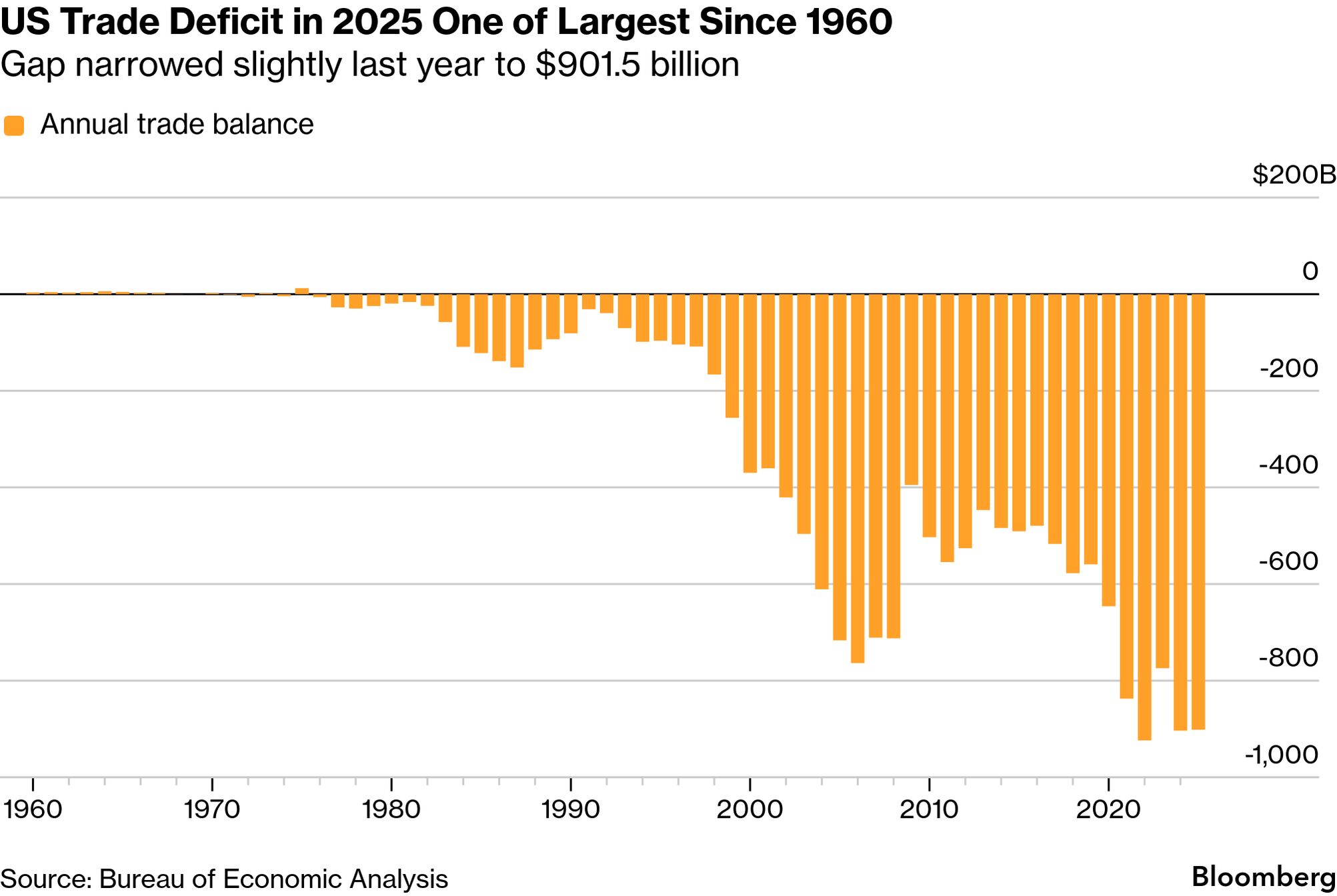

| US trade deficit grows |

| |

| Donald Trump's global trade war has not had (as of yet anyway) the desired effect when it comes to America's yawning trade deficit. In fact, the gap grew in December to $70.3 billion. This according to data from his own administration. The US Commerce Department reported that the shortfall culminated in a full-year deficit of $901.5 billion—one of the largest in data back to 1960. Trump has said tariffs are part of his strategy to reduce US reliance on foreign goods, encourage domestic investment and correct decades of declines in manufacturing employment. Recent data however has borne out a year of warnings from economists, showing it is largely American consumers and companies who are paying for Trump's tariffs rather than foreign countries. "After all the tariff headlines and swings in the data, the trade deficit barely budged in 2025," Nationwide Financial Market Economist Oren Klachkin said in a note. And those tariffs, many of which were ruled illegal by a federal appeals court, could be the subject of a US Supreme Court decision any day now. —David E. Rovella | |

What You Need to Know Today | |

| |

|

| Blue Owl Capital shares tumbled after a decision to restrict withdrawals from one of its private credit funds raised fresh concern over the risks bubbling under the opaque surface of the $1.8 trillion market. Shares of the alternative asset manager fell about 10% on Thursday to their lowest level in two and a half years. The move highlights the hazards confronting retail investors entering the fast-growing private credit market. Though investors are generally allowed to redeem a portion of their capital each quarter, payouts can be curtailed if withdrawal requests exceed set limits. The news also rekindled fears in an industry that has attracted increasing scrutiny in recent months. Worries are rising over valuations in the market and the quality of lending to firms with heavy debt loads and short track records. Critics of the newest Wall Street craze say they've seen this movie before—and it doesn't end well. | |

|

| But that's not stopping Wall Street's biggest from jumping in. Bank of America for one is committing $25 billion of its own money to private-credit deals. The company is said to plan investments in private-credit opportunities, an extension of the firm's existing direct-lending efforts. Bank of America is one of the last big US banks to make a formal commitment to private credit. Last year, JPMorgan set aside an additional $50 billion of the firm's balance sheet. Goldman Sachs has deepened its ties to the market through its asset-management arm. | |

| |

|

| |

|

| Kathryn Ruemmler, who resigned last week as the top lawyer at Goldman Sachs, corresponded with Jeffrey Epstein about a prostitution scandal that engulfed the US Secret Service during her tenure as White House counsel under former President Barack Obama. In a dozen or so exchanges that were sent months after Ruemmler left her White House position in 2014, she complained to Epstein about "this secret service crap" and forwarded to him a draft email that contained detailed, nonpublic information about the behind-the-scenes role the White House Counsel's office played in investigating the 2012 prostitution scandal. Although Ruemmler had left the White House, she remained embroiled in the matter as lawmakers and journalists probed her work. At the time she was under consideration for US attorney general. | |

|

| Europe's five biggest military spenders are said to be planning joint development of low-cost air defense weapons based on lessons learned on the battlefield in Ukraine. The new initiative is expected to be announced as early as Friday when defense ministers from the UK, France, Germany, Italy, Poland meet with the European Union's top diplomat and NATO's deputy secretary general to discuss hybrid threats and industrial cooperation. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Bloomberg Invest: Join the world's most influential investors and financial leaders in New York on March 3-4. Powered by insights from the Bloomberg Terminal and one of the largest global newsrooms, this flagship event examines how artificial intelligence disruption, geopolitical uncertainty, shifting central bank policy and the convergence of public and private markets are reshaping global finance. Don't miss forward-looking conversations with top CEOs, asset managers and industry titans in the heart of the financial district. Learn more here. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment