ON FEBRUARY 24, PRESIDENT TRUMP IS

EXPECTED TO SIGN HIS FINAL ONE — EVER!

Ian King here with some very big news.

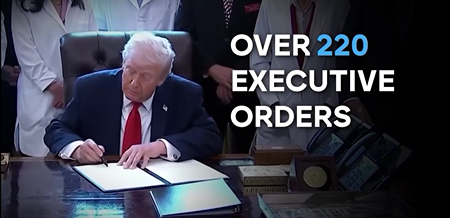

After 220 Executive Orders in one year. And with nearly three full years left in office…

I have learned the unthinkable…

On February 24th, President Trump is expected to issue what I believe will be his FINAL Executive Order.

I know that sounds crazy …

I didn’t believe it myself.

But then I saw all the details of the leak — coming directly from inside the White House — and I knew right away this was going to be a huge and shocking announcement.

I was able to get the full story for you here.

Regards,

Ian King

Chief Strategist, Strategic Fortunes

Why Amprius Insiders Are Selling—and Why Bulls Aren't Panicking

Authored by Thomas Hughes. Article Posted: 1/26/2026.

Article Highlights

- Amprius Technologies insider selling was executed under a 10b5-1 plan, and insiders still own nearly 13% of the company.

- Institutional interest and analyst sentiment remain supportive, with improving accumulation and a Buy-leaning rating mix.

- NDAA-compliant capacity expansion, strong revenue growth expectations, and easing short interest set up catalysts ahead.

Amprius Technologies (NYSE: AMPX) insiders—primarily CTO Constantin Stefan—have been selling shares. Those sales were executed under prearranged 10b5-1 trading plans, which allow insiders of publicly traded companies to make periodic, predetermined sales of stock. Such plans often coincide with share-based compensation and provide a way for insiders to realize gains. As of late January 2026, AMPX is up more than 400% from its 2025 lows, giving insiders strong reasons to take profits for portfolio diversification or to manage tax liabilities from option exercises.

The key takeaway is that insiders still own nearly 13% of the company, and other forces—including institutional and analyst trends—suggest the stock is being accumulated despite insider selling. Institutional ownership remains low and concerns about cash burn and scalability persist, but trends are improving. InsiderTrades data show institutional ownership creeping higher, with activity ramping at the end of 2025. In Q4, buying outpaced selling by more than $27 bought for every $1 sold, and a bullish bias carried into early 2026.

Silicon Valley Insiders are getting spooked about AI - here's why (Ad)

Almost no one sees it coming, but AI is about to split America into two over the next 12 months. On one hand, it'll make America's one-percenters richer and more powerful than ever. On the other hand, it's set to trap millions of hardworking Americans in financial quicksand. Former Google exec Kai-Fu Lee says AI could wipe out 50% of jobs by 2027. Elon Musk has said AI will surpass human intelligence by 2027. Mark Zuckerberg has said half of all coding could be done by AI within the next year. One ex-hedge fund manager whose team predicted Nvidia's rise in 2020 calls this the AI End Game, and he says there are three critical moves every American should make in the next 12 months to protect and grow their wealth through this paradigm shift.

See the three moves before the AI split happensSeven reports support the Moderate Buy rating, reflecting a strongly bullish skew—85% of ratings are Buy, with the lone outlier a Sell from Weiss Ratings. The analyst group sees more than 40% upside from consensus support targets and leaves open the possibility of a move toward the high end of the range, perhaps as high as $20 within the next few quarters.

Amprius Technologies Strengthens Capacity, Reduces Costs in Late 2025

Amprius has been focused on reducing costs while scaling operations. In mid-2025 the company paused construction of certain domestic manufacturing facilities to expand its contract manufacturing network. Partnering with South Korean manufacturers enables National Defense Authorization Act (NDAA) compliance while growing capacity in an asset-light way. NDAA compliance is important because Amprius's primary battery markets as of early 2026 are defense-related, including drones, unmanned vehicles and man-portable systems.

The upcoming Q4 2025 and subsequent earnings reports are likely catalysts. The company is expected to grow revenue by more than 120% in Q4, and following the Q3 report all analysts covering the stock raised their Q4 revenue estimates. Even so, longer-term forecasts may remain conservative despite this upward revision trend. Given the disruptive potential of silicon-anode lithium-ion technology, the stock is positioned for a persistently bullish revision cycle over the coming quarters and years.

Short Covering Signals Bottom in the AMPX Market

Short selling drove much of AMPX's correction in late 2025, with short interest spiking above 20% at its peak. By late January 2026, short interest had retreated about 22% month-over-month, which aligns with the market bottom that formed as 2025 ended and 2026 began. If short covering continues and upcoming results are solid, the 2026 rebound should gain momentum and could retest long-term highs near $16 early in the year. If not, the stock is likely to remain range-bound with a risk of deeper correction.

Currently, AMPX appears to be in rebound mode. The stock has climbed significantly off its late-2025 low and moved above a key resistance level. January price action suggests that resistance may be turning into support, which would help sustain the advance. In this scenario, AMPX could retest the long-term high near $16 before the March earnings report, though it will likely need that report or another catalyst to push to new highs.

This email communication is a paid sponsorship for Banyan Hill Publishing, a third-party advertiser of The Early Bird and MarketBeat.

If you would like to unsubscribe from receiving offers for Strategic Fortunes, please click here.

If you have questions about your account, please feel free to contact our U.S. based support team at contact@marketbeat.com.

If you no longer wish to receive email from The Early Bird, you can unsubscribe.

Copyright 2006-2026 MarketBeat Media, LLC. All rights protected.

345 North Reid Place, Suite 620, Sioux Falls, SD 57103. U.S.A..

No comments:

Post a Comment