| Read in browser | ||||||||||||||

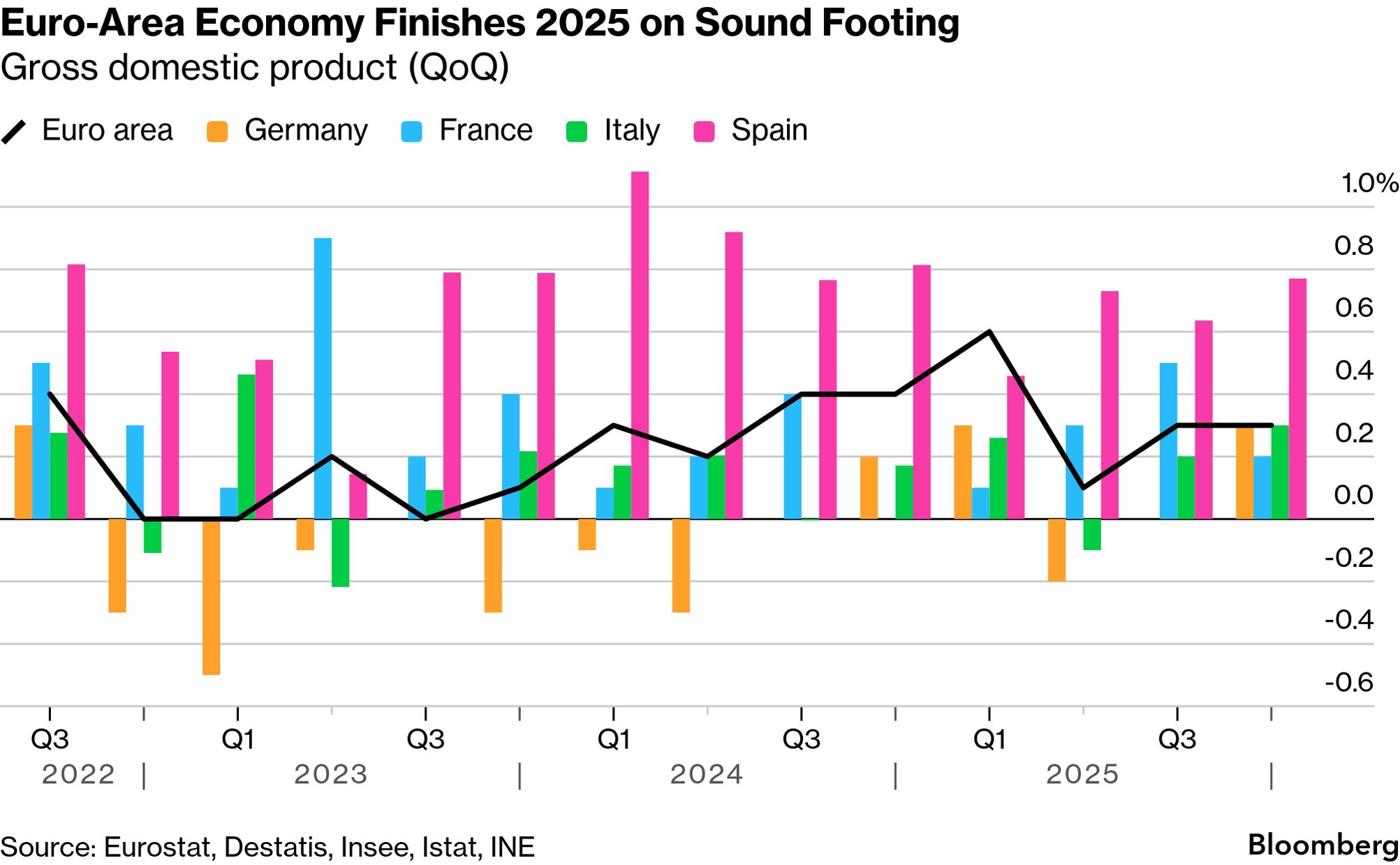

Welcome to the Brussels Edition. I'm Suzanne Lynch, Bloomberg's Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you're signed up. Some of the EU's economic behemoths shrugged off the trade turmoil unleashed by US President Donald Trump to post better-than-expected growth. Overall, the euro zone grew by 0.3 per cent in the last quarter of 2025. Germany, Italy and Spain all surpassed estimates, with the latter once again the standout performer with an expansion of 0.8%. At 0.2%, meanwhile, France matched forecasts. The positive news comes as markets digest Trump's pick of Kevin Warsh to succeed Jerome Powell as chair of the Federal Reserve. Confirmation of who will take over one of the biggest jobs in banking when Powell's term ends in May has given some direction to markets after a whirlwind week. Warsh, who will need Senate approval, has aligned himself with the president in recent months by arguing publicly for lower interest rates, a position that belies his longstanding reputation as an inflation hawk.  The main market impact so far has been a bump for the dollar, reversing an extended slide, while gold and silver also fell this morning in anticipation of the Warsh announcement. The dollar's rise is likely to be welcomed on this side of the Atlantic, as the European Central Bank looks ahead to its rate-setting meeting next week. Though analysts expect the ECB to keep rates steady, the recent dollar rout this month has given food for thought to decision-makers. The euro briefly traded above $1.20 on Wednesday – the highest since 2021. That's a potential headwind for the euro zone economy given the bloc's dependence on exports. German inflation also edged past 2% ahead of next week's meeting. Separately, in a sign of potential waning enthusiasm for the US investment case, Dutch pension fund PME is pivoting toward more European opportunities, especially in the technology sector. The US is "no longer the reliable ally it once was," PME Chairman Alae Laghrich said yesterday. While Laghrich acknowledged that the US economy can't be ignored, he listed Trump administration policies such as trade tariffs, as well as what he called "threats and not upholding existing agreements" as reasons for the fund's decision. Whether PME's move is a bellwether for a broader investment shift is yet to be seen. The Latest

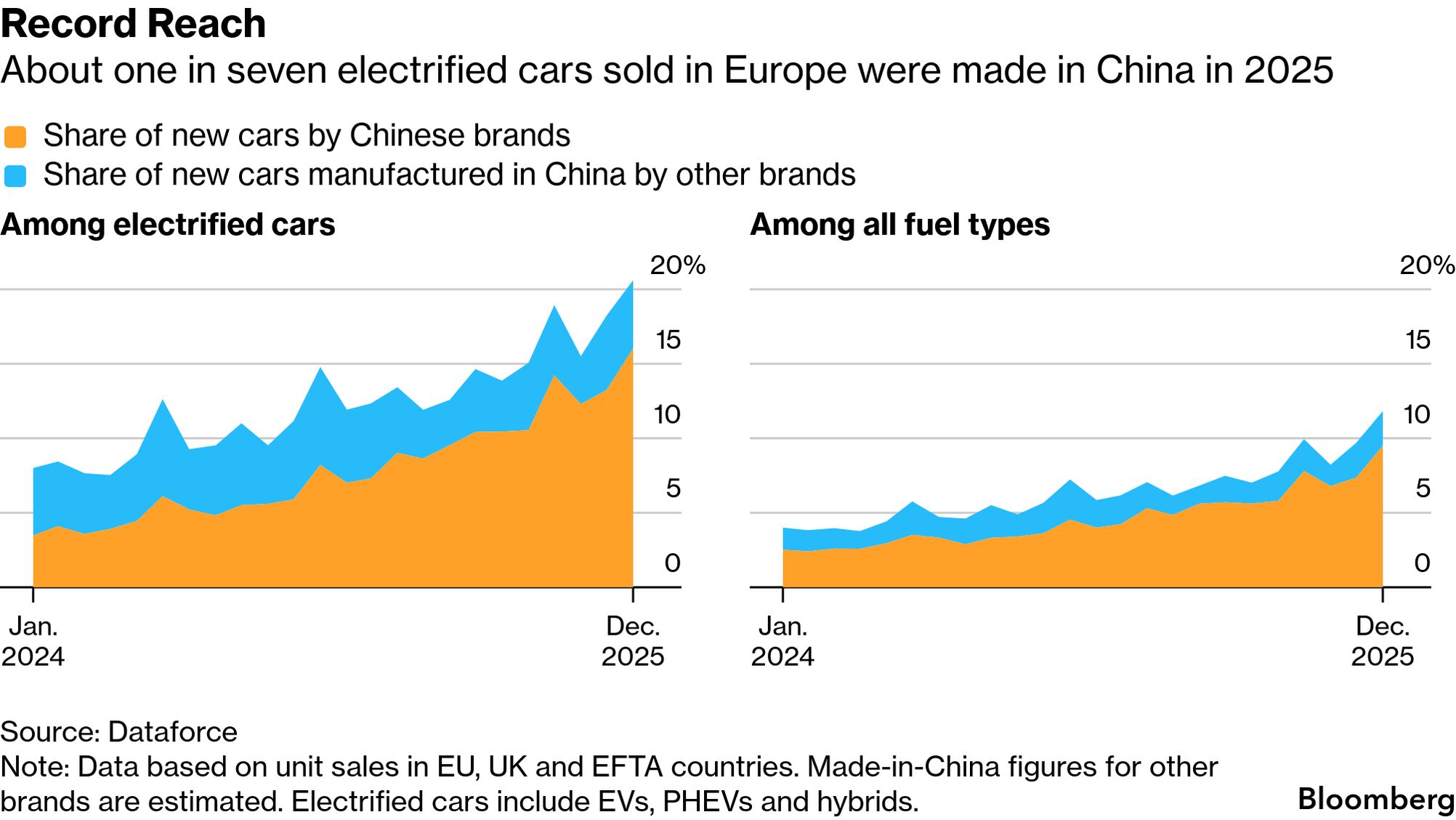

Seen and Heard on Bloomberg Hungarian Prime Minister Viktor Orban will continue to oppose Western financing to Kyiv and block Ukraine's potential future accession to the EU, according to Foreign Minister Peter Szijjarto. "We will not let the money of the European people be sent to Ukraine as long as we are in office," he told Bloomberg Television. He also defended the country's growing consumption of Russian energy. "Hungary is in a very dangerous, vulnerable situation with the Russian gas and oil being phased out," Szijjarto said of the EU plan. "This is an extremely harmful decision." Chart of the Day Chinese automakers built nearly one in 10 passenger cars sold in Europe last month, a record share that caps a year of rapid growth led by brisk sales of hybrid and battery-powered vehicles. Chinese brands accounted for 16% of Europe's electrified car market in December, and 11% for all of 2025, more than doubling from 2024. Coming up

Final Thought The Wallenberg dynasty is corporate royalty in Sweden, known for its strict hierarchy, sense of civic duty and firm-handed guidance. It is undergoing a succession effort, with the fifth generation leadership nearing retirement age and the next generation of leaders set to inherit a $40 billion business. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Friday, January 30, 2026

Brussels Edition: Euro-area boost

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment