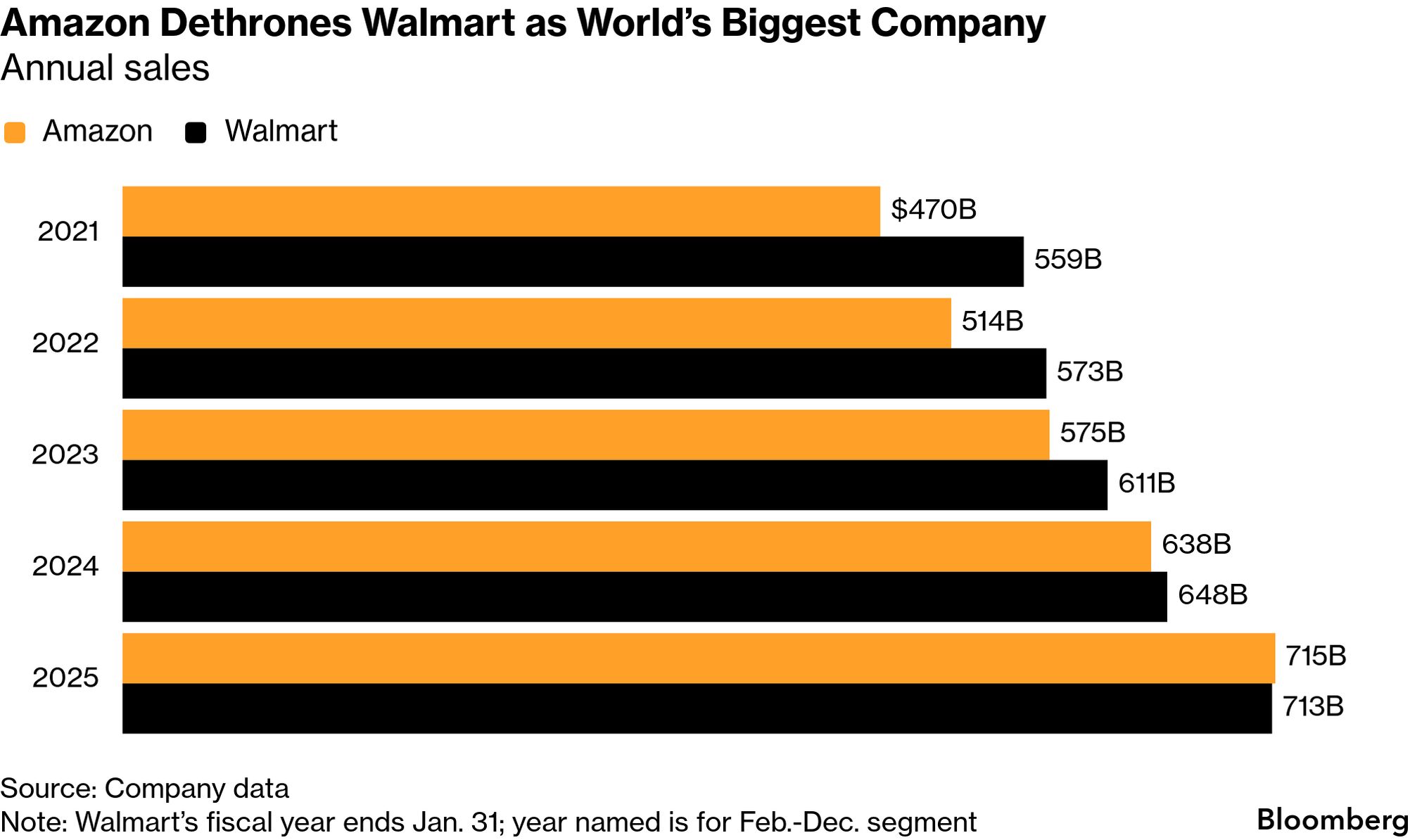

| The world's largest company measured by revenue is now Amazon. Spencer Soper covers the company and writes about why this milestone passed quietly on Wall Street. Plus: Five Below is where kids want to spend their allowances. If this email was forwarded to you, click here to sign up. Amazon.com Inc. shocked investors this month when it announced plans to spend $200 billion in 2026 on data centers, chips and similar indulgences, intensifying fears that the tech industry's investments in artificial intelligence infrastructure are so colossal, they may never be fully recouped. The pledge followed other big-spending commitments from Alphabet, Meta Platforms and Microsoft. Wall Street's obsession with AI appears to have buried the lead, though. While analysts and investors were poring over the details of the company's tech strategies and what they might mean for the broader AI market, many seem to have missed an important detail: Amazon has dethroned Walmart Inc. as the world's biggest company by revenue. The retailing giant this morning reported sales of $713 billion for the fiscal year that ended Jan. 31, below Amazon's $717 billion in sales for calendar year 2025. Leading the world's companies in sales is seen more as a measure of global scale and consumer reach than overall value and profitability, but it's still worth some bragging rights. Walmart had been on that perch for more than a decade, joining a rarefied club that includes the likes of Exxon Mobil Corp. and General Motors Co. Amazon's ascendance is only partly attributable to its strength in retail and shouldn't be viewed as an imminent threat to Walmart's grip on the US consumer. Instead, the shift highlights the importance of cloud computing in the modern economy. Amazon is the world's biggest data center owner, a business that's growing faster than the web store most people know. Its revenue without cloud computing was $588 billion—huge by any yardstick, but more than $100 billion shy of Walmart's overall sales. And the IRL behemoth's annual e-commerce sales in the US are expected to grow nearly three times as quickly as Amazon's this year, indicating it's gaining market share, according to EMarketer Inc. The retail fight between Amazon and Walmart will likely play out for years to come, with Walmart refining its thousands of stores as mini e-commerce distribution hubs and Amazon pushing deeper into rural America for more sales, where the competition from Walmart will be toughest. But Wall Street is barely paying attention to that fight. On recent Amazon earnings calls, analysts have narrowly focused on what the company is spending on its data centers and how fast its cloud-computing revenue is growing. If the cost of the expansion outpaces sales growth, investors get skittish. It's a familiar pattern for veteran Amazon observers. The company's push into a national warehouse network, which played out largely from 2007 to 2015, was fraught with tension between founder Jeff Bezos and shareholders, who accused him of operating a "nonprofit." Bezos reinvested in the company's growth at the expense of profit margins, and it took years for him to get investors fully on board. Today, Bezos' successor as CEO, Andy Jassy, finds himself in a similar tussle, but this time it's about data centers rather than warehouses. And just like Bezos, Wall Street is more focused on how much he's spending than on how much he's bringing in. That's as good an explanation as any as to why Amazon seizing the revenue crown from Walmart has generated such scant interest among investors. Previously in Businessweek: Walmart Wants to Be Something for Everyone in a Divided America |

No comments:

Post a Comment