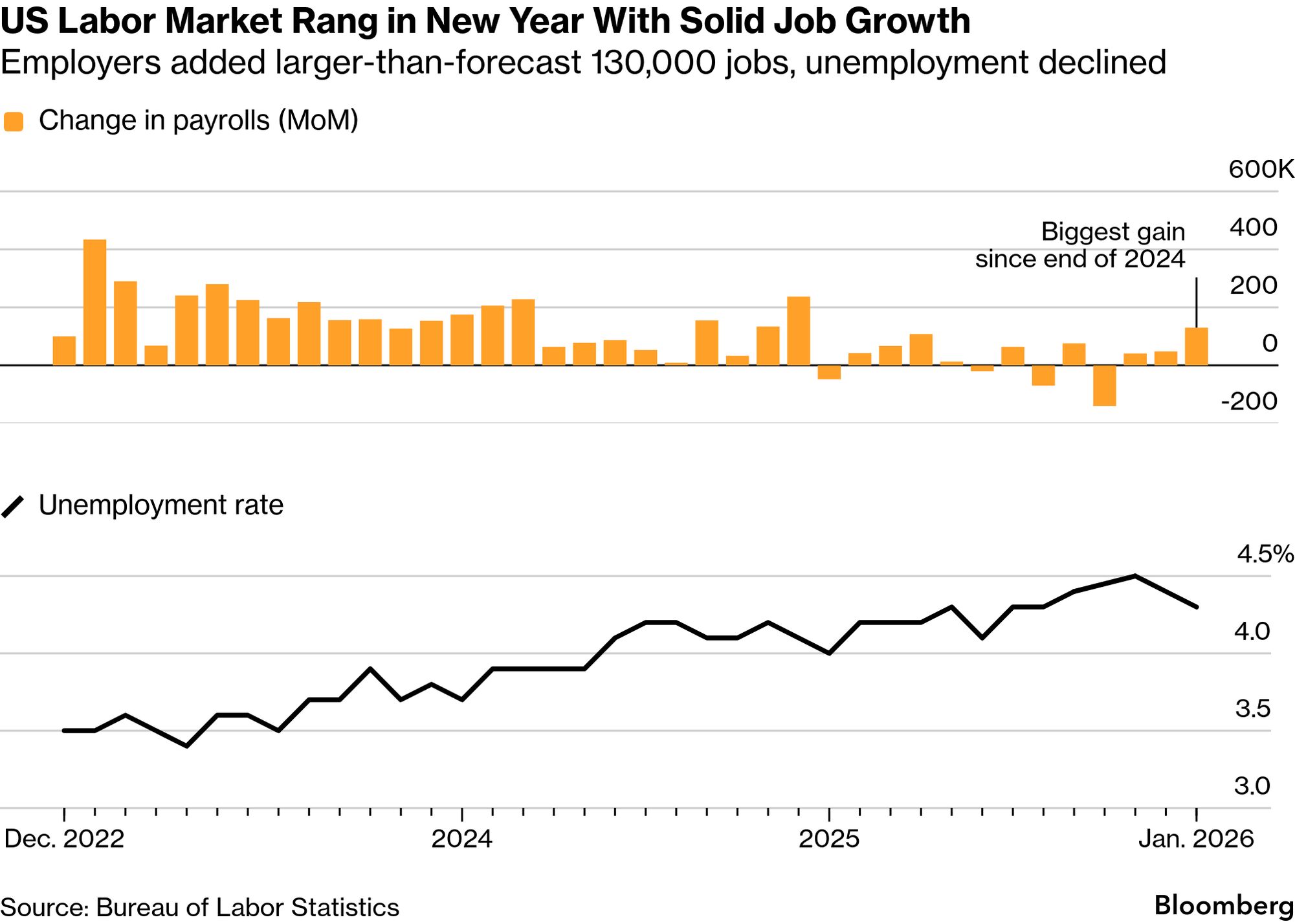

| This morning was unusual for data watchers, as the US reported its monthly jobs figures for January a few days late, after a partial government shutdown last week. Federal Reserve reporter Enda Curran writes about the ups and downs in the charts. Plus: Drug cartels are embracing crypto and freelance money launderers, and Americans have a growing appetite for fiber. If this email was forwarded to you, click here to sign up. The AI jobs apocalypse is on hold, at least for now. US companies hired at a surprisingly brisk pace in January, according to the Bureau of Labor Statistics, with the 130,000 jump in payrolls the most in more than a year. The unemployment rate unexpectedly fell, calming fears that employers are about to let workers go in favor of bots. While hiring continues to be dominated by sectors such as health care and education, there were green shoots in other areas as well. Manufacturing added 8,000 roles after months of shedding jobs. Brian Coulton, chief economist at Fitch Ratings, noted that in the past three months payroll gains averaged 73,000, which he described as a pretty healthy number. "This contrasts with some recent lurid headlines following other data points on job cuts and falling vacancies," he said. "The downside risks to the labor market the Fed was fretting about late last year have not evaporated, but they definitely look to be receding." President Donald Trump was quick to agree. In a social media post after the data was released, Trump hailed the "GREAT JOBS NUMBERS" and said the US should be paying the lowest interest rates globally. What Trump didn't say is that the jobs data represents good news on the economy but bad news on rates, given there will be less pressure for the Federal Reserve to ease borrowing costs if people are holding on to their jobs. The Fed in January held interest rates steady, partly because it thought the labor market was stabilizing—a call that now looks good. Still, there was plenty of caution from economists about reading too much into one month's print. Revisions to last year's data showed a marked slowdown in hiring. Job gains averaged just 15,000 a month last year, down from the 49,000 pace that was initially reported. A separate revision showed that almost 900,000 fewer jobs were added from March 2024 to March 2025 than initially reported. That means last year saw the weakest increase in US payrolls outside of a recession since 2003, when the job market was still recovering from the dot-com bust. For the moment, the picture looks slightly more upbeat, said Seema Shah, chief global strategist at Principal Asset Management. "Against a backdrop of powerful structural forces that are suppressing headline job creation—retirements, shifting immigration dynamics and AI-driven productivity gains—the payrolls figure points to a labor market that remains firmly intact," she said. Related: CBO Boosts US Deficit Call by $1.4 Trillion on Trump Policies |

No comments:

Post a Comment