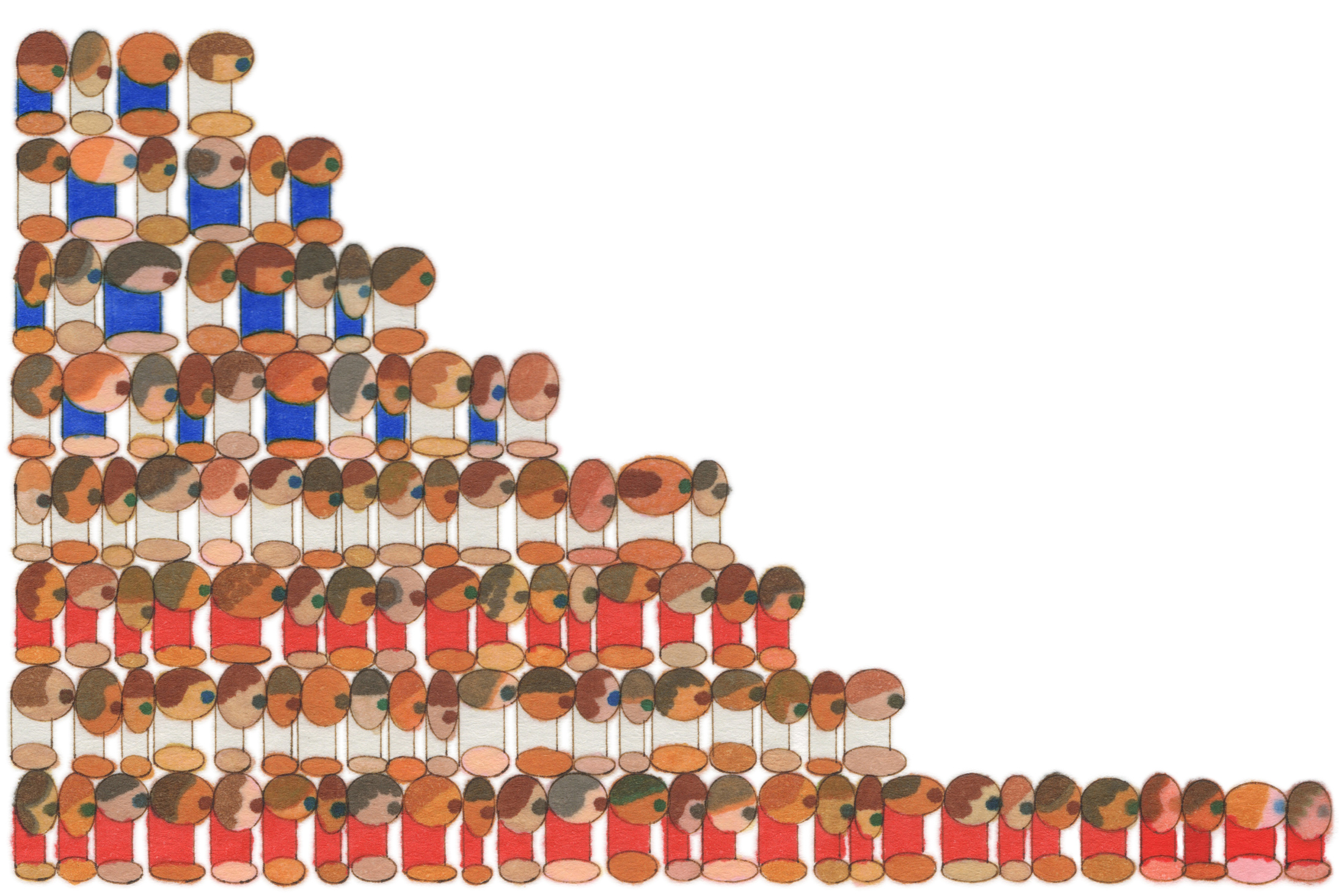

| The intrigue about who President Donald Trump would nominate to lead the Federal Reserve for the next four years is over. Bloomberg Businessweek's senior economics writer Stacey Vanek Smith writes today about what to expect if Kevin Warsh is confirmed. Plus: An interview with California Governor Gavin Newsom, and an essay on how the US population could shrink as soon as this year because of Trump's immigration crackdown. If this email was forwarded to you, click here to sign up. "Stay out of elected politics." This was Federal Reserve Chair Jerome Powell's response when asked by a reporter on Wednesday what advice he would give his successor. "Don't get pulled into elected politics. Don't do it." Less than 48 hours later, the White House announced who would be considering Powell's potentially tall order. "I am pleased to announce that I am nominating Kevin Warsh to be the CHAIRMAN OF THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM," President Donald Trump posted on his Truth Social platform early this morning. "I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is 'central casting,' and he will never let you down. Congratulations Kevin!" If Warsh, 55, is confirmed by Congress, he would take up the position when Powell's term as chair ends in May.  Warsh. Photographer: Tierney L. Cross/Bloomberg The announcement ends months of speculation about who Trump might tap for the job. At one point or another, the list of contenders included administration insiders, such as White House economist Kevin Hassett and Treasury Secretary Scott Bessent, along with Fed officials past and present, including Christopher Waller. This would be Warsh's second stint at the central bank: President George W. Bush appointed him to the Fed's Board of Governors back in 2006. The onetime Morgan Stanley executive reportedly played a key role in organizing the government's bailout of major Wall Street banks during the financial crisis. Warsh has long been known as a "hawk," someone who prioritizes price stability and tends to err on the side of higher interest rates in times when inflation is running above the Fed's target rate of 2% (as it is now). More recently, though, Warsh has criticized the central bank for being too cautious in lowering interest rates, a stance that likely helped earn him Trump's approval. Powell, whom President Barack Obama nominated to the Fed board in 2011 as a bipartisan gesture to satisfy Senate Republicans, was also known as a moderate hawk when Trump elevated him to chair during his first term. But Trump soured on his pick almost immediately, savagely attacking him and other Fed officials on social media and in public comments, calling them "boneheads" for not using monetary policy to stimulate the economy. Since returning to the White House last year, Trump and his lieutenants have waged an increasingly aggressive campaign to chip away at the central bank's independence. Bessent has called for an internal review of all Fed operations while the Justice Department has targeted Powell and Fed Governor Lisa Cook in criminal investigations. At the same time, Trump has demanded the Fed lower interest rates at a faster clip to spur growth and reduce the cost of servicing the country's giant debt pile. (Trump has said he believes the benchmark rate should be cut to 1%; it's currently about 3.5%). This week, when the central bank's rate-setting committee elected to stand pat, Trump lashed out at Powell on a social media post, saying, "He is costing America Hundreds of Billions of Dollar a year in totally unnecessary and uncalled for INTEREST EXPENSE." Trump's aggressive tactics have yielded mixed results. Globally, investors have signaled that they are troubled by the prospect of the president exerting control over the central bank by dialing back purchases of US government bonds and selling dollar-denominated assets. In an interview with Businessweek earlier this month, former Fed Chair Janet Yellen said Trump's gambit to force Powell to step down early appeared to be "backfiring." She raised the possibility that the unprecedented moves to force regime change at the central bank may harden Powell's resolve to serve out the remaining two years of his term as Fed governor, rather than exiting the central bank when a successor was confirmed, as has been routine at the institution. "Maybe somebody had the misguided notion that this is a good way to pressure Powell to leave," Yellen said. "But his interest in staying probably is higher if … he sees the Fed's independence is seriously under threat." Many also seem to believe that Warsh won't necessarily do the president's bidding if confirmed as Fed chair. After the announcement of his nomination, the dollar soared—it's poised to have its best day since July. Even President Trump seemed aware of the possibility: In a speech last week in Davos, Switzerland, Trump acknowledged that his new pick for chair might, like Powell himself, have an independent streak. "They change once they get the job … they do," he lamented. "All of a sudden it's, 'Let's raise rates a little bit.' … It's amazing how people change once they have the job. It's too bad, sort of disloyalty, but they've got to do what they think is right." Related explainer: What Does Kevin Warsh's Nomination Mean for the Fed? In Conversation With Gavin Newsom | Fresh off a recent trip to Davos, California Governor Gavin Newsom headlined a Bloomberg Newsmaker event Thursday in San Francisco. In a globe-spanning conversation with Businessweek editor Brad Stone, Newsom touched on major issues in the news, as well as on his own high-profile clashes—and uneasy personal relationship—with the US president. "I think it's important what we've done putting a mirror up to the aberrant behavior of Donald Trump," Newsom said of his meme-filled social media attacks. That, he said, "has allowed me to drive a conversation that I couldn't drive in the past." He stressed that his pushback against the administration includes measures of substance, along with the goofy AI-generated artwork, pointing to the 53 lawsuits California has filed and the coalition he's formed with other Democratic governors to protect health care and reproductive freedom. Newsom also discussed the ICE sweeps in Minnesota that led to the deaths of two US citizens, his experience at the World Economic Forum in Davos and the controversial wealth tax that may be headed to November's ballot in California. He also drew some online attention for pretending to know little about San Jose Mayor Matt Mahan, who's been critical of Newsom and announced earlier in the day he would run to succeed Newsom as governor. "I don't know enough about him," Newsom said. "I wish him good luck." You can watch the full interview here and read the write-up in our California Edition newsletter. Previously in Businessweek: 'I Want to Win': Inside Gavin Newsom's Plan for Taking On Trump |

No comments:

Post a Comment