| Read in browser | ||||||||||||||

Alphabet's latest bond spree is testament to how debt has become the Achilles heel of investment in artificial intelligence. The spending threatens to transform how investors view technology companies and US stocks more broadly.

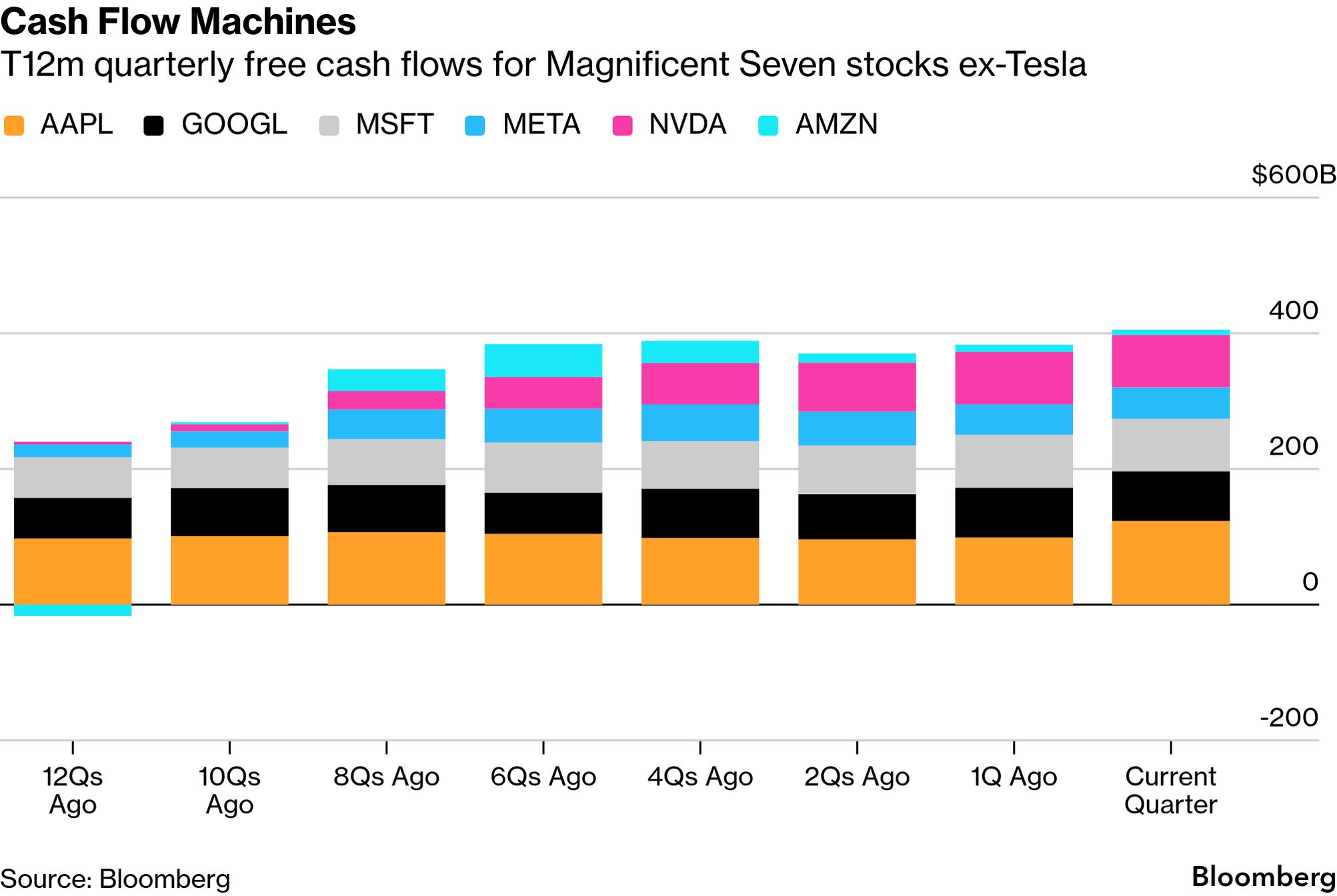

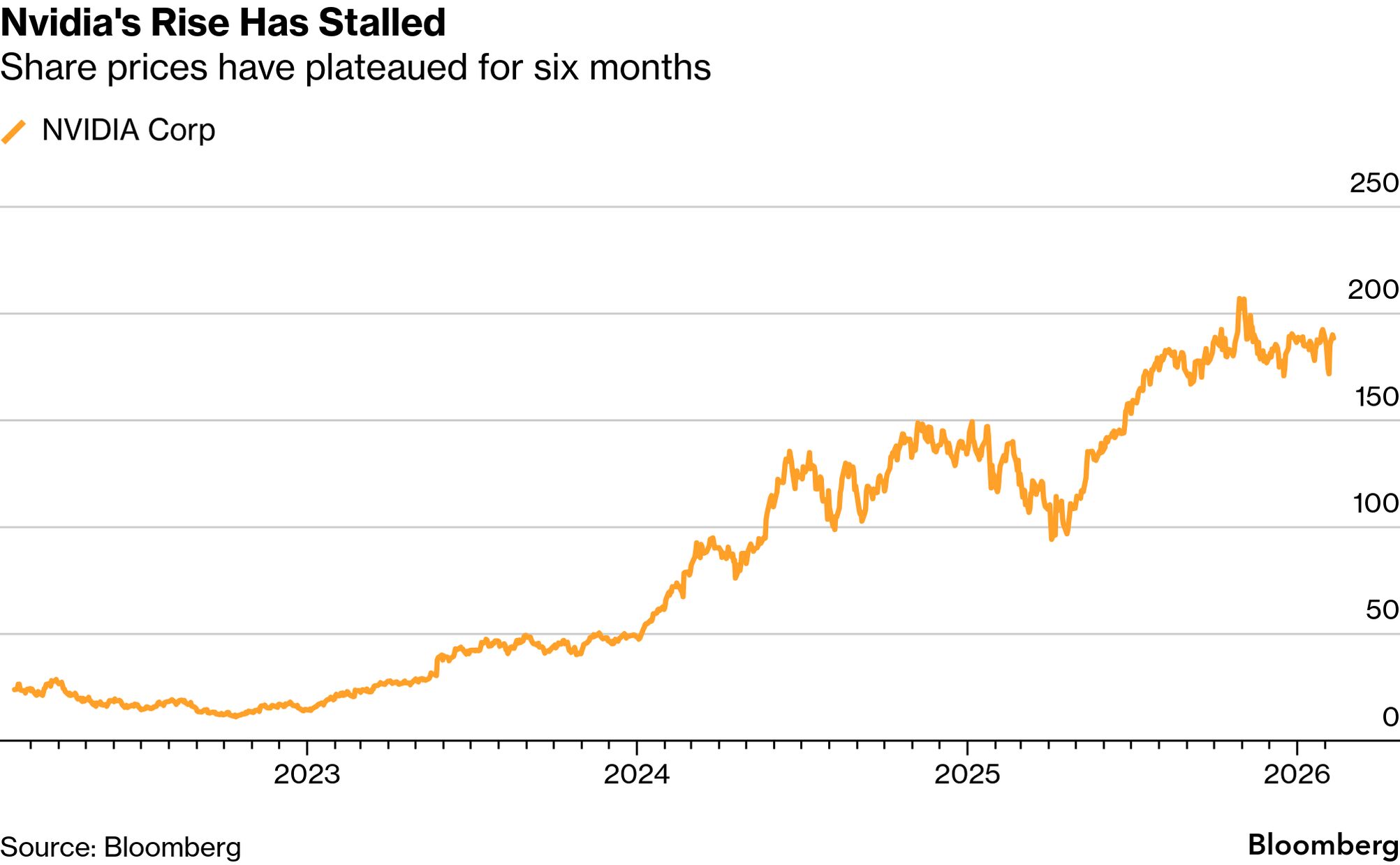

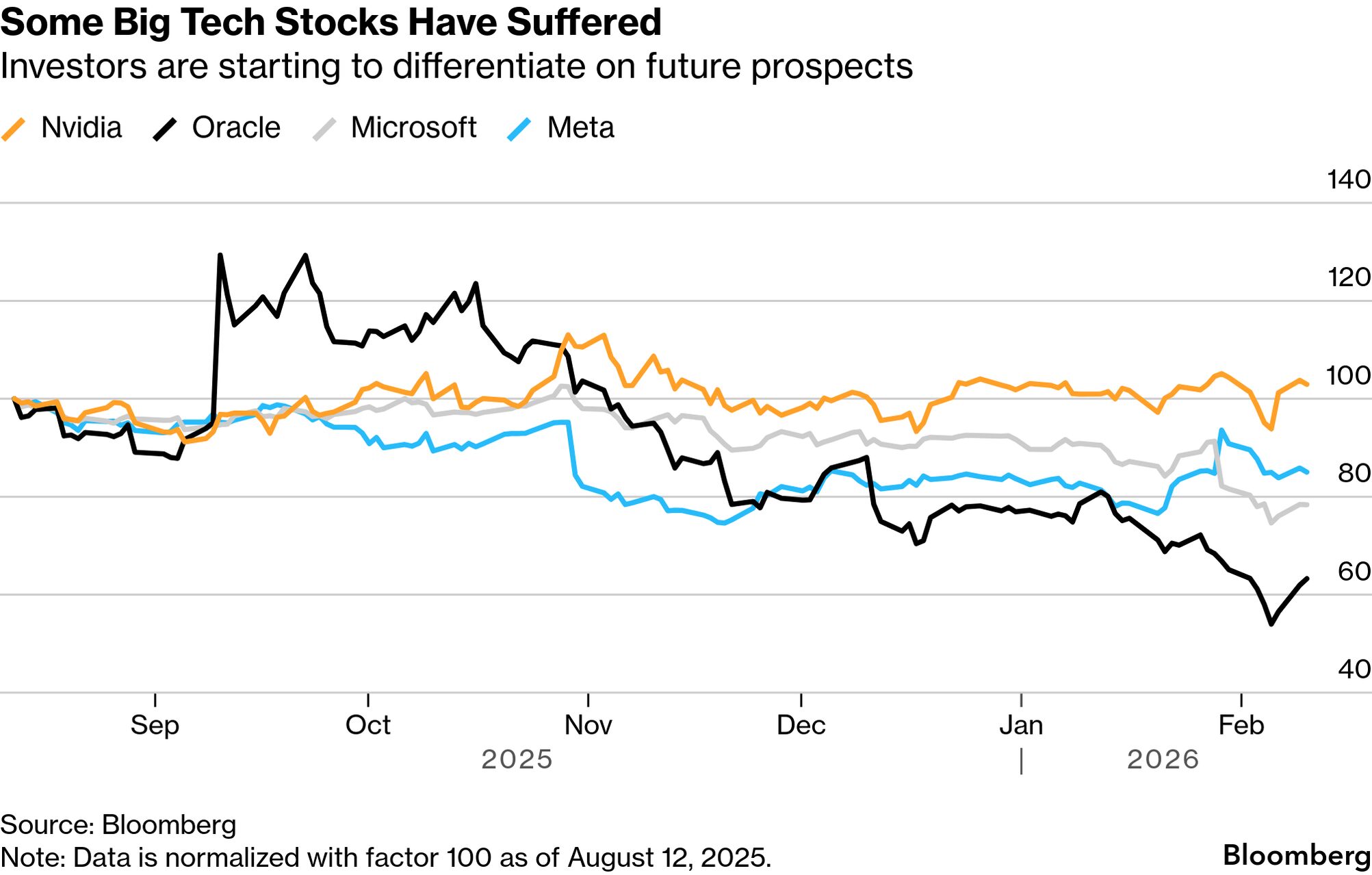

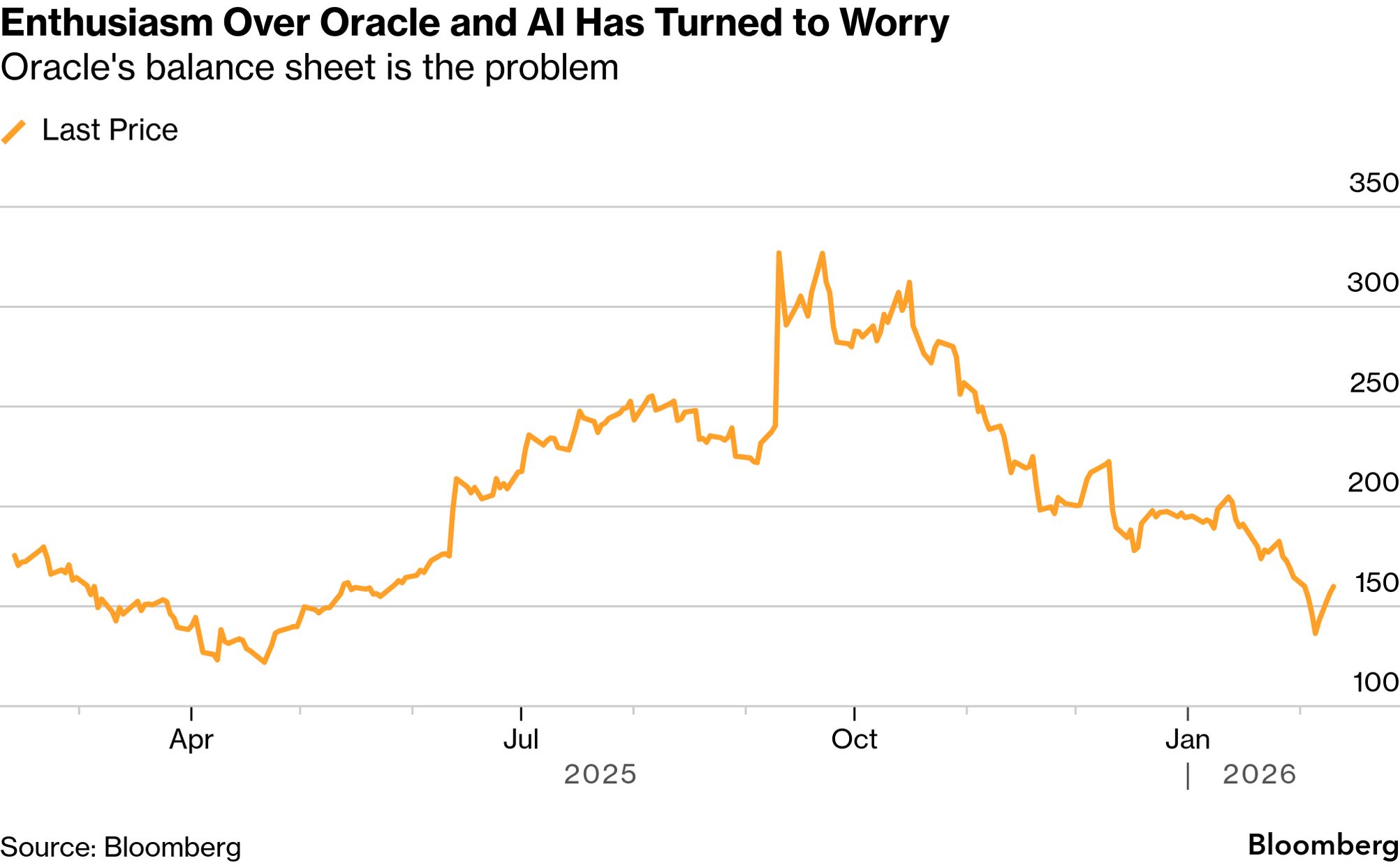

Why are they raising so much debt?Big Tech companies are cash-flow machines that dominate the list of most valuable publicly-traded companies. This helps the technology industry get billed as light on capital needs with so much operating leverage that revenue from new customers mostly falls to the bottom line as profit, fattening margins and rewarding shareholders.  Artificial intelligence changes that. Alphabet, the parent of Google, plans to make $175 billion to $185 billion of capital investments this year. Collectively, Alphabet, Amazon, Meta, and Microsoft plan to spend $500 billion in 2026 on AI investments alone. This unprecedented splurge promises to turn the model of software companies as capital-light firms upside down. Investors have noticedInvestors are officially worried. When AI first caught investors' attention, Big Tech was rewarded because of the transformative potential the technology has on everything we do. Stocks briefly paused their rally in 2024 over recession jitters but they resumed their ascent in the first half of 2025. Take Nvidia, for example. From a low of $11.21 just before ChatGPT went public in late 2022, the company's share price rose over 18-fold in just three years.  Over the last half-year or so, as the scale of investments has become clear — and Big Tech's balance sheets have deteriorated — investors have begun to punish the firms with the largest AI risk profiles and the highest debt loads. Their shares have underperformed as a result and even Nvidia has stalled.  Oracle's caseAt the end of last year, I pointed to Oracle as the poster child of this transformation. Seven years ago, the company had over $70 billion in cash and cash equivalents on its balance sheet to offset its almost $60 billion in long-term debt. That was a 25% cushion of cash over debt. By the quarter that ended in November, Oracle's cash pile was down to just $11 billion and long-term debt had ballooned to $96 billion, a shortfall of monumental proportions. Yes, Oracle finished the most recent quarter with $19 billion in cash. But it did so by raising gobs of debt that swelled its long-term liabilities to $116 billion. The stock's performance is telling.  The stock popped 36% on a single day in September - the largest since 1992 for the firm - after Oracle signed a deal with ChatGPT's parent OpenAI to supply 4.5 gigawatts worth of data center capacity. Its founder Larry Ellison briefly became the richest person in the world. But the resulting debt binge made investors look closer at the company's balance sheet and the bottom fell out of the shares, cutting the price in half. The missing AI IPOMore recently, Alphabet is making the headlines. Google's parent ended up raising more than twice as much money as it planned originally, with a $32 billion offering that includes a rare 100-year bond — the first since 1997 in the heyday of the Internet bubble. While the success of the offering assuaged some investor concerns about the increasing use of debt and helped boost shares of laggards like Oracle, it raises questions about the market's ability to absorb massive stock offerings from unlisted — and untested — AI players. OpenAI, Anthropic and Elon Musk's xAI have all indicated plans to go public. It's telling that when Microsoft reported earnings last month and its stock lost $440 billion in market value on a single day, among the biggest investor concerns was that just under half of the company's $625 billion in obligations for future cloud computing contracts were tied to OpenAI. A pure play IPO — a central player that's emblematic in the business and where investors can channel their hopes and dreams — has been missing from the AI bubble. But because of the debt now involved in AI, fear is driving much of investor sentiment and may hurt those companies' IPO prospects. Big tech is no longer asset lightIn the end, debt isn't going to break a company like Alphabet. It's a tool they are using to preserve cash. But it does call into question whether these companies deserve the rich valuations they have garnered. You're paying nearly 30 times earnings for Alphabet for a low double-digit growth rate, helping boost the S&P 500's own price/earnings ratio to 26 times. You pay just over 18 times for the European Stoxx 50, a discount of 40%. When the companies most responsible for creating that disparity are transforming themselves from asset-light software businesses into asset-heavy firms competing fiercely in a new technology with unpredictable outcomes, investors aren't going to pay a premium for American stocks. And suddenly, the rationale for US outperformance evaporates. Things on my radar

More from BloombergEnjoying The Everything Risk? Check out these newsletters:

You have exclusive access to other subscriber-only newsletters. Explore all newsletters here to get most out of your Bloomberg subscription.  Follow us You received this message because you are subscribed to Bloomberg's The Everything Risk newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Wednesday, February 11, 2026

Big Tech is going big on debt and that changes everything

Subscribe to:

Post Comments (Atom)

[80-90% Losses Possible] Do You Own These Stocks?

For the first time in over 50 years, FOUR economic forces could collide and upend the market and economy... ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment