| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm Suzanne Lynch, Bloomberg's Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you're signed up. In an interview with Bloomberg TV, European Council President Antonio Costa urged leaders to seize the moment. He cited a "clear sense of urgency" among EU decisionmakers, stressing that "now we need effectively to take decisions with an impact." "We need to ensure that we have a real European capital market to fund our companies, fund innovation, and to be competitive in the global market," Costa said.  Antonio Costa, president of the European Council, during a Bloomberg Television interview in Brussels, Belgium, on Tuesday, Feb. 10, 2026. He also weighed in on growing calls for Europe to develop a digital euro as officials explore whether to break the hold US payment firms like Visa or Mastercard have over Europe's transactions — or to push back on the dollar's global dominance. Costa argued that Europe's digital options would help weaken those constrictions. "It's clear that we need to have a payment digital infrastructure in Europe to allow us to make payments without any kind of dependence," he said. French President Emmanuel Macron and German Chancellor Friedrich Merz are among those attending today's Antwerp summit, where they'll come face-to-face with business leaders. Exxon's Matt Crocker told John Ainger ahead of the Antwerp summit that Europe needs to make progress. "We have investments ready to go in Antwerp and Rotterdam to use our existing refining infrastructure so it's quick and we can invest, but those are on pause because the regulators are not willing to support that," he said. Speaking this lunchtime at the summit, European Commission President Ursula von der Leyen addressed business concerns, admitting that there is "too much gold-plating" when it comes to regulation in Europe. She cited the example of a truck in Belgium being permitted to weigh up to 44 tons, but only allowed carry 40 tons when it crosses the border to France. She pledged to come forward with a European-wide company structure known as the "28th regime." Her call for "deep regulatory housecleaning" is a memorable phrase, but businesses are asking whether it will actually happen. The Latest

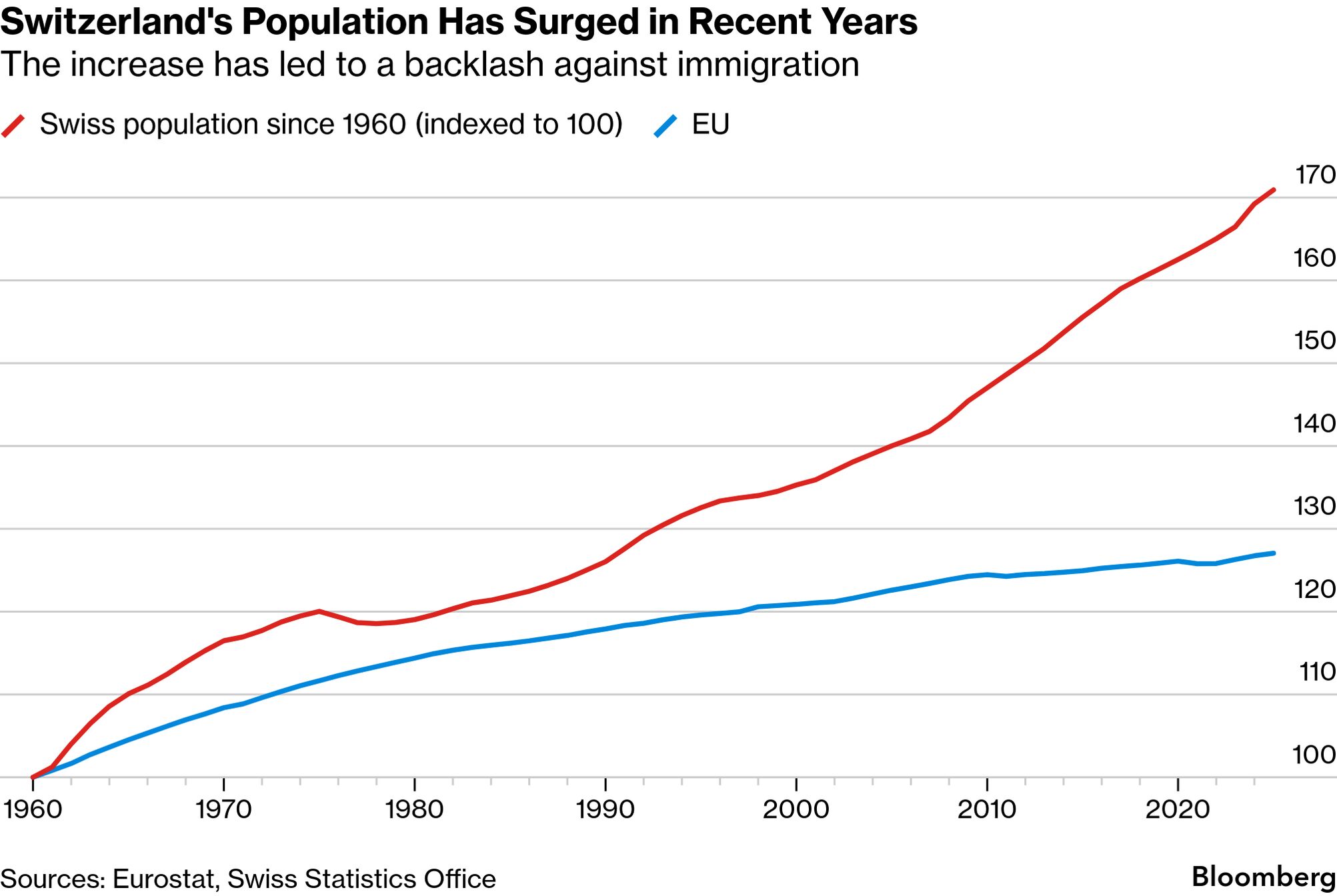

Seen and Heard on Bloomberg Commerzbank AG Chief Executive Officer Bettina Orlopp said current European proposals for reducing the regulatory burden on banks don't go far enough, adding urgency to the debate about the bloc's declining competitiveness a day before leaders meet to discuss the topic. "We are clearly a strong supporter, not only to think about simplification, but also deregulation," Orlopp said Wednesday on Bloomberg TV. "We also clearly advocate to rethink that," given efforts in the US and the UK to roll back rules and capital levels. Chart of the Day Switzerland will vote in June on whether to cap its population at 10 million after a proposal — backed by the right-wing People's Party, or SVP — gathered enough signatures under Switzerland's direct democracy system. Both the government and parliament are against the so-called "sustainability initiative" to cap the population, largely shutting out immigrants when the 10-million number is reached. Still, it has the support of about 48% of voters, according to a poll in December. Coming up

Final Thought Central Warsaw. Photographer: Damian Lemanski/Bloomberg When Polish tech executive Jacek Swiderski was studying in Germany in the 1990s, it seemed unlikely that his home country might one day come out of the shadow of its larger, richer neighbor. Yet three decades later, the internet company he founded and still runs is expanding by acquiring Germany's third-largest travel platform. Read Konrad Karasuski's piece on how Poland's $1 trillion economy is flexing its muscle in Germany. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Wednesday, February 11, 2026

Brussels Edition: Competitiveness moves to center

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment