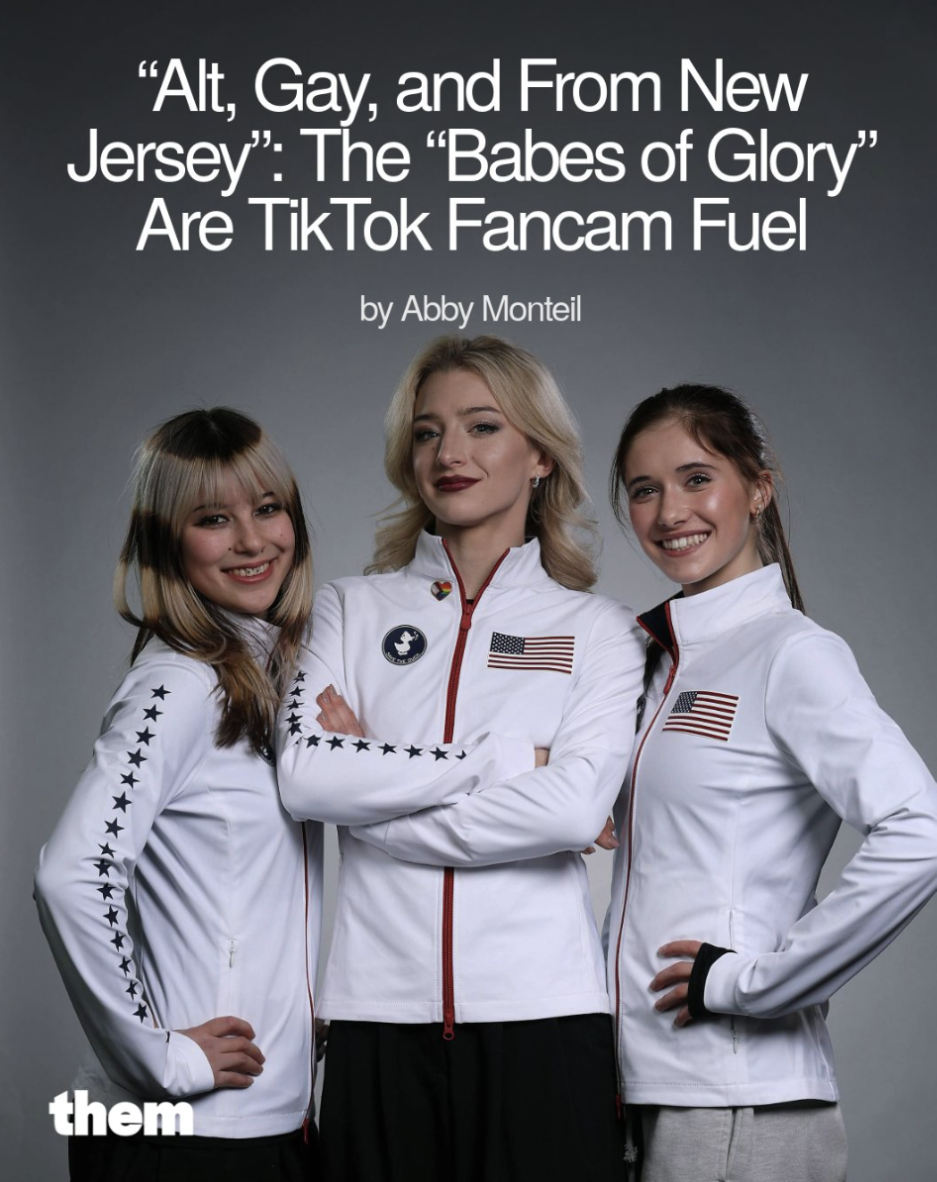

| On one hand, it may be difficult to see an American flag right now and feel any semblance of pride, what with US President Donald Trump reposting a racist video that depicted Barack and Michelle Obama as apes — Ronald Brownstein reminds us that the president's racist policies are harmful, too. And then there's ICE arresting nearly 379,000 people in the last year, only 14% of whom Nia-Malika Henderson says could be considered "the worst of the worst." But on the other hand, this Instagram post by Them has 115,000+ likes! And one of them is mine: If that headline somehow fails to convince you to root for the likes of Alysa Liu, Amber Glenn and Isabeau Levito, perhaps Adam Minter can. Just like the "Blade Angels" of US figure skating, he says the broader US Olympic team is a true melting pot of athletes. Just look at Erin Jackson, the Black gold medal-winning speed skater who proudly carried the flag during the opening ceremonies. Or Asian-American snowboarder Chloe Kim, who dominated qualifiers on Wednesday despite an injury. Or any of the openly LGBTQ athletes that Adam says are playing starring roles in several sports, including women's hockey, which Hilary Knight just captained to victory against Canada. "These diverse athletes broaden what it means to have national pride," Adam writes. You may not know it, but the federal government doesn't provide direct funding to America's Olympic program — a rarity in today's sports world. That financial freedom, Adam says, is critical because "it leaves competitors free from forced displays of political loyalty." Without that independence, freestyle skier Hunter Hess might not have spoken up last week when he said that his American flag didn't mean that he supports "everything that's going on in the US." These athletes "get to define the kind of America they want to represent," Adam says. He points to cross-country skier Jessie Diggins, who grew up outside of Minneapolis, as proof: "I'm racing for an American people who stand for love, for acceptance, for compassion, honesty and respect for others." Read the whole thing. And let's go USA! Here's a look at what Matt Levine calls the "AI whateverpocalypse trade:" You build an artificial intelligence application for some specific sort of business, coding or tax planning or whatever. You roll it out on a Tuesday morning. You announce it in blandly optimistic terms and do some cool demos. You go on financial television, and when they ask you — as they will — a question like "won't this disrupt the business model of software-as-a-service companies" or "won't this put financial advisers out of business," you smirk ruefully and shake your head and say "well there is a lot of disruption coming, and it may be difficult to know what role money will play in a post-artificial general intelligence world." And by Tuesday afternoon every software company or wealth management company or whatever sector you're targeting will have sold off by like 10%. Oh and of course the other thing you do is, on Monday — before you announce the new product — you buy a bunch of put options on all of the software/wealth management/whatever companies' stocks. And you make like a 1,000% one-day return on your money, probably not in huge size but in useful size.

This is a fictional business model, of course. But as with many of Matt's this-is-not-investing-advice scenarios, it closely resembles what's happening in real life. Here's Chris Hughes today on the AI selloff: Investors have been nervous for months about AI's potential to threaten long-standing business models by giving customers a cheaper, or free, means of doing things they currently pay for. The threat became tangible last week when AI firm Anthropic PBC released add-ons enabling lawyers to use its Claude chatbot for reviewing contracts and other tasks without needing coding skills. That had implications beyond companies providing law-based data services. Cue a broader sell-off capturing publishers, marketing groups and business-information providers. Vindicating the fears, Anthropic swiftly followed up with a product for finance professionals.

Now, Paul J. Davies — a journalist, need I remind you, who is paid to cover banking and finance — wonders whether the finance industry's perpetual money machine is at risk of imploding: "While I mostly suspect that the banking industry's talent for self-preservation will defend it from technological change, I do wonder if the extreme version of our fully automated AI future could make financial services as irrelevant as everything else." It's existential, but have some faith. Chris says "businesses that actually use AI to improve how they operate" — including financial services, retailers, health care and the like — could still prove very lucrative down the line. Bonus AI Reading: |

No comments:

Post a Comment