|

Reading time: 5 minutes |

News | Crypto Converter | Crypto Calculators |

Bitcoin trades like tech, not gold, as bear signals deepen |

|

Key points: |

Bitcoin's recent sell-off moved in step with high-growth tech stocks, reinforcing its short-term behavior as a risk asset rather than a safe haven. On-chain, derivatives, and ETF data continue to point to broad deleveraging, with growing debate over whether $60,000 marks a midpoint or a durable bottom.

|

News - Bitcoin's latest pullback has sharpened a long-running debate. Is BTC functioning as digital gold, or is it still being treated as a growth trade? |

A recent report from Grayscale argues the answer, for now, is clear. Bitcoin's decline earlier this month closely tracked U.S. software stocks, a pattern more consistent with emerging technology assets than defensive stores of value. As investors reduced exposure to risk, BTC fell alongside equities, while physical gold climbed to record highs and absorbed fresh inflows. |

Grayscale maintained that Bitcoin's long-term design still supports a store-of-value case, pointing to its capped supply and decentralized network. However, at just 17 years old, the asset has yet to consistently demonstrate capital preservation during periods of market stress. |

Leverage flush adds to downside pressure - Short-term market dynamics have reinforced this risk-driven behavior. Recent price swings triggered more than $250 million in crypto liquidations across long and short positions, even as Bitcoin traded within a narrow range near key support levels. At the same time, demand indicators weakened, exchange inflows rose, and derivatives markets continued to shed leverage. |

Spot Bitcoin ETFs have also remained under pressure. U.S.-listed funds recorded roughly $318 million in net outflows since early February, highlighting softer institutional appetite during the downturn and adding to near-term selling pressure. |

Is the bear market halfway done - Research from Kaiko suggests Bitcoin's move toward $60,000 may represent a midpoint rather than a final bottom. Historically, post-halving bear markets have involved extended drawdowns lasting several months, often marked by repeated failed rallies before stabilization. |

On-chain indicators support a cautious outlook. The Mayer Multiple has fallen to levels last seen during deep bear markets, while futures open interest and spot trading volumes have declined sharply. While some analysts see early signs of accumulation, others warn that further downside toward the low $50,000 range remains possible before the cycle resets. |

For now, Bitcoin continues to trade less like gold and more like a growth asset still searching for conviction. |

Vitalik Buterin reframes Ethereum's AI role as ETH faces capitulation debate |

|

Key points: |

Vitalik Buterin is urging builders to move away from a blind race toward AGI and instead use Ethereum to guide AI development around privacy, verification, and decentralization. At the same time, Ether is trading in a zone associated with capitulation, with on-chain data and institutional behavior split between aggressive accumulation and warnings of further downside.

|

News - Vitalik Buterin has renewed his call for a more deliberate approach to artificial intelligence (AI), arguing that the current obsession with racing toward artificial general intelligence (AGI) risks repeating the unchecked concentration of power Ethereum was designed to resist. |

In a recent post on X revisiting ideas first outlined two years ago, Buterin said AI development should prioritize human freedom, privacy, and verifiability over raw acceleration. He outlined a near-term vision in which Ethereum serves as infrastructure for private AI interaction, anonymous payments for AI services using cryptography, and systems that verify how AI behaves rather than relying on centralized providers. |

Buterin also described Ethereum as a coordination layer where AI agents could interact economically, post security deposits, build reputations, and resolve disputes onchain. Paired with AI tools that help humans evaluate decisions and outcomes, he argued this could make decentralized governance and markets function at real-world scale. |

Ethereum's architecture shifts as ZK enters the base layer - This philosophical push comes as Ethereum advances one of its most consequential technical changes since The Merge. |

Developers are progressing plans to let validators verify blocks using zero-knowledge proofs instead of re-executing every transaction. The proposed EIP-8025 would make this optional, lowering hardware requirements and allowing full block validation on consumer hardware while preserving decentralization. |

The first L1-zkEVM workshop is scheduled for February 11, 2026, and will mark the formal kickoff of Ethereum's roadmap toward proof-based block validation. |

Price capitulation meets aggressive accumulation - Meanwhile, Ether's price action has intensified debate over whether the asset is nearing a durable bottom. On-chain data shows ETH's MVRV Z-Score has fallen to -0.42, a level historically associated with capitulation, though still above the deepest bear market lows seen in prior cycles. |

Despite the uncertainty, BitMine Immersion Technologies has continued to accumulate Ether aggressively, purchasing more than 40,000 ETH in a single day. Chairman Tom Lee has pointed to past cycles where similar drawdowns were followed by sharp recoveries, even as other analysts caution that further downside remains possible. |

For now, Ethereum sits at a crossroads, with long-term architectural ambition colliding with short-term market stress. |

Wintermute: AI boom is capping crypto's upside |

|

Key points: |

Capital flowing into AI has capped crypto's upside, with traders linking recent underperformance to sustained rotation into AI-related assets. At the same time, on-chain data shows AI agent payments have yet to gain real traction, even as firms increasingly rely on AI for trading and risk management.

|

News - Crypto's struggle to regain momentum may have less to do with its own fundamentals and more to do with where capital is going. According to trading firm Wintermute, investment flows into artificial intelligence (AI) have absorbed available risk capital for months, limiting crypto's ability to outperform during rallies. |

Wintermute said crypto's tendency to underperform on the way up and sell off more sharply on the way down is largely explained by rotation into AI-linked equities. When AI companies are stripped out of the Nasdaq 100, crypto's negative performance skew nearly disappears, reinforcing the view that the AI trade has been crowding out digital assets. |

Agent payments fall short of the hype - That capital imbalance is becoming visible onchain. Data from Artemis shows that x402, a standard designed to enable automated payments between AI agents, has seen activity collapse. Daily x402 transactions fell by more than 92% from December to February, dropping from roughly 731,000 to about 57,000. |

The sharpest decline came from infrastructure and utility-related services, where activity fell over 80%. Analysts said the tooling highlights what an agent-based economy could look like, but real demand has yet to materialize. Despite strong developer interest and growing agent-focused platforms, most x402-linked tokens have struggled to attract sustained investor attention. |

AI helps manage risk, not market cycles - While AI has yet to revive crypto markets, its role inside trading firms continues to expand. A survey by Nickel Digital Asset Management found that 96% of executives said AI already plays a major role in investment processes. |

Still, Nickel's leadership stressed that automation has limits. During periods of market stress, human oversight remains essential to manage faulty data, enforce risk controls, and avoid cascading failures. In other words, AI can help firms navigate volatility, but it cannot replace disciplined decision-making or reverse broader capital rotation trends. |

For crypto to reclaim momentum, traders say the AI trade itself may first need to cool. |

Fugitive crypto scammer gets 20 years while pig-butchering crackdown widens |

|

Key points: |

A U.S. court sentenced Daren Li to 20 years in prison for orchestrating a $73 million global crypto scam, even as he remains a fugitive after fleeing electronic monitoring. The case highlights the growing scale of social engineering scams run from Southeast Asia, which continue to drive billions of dollars in crypto-related losses.

|

News - A federal judge in California has sentenced Daren Li to 20 years in prison for leading a $73 million international cryptocurrency fraud scheme, handing down the maximum statutory sentence despite Li remaining on the run. |

Li, a dual national of China and St. Kitts and Nevis, was sentenced in absentia after prosecutors said he cut off his electronic ankle monitor in December and fled supervision. The court also imposed three years of supervised release. |

According to court filings, Li and his co-conspirators operated scam centers in Cambodia and used social engineering tactics known as pig butchering to target victims. The group initiated contact through social media platforms, dating apps, and unsolicited messages, gradually building professional or romantic trust before directing victims to spoofed crypto trading websites. |

In other cases, the conspirators posed as tech support agents and convinced victims to send funds to resolve fabricated computer or security issues. Prosecutors said at least $73.6 million in victim funds was routed through bank accounts tied to the ring, with nearly $60 million laundered through U.S. shell companies before being converted into cryptocurrency. |

Cambodia's role in industrial-scale crypto fraud - The sentencing adds to growing scrutiny of scam compounds in Southeast Asia. Analysts at TRM Labs have identified Cambodia as a major hub for organized crypto fraud, with scam centers generating tens of millions of dollars daily through repeatable social engineering models and forced labor operations. |

U.S. authorities said eight of Li's co-conspirators have already pleaded guilty, with investigations ongoing to locate Li and dismantle related networks. |

Social engineering remains crypto's biggest threat - Law enforcement officials continue to warn that social engineering scams are the leading risk facing crypto users. These schemes accounted for roughly 41% of all crypto security incidents in 2025, driving losses in the billions and underscoring that user manipulation, not protocol flaws, remains the industry's most persistent vulnerability. |

|

More stories from the crypto ecosystem |

|

Interesting facts |

Bitcoin infrastructure and AI are intersecting in mining investments: Shares of TeraWulf and Cipher Mining surged recently after Morgan Stanley initiated bullish coverage based on their potential to repurpose mining capacity for AI data center workloads, hinting at crossover demand between crypto mining and AI computing infrastructure. Tether's "$20B raise" was framed as a misunderstanding: Tether's CEO said the widely cited $15–$20 billion figure was discussed as a hypothetical maximum, not a fundraising target, while noting about $187 billion of USDT was in circulation at the time of reporting. Blockchain adoption is quietly becoming mainstream beyond finance: Analysts now expect global blockchain technology market growth from ~$31B in 2024 to over ~$1.4T by 2030, driven by use cases from supply chain tracking to digital identity and smart contracts, not just crypto speculation.

|

Daily news for curious minds. |

Be the smartest person in the room. 1440 navigates 100+ sources to deliver a comprehensive, unbiased news roundup — politics, business, culture, and more — in a quick, 5-minute read. Completely free, completely factual. |

Sign up now! |

|

Top 3 coins of the day |

Pippin (PIPPIN) |

|

Key points: |

PIPPIN jumped to around $0.38 after rebounding sharply from its recent dip near the $0.26 to $0.28 zone. The move unfolded on strong volume, with price reclaiming both moving averages even as the 20 MA remained below the 50 MA.

|

What you should know: |

PIPPIN posted a strong daily surge after bouncing from the $0.26 to $0.28 region, reversing a short-term downtrend that followed its earlier rejection near $0.45. The latest candle reflected aggressive buying interest, allowing price to reclaim ground lost during the prior pullback. |

Despite the recovery, the moving average structure remains mixed. While price has moved back above both the 20-day and 50-day moving averages, the faster 20 MA continues to sit below the 50 MA, signaling that trend confirmation is still developing rather than complete. |

Momentum conditions improved alongside the rally. The RSI climbed back toward the upper mid-range near 60, suggesting strengthening bullish pressure without entering overheated territory. Trading volume also expanded noticeably during the advance, pointing to speculative participation rather than a low-liquidity move. |

For now, $0.30 remains a key support to watch, while the $0.45 to $0.50 zone stands as the next major resistance area. |

River (RIVER) |

|

Key points: |

RIVER climbed to $18 after rebounding sharply from the $13 to $14 zone, extending its recovery from recent lows. The upswing came alongside a clear pickup in volume, while MACD and Bollinger behavior continued to reflect elevated volatility rather than trend stability.

|

What you should know: |

RIVER staged a strong rebound after stabilizing near the $13 to $14 region, following a steep corrective slide from its January peak. The latest advance unfolded with expanding daily candles, signaling renewed buying interest after a period of consolidation. |

Volatility widened as price moved back toward the upper half of the Bollinger range, suggesting an expansion phase rather than a compressed breakout. At the same time, MACD momentum improved from deeply negative readings, indicating that selling pressure eased, though the indicator remained below the zero line and stopped short of confirming a full trend reversal. |

Trading activity increased notably during the rebound, coinciding with recent spot listings on LBank and HTX, along with the rollout of River's official cross-chain bridge connecting Ethereum, Base, and BNB Chain. These developments likely boosted short-term participation and liquidity. |

For continuation, $14 to $15 remains key support, while $20 to $21 is the next resistance area to monitor. |

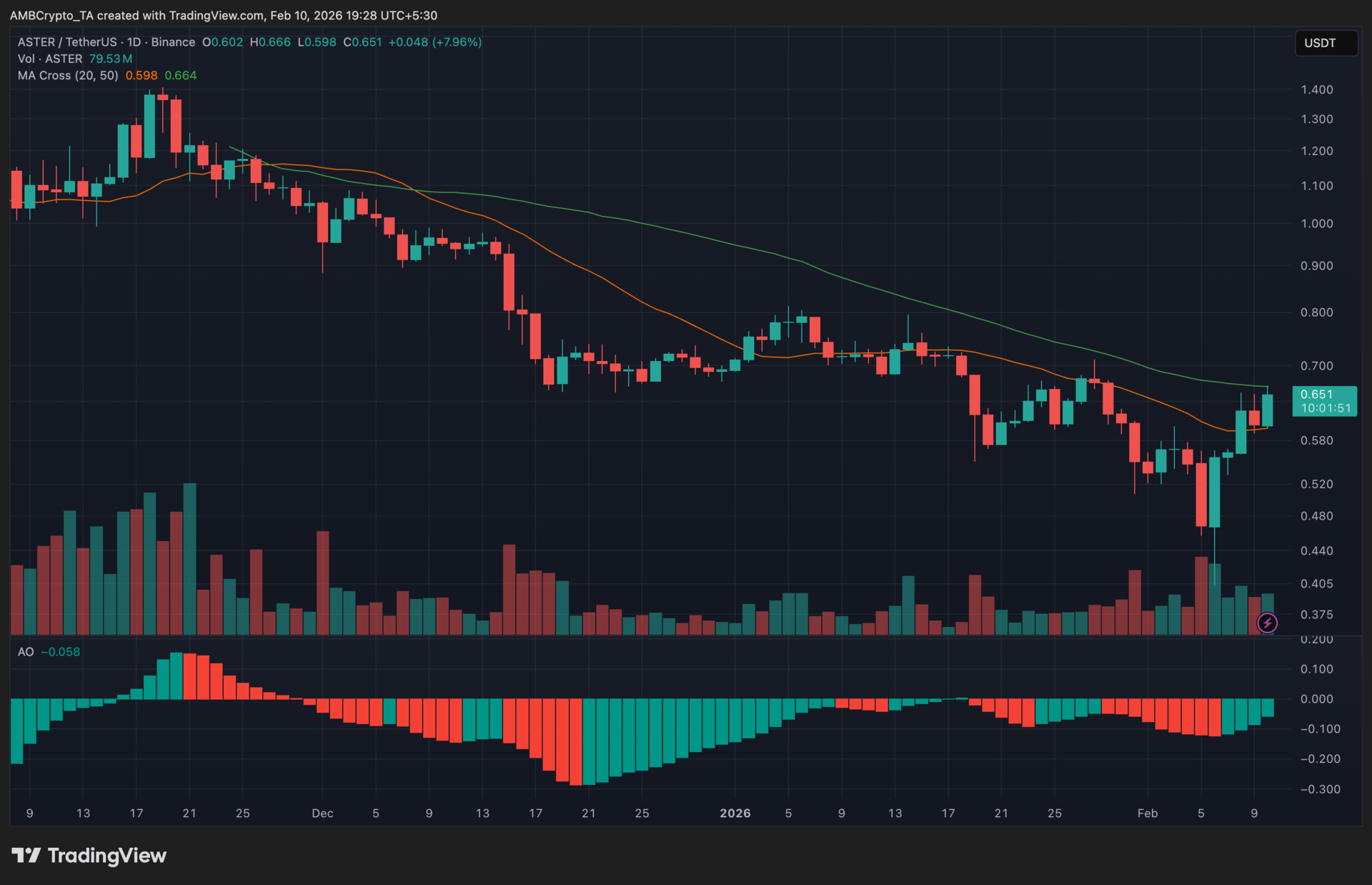

Aster (ASTER) |

|

Key points: |

ASTER advanced to around $0.65 after rebounding from its recent low near the $0.48 to $0.50 area. The recovery came with a noticeable rise in trading volume, even as the broader MA structure remained cautious and the Awesome Oscillator turned green below the zero line.

|

What you should know: |

ASTER recorded a steady rebound after dipping toward the $0.48 to $0.50 zone, marking its strongest daily move since late January. The latest candle followed a prolonged downtrend from November highs above $1.20, suggesting short-term relief buying rather than a confirmed trend reversal. |

From a trend perspective, conditions stayed mixed. Price reclaimed the 20-day moving average, but the 20 MA continued to track below the 50 MA, keeping the broader structure tilted bearish. The 50 MA near the $0.66 to $0.67 region now stands as an important resistance area. |

Momentum signals also remained tentative. The Awesome Oscillator stayed below the zero line, but the histogram flipped green, indicating that bearish pressure eased. Volume expanded during the bounce, pointing to organic buying interest. |

For now, $0.55 to $0.60 acts as key support, while a sustained move above $0.66 is needed to improve the short-term outlook. |

How was today's newsletter? |

|

No comments:

Post a Comment