Any content you receive is for information purposes only. Always conduct your own research. *Disseminated on Behalf of ZenaTech, Inc.

Krypton Street Just Put (ZENA) At The Top Of This Morning's Watchlist

—Tuesday, February 10, 2026.

Don't Miss The Next Breakout—Get Real-Time Alerts Sent Directly

To Your Phone. Up To 10X Faster Than Email.

Consider Starting Your Own Research On (ZENA)

While It's Still Early…

[Company Website] | [Corporate Presentation]

February 10, 2026

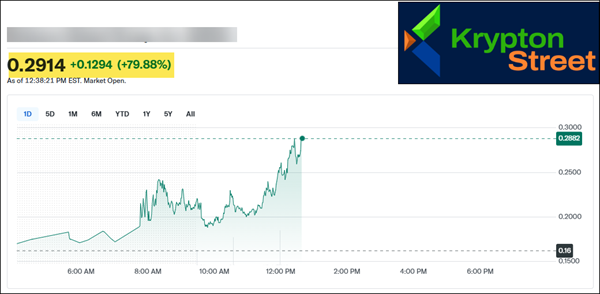

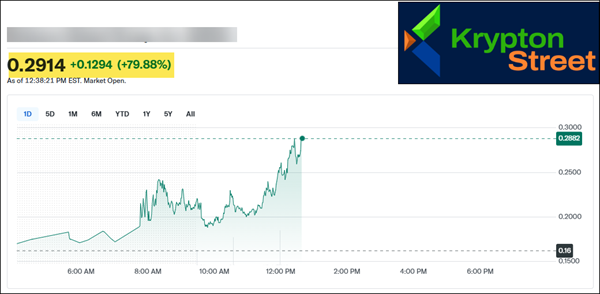

Early Wake Up Call | (ZENA) Just Hit Our Morning Radar—Here's Why Dear Reader, Now that yesterday's profile is behind us—along with an approximate 79% move—we're moving straight to the next name on our screen.

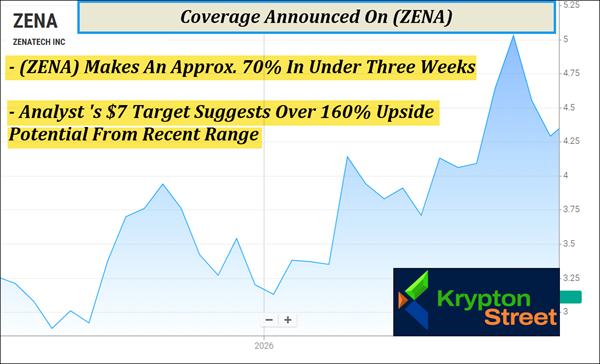

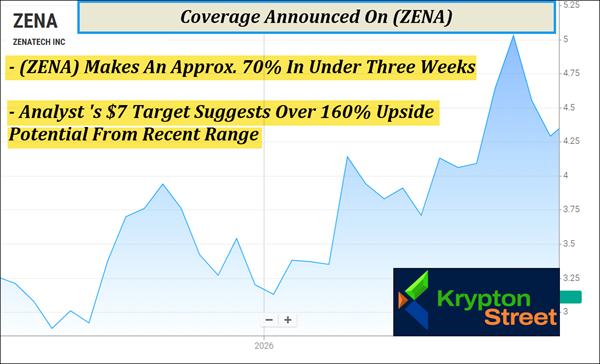

The global drone services market is projected to reach $20.92B in 2026 and is anticipated to grow over 490% to reach approximately $123.82B by 2034. Simultaneously, the global quantum computing market is projected to reach $1.88B in 2026 and is estimated to grow over 900% to reach approximately $19.44B by 2035. At the intersection of these two explosive technological frontiers sits ZenaTech, Inc. (Nasdaq: ZENA), a company building a vertically integrated ecosystem and AI autonomy platforms designed to capture this massive future multi-sector growth. And this is just one of the reasons why (ZENA) is topping our watchlist this morning—Tuesday, February 10, 2026. But keep in mind, one analyst's recent target suggests triple-digit upside potential. On top of that, (ZENA) already showed what it can do, going from about $3.03 on Jan 2 to an intraday high near $5.17 on Jan 22, 2026 — an approximate 70% move in under three weeks, according to data available from Barchart.

And if that kind of disconnect between what's being built and what's being recognized catches your attention, here's where the story starts getting especially interesting. Analyst Coverage

As ZenaTech, Inc. (Nasdaq: ZENA) continues to hit its operational milestones, one analyst is beginning to factor its growth potential into valuations. Matthew Galinko, an analyst at Maxim Group, recently reiterated a $7 target on ZENA. Given (ZENA)'s $2.67 recent range, this target suggests a potential upside of over 162%. This valuation reflects the company's strong positioning within the NDAA-compliant (National Defense Authorization Act) drone market and its potential to capture a larger share of the $123.82B drone services market projected by 2034. Company Overview: A Multi-Disciplinary Technology Integrator

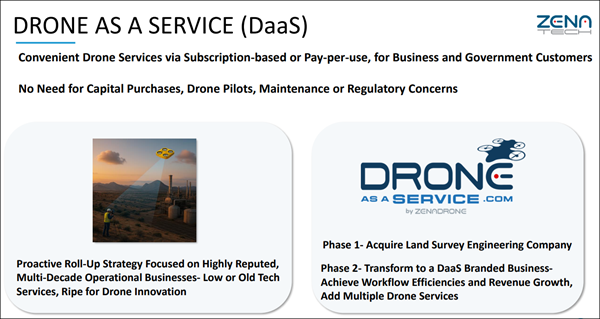

ZenaTech, Inc. (Nasdaq: ZENA) is a technology solution provider that has spent the last several years carving out a specialized niche in high-growth sectors including artificial intelligence (AI) drones, Drone as a Service (DaaS), enterprise software (SaaS), and quantum computing. While many organizations focus on a single piece of the technology puzzle, (ZENA) has taken a more comprehensive approach. By combining advanced hardware manufacturing with proprietary mission-critical software, the company has positioned itself as a primary partner for commercial, government, and defense clients.

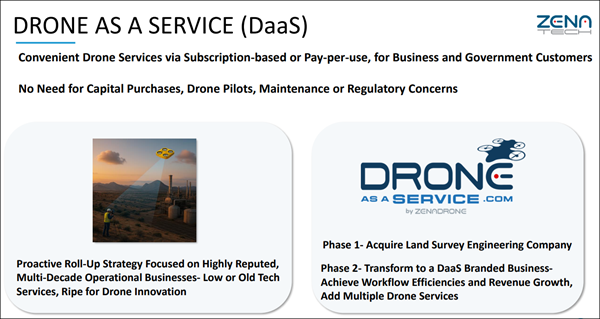

The company's operations are anchored by its wholly owned subsidiary, ZenaDrone, which designs and manufactures autonomous business drone solutions. These are not recreational devices; they are high-performance platforms capable of incorporating machine learning, predictive modeling, and even quantum-enhanced processing. From precision agriculture to industrial inspections and logistics, (ZENA) is providing the tools necessary for industries to transition into the age of automation. One of the most significant differentiators for (ZENA) is its commitment to NDAA compliance. In an era where security and national interest are paramount, the company is developing a vertically integrated supply chain that avoids restricted components. This focus on domestic and allied manufacturing standards makes (ZENA) a unique player in the race for government and Homeland Security contracts. The DaaS Roll-Up Strategy: Scalable Growth Through Acquisition

At the heart of ZenaTech, Inc. (Nasdaq: ZENA)'s current growth phase is an aggressive Drone as a Service (DaaS) expansion strategy. The company is actively acquiring low-tech companies and innovating their processes and workflows using drones. The sectors are land surveying and mapping, industrial inspections, engineering, and industrial maintenance. The goal is simple yet powerful: acquire companies with existing revenue and blue-chip client lists, then modernize their legacy processes using (ZENA)'s proprietary drone technology. This "roll-up" strategy has already shown remarkable momentum. In early 2026, ZenaTech announced the completion of its 20th acquisition in just one year. These acquisitions are not just about adding numbers; they are strategic geographic and sectoral anchors. For example, recent additions include: - Land Surveying in Virginia: Strengthening access to federal government projects in the D.C. Metro area.

- Agricultural Solutions in California: Providing essential services for environmental monitoring and public works for vineyards and wildlife management in a region prone to climate-related challenges.

- Championship Golf Course Surveys: Launching specialized mapping services in Florida to optimize turf health and drainage management.

By building a global, multi-service network, (ZENA) is creating a recurring revenue model that allows clients to access advanced aerial data without the capital burdens of owning a drone fleet. This makes the technology accessible to a far wider range of industries, from mining to property management. Proprietary Hardware: The Spider Vision Advantage

A major bottleneck for many drone companies is the reliance on third-party components that may not meet the security requirements of the U.S. government. (ZENA) is solving this problem through its Taiwan-based Spider Vision Sensors (SVS) manufacturing facility. This 16,000 square foot facility is specifically configured to produce NDAA-compliant components, including printed circuit boards (PCBs) and advanced drone cameras, sensors and motors. The Taiwan facility is just one part of a broader, expanding global manufacturing footprint. (ZENA)'s manufacturing and assembly operations now span three active facilities, each supporting different stages of production and compliance requirements. (ZENA) operates a UAE-based manufacturing facility that has been active since 2022 and has expanded to over 22,000 square feet, supporting drone production and assembly for international markets. The company is also expanding its Arizona facility, which currently handles research and development, sales, and US operations, and is now being built out to support US-based defense drone manufacturing and assembly. This level of vertical integration gives (ZENA) several key advantages: 1. Supply Chain Resilience: Reduced dependence on global logistics chains that are often subject to geopolitical instability. 2. Customization: The ability to tailor hardware specifically for military-grade or high-precision industrial use. 3. Regulatory Approval: Meeting the stringent standards of the Federal Communications Commission (FCC) and the Department of War. The facility is currently transitioning into full operational mode, which is expected to support the scaled production of the company's flagship ZenaDrone 1000 and its new IQ Series platforms.

Quantum Computing: Processing the Future

Perhaps the most ambitious arm of ZenaTech, Inc. (Nasdaq: ZENA)'s roadmap is its quantum computing division. As drone fleets become more complex—collecting massive volumes of sensor data—classical computing systems reach their limits in real-time processing and analysis. (ZENA) is currently progressing multiple R&D initiatives advancing its proprietary quantum computing hardware platform designed for Defense and Homeland Security applications. The company has already initiated the procurement of key components for its first five-qubit prototype, which is expected to be operational by late 2026. This platform is intended to support: - Real-Time Data Analysis: Processing high-volume datasets from drone swarms in contested environments.

- Predictive Modeling: Advanced forecasting for weather and wildfire management.

- Mission Planning: Optimizing ISR (Inspection, Surveillance, and Reconnaissance) missions for military and government operations.

By integrating quantum processing with its existing AI-driven systems like Zena AI and the Eagle Eye project, the company is aiming to provide a level of situational awareness that classical systems simply cannot match. Strategic Leadership and Operational Excellence

The rapid execution of (ZENA)'s multi-pillared strategy is driven by a leadership team with a blend of academic and industrial expertise. CEO Shaun Passley, Ph.D., a serial entrepreneur and company builder, brings a deep background in technology and business management, while CFO James Sherman has over 35 years of experience in high-growth companies, including leadership roles at divisions of Sprint and Mitsubishi Corporation. This team has successfully guided (ZENA) through its transition to the public markets, resulting in a reported 1,225% year-over-year revenue growth in Q3 2025. Furthermore, the Drone as a Service segment has quickly become the company's primary revenue driver, accounting for 82% of total revenue in the most recent quarter.

7 Factors Putting (ZENA) At The Top Of This Morning's Watchlist

—Tuesday, February 10, 2026…

1. Recent Momentum: (ZENA) made an approximate 70% move in under three weeks, from early January to a late-January high.

2. Dual Megatrends: positioned at the convergence of drone services projected to grow over 490% and quantum computing projected to grow over 900%, (ZENA) operates where long-term technology demand is structurally accelerating. 3. Analyst Coverage: coverage recently highlighted (ZENA) with a reiterated $7 target, which suggests over 160% upside potential from its recent range. 4. Quantum Roadmap: development of a five-qubit prototype targeted for late 2026 places (ZENA) among a small group pursuing quantum hardware tied to real-world defense and data workloads. 5. DaaS Scale: rapid expansion through 20 completed acquisitions has established (ZENA) as a consolidator in Drone as a Service across surveying, inspections, and public works. 6. Hardware Control: in-house manufacturing through the 16,000 sq ft Spider Vision Sensors facility gives (ZENA) tighter oversight of components, customization, and production timelines. 7. National Defense: a vertically integrated, NDAA-aligned supply chain differentiates (ZENA) in government and defense workflows where component sourcing matters. Consider Starting Your Own Research On (ZENA)

While It's Still Early…

[Company Website] | [Corporate Presentation]

(ZENA) is lining up at the crossroads of two fast-growing technology arcs: drone services projected to expand over 490% and quantum computing projected to rise over 900%. Add in a rapid buildout of Drone as a Service through 20 acquisitions, a push toward an NDAA-aligned supply chain for defense-adjacent workflows, and in-house production capacity via a 16,000 sq ft sensor facility—this is a name that's assembling multiple pieces of a larger ecosystem. And the market has already shown it can pay attention quickly, with an approximate 70% move in under three weeks earlier this year, alongside a reiterated $7 analyst target that suggests over 160% upside from its recent range. We have (ZENA) at the top of our early watchlist right now. Pull up (ZENA) while it's still early. Keep an eye out for my next update, it could be hitting within the next 60-90 minutes. Sincerely, Alex Ramsay

Co-Founder / Managing Editor Krypton Street Newsletter

|

No comments:

Post a Comment