| Read in browser | ||||||||||||||

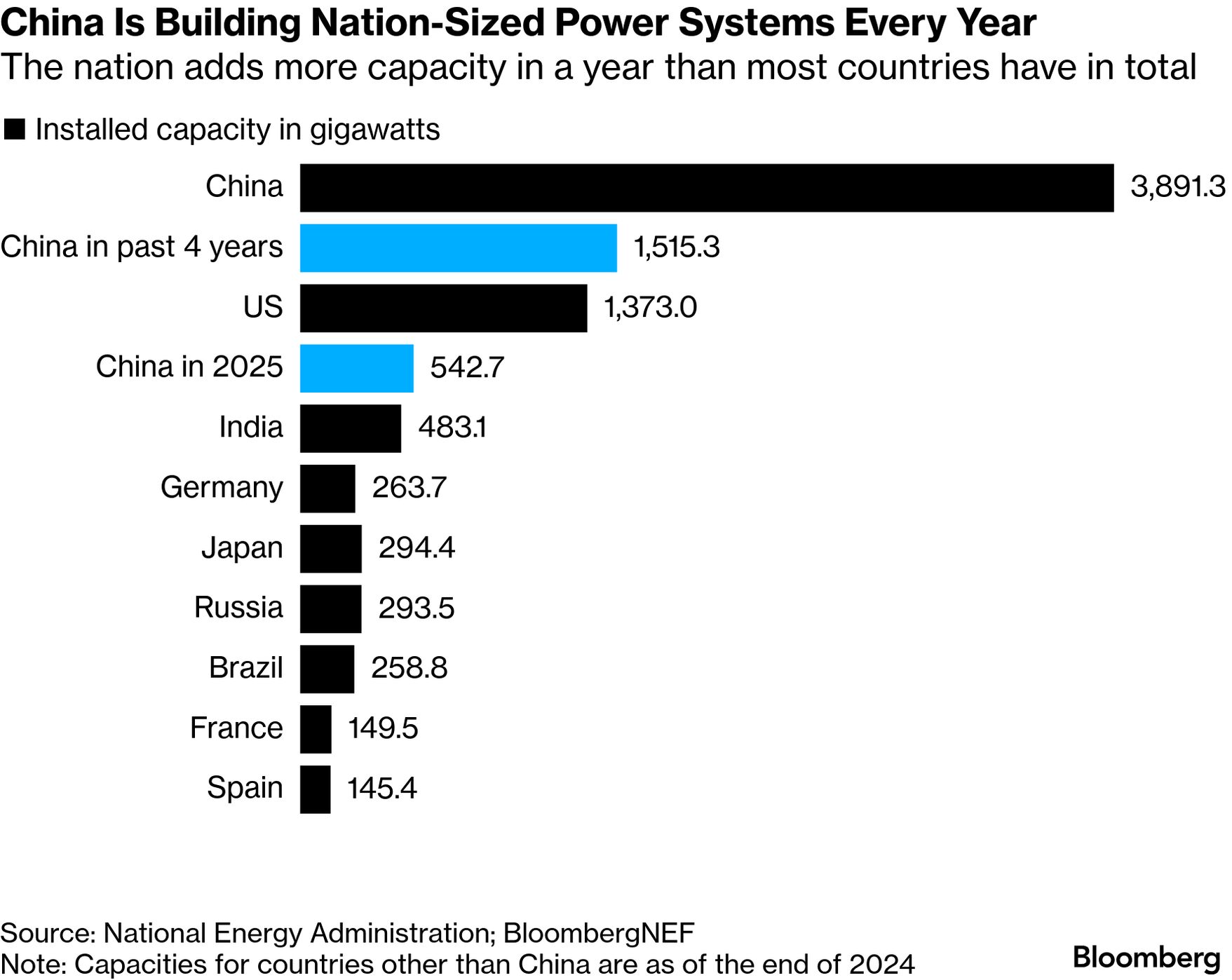

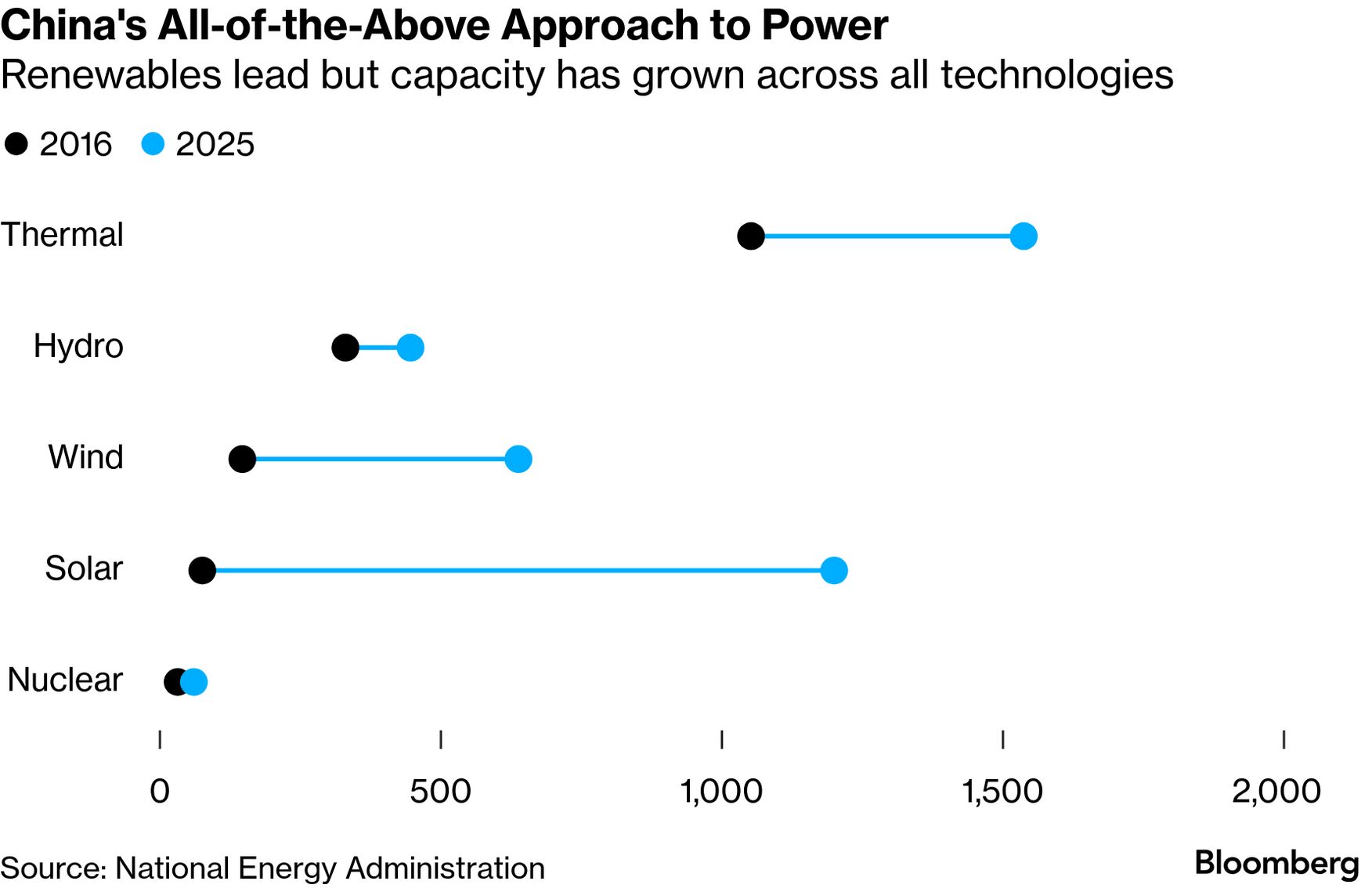

China's energy-building rush has no match. In the past four years, it has added more power generation than the entire US system. Today's newsletter looks at how China is gaining an edge over new power-hungry technologies by ensuring a stable and abundant energy supply and reducing its dependency on fossil fuels. Meanwhile, New York and other East Coast cities are still in the grips of bone-chilling temperatures. Residents may get a break from the cold next week — only for another storm to hit the region. We also look at how power outages add billions in hidden disaster costs and why California's clean air regulator cheered Canada's deal to import Chinese EVs. Subscribe to Bloomberg.com for unlimited access to all our stories. Energy spending spreeChina is undertaking an energy-building boom unlike anything the world has ever seen, as Beijing seeks to ensure supply for power-hungry facilities that are key to dominating emerging industries of the future. The nation added 543 gigawatts of new capacity across all technologies last year, according to data from the National Energy Administration on Wednesday. That's 12% more than all the power plants combined in India as of the end of 2024. The generation China has added since the end of 2021 is also larger than the entire US system.  President Xi Jinping's aims are to ensure a stable and abundant energy supply, limit dependence on fuel imports, and to hand a competitive advantage to growing, and energy-hungry, industries like artificial intelligence, robotics manufacturing and advanced materials — just as concerns rise those sectors could be constrained in the US by a lack of cheap electricity. "The build-out remains very strong, with super robust numbers going from record to record," said Michal Meidan, the head of China energy research at the Oxford Institute for Energy Studies. "The priority is security of supply, and not just that, but the availability of competitively priced energy." China is taking an all-out approach to energy sources. Solar accounted for more than half of new additions last year, while installations of wind farms and thermal plants that burn coal and natural gas were also at records, according to NEA data. Nuclear and hydropower posted smaller increases but are poised to play a much larger role in the future. The nation has the world's biggest pipeline for atomic reactor construction and is planning to make a massive hydropower project in Tibet the world's largest power plant. Building officially started on the $167 billion facility in July.  Capacity additions have been far slower in the US after power demand appeared to plateau decades ago. Now, the country is struggling to meet the needs of power-hungry data sectors following the rapid development of AI, leaving electricity markets very tight, said Samantha Dart, the co-head of global commodities research at Goldman Sachs Group Inc. "The US might face a bottleneck whereas China doesn't seem to be bottlenecked at all," she said. Beijing now has to decide where things go in the future. The massive additions of wind and solar have at times overwhelmed the grid, leading to small rises in curtailment. And even as the country builds new coal power plants, all the new clean energy means they're being used less. "Coal plant retirements are really slow, utilization is dropping, and yet new capacity keeps being added," said Belinda Schäpe, a China policy analyst at the Centre for Research on Energy and Clean Air. "It's becoming quite ridiculous." Read the full story on Bloomberg.com and subscribe to Green Daily for more exclusive data and analysis on China's bid to dominate power markets. Power supernova30% China's electricity share of final energy consumption Tilting scales"Leadership in the AI race, which sits with the US now, might over time shift to China" Samantha Dart Co-head of global commodities research at Goldman Sachs Group Snowpocalypse, take two?By Brian K Sullivan, Leslie Kaufman The odds that another winter storm will pummel the US East Coast early next week are rising, putting power grids to the test again as the region recovers from a larger system that upended travel and triggered widespread blackouts. Eastern North Carolina, extreme southeastern Virginia and eastern Massachusetts have 60% chance or more of minor weather impacts from a storm, according to the US Weather Prediction Center. A wider area from South Carolina to Massachusetts, including Long Island and coastal New Jersey, has a 40% or higher chance of moderate effects from Feb. 1 to Feb. 2. The details of next week's system are still uncertain, and the forecast could still shift.  A resident clears snow in Somerville, Massachusetts Photographer: Mel Musto/Bloomberg The storm comes on the heels of a larger system that dropped more than a foot of snow across a wide part of the US from the Mississippi River to the Atlantic, including New York City, snarling air travel and knocking out power to hundreds of thousands of customers. That storm, exiting Maine on Tuesday, is leaving frigid air in its wake, adding to the misery of those without power in regions where electric heat is the primary source for warming homes and businesses. Regulators have warned that rising power demand from data centers and electrification is increasing the risk of winter blackouts, particularly during extended periods of extreme cold. One early estimate suggested this week's storm could result in $24 billion in total economic losses. But a new analysis by RMI, a clean energy nonprofit, suggests that the current methods for counting the damages from power outages mean we are likely undercounting their impact — and those of similar storms — by a significant margin.  Snow is cleared at Ronald Reagan Washington National Airport (DCA) in Arlington, Virginia, US Photographer: Valerie Plesch/Bloomberg Current insurance metrics focus too narrowly on physical property damage while ignoring the "non-linear compounding losses" that occur when the grid stays down, such as food and medicine spoilage, as well as transportation disruptions that can extend well beyond the outage area. Traditional estimating tools like the Value of Lost Load (VoLL) fail to capture the reality of a multi-hour blackout beyond a given time window or narrow geography, the authors say. This gap may be massive: In the aftermath of Hurricanes Sandy and Harvey, one study found that business interruption losses were 800% to 900% higher than actual property damages. Even if business interruptions added just 30% to 50% to direct totals, the RMI authors noted, it would imply at least an additional $35 billion per year that isn't captured in US disaster-loss calculations. The costs of winter weather in the US are mounting: According to reinsurer Swiss Re, annual insured losses from winter storms averaged $7 billion from 2021 to 2025, more than triple the average from 2011 to 2020. You can subscribe to Bloomberg News for all the latest on extreme weather and its impacts around the world, and read the story on how insurers could capture the real cost of disaster. More from Green California Air Resources Board chair Lauren Sanchez speaks during the BNEF Summit. Photographer: Randall Gee California's top environmental regulator lauded a trade deal Canada struck to import electric cars from China as a win in the global effort to replace gas vehicles. "I'm excited to see what unfolds in Canada now after you see what the prime minister announced," California Air Resources Board chair Lauren Sanchez said Tuesday during a BloombergNEF summit in San Francisco. "It only reinforces that the Trump administration is going it alone." China and Canada reached a wide-ranging agreement to lower trade barriers and rebuild ties earlier this month, signaling a pivot in Canadian foreign policy and a break from alignment with President Donald Trump's trade agenda. Canada's Prime Minister Mark Carney agreed to allow 49,000 Chinese electric vehicles into its market at a tariff rate of about 6%, removing a 100% surtax, in response to Chinese leader Xi Jinping cutting tariffs on canola, a key Canadian agricultural export. The move sent shockwaves through the US auto industry, where executives fear Canada could become a back door to the US market for cheap Chinese cars, and prompted Trump to threaten a 100% tariff on Canadian exports to the US. Read the full story. Photo finish Heavy snow falls on Madrid, Spain, on Jan. 28 Photographer: Fabiola de Moura Snow is everywhere these days, even in Madrid, which hadn't seen heavy snowfall in five years. Still, the white flurry left only a thin cover of snow in some neighborhoods and by midday the sun was already up. Storm Kristin, which is barreling across Iberian Peninsula, has left 2 dead in Portugal and about 1 million people without power due to hurricane-force winds. More from Bloomberg

Explore all Bloomberg newsletters. Follow us You received this message because you are subscribed to Bloomberg's Green Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Wednesday, January 28, 2026

China eclipses the entire US grid

Subscribe to:

Post Comments (Atom)

This options discovery started as a quiet test… then the numbers piled up

What showed up in 2025 made it impossible to ignore View in browser View in browser For almost 3 decades now, I’ve tra...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment