| Read in browser | ||||||||||||||

Are investors selling America? A week of bruising global tensions revived calls to shun US assets and saw the dollar touch a four-year low. For all the hype, US companies are too big to ignore. At the margin, though, a shift is happening that could leave US equities weakened against their global peers.

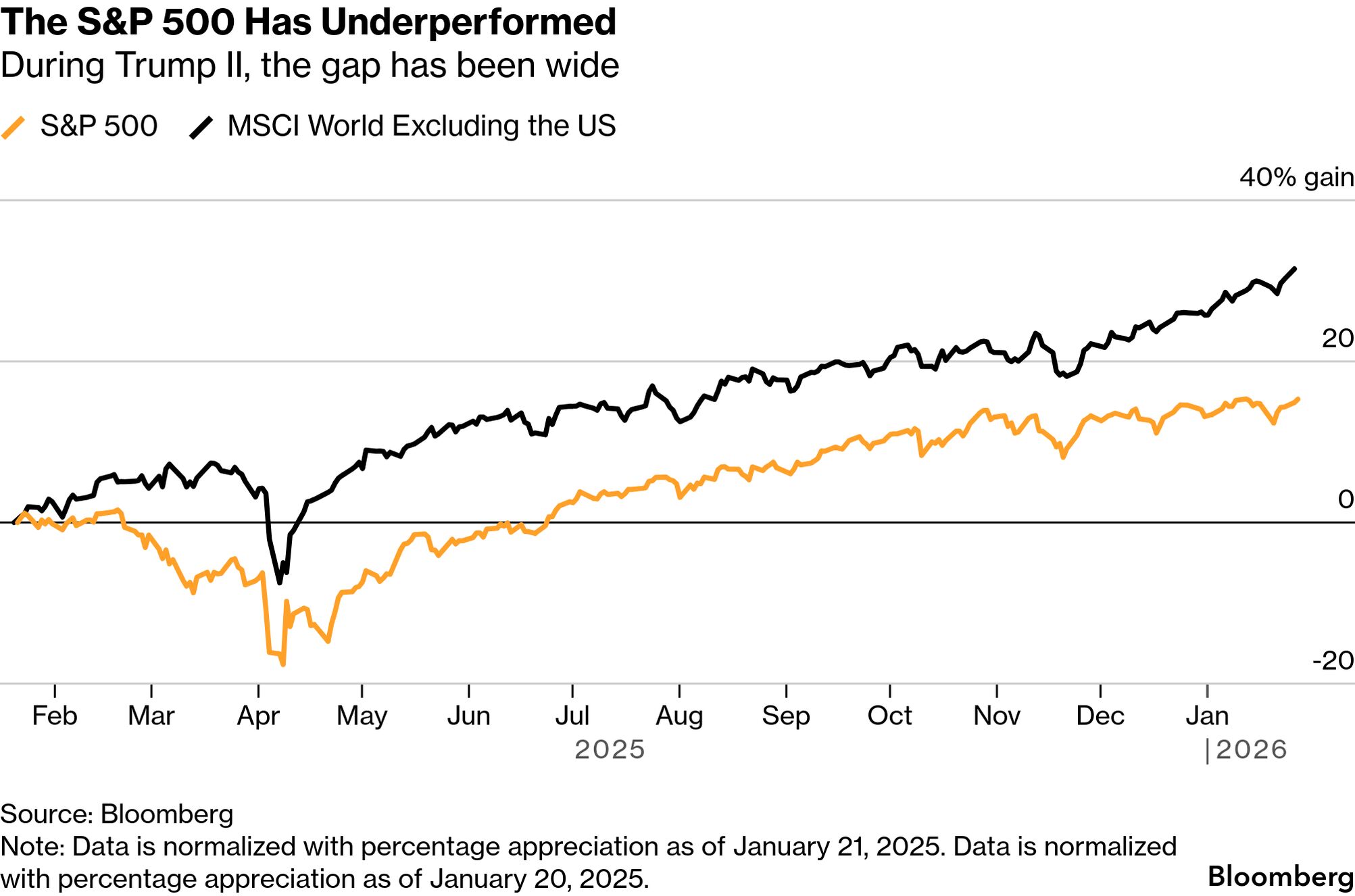

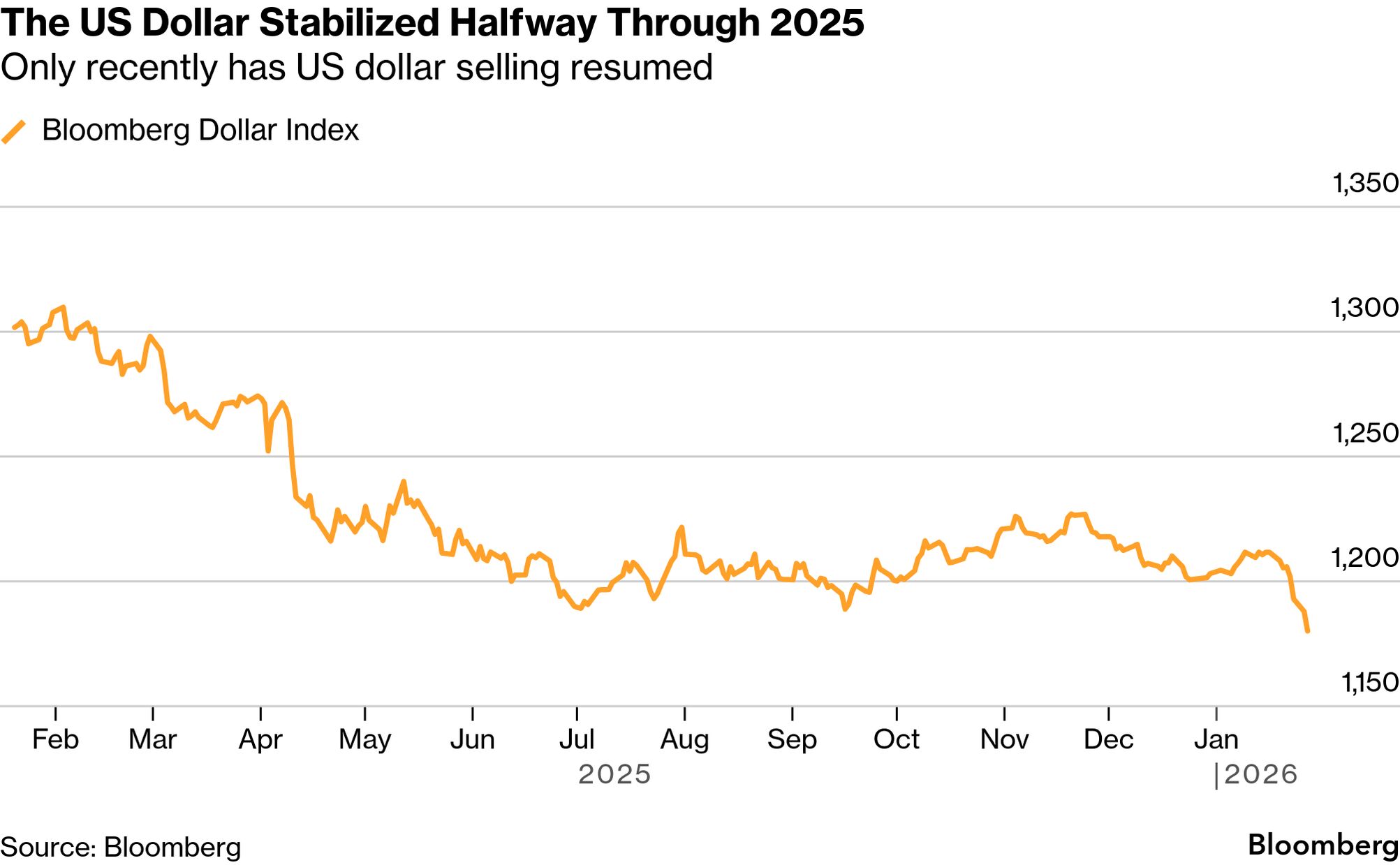

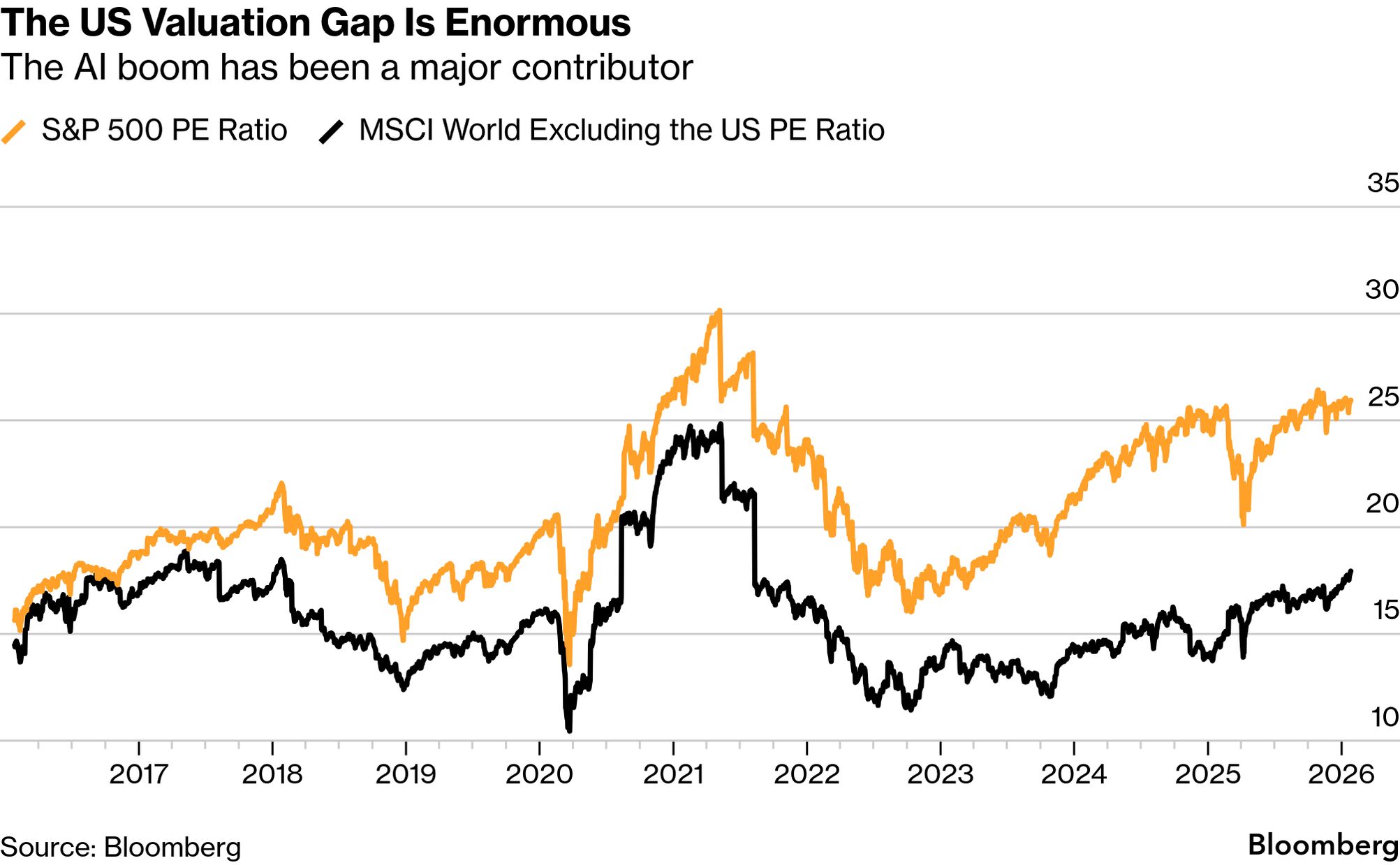

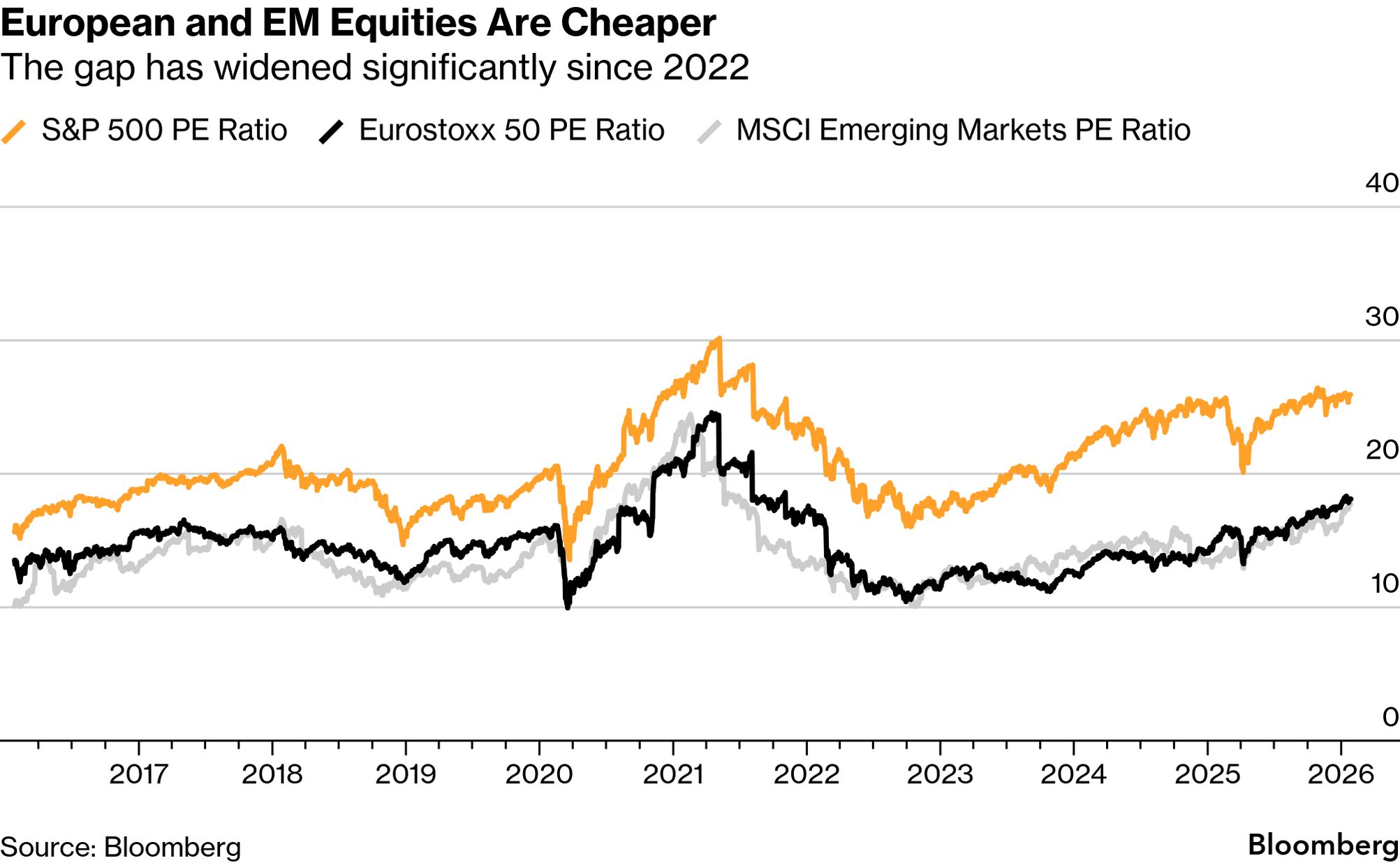

The king of market capIf you tallied up the market capitalizations of publicly traded stocks in the world, US equities would comprise about half of that value. That's just too big too ignore. What's more, the most profitable publicly-traded companies in the world are also in the US. After oil giant Saudi Aramco, the next eight companies banking the most income are all American — all of the Magnificent Seven megacap tech stocks except Tesla plus JPMorgan Chase and Berkshire Hathaway. If you're an investor looking to maximize returns, you can't help but be heavily invested in US equities. You can 'Sell America' at your own peril. But US equities just aren't keeping upFor every market narrative, there's a kernel of truth though. It's not that investors are literally rushing to the exits. But US equity markets have vastly underperformed global markets since Donald Trump returned to power a year ago, even as the S&P 500 has been climbing to record highs.  When measured on a purely aggregate basis, US equities did pretty well in 2025. The S&P 500 was up 16%, with dividends taking the total return to a hair under 18%. On a relative basis though, it was the first time in 20 years that the US was the worst-performing major equity market. Even worse, the Bloomberg US Dollar Index fell by over 8% in that time span, the steepest decline since 2017, making it the second worse year for the dollar in at least two decades. For investors with many options outside the US, sticking with America hurts. How are we to square a record-breaking market with this narrative? As I wrote last April after the Trump Administration announced a perplexing list of levies on every trading partner and beyond, the America First agenda "greatly undermined both trust in the rule of law and in the continued outperformance of the US economy." US stocks and the dollar took a hit as Trump's policy agenda was taking shape during the first three months of his presidency. They have since recovered thanks to Trump's ability to backtrack on his most draconian policy proclamations, the importance of the US market and the resilience of its economy. We had a similar scenario playing out after the Greenland standoff rekindled trade tensions, with both dollar and equity selling. But while US stocks quickly bounced amid continued corporate earnings growth, they're still lagging global peers. The total return on global equities is outpacing the S&P 500 since the April 2 'Liberation Day' by over 8 percentage points.  That's well short of a 'Sell America' trade but the seeds of mass selling once the US economy stumbles or the AI bubble pops have been sown. The valuation gapThinking about asset allocation going forward, it's notable that, since the advent of the artificial intelligence investment wave, the valuation gap between US equities and other markets has widened.  We should expect that gap to narrow, suggesting being underweight US equities makes sense going forward. Some of the beneficiaries of that pivot — with the exception of Japan and the UK — could be captured via the Eurostoxx 50 and the MSCI Emerging Market Index, both of which outperformed the S&P 500 last year and are still much cheaper.  Digging deeper in Europe, Spain's IBEX 35 is trading at 15 times earnings even after a 44% surge in the last 12 months. The MSCI Emerging Market index shows similar performance with a 40% rise and a price/earnings ratio of 18 times. Now contrast these to the S&P 500 — up just 15% over the same period and trading at 26 times earnings. Japan is another attractive investment alternative as I mentioned a few months back. Since the beginning of 2025, where the total return on the S&P 500 has been 20%, the Nikkei 225 has returned nearly 40% in US dollar terms. That outperformance could continue as both major political parties in the country are calling for high levels of fiscal stimulus. What makes the case for Japan even more interesting is that interest rates are finally rising after being kept low for decades. Low costs had encouraged investors to borrow the yen to fund the purchase of higher-yielding assets outside of Japan, a strategy known as the 'carry trade'. US equities have been a beneficiary of that trend. The Bank of Japan is now raising interest rates pushing long-term yields higher. At some point, that will make the carry trade strategy untenable. Before long, Japanese investors could start rebalancing toward domestic equities. None of this suggests foreign investors are collectively selling down US assets — at least not as long as the economy is strong. Still, with the US rally narrowly concentrated in megacap tech and high valuations to boot, a re-balancing out of US equities is clearly underway. Things on my radar

More from BloombergEnjoying The Everything Risk? Check out these newsletters:

You have exclusive access to other subscriber-only newsletters. Explore all newsletters here to get most out of your Bloomberg subscription.  Follow us You received this message because you are subscribed to Bloomberg's The Everything Risk newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Wednesday, January 28, 2026

Is ‘Sell America’ even a real thing?

Subscribe to:

Post Comments (Atom)

The difference between a double and expiring worthless

Three people asked me how I timed it. Fair question. ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment