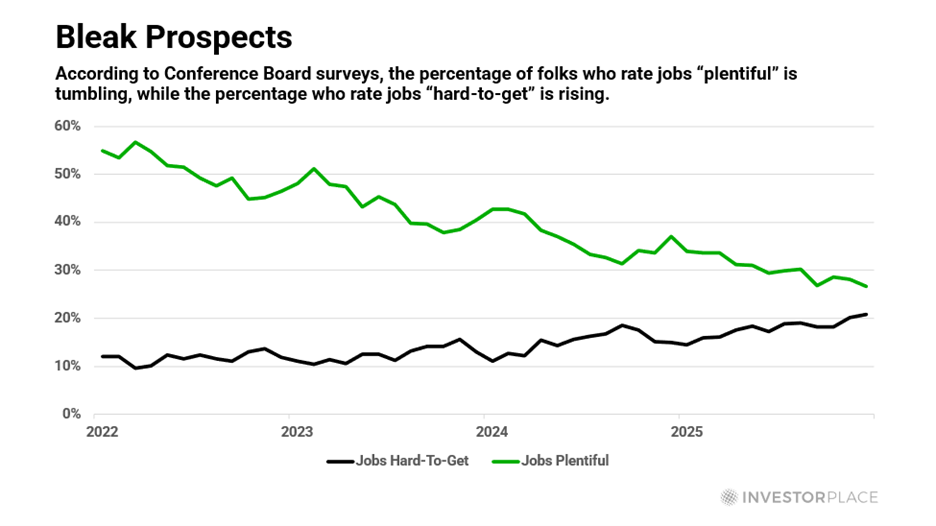

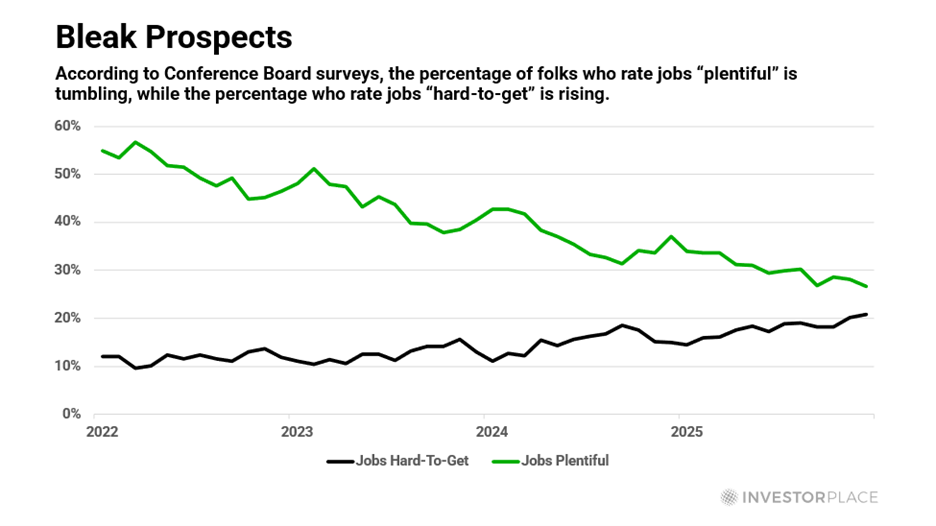

| WEEKLY ROUNDUP Job Losses Without Layoffs – Prepare Your Portfolio Now VIEW IN BROWSER Hello, Reader. Call it an accident, a blunder, or an “oops.” Regardless of the term, Amazon.com Inc. (AMZN) unsettled employees last week when it mistakenly sent an email to many of them referencing “reducing layers… and removing bureaucracy.” After that accidental email went out, Amazon quickly confirmed 16,000 corporate job cuts. This is the company’s second recent round of layoffs. It previously cut 14,000 jobs in October. Both cuts follow a memo sent by Amazon CEO Andy Jassy to employees last summer, stating that he expects the company to reduce its corporate workforce as it leans more heavily on generative AI tools to fulfill duties. "As we roll out more generative AI and agents, it should change the way our work is done," Jassy said. "We will need fewer people doing some of the jobs that are being done today, and more people doing other types of jobs." In short, Amazon’s layoffs come as part of broader tech industry restructuring. Most discussions about AI’s impact on employment focus on dramatic displacement – mass layoffs, like Amazon’s, and whole professions vanishing overnight. That makes for compelling headlines, but it misses the real near-term impact. AI’s earliest impact on the job market isn’t who gets fired. It’s on who never gets hired. The Federal Reserve’s Beige Book has noted repeatedly that firms are using AI tools to reduce the need for entry-level hiring, customer support staff, junior analysts, and back-office roles. Existing employees, augmented by software, are doing more work. Positions that would normally be backfilled are being quietly left open. That alone is enough to stall job growth. Recent productivity data reinforce the point: Output per hour has risen faster than total hours worked. In plain English, the economy is producing more output without needing more labor. If that dynamic persists – or accelerates – employment growth can turn negative, even if GDP remains positive. Survey data adds an important human dimension to the statistics. In the Consumer Confidence survey published by the Conference Board, the share of respondents saying jobs are “hard to get” has been rising, while the share saying jobs are “plentiful” has been falling. This shift is modest so far, but it is telling.

Historically, perceptions of job availability deteriorate before payroll numbers turn negative. People feel the slowdown first – through longer job searches, fewer callbacks, and fewer postings – long before layoffs dominate headlines. That pattern appears to be unfolding now. Perhaps the most underappreciated signal is coming from a group who rarely worries about employment: recent college graduates. According to data tracked by the Federal Reserve Bank of New York, unemployment among recent college graduates has risen, and underemployment has climbed to levels last seen during the pandemic disruption. More than 40% of recent grads are now working in jobs that do not require a degree. That is not a coincidence. Entry-level hiring is exactly where AI-driven efficiency shows up first. When firms can automate basic research, coding assistance, customer support, and routine analysis, junior roles become optional… or obsolete. And entry-level roles are the pipeline that sustains net job growth. If, as I expect, job growth turns negative in 2026, it may not feel like the end of the world. But it could feel like something even more unsettling: an economy that still runs, but with fewer people running it. All this tells me that now is the time to “future-proof” your portfolio. That is, invest in companies and industries that AI can never replace… even as it slowly begins replacing the workforce. But AI isn’t just changing the future of job growth or availability. It’s also changing the relationship between America’s public and private sectors. And investors need to pay attention. I’ll explain more below. But first, let’s take a look back at what we covered here at Smart Money… |

No comments:

Post a Comment