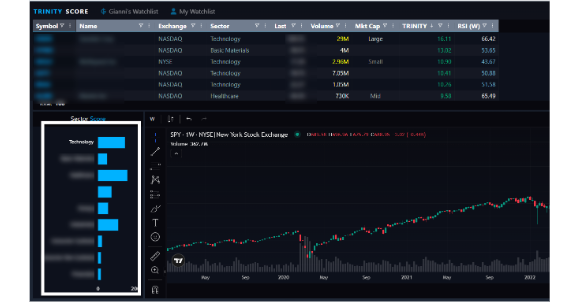

Gianni Di Poce: How the Trinity Terminal caught October's Top (And You Didn't)

The best trades aren't the ones everyone sees…

They're the ones that form quietly while the crowd celebrates.

October 29th looked like just another new high in tech.

Underneath, the liquidity cycle that had pumped $13 trillion into global markets had stopped expanding.

And the Trinity Terminal saw it happening.

While tech made highs, the Terminal stopped lighting up bullish alignments in the software space.

The institutional tides, waves, and ripples diverged. That's when I raised cash to 90%.

That divergence was the signal before the story. Now the headlines are catching up.

Tech is in free fall. Software is down 20% year to date. AMD beat earnings and still got destroyed.

I'm going to explain what happened, why the selloff feels so violent, and where the Trinity Terminal is picking up strength right now.

CLICK HERE to continue reading Gianni's article.

Brandon Chapman: How the Relationship Between XLK and XLP Reveals What's Coming Next

xMissing the shift from correction to bear market is one of the most expensive mistakes a trader can make.

By the time traditional indicators confirm it, the damage is already done.

Most traders rely on VIX spikes and chart patterns. But those tools measure reaction, not intention.

They tell you what already happened. Not what's about to.

There's a simpler signal hiding in sector rotation.

It lives in the relationship between two kinds of chips: silicon and potato.

This week I watched over 100,000 contracts hit XLP. That's not normal defensive positioning. That's someone preparing for something.

The "safe" sector is getting hedged hard. The place where scared money is hiding? Big money is buying protection against it.

I'll break down exactly what the options market is pricing in that most traders aren't seeing.

Join me this Monday at 2PM EST to see how it works.

Because when you understand what's happening between XLK and XLP, you're reading the market's actual intentions.

CLICK HERE to continue reading Brandon's article.

Jeff Bierman: Hold the Line (Until You Can't)

Toto released Hold the Line in 1978.

Jeff Porcaro on drums. Steve Lukather on guitar. The song that put them on the map before Africa ever existed.

I picked that title Thursday morning for a reason. We are holding a line right now.

The market sits at 6,900 on the S&P. One percent from all-time highs. And traders are already panicking.

I watched it happen all week. People are asking why this is dropping…

…why we cannot break through…

…why the market feels so heavy when we are this close to new records.

Here is what I told my members on Thursday - you are within 1% of an all-time high, and you are already crapping the bed.

Get the Fed out. You could fall 30% easy from here and it could happen tomorrow.

The weekly S&P 500 RSI just hit a 59 handle. Next week it will be a 57. Then a 56.

This is a slow bleed. A drip in your faucet that you ignore until one day the bathtub comes through the ceiling.

The Genesis Cog Scanner tracks these setups before the breakdown happens.

It identifies when the weekly cycles are rolling over while the daily charts still look fine.

That is the edge.

Because if you are bearish short term like I am, you need to understand one thing: How to hold the line without getting destroyed in the process.

This weekend, I'll show you how to hold bearish positions with discipline and build into weakness the right way.

CLICK HERE to continue reading Jeff's article.

Blake Young: You Can't Outsmart Your Own Rules

Throughout history, philosophers have debated paradoxes about everything in Heaven and on Earth.

Consider: if you have a mountain of sand and remove one grain at a time, at what point is it no longer a "mountain"?

Or if God is omnipotent, can He create a rock so large that even He cannot lift it?

These questions are meant to stimulate discussion.

But I want to use that last one to help you see the paradox of not following your trading rules.

CLICK HERE to continue reading Blake's article.

Tony Rago: How to Handle Volatility Daytrading

Monday's session hammered this home from a different angle. The S&P 500 had just printed a 152-handle daily bar, the NQ looked identical, and both were bleeding into the afternoon.

Context forced another adaptation.

I told the room: "A lot of times I like to buy things that are tested from above. On a day like today, we want to stick with the other side of the setups where we're selling from below."

The Golden Setup methodology has two sides. Most people associate it with buying levels tested from above, waiting for price to come down to a key level and bounce.

But on a day where the market has dropped too far, too fast, and every bounce is getting sold, you flip the playbook. You sell levels tested from below using the same framework in the opposite direction.

I still bought the weekly pivot test from above on the NQ that morning. We made 20 handles on it.

But I told the room afterward: "That was clearly the wrong trade. The better trade was shorting the weekly pivot back through and just holding the damn thing."

The market dropped 600 handles from where that short entry was available. A profitable trade can still be the wrong trade if a far better setup was sitting right in front of you.

CLICK HERE to continue reading Tony's article.

No comments:

Post a Comment