| I'm Jonathan Levin and this is Bloomberg Opinion Today, your source for all the latest developments on the Fed chair reality show. Sign up here. Warsh Is Trump's Fed Pick | The Federal Reserve is one of the world's most powerful institutions. Its leaders must be economically brilliant, politically astute and financial market savvy. But perhaps above all, they must be very handsome — at least that's how President Donald Trump seems to think about it. The big news of the day was that Trump's reality show-like search for the next Fed chair ended in most curious of possible outcomes: with the selection of Kevin Warsh, a former Fed governor with a long history of hawkish statements. On the face it, it was extraordinarily hard to square the Warsh pick with Trump's longtime preference for easier monetary policy. During his time at the Fed from 2006-2011, Warsh was famously among the most vocal critics of quantitative easing and the most paranoid about inflation. And, sure, people can change. Though still a big critic of the Fed's large balance sheet, Warsh has conveniently become more dovish on interest rates in the past year — in a way that clearly supported his candidacy. But in the bizarre place that is TrumpWorld, it might have been his well-defined jawline that really put him over the top. "On top of everything else, he is 'central casting,' and he will never let you down," Trump wrote on social media. Don't forget, too, that Warsh is the son-in-law of major Republican donor and former Trump classmate Ronald Lauder, the son of Estee Lauder. That probably didn't hurt.From a markets and economic standpoint, it's hard to see how the Warsh nomination will lead to an optimal outcome. "If he lowers interest rates, markets will perceive him as a Trump lackey who has abandoned his principles," I wrote in my column Friday. "If he holds rates high for too long, he'll be at loggerheads with the president in no time — and that will generate volatility of its own." The main silver-lining is that Warsh won't be able to rule by fiat. Ultimately, he's still just one of 12 voters on the Fed's rate-setting committee.

