| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm John Ainger, Bloomberg climate and energy reporter, bringing you the latest from the EU. Make sure you're signed up. Donald Trump's "beautiful armada" — led by the USS Abraham Lincoln — has arrived in Middle Eastern waters, and the US president warned that the threat of military strikes is a real possibility unless Iran comes to the table to forge a nuclear deal. Brent crude futures hit $70 a barrel for the first time since September today, with Trump's belligerent tone injecting a risk premium into prices. While not included in Trump's latest military endeavor, the EU is ratcheting up economic pressure. Foreign affairs ministers meeting in Brussels today adopted additional sanctions following a brutal crackdown on protests that has killed thousands of civilians. They're also poised to designate the Islamic Revolutionary Guard Corps, or IRGC, a terrorist organization. This is a call "to return the capacity to Iran's people to decide for, and by, themselves their own future," Jean-Noël Barrot, France's foreign minister, said ahead of the talks. "No one else can do it in their place."  Jean-Noël Barrot. Photographer: Jeremy Suyker/Bloomberg It comes just months after foreign ministers from France, Germany and the UK and the EU's top envoy held talks with their counterpart, Abbas Araghchi, to try to avert a full-blown crisis. Much of what happens in coming days will depend on how the IRGC responds, Patrick Sykes and Dina Esfandiary reported in a must-read analysis this month. Decades of Western sanctions have supercharged the organization's rise from a branch of the military to a gargantuan economic and political force. That means it has the most to lose if the system falls. Our colleagues at Bloomberg Economics believe that strikes on Iran are "likely," unless it disbands its atomic program — something it's long resisted. For its part, Tehran has said it's ready for dialog but warned it would respond with unprecedented force if pushed. The Latest

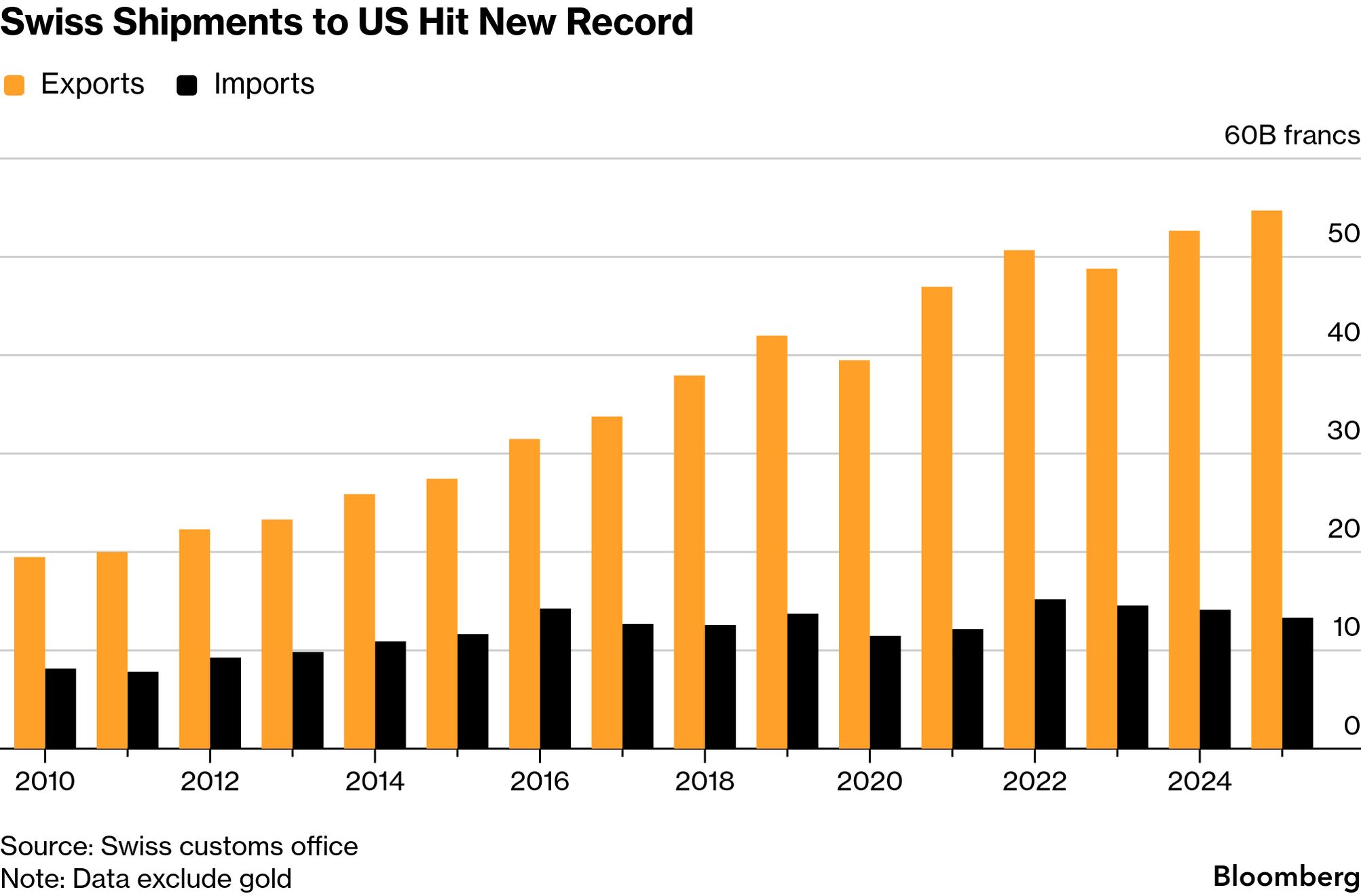

Seen and Heard on Bloomberg Deutsche Bank is enjoying a "really strong start" to 2026 after it closed out a record year for profit with higher trading income and a new share buyback, according to CFO James von Moltke. The results were overshadowed by a surprise raid on its headquarters yesterday, as part of a money laundering probe looking at past dealings by staff with firms linked to Roman Abramovich. "We're cooperating as we do in each case with the prosecutor in their search," von Moltke told Bloomberg TV. Chart of the Day Switzerland exported a record amount of goods to the US last year despite Trump slapping some of his highest tariffs on the country. Swiss shipments worth $71.5 billion — excluding gold — went to the world's biggest economy, a 3.9% increase from the previous year, according to official data. Coming up

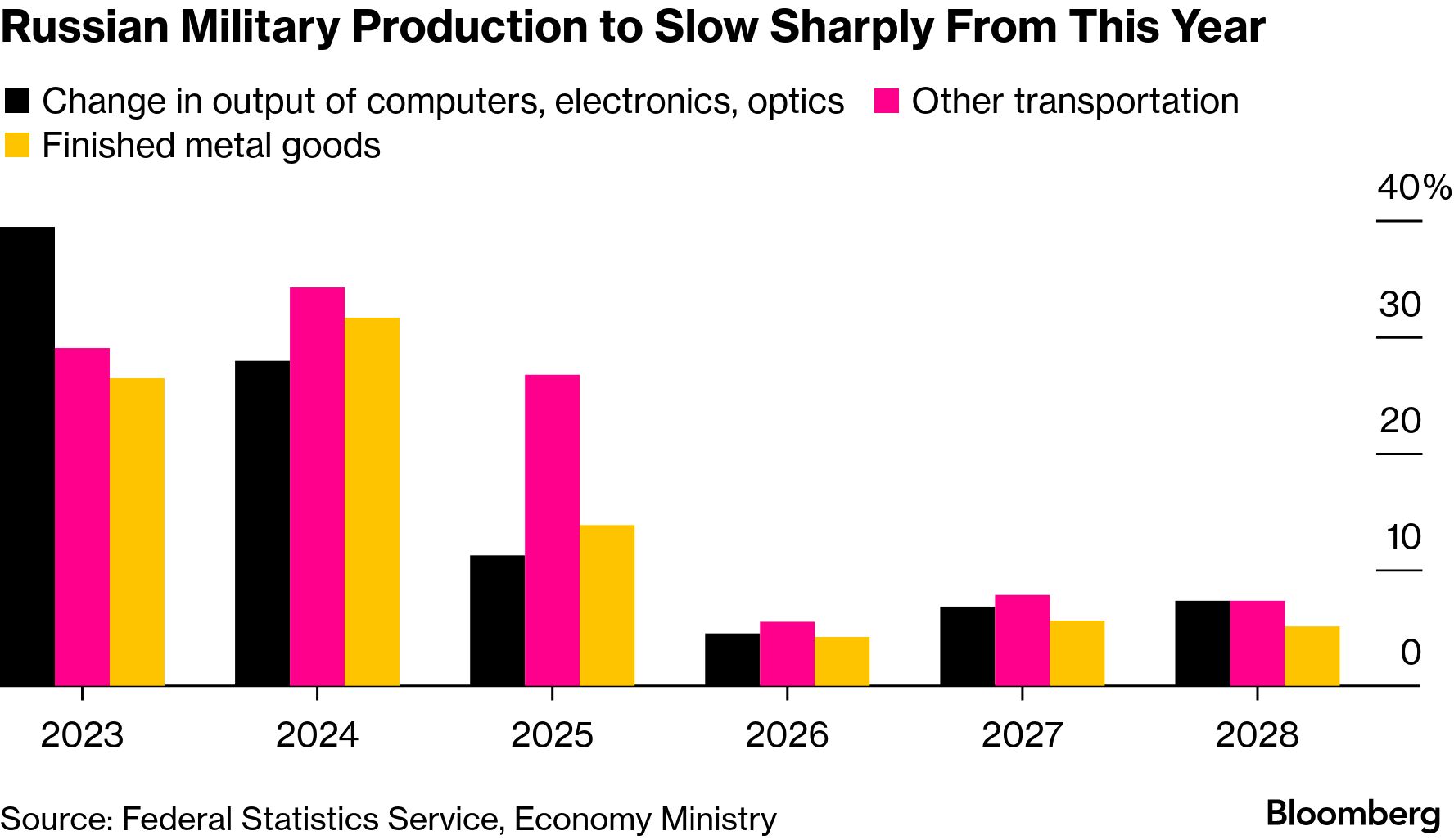

Final Thought Russia's defense industry is poised to pare back production significantly this year as the Kremlin prioritizes economic stability and balancing finances over further increases in spending on the war in Ukraine. Sectors tied to state defense orders, including for military equipment and components, drones and ammunition, will see annual growth of just 4% to 5% in 2026, compared with roughly 30% in recent years, according to data from the Economy Ministry in Moscow. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Thursday, January 29, 2026

Brussels Edition: Iran on the brink

Subscribe to:

Post Comments (Atom)

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

-

PLUS: Dogecoin scores first official ETP ...

No comments:

Post a Comment