| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm John Ainger, Bloomberg climate and energy reporter, bringing you the latest from the EU. Make sure you're signed up. An EU commitment to buy $750 billion of American energy was one of the most eye-popping elements of last summer's Turnberry trade agreement — inked at the Donald Trump-owned golf course in Scotland. Now some are starting to blink. At the time, it was seen as a necessary, if ambitious, overture to the US president's fascination with big numbers. Yet it also acknowledged the reality that the US would become the EU's dominant supplier of liquefied natural gas in the years to come, with the bloc set to ban all Russian imports of the fuel from 2027. Over the past week, however, a nagging fear has spread that Europe is falling into a familiar trap.  European Commission President Ursula von der Leyen and US President Donald Trump in Turnberry, Scotland on July 27. Getty Images Europe Europe's dependence on Russian energy grew from a "gas for pipelines" deal struck between West Germany and the Soviet Union in the 1970s, building until Russia supplied nearly half of the EU's demand for the fuel before the invasion of Ukraine in 2022. The conflict sent prices to record highs as the EU tried to wean itself off its addiction, raising the specter of deindustrialization in Germany and beyond. America now provides almost 60% of the EU's LNG. Though more expensive than Russian pipeline gas, those supplies are set to form the bedrock of Europe's future energy mix — at least until the bloc reaches net-zero by the middle of the century. As much as 80% of its LNG imports could come from the US by 2030. That has more than a whiff of energy dependence and Trump's bellicose rhetoric over Greenland is shifting the calculus. EU Energy Commissioner Dan Jorgensen today said threats over the Arctic island are a "wake-up call" for the bloc, which is "actively looking" to further diversify its LNG supplies.  Dan Jorgensen Photographer: Simon Wohlfahrt/Bloomberg Those echoed similar comments in recent days, with Fatih Birol, executive director of the International Energy Agency, warning against Europe putting all its "eggs in one basket." To be clear, Europe is a key buyer of US energy and so the prospect of Trump cutting off supplies is small, and deals are struck between companies, not countries. Yet any reliance would still give America leverage in an increasingly fractious geopolitical environment. The problem is that Europe is "energy poor" and doesn't have many alternatives. Norway's production is already stretched, while other big suppliers like Qatar have issued warnings about the burdensome red tape of doing business with the bloc — particularly laws aimed at curbing environmental damage and human rights violations in the supply chain. In the wake of Russia's invasion of Ukraine, the EU decided to accelerate the buildout of renewables. Amid a green backlash, the question is whether it can do so again. The Latest

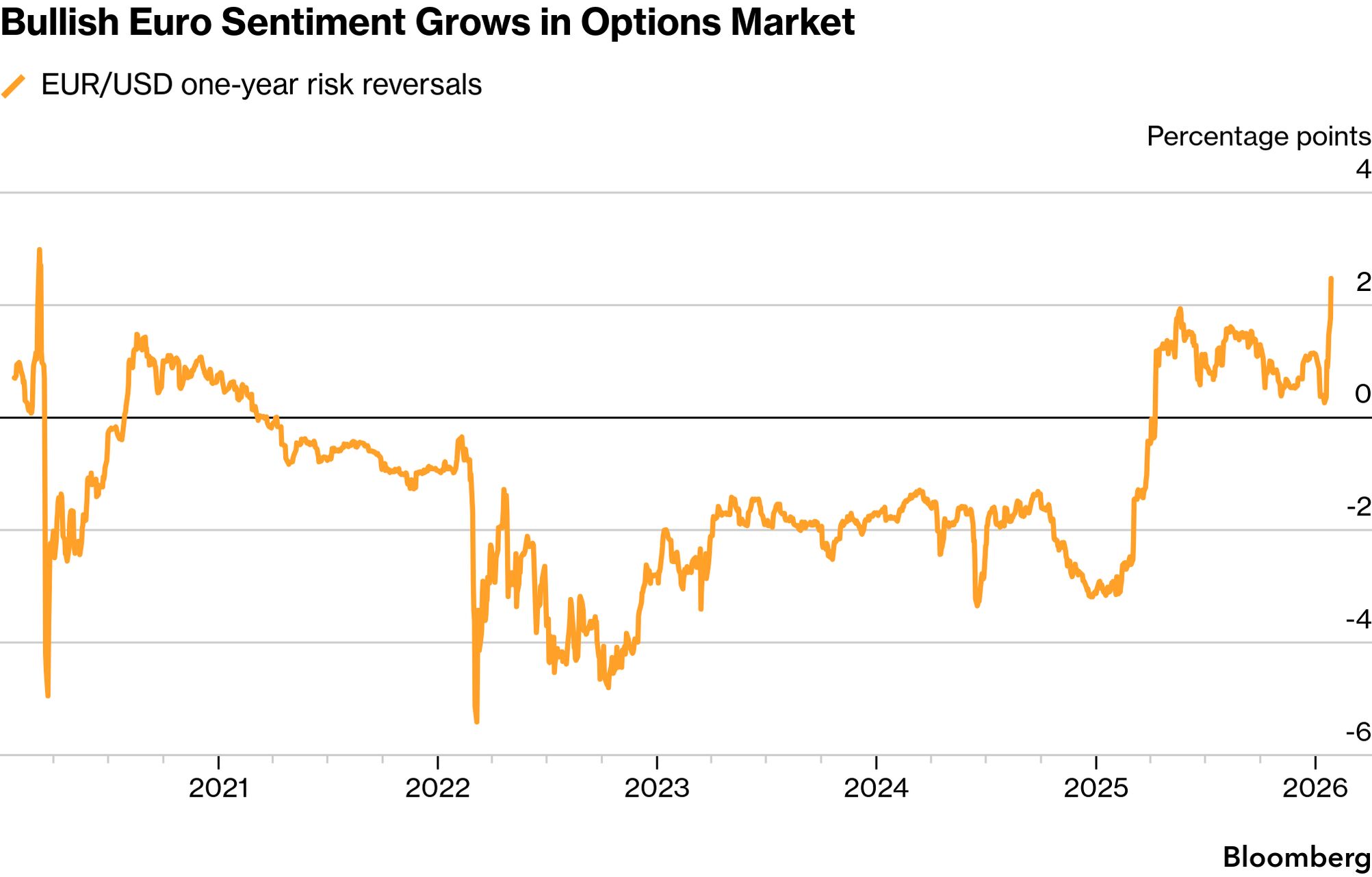

Seen and Heard on Bloomberg French Finance Minister Roland Lescure said France's G-7 presidency will seek "diagnosis" and "action" on imbalances in the global economy, particularly China's vast trade surpluses with the US and Europe. "This is obviously unsustainable," he told Bloomberg TV after chairing a meeting of his G-7 counterparts. "We need to invest more in Europe. There should probably be less twin deficits in the US, and certainly China has to engage into a more consumption-led economy." Chart of the Day The ECB is closely watching how an appreciating euro is affecting inflation and will consider the impact when setting monetary policy, according to Governing Council member Francois Villeroy de Galhau. While reiterating that officials don't have any target for the exchange rate, the French central banker joined others in warning that further euro strength could weigh on consumer prices. Coming Up

Final Thought Items for sale in the window of a Louis Vuitton store in Paris. Bloomberg LVMH had a poor Christmas and indicated 2026 won't get much better, dampening investors' hopes of a rebound for the luxury sector. The owner of brands such as Louis Vuitton and Christian Dior posted a worse-than-expected 3% drop in organic sales in the fourth quarter at its main fashion and leather goods unit. CEO Bernard Arnault told investors that 2026 is unlikely to be straightforward and the group would limit spending as a result. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Wednesday, January 28, 2026

Brussels Edition: A familiar trap

Subscribe to:

Post Comments (Atom)

America’s New AI “Moonshot” Has Already Begun

When Washington decides it can't lose, the buildout shifts into overdrive... America’s New AI “Moonshot” H...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment