| I'm Justin Fox and this is Bloomberg Opinion Today, a regime-cum-sensibility of Bloomberg Opinion's opinions. Sign up here. AI Won't Kill All the Stonks | The rise of generative artificial intelligence looks to be a significant economic development, one that investors have reason to be excited about. So, uh, why have markets been tanking this week? There seem to be two main explanations: - It's hard to know which corporations will profit from AI and which will be wiped out by it.

- The upkeep sure seems to cost a lot of money.

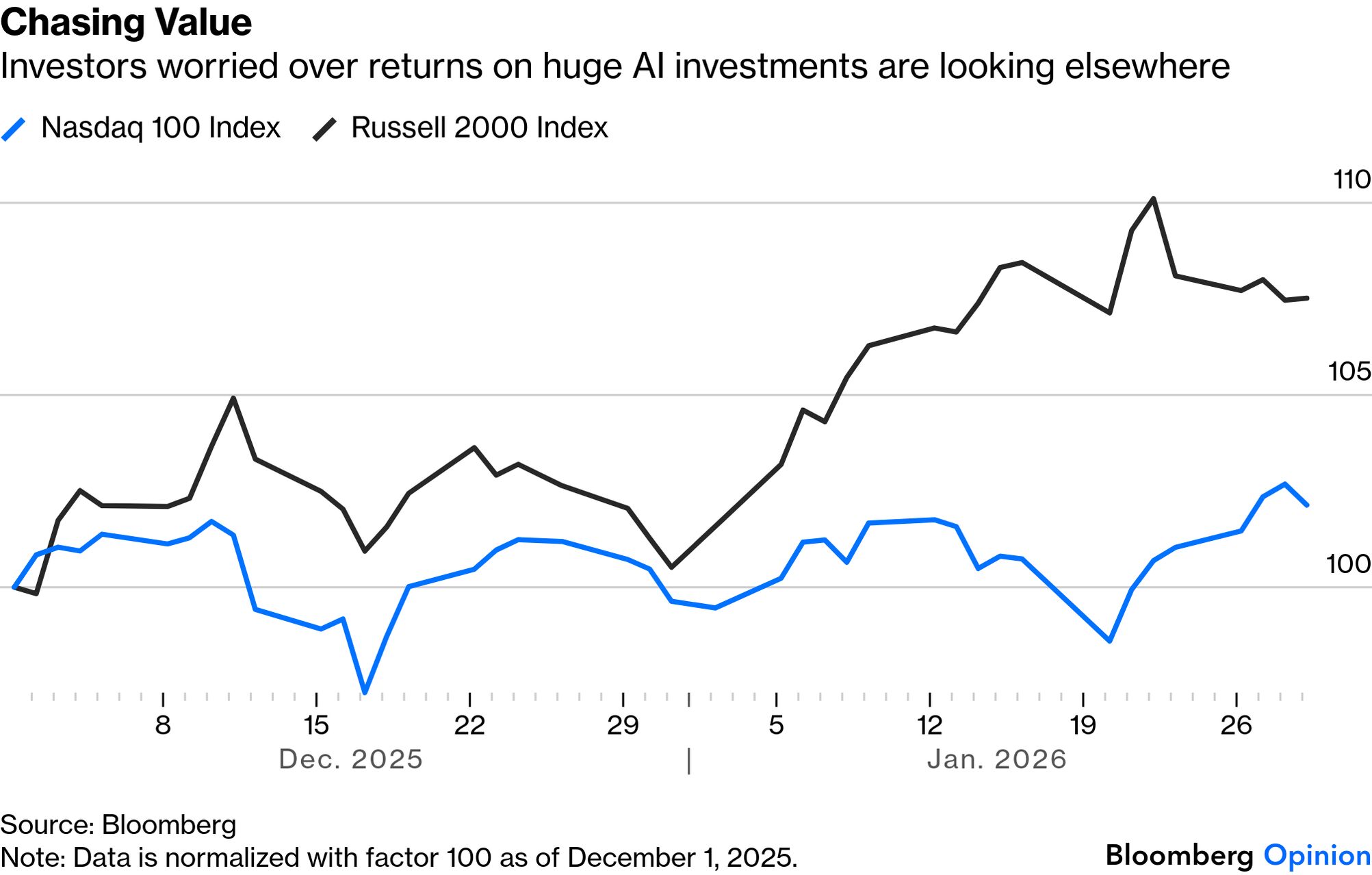

Dave Lee is of the opinion that maybe the stock market is overdoing the worries a little. (Is that something the stock market has been known to do? Yes.) In a column yesterday, he describes as "highly premature" the sudden consensus that software companies are toast because of Anthropic PBC's newest software-supplanting offering (about which Parmy Olson has more to say). Today he digs into Google parent Alphabet Inc.'s earnings report and its prediction that 2026 capital expenditures will be "in the range of $175 to $185 billion," way above the $119.5 billion projected by the Bloomberg analyst consensus. What Dave sees is a company that "has turned what looked like a mortal threat — people using AI instead of Google search" into what Alphabet Chief Executive Officer Sundar Pichai calls an "expansionary moment." Google's gigantic search business is growing fast, and Google Cloud, through which its sells AI technology to other companies, is growing even faster. For now, Dave argues, Alphabet looks to be one of the companies on AI's good side — and investors kinda-sorta agree, with its stock down early today like just about every tech stock, but nothing like last week's 10% one-day crash at Microsoft Corp. Bonus stonks reading: "This is still very much a rotation, not a selloff," writes Richard Abbey. Big, expensive tech stocks have been treading water for a while. Smaller, cheaper, mostly non-tech stocks have been doing better. What Is a Peter Mandelson? | Those of us not from the UK (and probably some people who are) have been wondering for several decades what exactly this guy Peter Mandelson does and why he keeps returning to positions of power. A TV producer who became a Labour Party spin doctor, cabinet minister and, most recently, ambassador to the US, Mandelson has frequently been caught up in controversy over the years, but somehow always landed on his feet. Now Mandelson's relationship with sexual predator Jeffrey Epstein has its own Wikipedia page and police are looking into whether he provided market-sensitive information to Epstein during the financial crisis, prompting Adrian Wooldridge to wonder if the "Age of Mandelson" may finally be over. But, um, what was the Age of Mandelson? Adrian says the "regime-cum-sensibility" had three pillars: - Bobo-ism — that is, "a combination of bourgeois and bohemian values" (in possibly related news, "Bobo" coiner David Brooks has just left the New York Times).

- Cosmopolitanism.

- Spin-doctoring.

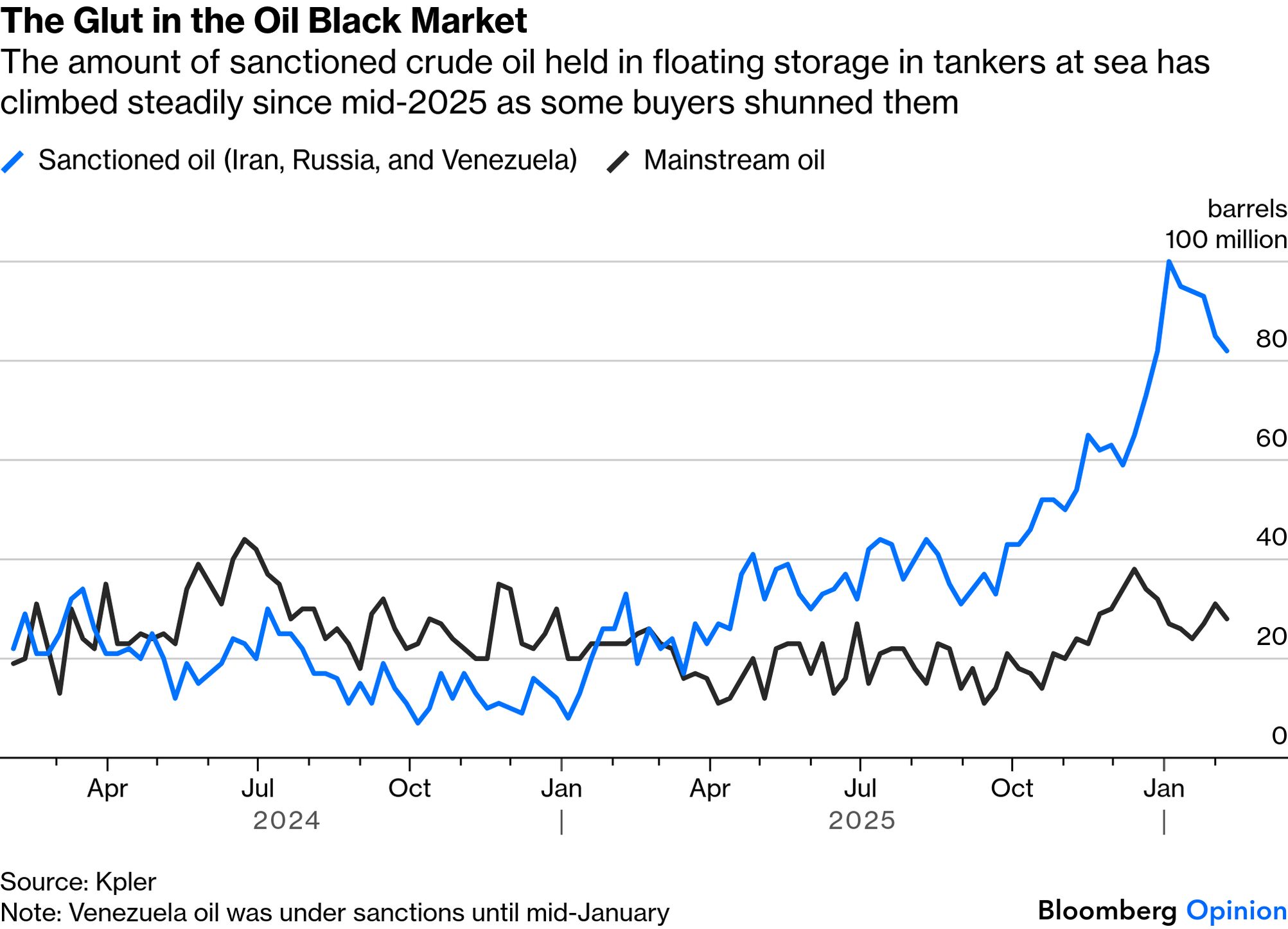

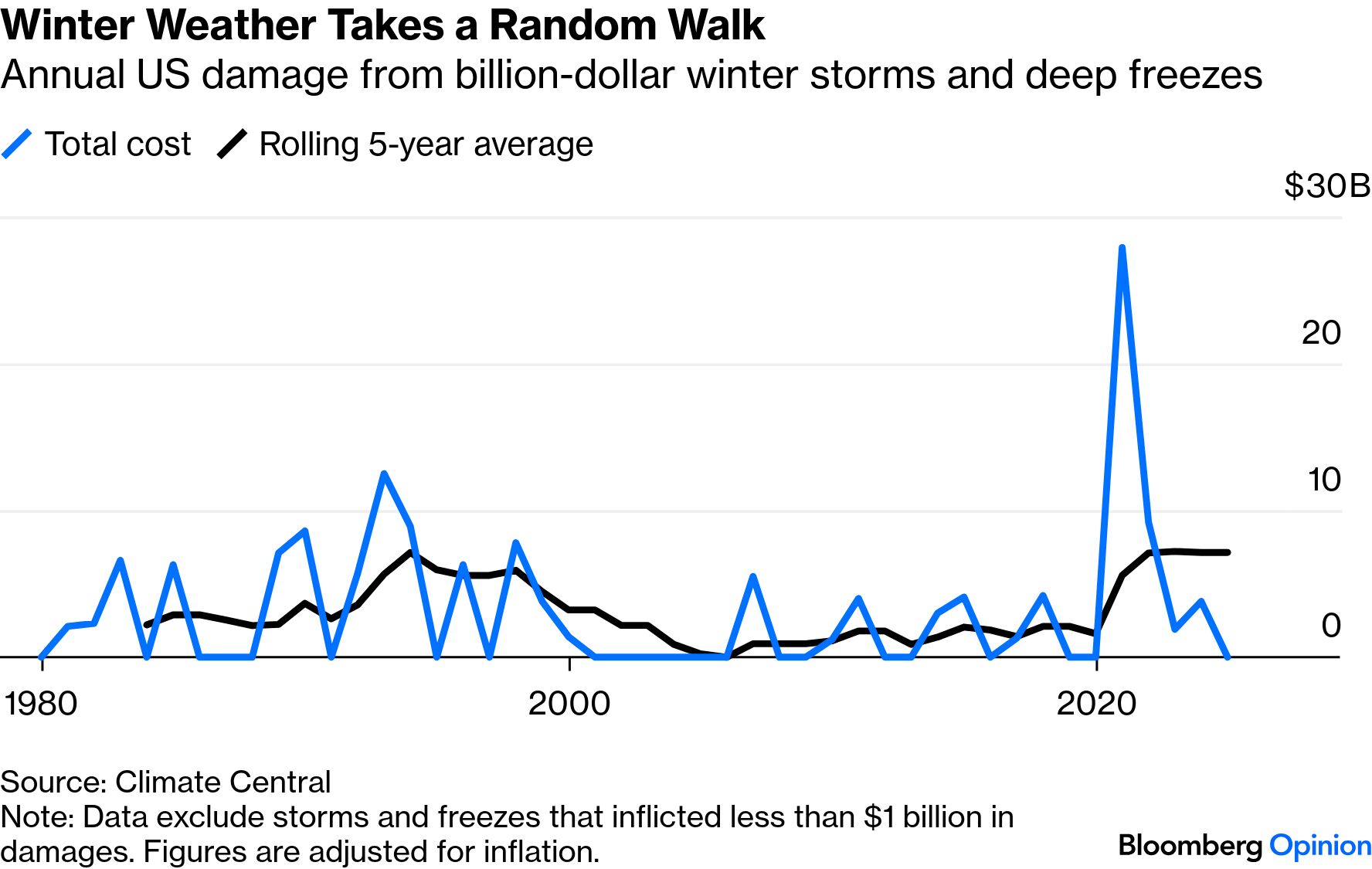

I mean, I can think of more oppressive regimes than that. But like Adrian, I too cringe when I see (and smell) people smoking weed on the sidewalk at 9 a.m. If that's Bobo-ism, then I say good riddance. Another curious thing is that Peter Mandelson is not Mr. Mandelson, he's Baron Mandelson, and it would take an act of Parliament to strip him of that title. Matthew Brooker says the Baron Mandelson predicament is just the latest in a series of embarrassments stemming from a system in which prime ministers can bestow peerages on whomever they choose. "The obvious answer is to outsource this task to an independent body that would properly vet prospective appointees," he concludes. These are tough times for black-market Iranian and Russian oil. It's not so much that US and European sanctions and political pressure are becoming more effective, writes Javier Blas. It's that the non-sanctioned oil is so cheap that it doesn't really pay to break the rules. It's been very cold lately in much of the US. Does that mean climate change is a hoax? No, last month was the fifth-warmest January on record worldwide. Mark Gongloff observes that, overall, damage from winter weather in the US shows no clear trend since 1980 — although it was especially bad in 2021 and will be again this year. It'll take more than bombs to fix Iran. — Bloomberg's editorial board Democrats have leverage over ICE. — Nia-Malika Henderson Taking on Takaichi Derangement Syndrome. — Gearoid Reidy Hollywood's boss-talent political divide is back. — Ronald Brownstein Housing affordability starts with good jobs. — Kathryn Edwards Curling shows the way for US Olympic team. — Adam Minter Five bananas won't pay the rent. — Matt Levine Credit Suisse is haunting UBS. — Paul J. Davies Bitcoin had a bad day. New Anthropic model does financial research. Top hedge fund has a divorce problem. Sir Ian McKellen as Sir Thomas More. The CIA has had it with facts. Even with a torn ACL, Lindsey Vonn can lift. Notes: Please send black-market oil and feedback to Justin Fox at justinfox@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment