| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm Suzanne Lynch, Bloomberg's Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you're signed up. Addressing political heavyweights like France's Emmanuel Macron and Germany's Friedrich Merz, some of the biggest names in business are expected to make their pitch that Europe needs to do something about its competitiveness problem, and fast. Coupled with China's growing might, Donald Trump's latest threats towards Europe over Greenland has brought into focus the need for the bloc to up its game economically. Carmakers have already made their pitch, with the European Automobile Manufacturers' Association urging the EU to reverse the decline in car production. As Bloomberg previously reported, the EU's executive branch is already readying a new "made in Europe" law, known as the Industrial Accelerator Act. The proposal is designed to ensure that European companies get preferential treatment for investment decisions, upending a free-trade philosophy that has governed decades of policy — annoying allies like Britain.  Stephane Sejourne, vice president of the European Commission, who has been spearheading the Industrial Accelerator Act. Photographer: Nathan Laine/Bloomberg In its effort to respond to concerns, the EU is poised to soften the emissions-trading system later this year amid complaints by business that it adds cost. Germany is also expected to raise concerns at Thursday's summit about the allocation of funds in the EU's next seven-year budget, demanding that more money flows into investments rather than agriculture and cohesion. Another central challenge for the EU is the capital markets and financial sector. Forming a single market for investment has long eluded the bloc. Speaking at a Bloomberg event in Brussels last night, George Theocharides, head of the Cyprus Securities and Exchange Commission, welcomed the Commission's recent markets integration and supervision package, but captured some of the key problems still facing Europe.  George Theocharides in Brussels, on Feb. 9. Photographer: Sarah Bastin/Bloomberg Legal, supervisory, operational and sometimes cultural barriers still make cross-border investment "far more difficult than it should be," he said. "This fragmentation increases the cost of capital for the European businesses, limits the scale up journey for our innovators, and pushes companies and growth companies to look elsewhere for funding." The Latest

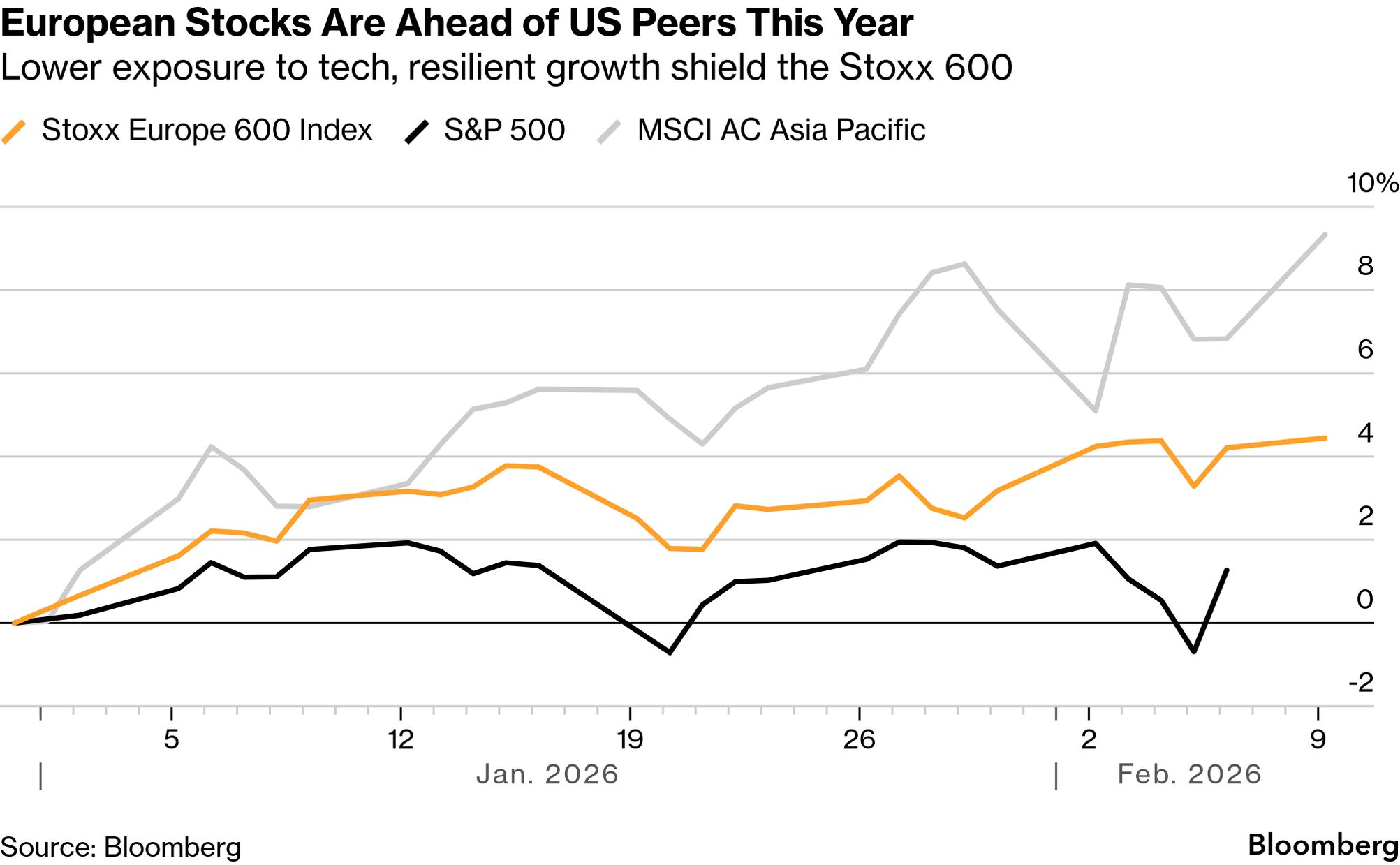

Seen and Heard on Bloomberg Deutsche Bank strategist Maximilian Uleer outlined his preference for US over European equities in the next three to six months. "Right now, the US is growing faster," he said in an interview with Bloomberg TV. "I think H2 of this year potentially Europe will be outpacing, or at least picking up versus the US, and then the growth gap shrinks." Chart of the Day Despite Uleer's predictions, European stocks have outperformed US peers this year amid a selloff in technology shares. A relatively-low exposure to the sector has helped, while investors also see resilient economic growth in the region. Coming Up

Final Thought A wine logistics warehouse in Blanquefort, France. Photographer: Balint Porneczi/Bloomberg French wine and spirits exports slumped to their lowest volume in at least 20 years amid weak demand and trade tensions with top buyers US and China. Exports dropped 8% to €14.3 billion last year. Sales by value have been dwindling since 2022. The challenges from weak global demand are being compounded by extreme weather and trade wars. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Tuesday, February 10, 2026

Brussels Edition: An industrial-sized call for help

Subscribe to:

Post Comments (Atom)

Trump Planning to Use Public Law 63-43: Prepare Now

Three hidden words in a century-old law are back in focus ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment