| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm Suzanne Lynch, Bloomberg's Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you're signed up. The EU has introduced 19 such bundles targeting Moscow since Russian tanks rolled into northern Ukraine in February 2022. The most recent, signed off by EU leaders in October, included a phase-out of Russian LNG purchases, as well as sanctions on the country's banks, crypto exchanges and entities in India and China — large buyers of Russian oil. As Alberto Nardelli reported yesterday, the EU is now considering banning Russian imports of several platinum group metals and copper as part of its latest sanctions package. The restrictions may cover iridium, rhodium, platinum and copper, according to people familiar with the matter.  Pedestrians use a flashlight to illuminate an unlit street during a power blackout in Kyiv. Photographer: Andrew Kravchenko/Bloomberg The ban is planned amid tight markets for the targeted metals. Copper prices have hit record highs this year amid strong demand and constrained mine supply worldwide. Platinum also continues to experience a supply deficit. If adopted, the new restrictions would mainly target MMC Norilsk Nickel PJSC, Russia's largest mining company, which has not been sanctioned. Also part of the package under discussion is a proposal to replace the current price cap on Russian oil with a ban on maritime services. The move could see European companies prohibited from providing services such as insurance and transportation needed to move Russia's oil regardless of the price of the commodity. However, all these proposals need to get unanimous backing from member states, and several capitals have already indicated they're against replacing the price cap with a ban on services, according to the people. The discussions in Brussels take place against the backdrop of renewed Russian attacks after a brief moratorium on strikes against infrastructure sought by Donald Trump. Russia struck with 450 drones and more than 70 missiles, Ukrainian President Volodymyr Zelenskiy said, with Kyiv, Kharkiv, Odesa and Dnipro attacked overnight as temperatures dipped below -20C (-4F). The Latest

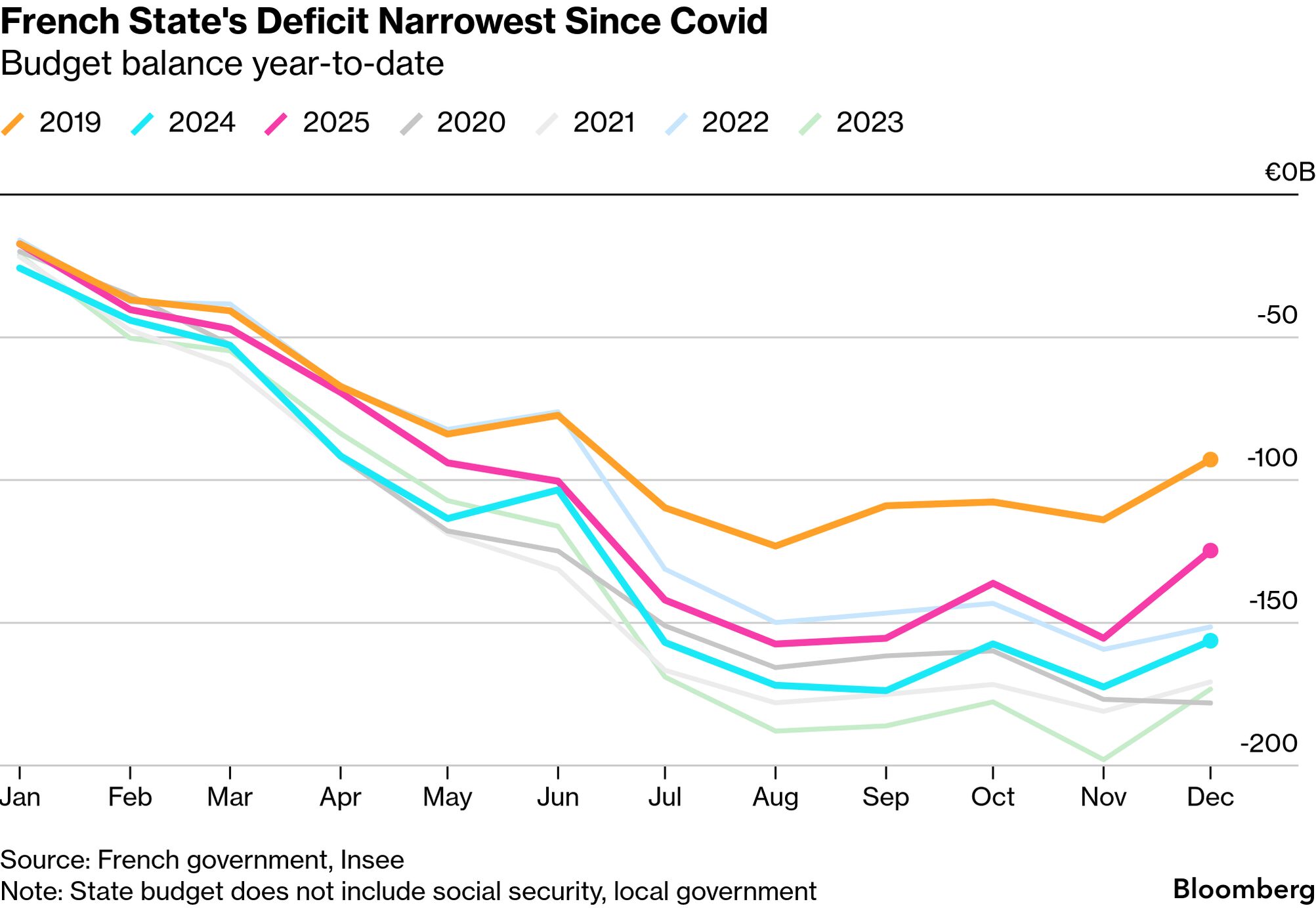

Seen and Heard on Bloomberg International Air Transport Association (IATA) Director General Willie Walsh says governments need to re-evaluate their sustainability methods and policies. "What we've seen is some of the initiatives that governments have used to try and promote the production of sustainable fuels just hasn't worked, particularly in Europe, where they've used mandates to try and force airlines to buy a product that doesn't exist," he told Bloomberg TV. "And all that's led to is higher prices, interesting, higher prices for jet fuel and for sustainable fuel." Chart of the Day France's parliament adopted a budget for 2026 after Prime Minister Sebastien Lecornu survived two no-confidence votes yesterday, bringing the curtain down on months of political upheaval that's rattled investor confidence in the country. There are also signs that France's finances may not have deteriorated as much as expected as data shows the deficit in the central state's accounts narrowed last year to the smallest since Covid. Coming up

Final Thought The Coca-Cola building in New York. Photographer: Michael Nagle/Bloomberg German agency BVK, overseeing the retirement assets of 2.8 million people, is warning of potential losses after investing billions of dollars with a splashy Manhattan developer. Lawmakers are asking how a government-controlled agency approved such deals. It is just one of many vocational pension fund managers in Germany that branched out from safe but low-yielding investments over the past decade in search for higher returns. Many have since suffered losses as commercial real estate valuations crumbled under the dual blow from higher vacancy rates and rocketing interest expenses. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Tuesday, February 3, 2026

Brussels Edition: EU eyes new Russia sanctions

Subscribe to:

Post Comments (Atom)

Before you take another trade, watch this

I went live yesterday with a Squeeze Traps training that covered something you're probably experiencing right now. How many t...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment