| Bloomberg Evening Briefing Americas |

| |

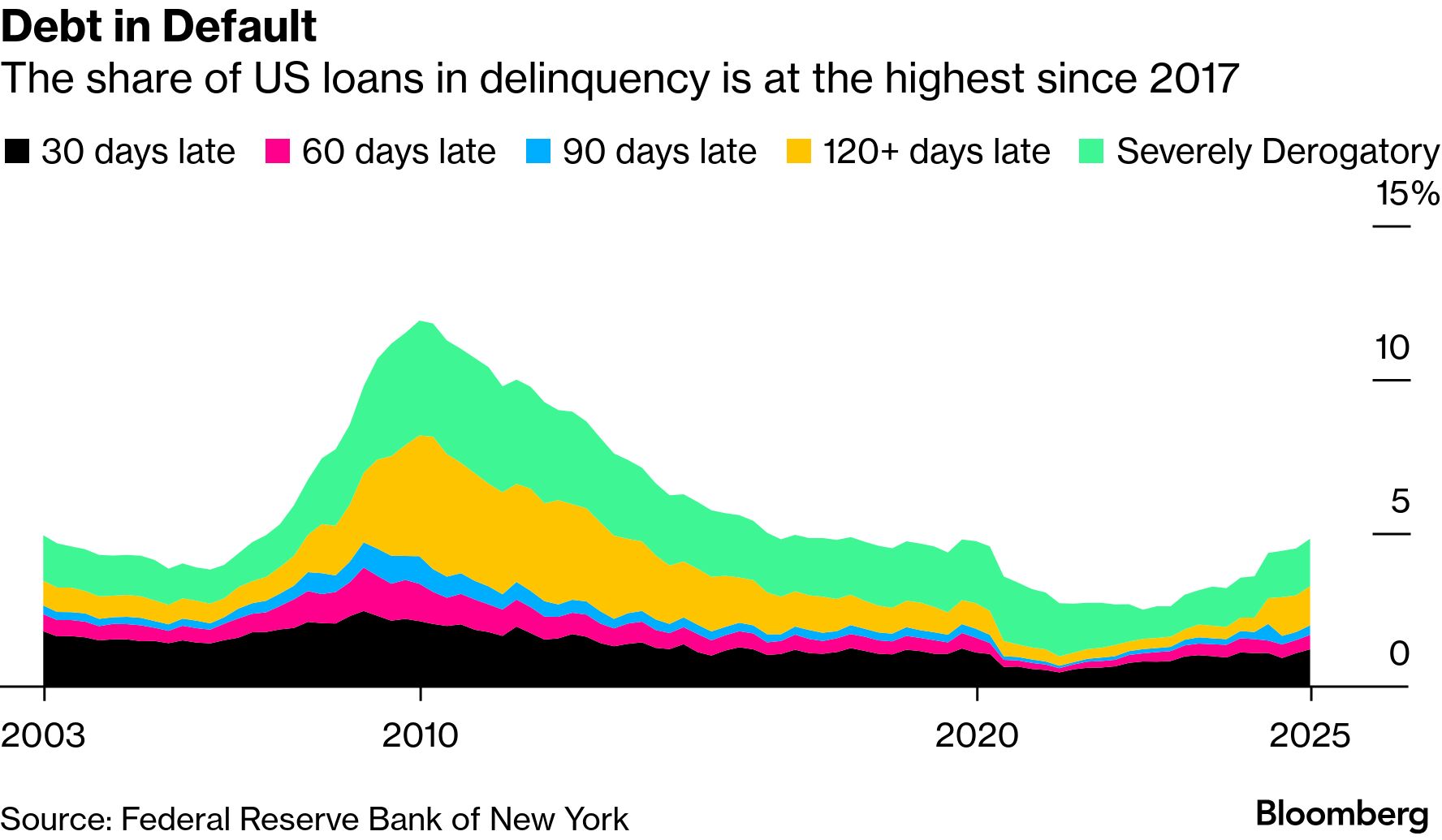

| Delinquency rates on loans ranging from mortgages to credit cards rose to 4.8% of all outstanding US household debt in the fourth quarter, the highest level since 2017, driven by rising defaults among low-income and young borrowers. While the overall share of loans in some stage of default is near pre-pandemic averages, the rise in delinquencies among the lowest earners adds to evidence of an increasingly bifurcated economy, data from the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit released Tuesday showed. The rise in defaults was driven by delinquencies in mortgage payments, with New York Fed researchers finding them particularly high in lower-income zip codes. Student-loan delinquencies, which have surged following the end of a pandemic pause in payment requirements and Donald Trump's new effort to crack down on indebted student borrowers, have contributed to the rise in defaults. The increased struggle among low-income and young borrowers unable to pay their loans is consistent with elevated unemployment rates among some parts of the US population. The jobless rate for workers 16 to 24 years old stood at 10.4% in December, near the highest levels since the depths of the pandemic. —Jordan Parker Erb | |

What You Need to Know Today | |

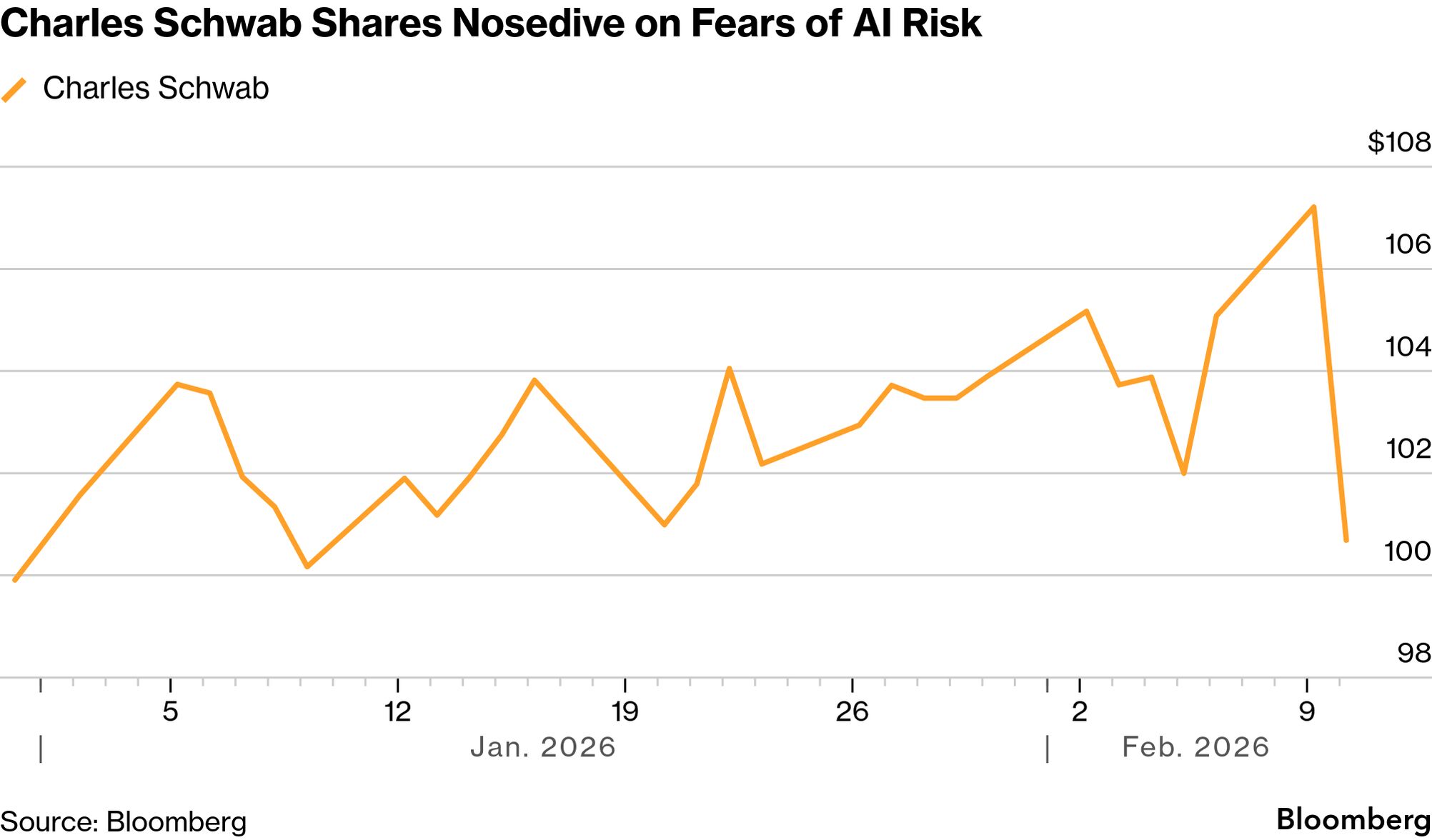

| More artificial intelligence collateral damage. Tax planning and wealth management stocks sank Tuesday after financial software provider Altruist launched an artificial intelligence tool for creating tax strategies, sparking concerns that traditional players could be at risk. Altruist's new tool helps financial advisers personalize strategies for clients and create pay stubs, account statements and other documents, the company said. Investors responded precisely the way they did last time—by running away. Raymond James Financial dropped 8.8% for its worst day since March 2020, while Charles Schwab sank 7.4% and LPL Financial Holdings lost 8.3%, their worst sessions since April. | |

|

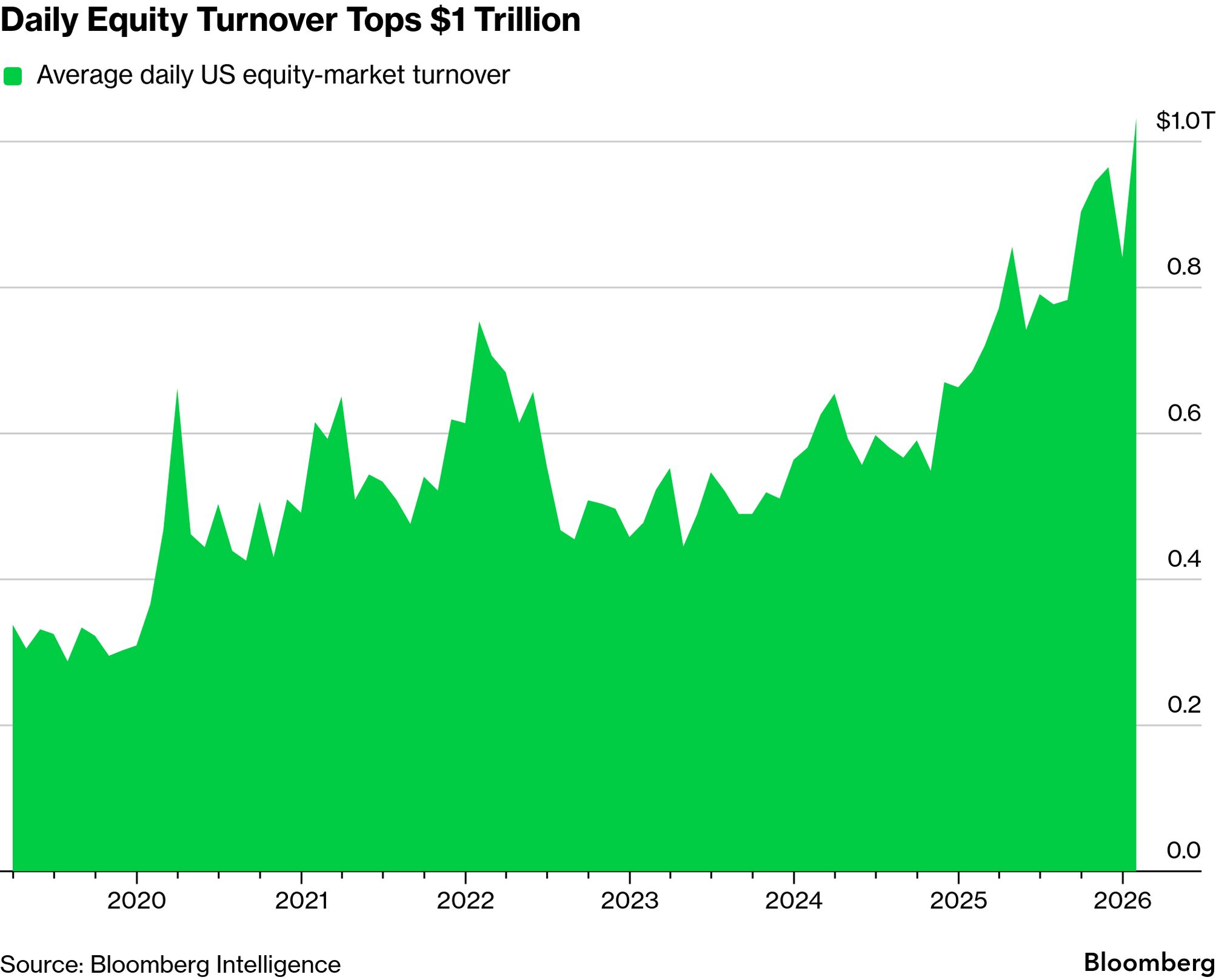

| US equity markets are moving more money than ever before, blowing past $1 trillion in shares traded each day as heavy volume becomes the new norm. The surge marks a sharp step-up from a year ago. Equity turnover averaged a record $1.03 trillion in January, a roughly 50% increase from the same period in 2025, according to data compiled by Bloomberg Intelligence. More than 19 billion shares traded hands daily over the span, the second-most ever. The jump reflects a broad-based increase in participation across the market. Mom-and-pop investors and institutional players alike have become more active as US stocks hover near record highs. Yet the influx is unfolding amid concerns over stretched valuations, raising the stakes for those crowding into the market. | |

|

| McKinsey agreed to hand control of its $20 billion investment arm to Neuberger Berman, after decades of managing the fortunes of the consulting firm's current and former partners in sophisticated hedge fund and alternative strategies. The deal marks a significant expansion for Neuberger and a new chapter for the consulting giant best known for advising blue-chip companies and governments. McKinsey had been reviewing options for the fund manager, known as MIO Partners, for about a year. As part of the transaction, which is subject to regulatory approval, MIO's financial advisory business and about 280 employees are expected to join Neuberger and will operate as a unit of that firm. Financial terms weren't disclosed. | |

|

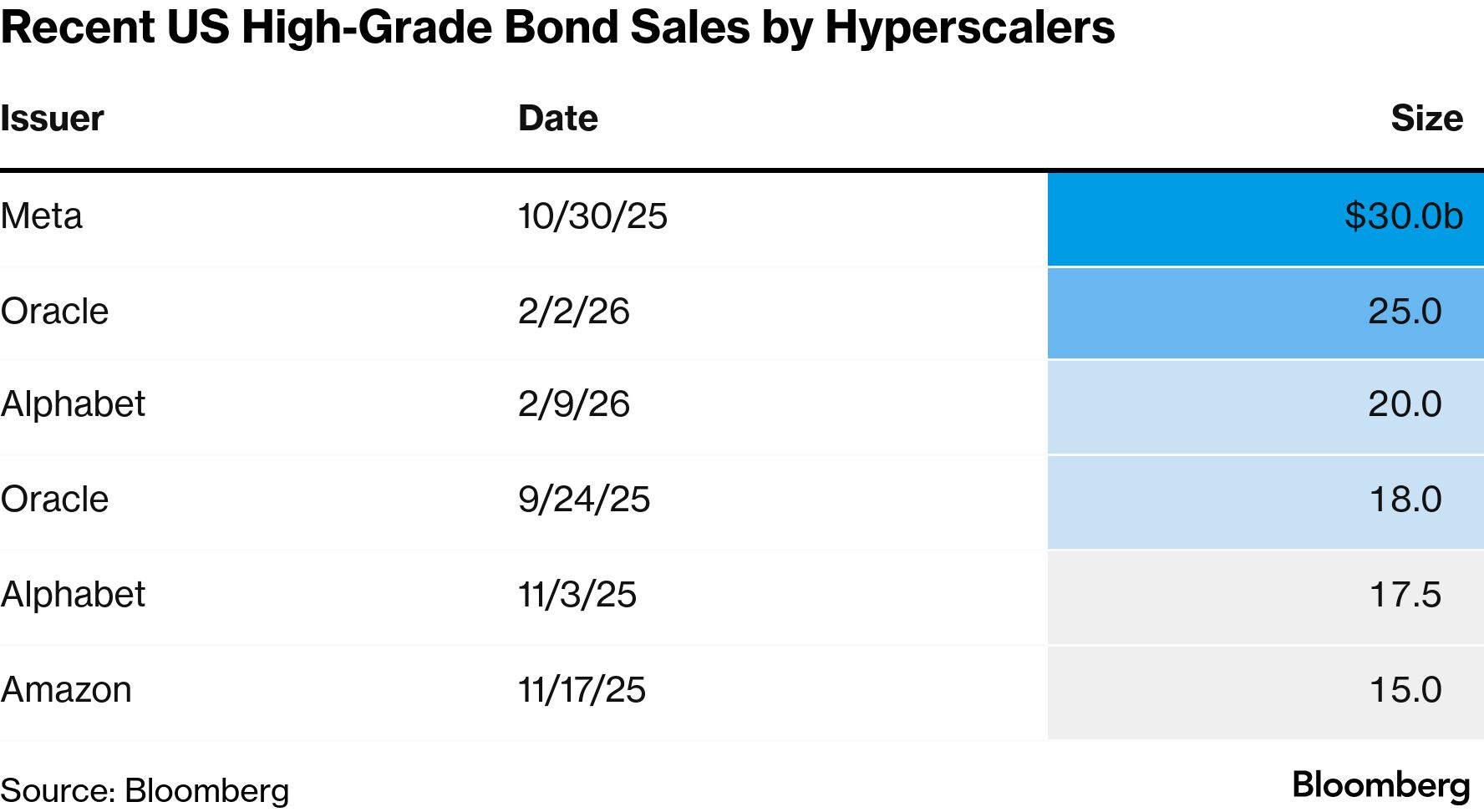

| Alphabet's jump into the AI pool raised almost $32 billion in debt in less than 24 hours, showing the enormous funding needs of tech giants competing to build out their capabilities—and the huge appetite from credit markets to fund them. The Google parent sold sterling and Swiss franc-denominated offerings, both of which were the biggest-ever corporate bond sales in their respective markets. Those deals followed Monday's $20 billion dollar debt sale. | |

|

| Paramount—despite repeated rebuffs—again sweetened its bid for Warner Bros. Discovery, seeking to address some of the company's concerns in an increasingly desperate effort to thwart a planned deal with Netflix. Paramount said it will cover the $2.8 billion termination fee Warner Bros. will have to pay Netflix if it ends the agreed-upon tie-up. It also pledged to backstop a Warner Bros. debt refinancing and pay $1.5 billion in associated fees, if necessary. Paramount stopped short of raising its $30-a-share all cash bid, however. But to underscore its confidence in swift regulatory approval, Paramount (controlled by the Trump-friendly Ellison family) said it will pay a "ticking fee" to Warner Bros. shareholders of 25 cents a share for every quarter the transaction isn't closed beyond Dec. 31. | |

|

| Senior Trump administration immigration officials were excoriated by Democrats on Capitol Hill Tuesday as they attempted to defend employee training in the aftermath of agency killings of US citizens, as well as the growing library of video evidence and lawsuits tied to alleged civil rights violations by masked federal agents. At a House Homeland Security Committee oversight hearing, Immigration and Customs Enforcement acting director Todd Lyons bore the brunt of the attacks. One Republican used the hearing to fault the handling of agency actions in Minnesota—where heavily armed paramilitaries shot dead observers Renee Good and Alex Pretti—while still defending Trump's immigration dragnet. GOP Representative Michael McCaul of Texas—who is not running for re-election—said he had "called for de-escalation after the two deaths," adding that "roving patrols should be done at the border rather than in the major cities of the United States.  Todd Lyons Photographer: Al Drago/Bloomberg Democratic Representative Dan Goldman of New York, a former prosecutor, told Lyons that immigration agents demanding proof of citizenship on American streets bore similarities to Nazi Germany and the Soviet Union. Lyons, who objected to the comparison, stood behind ICE's tactics and refused to apologize to the families of Good and Pretti for their deaths. Good, 37, was shot in the head by an ICE agent and Pretti, also 37, was shot multiple times in the back, reportedly by two Customs and Border Protection agents. Both victims were unarmed at the time they were killed. The Congressional hearing comes as a funding battle over the Department of Homeland Security, the parent of the various immigration agencies, reaches a crescendo this week. | |

|

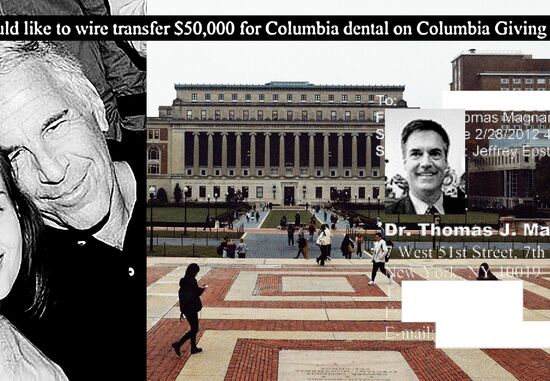

| More Epstein file fallout for the Trump administration. US Commerce Secretary Howard Lutnick sought to minimize his relationship with convicted sex offender Jeffrey Epstein even as he acknowledged visiting the disgraced financier at his private island in 2012—after Epstein was convicted. It also happened to be years later than Lutnick had previously said their relationship ended. A growing number of members of Congress, on both sides of the aisle, have called on Lutnick to resign. And there was additional Epstein-related news regarding Trump himself.  Howard Lutnick, left, and Donald Trump Photographer: Andrew Harnik/Getty Images North America Kimbal Musk, a longtime director at Tesla and the brother of Elon Musk, was also connected with at least two women through Epstein several years after Epstein pleaded guilty to sex crimes, emails released by the US Justice Department show. Sultan Ahmed bin Sulayem, the chairman and chief executive of logistics giant DP World—one of Dubai's most powerful executives—swapped messages with Epstein before and for more than a decade after Epstein's 2008 jail sentence. As shown in newly released emails and others obtained by Bloomberg News, bin Sulayem sent Epstein remarkably intimate and unguarded messages. | |

| |

| New Year Sale: Save 60% on your first year

Enjoy unlimited access to Bloomberg.com and the Bloomberg app, plus market tools, expert analysis, live updates and more. Offer ends soon. | | | | | | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment