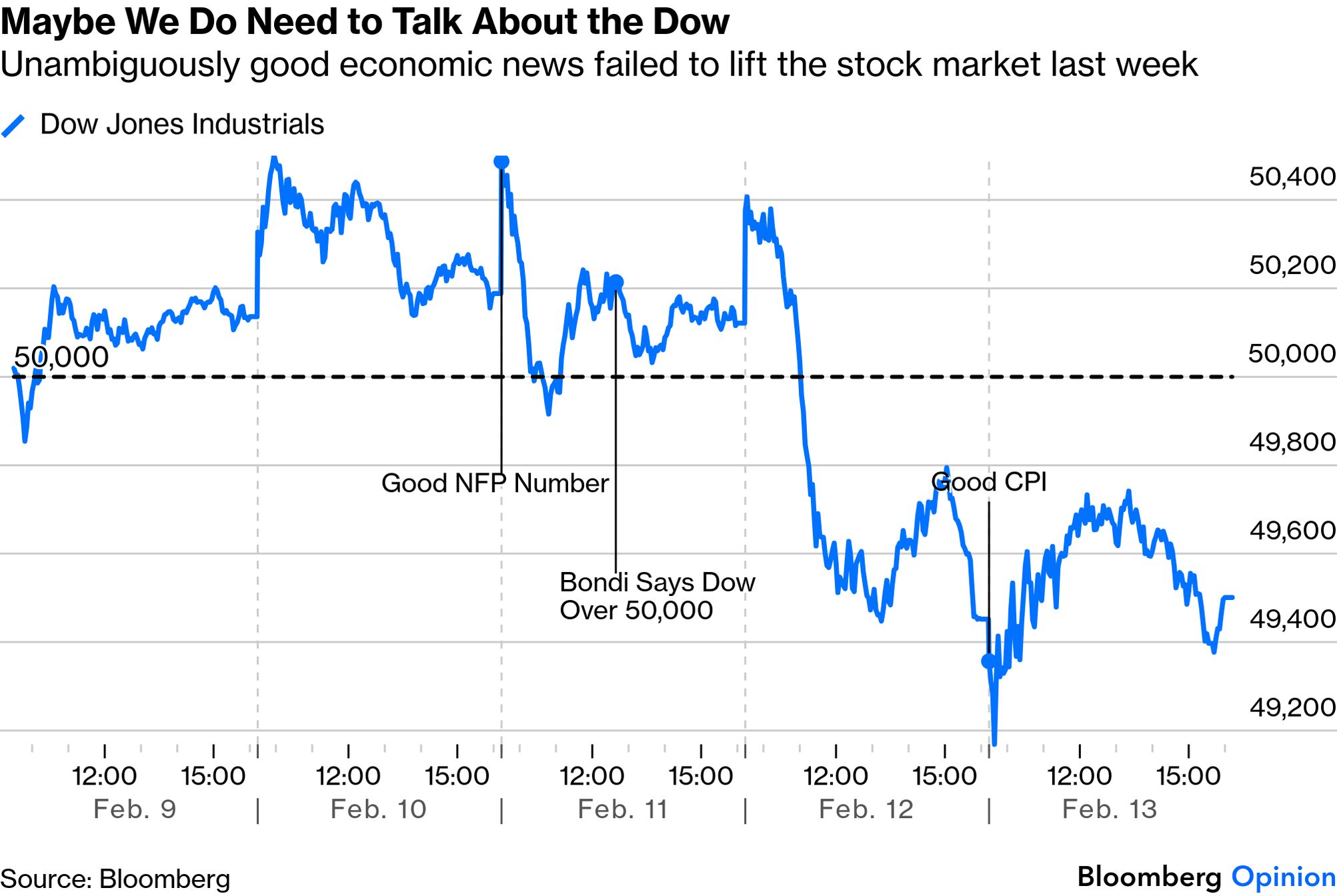

| The US attorney general, Pam Bondi, thinks we should talk about the Dow Jones Industrial Average more. It would be churlish not to let her have her wish. In combative testimony in front of Congress last week, she said: The Dow is over 50,000 right now, the S&P at almost 7,000, and the Nasdaq smashing records, Americans' 401(k)s and retirement savings are booming. That's what we should be talking about.

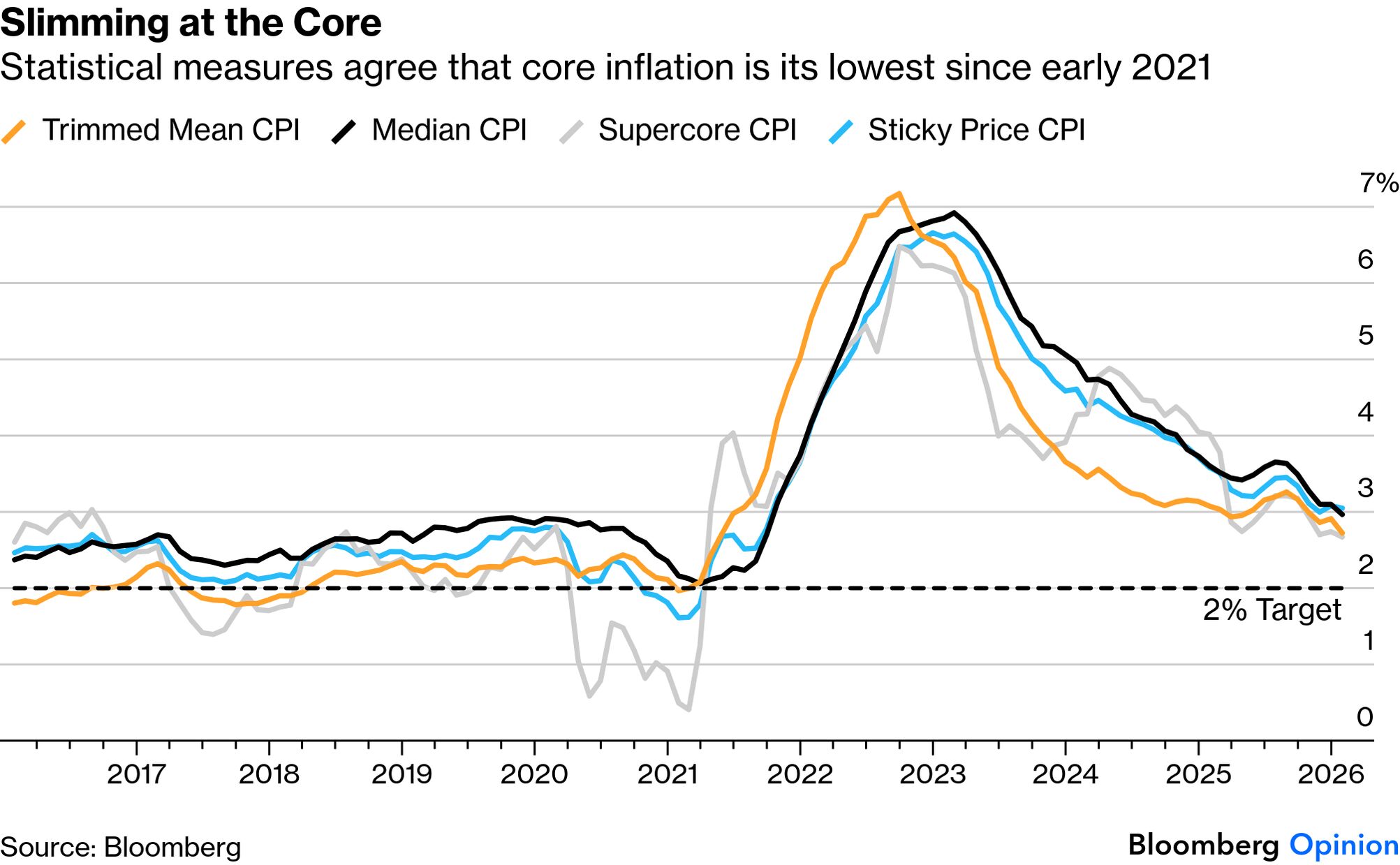

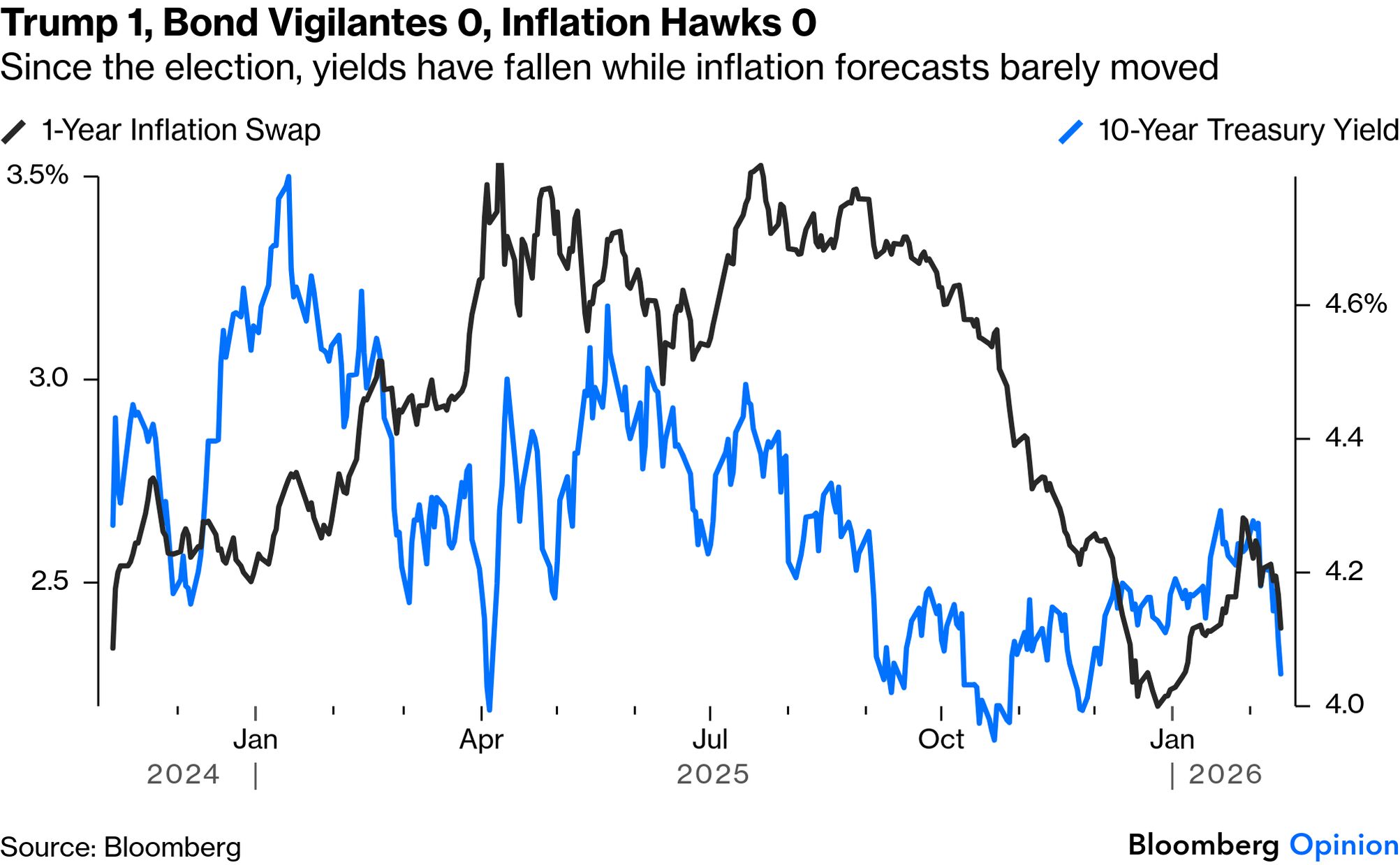

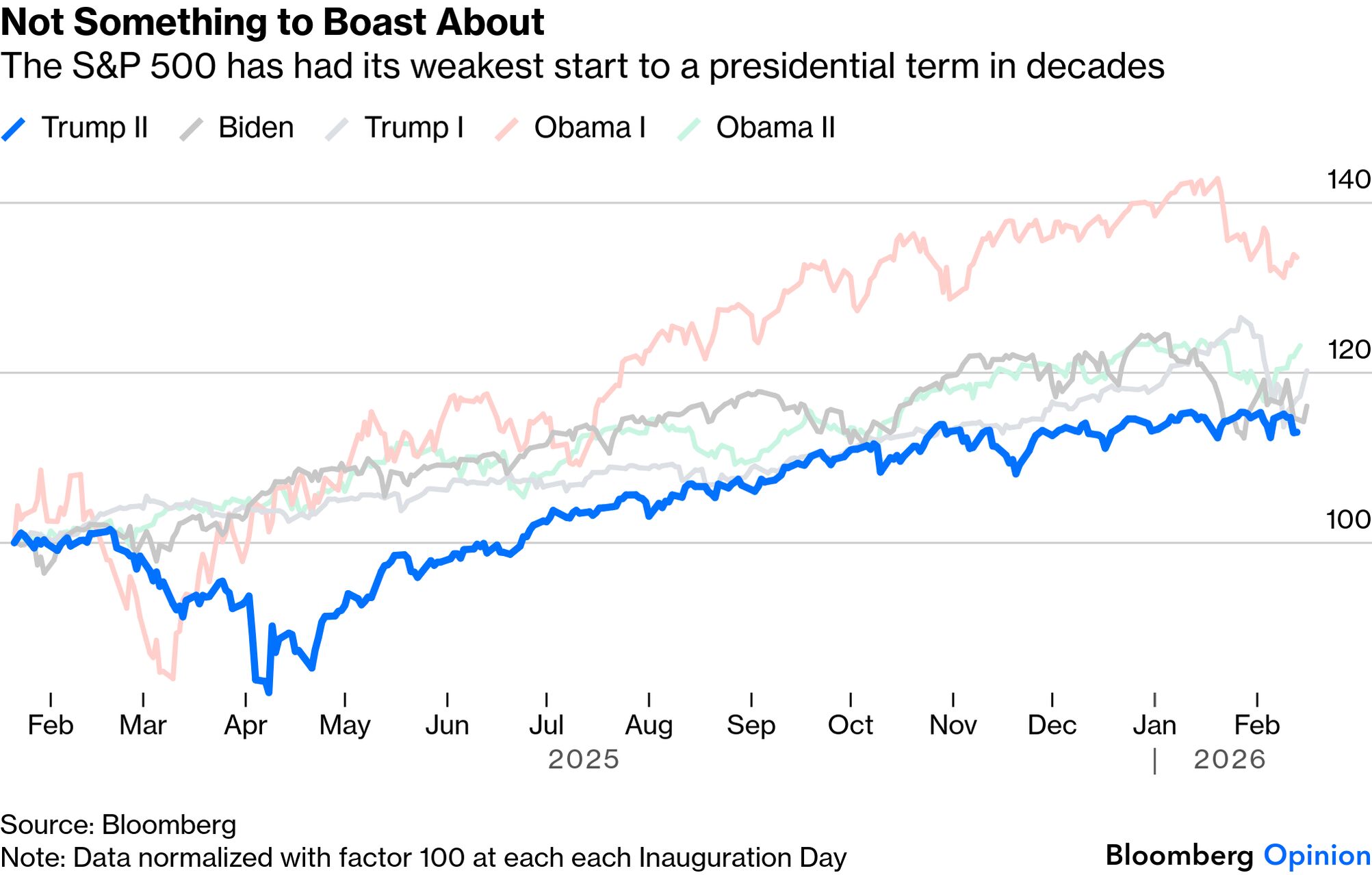

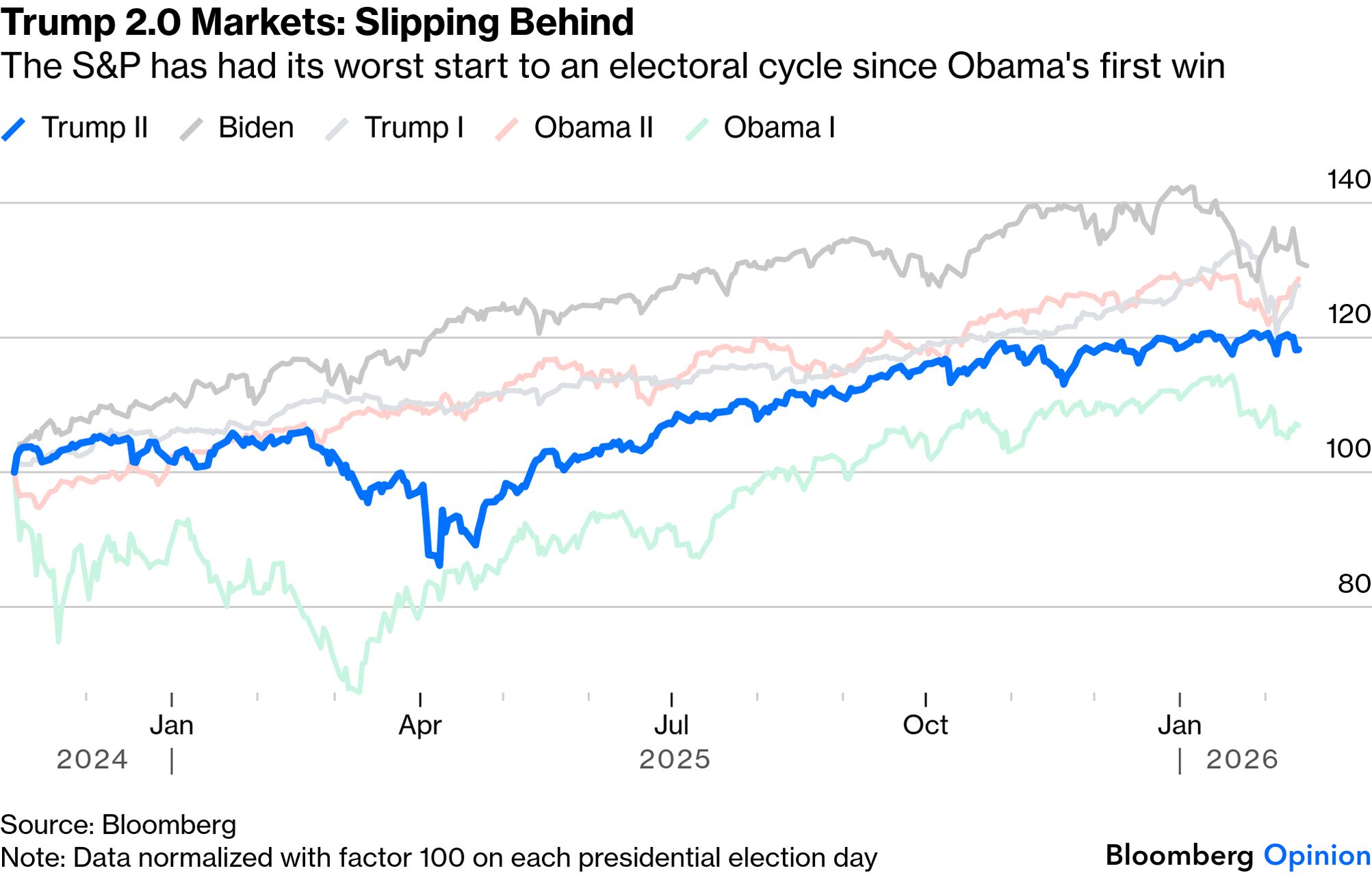

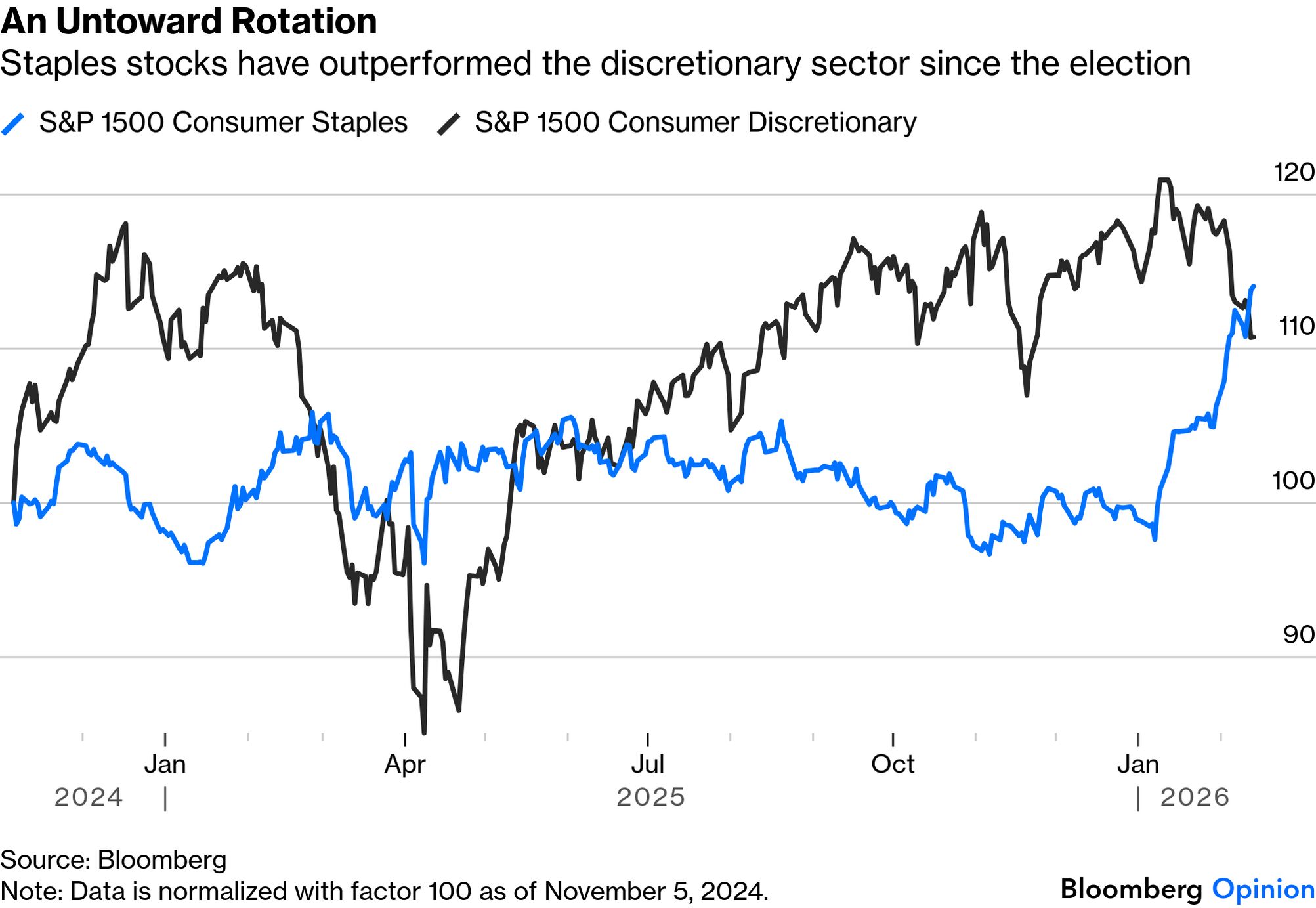

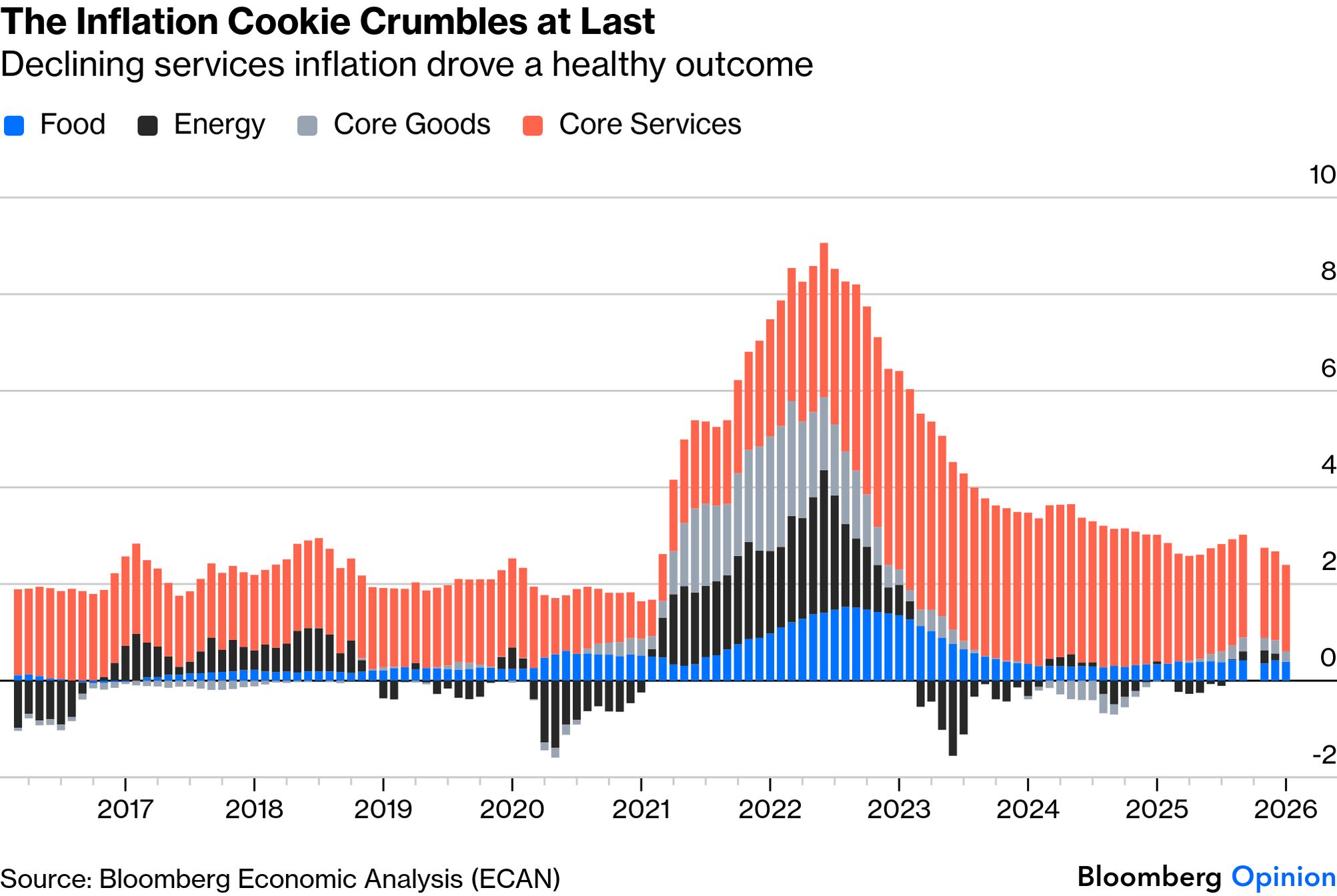

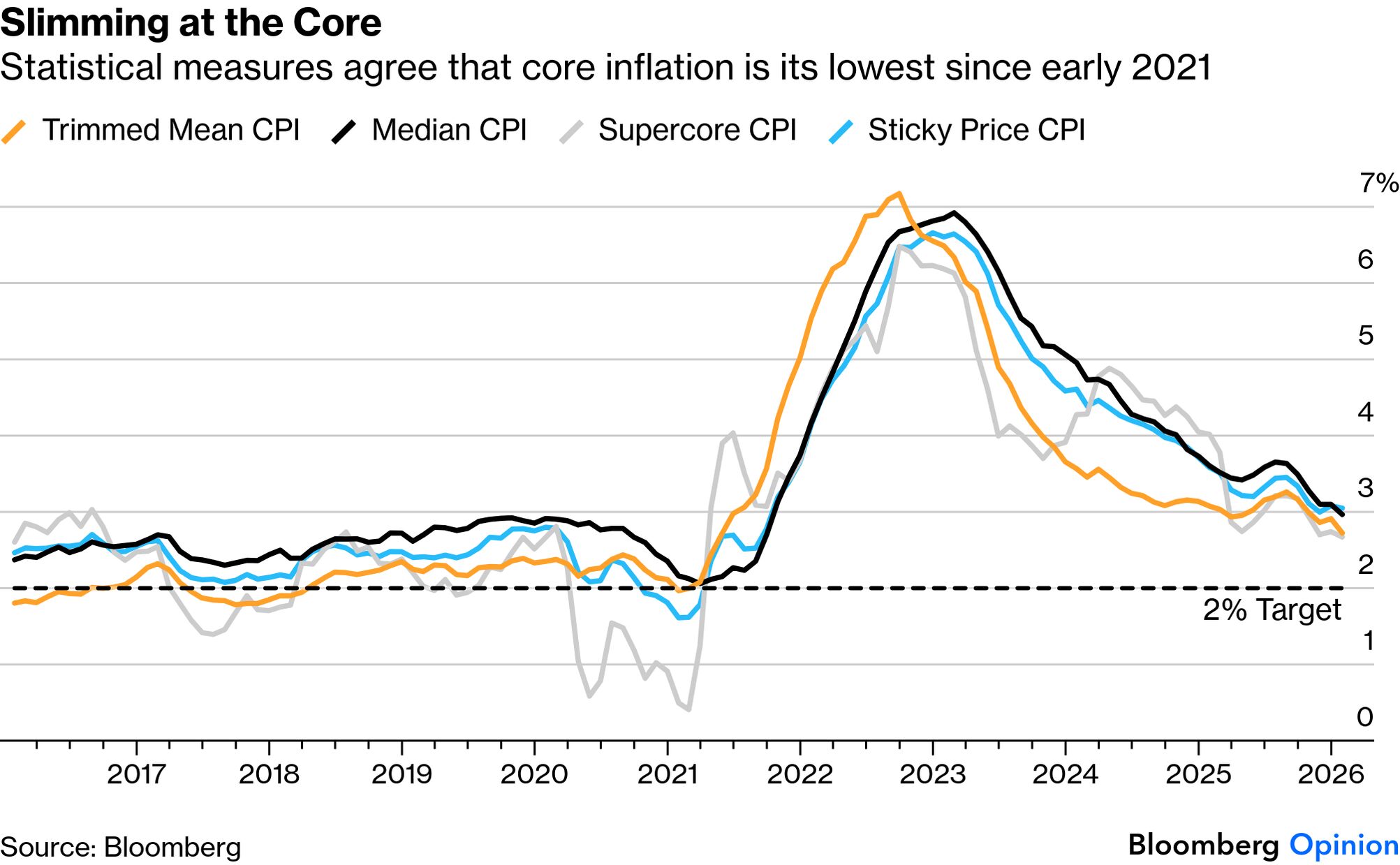

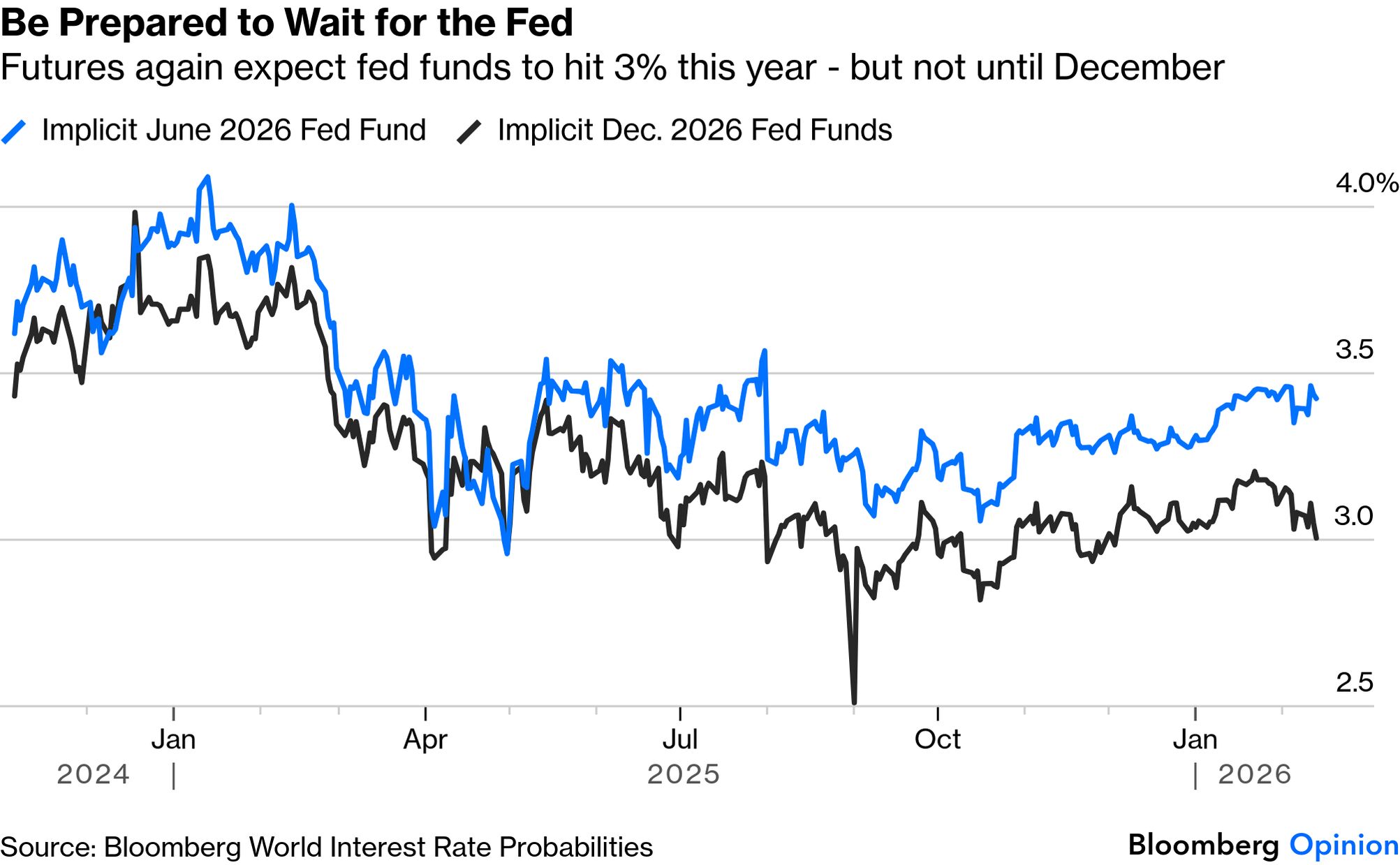

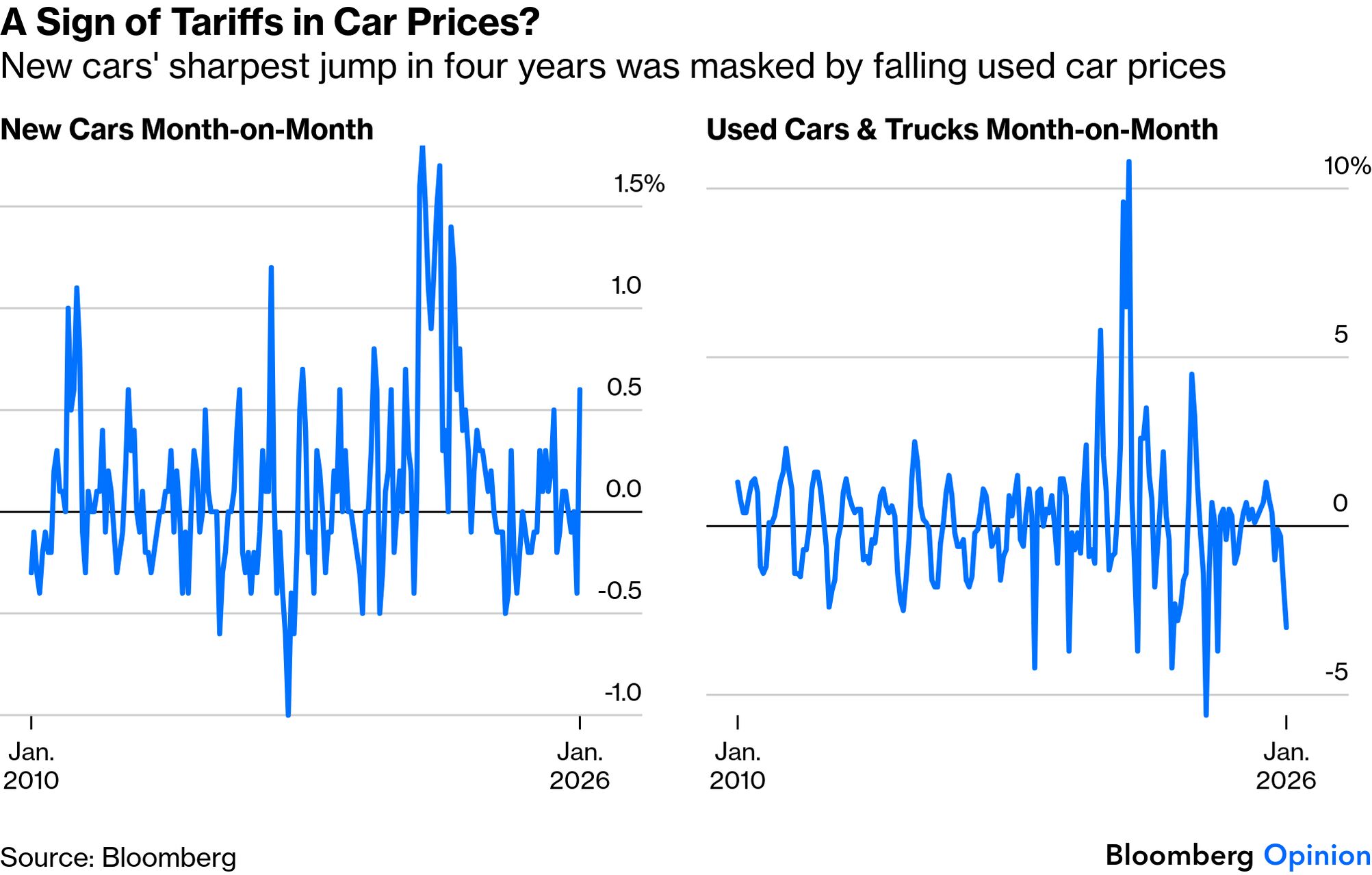

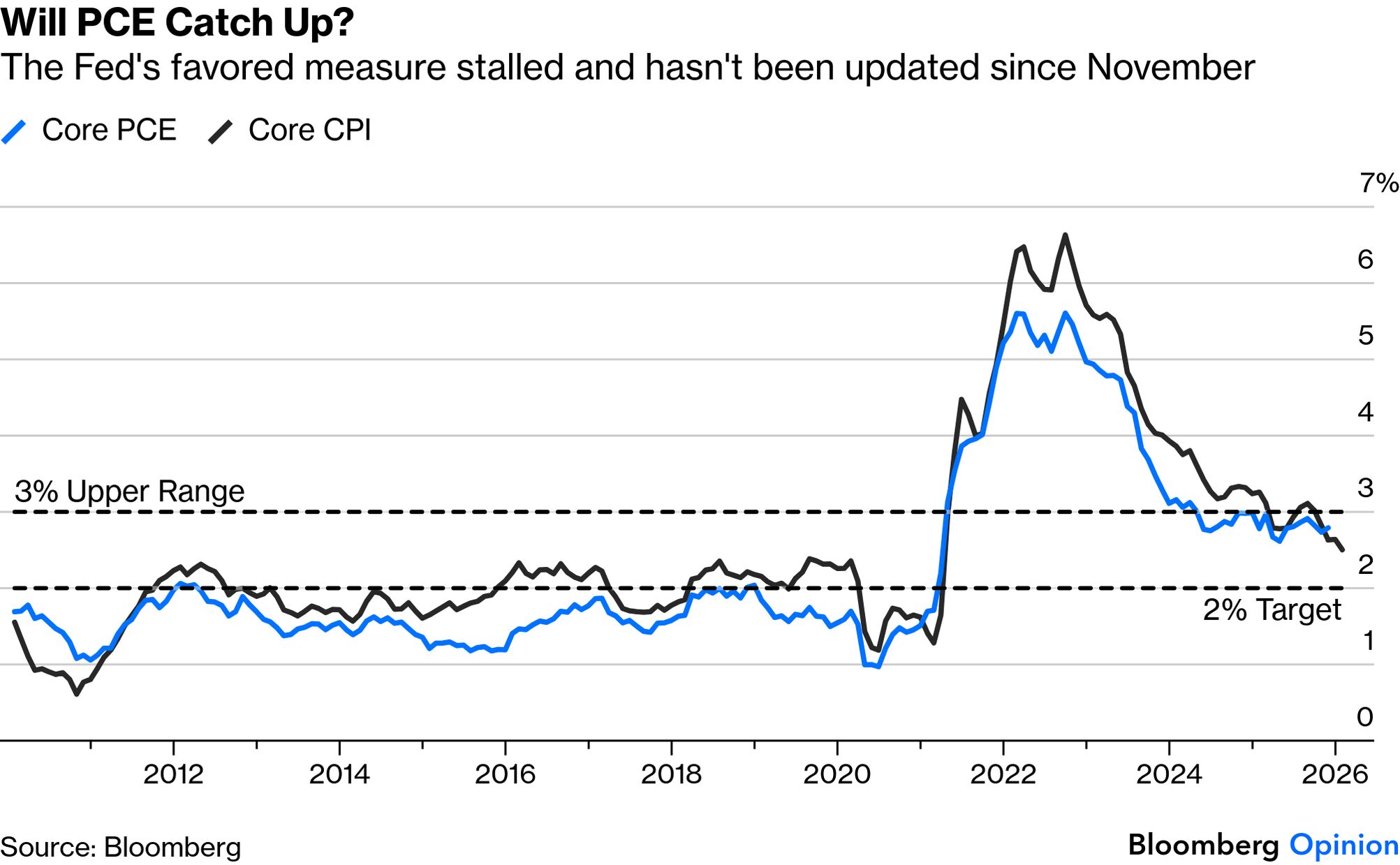

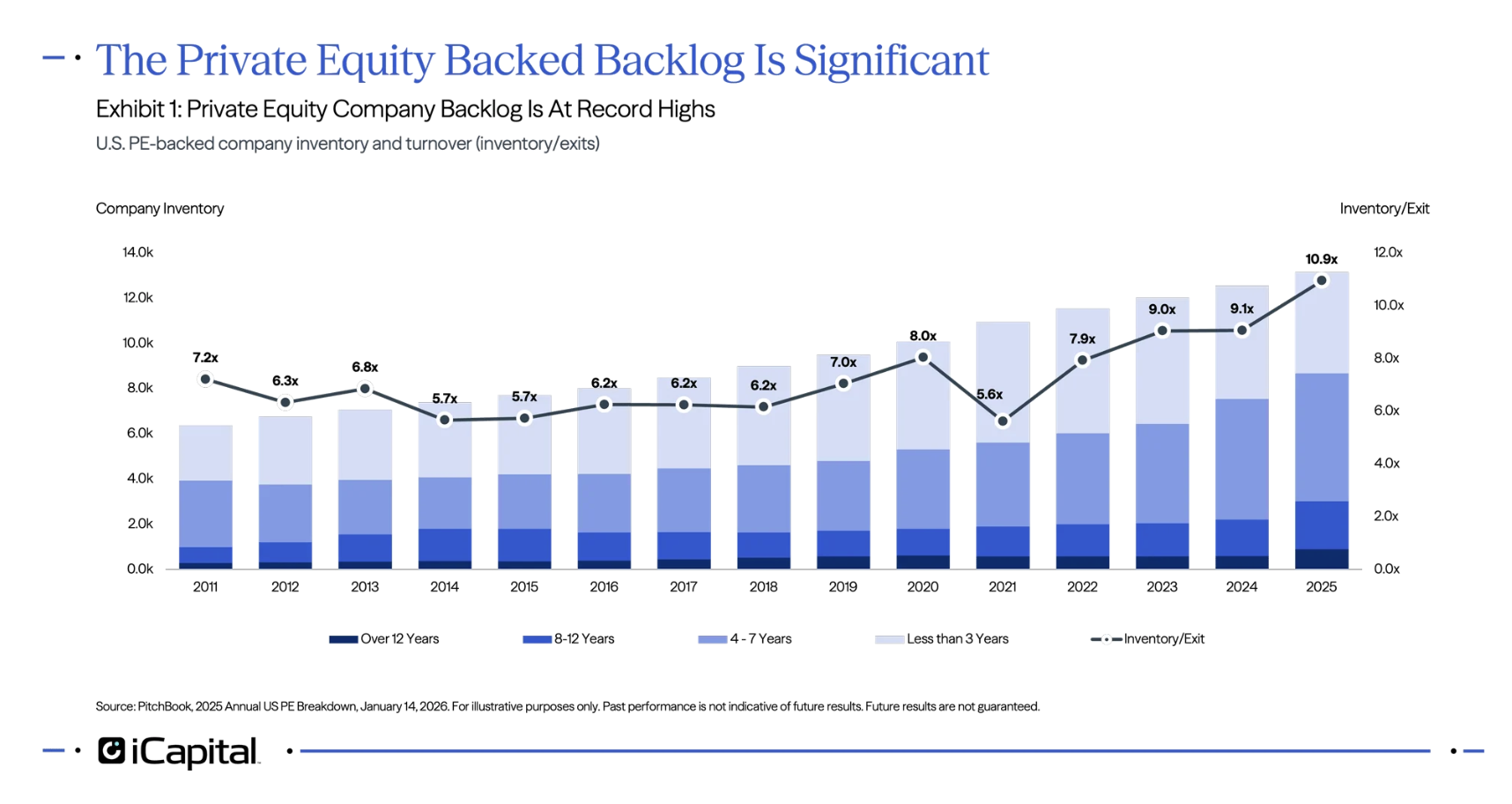

This was, frankly, offensive. There's no reason why a congressional panel charged with overseeing the Department of Justice should ask the attorney general about the stock market. It's a patently obvious attempt at diversion. But as Points of Return does discuss such things, let's analyze Bondi's point. The Dow is a flawed measure, as Points of Return has laid out many times. Using it for now, Bondi's assertion that it was over 50,000 was true at the time she spoke, but not for much longer, despite stronger employment data than anyone had expected that day. It fell sharply below the landmark the next day, and Friday's inflation data, also far better than forecast, failed to lift it: It's a bad sign when markets find good news unwelcome. It's not just macro data that ought to be helping. US corporate earnings grew at 14.4% in the fourth quarter, the best in four years. Fears that the bond market would revolt against fiscal imprudence and send yields surging were also nixed this week. Yields are lower than on Election Day 2024, while inflation swaps are barely changed: This is quite an achievement. The administration has talked about growth, cut taxes, and slapped tariffs on anything that moves, and yet bonds are not complaining. That should set up the stock market for great things. But it's not happening. The S&P 500 has gained 14% since election day. That's the weakest start to a presidential term in decades. The stock market was doing better at this point in both Obama terms, and Joe Biden's, and Trump 1.0: Bondi might retort that markets try to react to news before it happens, and there was indeed a nice Trump rally after election day. Therefore, starting at the inauguration is unfair. Nice try. Here is the same chart, starting on each of the last five election days: Obama, elected in the thick of the Global Financial Crisis, moves from first to last. Other than that, Trump 2.0 is unaffected. There is nothing wrong with the stock market's performance under this administration, but there's nothing particularly impressive about it, either. Looking into the entrails of the market, it's in the throes of a rotation. Consumer discretionary stocks, which benefit most from a roaring economy, have given up ground and now lag consumer staples since Trump's second election victory. This is typically what is seen when the economy is in trouble and the market is falling: This does look like a market running out of steam and belatedly pausing to look at the considerable risks incurred in building the infrastructure for AI. None of it gives any reason to vote against the president who happens to be in charge. If the market corrects now, that's a lot healthier than a sustained boom followed by a bust. In any case, no president should judge himself by the stock market. Too many factors beyond presidential control are involved. As for Bondi's opinion on this, it's of no interest. Rather than talk about stocks, she should answer questions about how she's doing her job. Inflation: Wait 'Til Friday | Price rises continue to dominate US politics, according to pollsters, so the latest Consumer Price Index data published last Friday would have given Bondi material that she'd be happy to talk about. They showed progress on any sensible measure. This is our standard beautiful breakdown of annual inflation into the main components of food, energy, core goods and core services. As has been true for a while, overall inflation is now mainly a phenomenon of services, but the trend — having picked up last year during the turmoil over tariffs — is once again unmistakably downward: The more sophisticated statistical measures that the Fed uses to gauge underlying inflation pressure all agree that the problem is easing. Taking all the components of the index, both the median and the trimmed mean (excluding outliers and averaging the rest) are a little above the headline figure, but descending and at their lowest since the early days of the inflation spike in 2021. The Fed's favored "Supercore" (services excluding housing) is also at a fresh low. The Atlanta Fed's measure of sticky price inflation, for those products and services whose prices logistically take a while to change, also declined and is now at 3%:  Inflation isn't back to the range around 2% it occupied for many years before the pandemic. Policymakers would prefer it to fall further. But disinflation has resumed despite resolute attempts to stimulate the economy. This gives no particular reason for the Fed to cut rates next month, but if the current trend continues, then it's fair to expect more cuts by the end of 2026. That is what the market is now discounting, with two likely in the last six months: This doesn't mean that the authorities have the all-clear on inflation, unless they would accept an effective target closer to 3%. Companies bore the brunt of tariffs last year, but Omair Sharif of Inflation Insights LLC points out that prices of new cars had their biggest jump in several years in January. Falling used car prices — unaffected by tariffs — masked this, but it's possible that tariffs will only now be passed on to customers: Another issue that could make for another big Friday this week concerns the Personal Consumption Expenditure (PCE) deflator. The Fed's official target, it has for many years shown somewhat lower price rises than the CPI. Thanks to last year's shutdown, these data haven't been updated since November. At that point, PCE had been stuck close to 3% for two years, and had risen above core CPI: The odds are that it will now fall. If Friday's data show that it has continued to stall, that could be an issue. Private Equity's Long Road | Private equity has problems, as university endowment managers following the famed Yale Model are learning firsthand. At roughly $7 trillion, PE is now at a size where its troubles could spill over into the broader financial system. At Davos recently, Oliver Wyman's Huw van Steenis recounts a frank exchange between large asset owners who were frustrated by the lack of distributions they were receiving from big private equity portfolios. He feared that this adds pressure to find solutions via secondary and continuation vehicles if exits don't accelerate. This chart by iCapital's Nick Veronis shows that PE managers are holding on to company investments about 20% longer than they used to. In 2025, the average age of a portfolio company reached 4.4 years, a 20-year high: Add that to the strains caused by high interest rates — after the extraordinarily long period when easy money buoyed the asset class — and muted deal activity, and the outlook for private equity looks unpromising. Analysts at London-based With Intelligence point out that although experienced allocators look at returns over longer cycles, many are concentrating their commitments with smaller groups of top-performing firms, while cutting back or exiting relationships with weaker managers: Hopes that a pro-business Washington would breathe life back into dealmaking have yet to live up to expectations. This leaves private equity stuck in a holding pattern sitting on unsold companies worth trillions of dollars, many of which were bought during the easy-money years at buoyant valuations and are now far harder to exit. Even if deal activity picks up, that backlog won't clear overnight and will likely take years. Still, some early progress suggests to optimists that a turnaround is underway. Interest rates are falling and likely to continue downward, making both acquisitions and exits more feasible. With Intelligence suggests that the public market has been more receptive to new listings of late. If stock markets remain stable, 2026 could see a steady, if unspectacular, rise in strategic deals and initial public offerings: Private equity may be down, but it's not out. We expect plenty of opportunities in 2026 for savvy investors ready to stay committed and maintain vintage year diversification. They just need the right tools, and partners, to pick the managers that can outperform through the current climate.

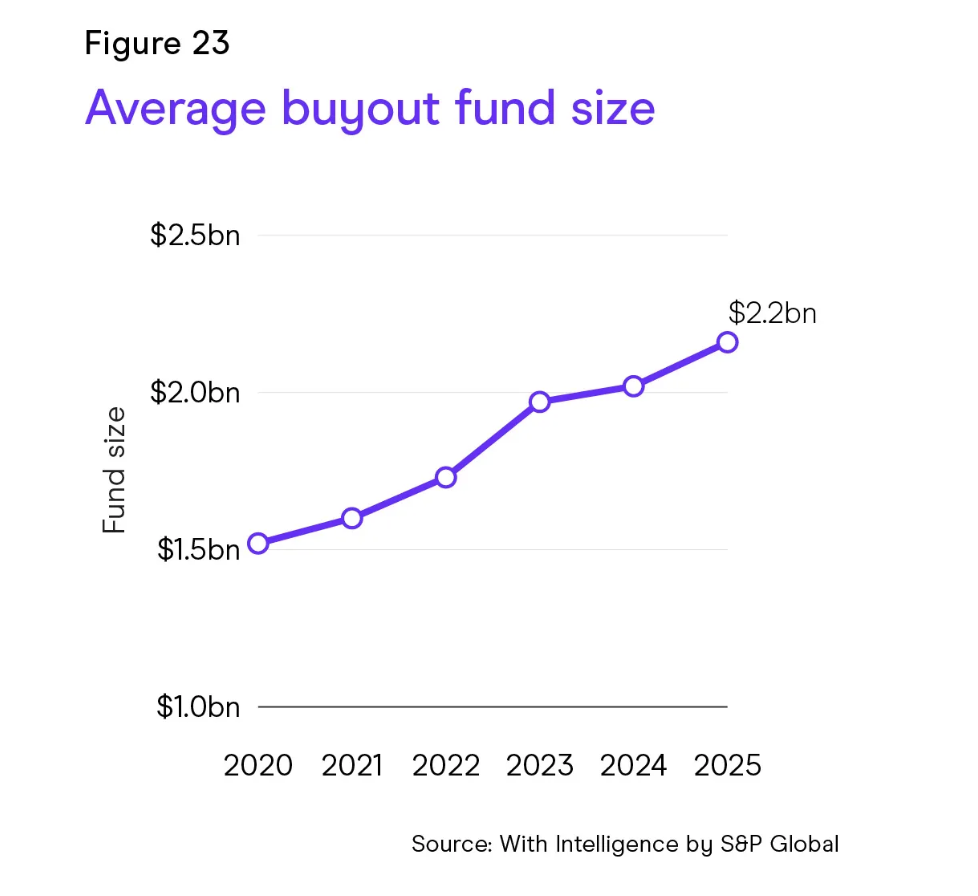

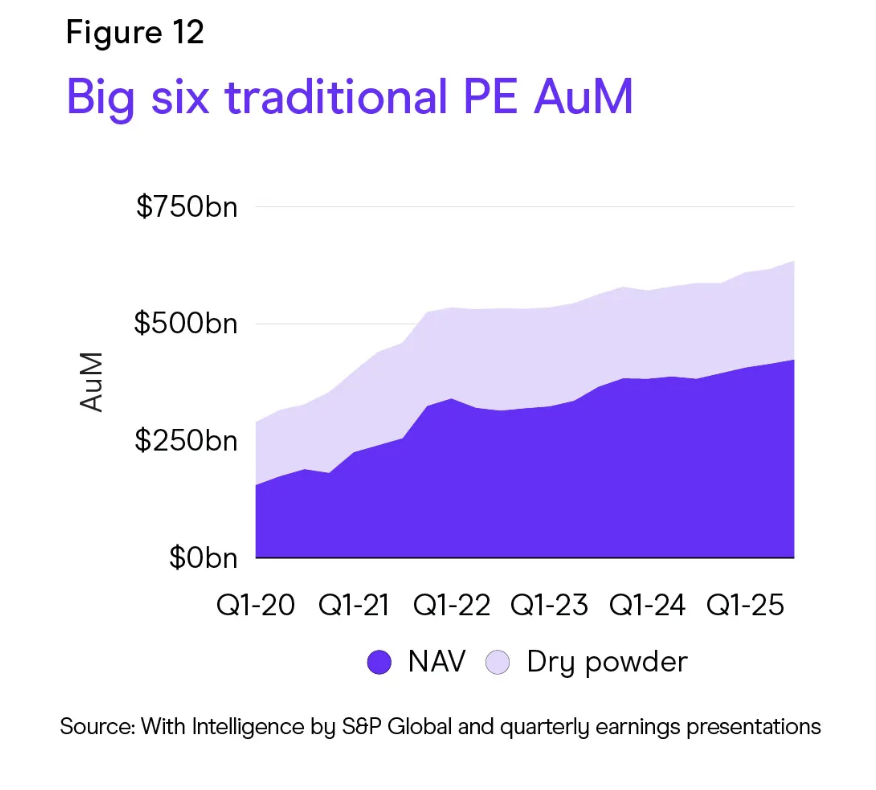

Private equity firms still have plenty of dry powder. With AI reshaping workflows across industries, this opens investment opportunities in disruptive technologies and the supporting infrastructure. Assets under management at the biggest firms continue to increase: Goldman Sachs' David Solomon calls the prevailing market environment constructive, getting to a point where more private equity portfolios can come forward: I'm not saying it's going to be a record year that would compare to 2021 for equity issuance, but I think it's going to be a continued trend of improvement as we saw in 2025.

Growth is likely to come more slowly. Returns may prove uneven and competition for capital is only getting tougher, even if private equity remains crucial in diversified private-markets portfolios. As David Sambur of Apollo Global Management argues, any lasting rebound will require a "return to the roots of the asset class": disciplined buying, hands-on operational improvement and clear, repeatable paths to liquidity: These fundamentals were central to PE's earliest successes but were lost sight of during periods of excess against an ultra-accommodative backdrop. We believe a return to fundamentals will define those strategies best positioned to outperform in a world with normalized rates.

Sambur notes that the managers most likely to perform will not be chasing beta or momentum. Rather they must return to their craft as builders, operators, and investors who can make value creation a repeatable system. For the rest of the industry, more rate cuts would be a relief. — Richard Abbey |

No comments:

Post a Comment