Kevin Warsh, the End of QE, and the Great AI Divide VIEW IN BROWSER

Markets love to pretend that personnel changes don’t matter. “The institution is bigger than the individual.” That’s usually true – until policy tools change, not just policy rates. And the nomination of Kevin Warsh as the next board chair of the U.S. Federal Reserve has the feel of one of those moments where something actually does change. Not overnight but directionally – and in ways that matter enormously for how capital gets allocated over the next decade… Because Warsh doesn’t just represent a different rate path. He represents a potential regime shift away from quantitative easing (QE) as the default market backstop. And if that happens – even partially – the single most actionable investment implication today isn’t “rates up” or “rates down.” It’s whether the market continues to subsidize long-duration stories – or forces investors to get paid sooner. And that’s why the AI market is about to split in two. Welcome to the Great AI Divide. Kevin Warsh’s Federal Reserve Vision: Less QE, More Market Discipline Strip away the hot takes and caricatures, and Warsh’s worldview is surprisingly coherent. He is: - Not reflexively anti-rate cuts

- Deeply skeptical of QE and balance-sheet expansion

- Highly sensitive to term premia, market distortions, and asset-price inflation

- Openly critical of the idea that the Fed should permanently suppress long-term yields

In other words, Warsh is not saying, “Tighten policy at all costs.” He’s saying, “Stop engineering asset prices via the balance sheet, and let markets do more of the work.” That’s an important distinction. Under a Warsh-style framework, it is entirely plausible that we see rate cuts at the short end alongside an abandonment of large-scale QE efforts. That would mean a smaller, more disciplined Fed balance sheet where long-term rates are set more by markets than by the Fed’s intervention. That structure – cuts without QE – is not the regime investors have been trained on for the past 15 years. And markets will have to re-learn how to price assets in it. Why a Shift Away From QE Changes Asset Pricing Most investors think QE was just “extra stimulus.” But that’s not quite right. Rate cuts affect borrowing costs. QE changes what assets are worth by removing duration risk from the market entirely. It doesn’t just lower rates – it rewrites the discount curve. QE did three deeply important things: - It crushed the term premium – the extra return investors normally demand for tying up capital long-term – effectively de-risking long-dated assets.

- It flooded markets with forced liquidity: Capital had to go somewhere – and it went into duration.

- And it made time arbitrage extraordinarily profitable: Cash flows far in the future suddenly mattered almost as much as cash flows today. That’s why revenue-free growth stories, long-dated software models, and ‘total addressable market’ narratives thrived.

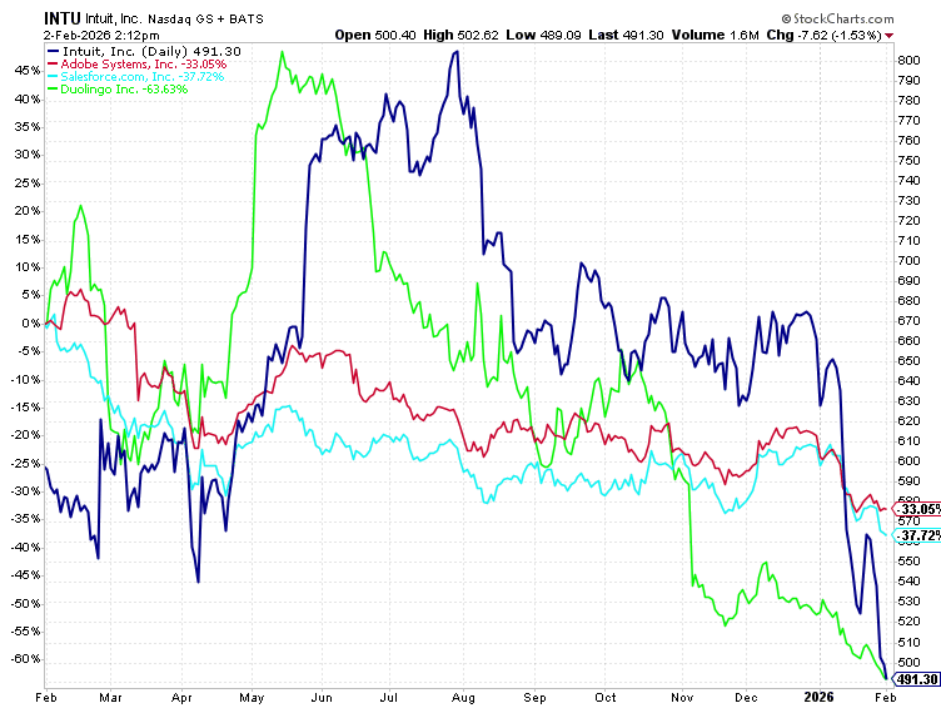

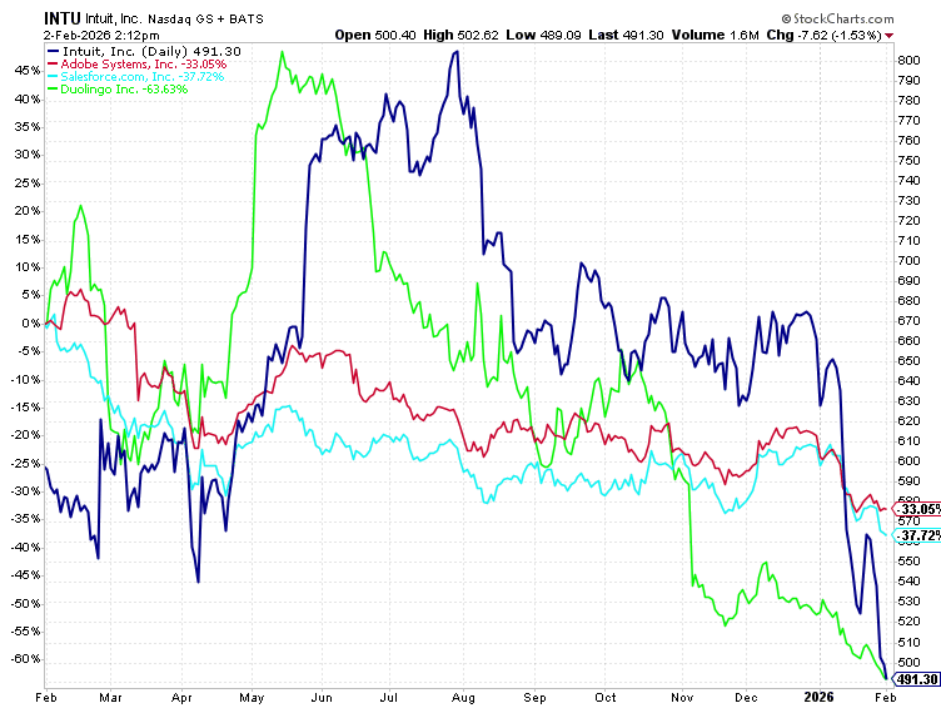

That last point is the quiet killer for today’s market. QE didn’t just lift markets broadly – it rewarded waiting. If your business model was: “Trust us, the profits come later,” then QE was your best friend. QE rewarded duration. But if Warsh truly marks a secular move away from QE as a standing tool, several things happen – slowly at first, then all at once. First, long-term rates tend to drift higher; not because growth is exploding, but because investors once again demand compensation for time, inflation risk, and uncertainty. Second, liquidity becomes more selective. Capital still exists, but it has standards again. You don’t get paid just for showing up with an AI slide deck. Third, volatility rises. Markets have to do actual price discovery: rude but necessary. And fourth, multiples stop expanding automatically. Earnings matter again – arguably the most important implication of a shift away from QE – because valuation expansion can no longer do all the work. And that brings us to the most important consequence of all… How Fed Policy Could Split the AI Market For the past few years, the market treated “AI exposure” as one homogeneous trade. If a company mentioned “AI” in its quarterly call? Buy it. If management referred to it as “transformational”? Buy more. Who cares if profits were unclear? The Fed’s got our back. But now Warsh is putting an end to that era. In a post-QE or QE-lite regime, time matters again – which creates a structural divide in the AI industry between “AI Now” and “AI Later” stocks. AI Now “AI Now” companies are those converting AI demand into revenue, margins, and earnings today. They are AI bottlenecks: the choke points where demand turns into revenue. They include businesses tied to compute, networking, memory, power generation and grid equipment, thermal management, data-center infrastructure, semiconductor manufacturing and tools, physical AI supply chains, etc. These are the AI builders turning spending into profits today. These companies benefit from AI demand regardless of liquidity conditions, because their products are capacity-constrained; their customers are hyperscalers, enterprises, and governments; and their spending is ROI-justified, not speculative. Higher long-term rates don’t kill these businesses. They slow the froth, not the fundamentals. In fact, a non-QE world can help them by killing marginal competitors, forcing customers to prioritize efficiency, and channeling capital toward projects with real payback. This is AI as industrial revolution rather than meme stock. Then there are the “AI Later” stocks… AI Later These companies are the ones whose investment case rests on long-tailed monetization, margin expansion over time, and cash flows several years out. These are stocks whose terminal value – not today’s numbers – is doing most of the valuation work. These businesses often say things like, “Usage is exploding… but we’ll figure out profits and pricing later.” That model thrives in a QE world. But it struggles when discount rates rise, term premia matter, and liquidity disappears. This doesn't mean all AI software is doomed. It means the bar moves way up. Markets stop rewarding adoption and only reward cash returns. And if an AI software stock isn’t delivering cash returns today, it gets punished – even if AI adoption is soaring. Just ask Adobe (ADBE), Salesforce (CRM), Intuit (INTU), Duolingo (DUOL)… the list goes on and on.

The repricing in “AI Later” stocks has been sharp and widespread – and would likely intensify under a Warsh-style regime. What a Post-QE Federal Reserve Means for Economic Growth Here’s the part that may surprise people: A move away from QE does not automatically mean weaker growth. It changes how growth is financed, not whether growth exists. It means fewer zombie projects, less financial engineering, and a heavier emphasis on productivity-enhancing investments. But it doesn’t mean the end of growth. It just means the end of excess. AI infrastructure – the stuff that actually reduces costs, improves throughput, and boosts output – fits perfectly into that framework because it isn’t excessive spending. It is critical spending. This is how we get nominal GDP growth without runaway asset bubbles, earnings growth without multiple insanity, and ultimately, a healthier (even if noisier) market. Very un-2010s. Very real-economy. The Final Word If Kevin Warsh really does mark the beginning of the end of QE as a default policy tool, the implications are profound – but not uniformly negative. The key is recognizing that AI is no longer one trade. It is splitting into: - AI Now – monetizing, cash-generative, infrastructure-driven

- AI Later – long-duration, liquidity-dependent, narrative-heavy

In a QE world, both could win. But in a post-QE world, AI Now becomes the core exposure, and AI Later becomes a selective, high-risk side bet. That’s the Great AI Divide. And it may end up being the most important investment implication of Warsh taking over the Fed. If this divide is real – and a post-QE world forces capital toward cash-generating, infrastructure-heavy winners – then the next question isn’t whether to own AI… It’s which AI Now companies move from commercial demand to direct government-backed acceleration. The Genesis Mission – a Manhattan Project–scale push across AI, semiconductors, nuclear energy, and advanced manufacturing – is about to make that distinction explicit. And on Feb. 22, Washington will begin revealing exactly where the money, contracts, and resources are going. I believe this creates a narrow, 30-day window to position ahead of the companies that will become the infrastructure backbone of America’s AI strategy. And I’ve already identified eight firms positioned to benefit before Wall Street fully prices them in. If Warsh marks the end of QE as a safety net, the Genesis Mission may mark the beginning of a new, government-backed AI profit cycle. The question is whether you’ll see it early – or after the move is already over. I’ve laid this out in detail in my latest briefing, which you can check out right here. Sincerely, |

No comments:

Post a Comment