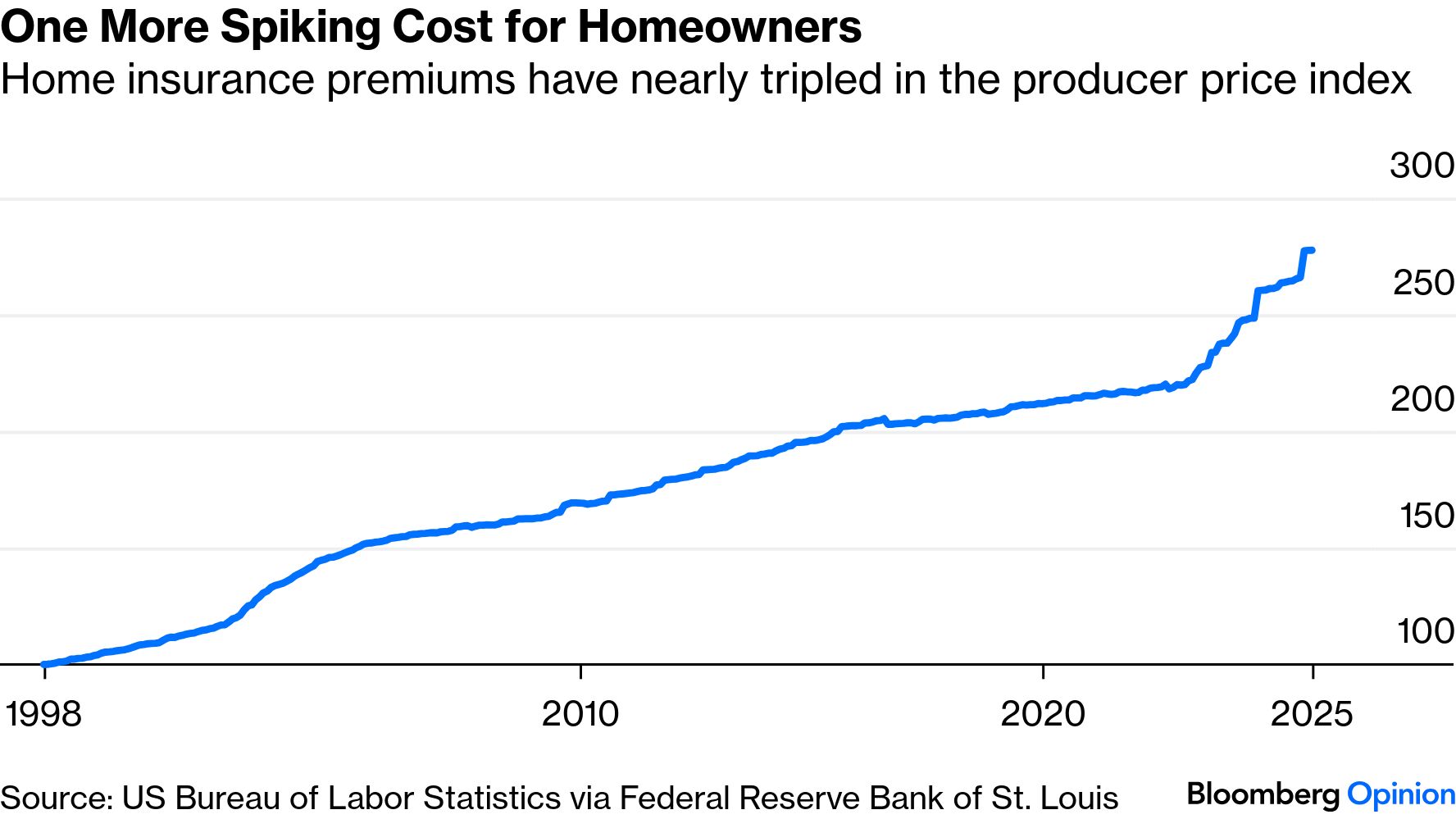

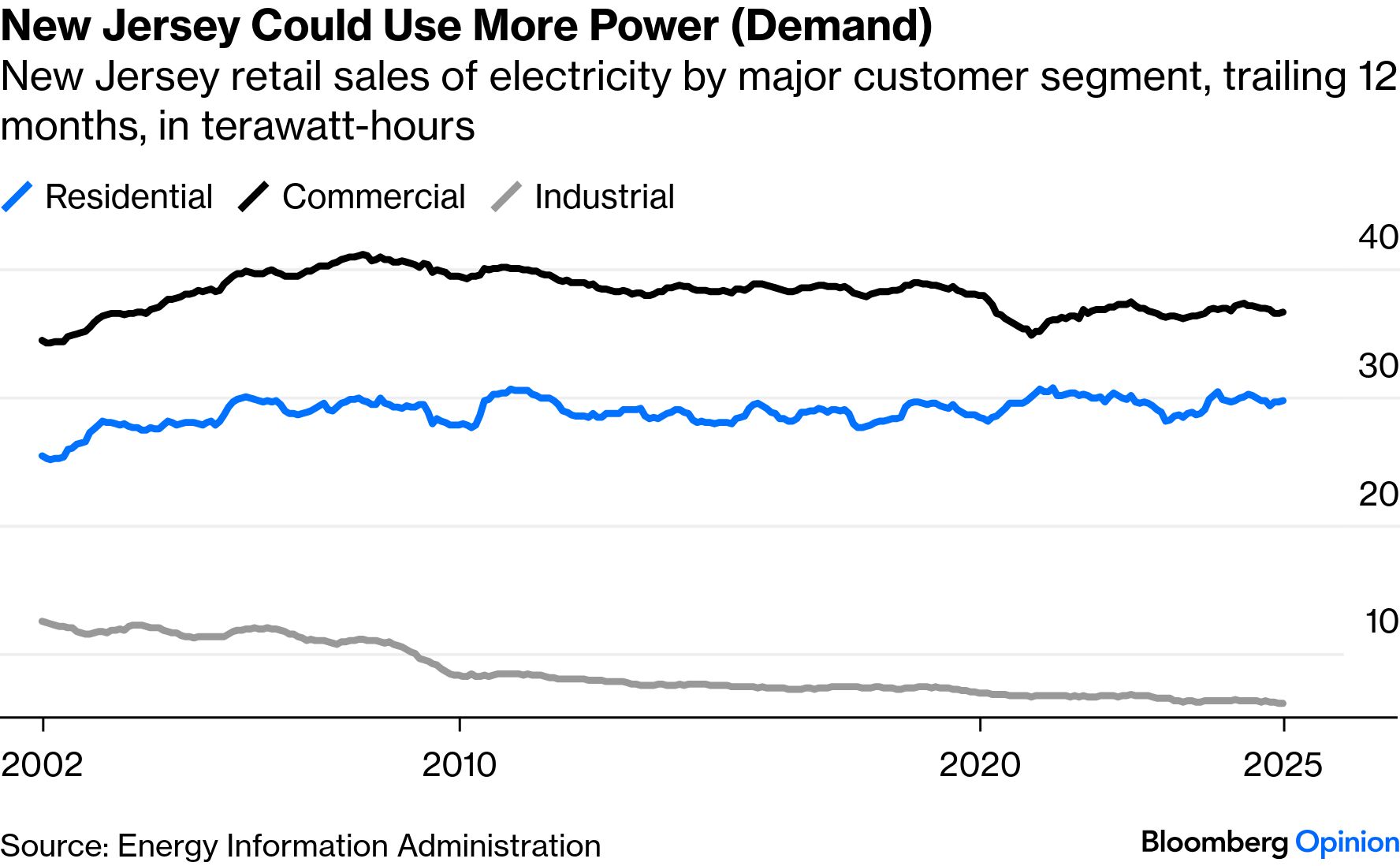

See more of what I had to say in this video: Green Shoots in Florida Housing | Nowhere is the Warsh nomination as important as the US housing market, where first-time buyers are still struggling to get a foothold at a time when prices are high relative to incomes and mortgage rates are still meaningfully above 6%. But according to Conor Sen, there may be some green shoots emerging in Florida, one of the hardest hit states. As Conor explains, "the key dynamic in Florida is that inventory is no longer increasing, a big change from the past few years when unsold houses steadily accumulated on the market." On a year-over-year basis, home prices are still falling in Tampa and Miami, but the market could be moving back toward some semblance of normalcy. However, Conor cautions that other parts of the country are still much earlier in that normalization process, with affordability having hardly improved so far. Another ongoing concern for prospective homebuyers is the soaring costs associated with homeowners insurance. Premiums are up nearly 25% from 2019 to 2024 in inflation-adjusted terms. "One problem is that disasters are getting more expensive," the Bloomberg editorial board writes. States still spend far too little on resilience, and legal costs have been increasing due to plaintiff-friendly laws. The attack on America's disaster recovery agency isn't helping. Mark Gongloff writes that Homeland Security Secretary Kristi Noem, as head of the Federal Emergency Management Agency, has already overseen the departure of a fifth of FEMA's staff, and she wants to downsize even further. Noem is also holding up around $17 billion in relief funds destined for the victims of earlier disaster losses, according to New York Times reporting. While Noem is already under fire for the tragedies unfolding on her watch in Minneapolis, Mark writes that her oversight of other disasters is equally problematic and poses a "greater threat to leave millions of Americans immiserated." To put the world's climate challenges in perspective, consider the following chart from the editorial board's piece on insurance. In recent years, there's been a major uptick in billion-dollar disasters, and insured losses were $108 billion in 2025. Electricity is yet another factor aggravating the cost of homeownership in America these days. That was especially clear in New Jersey, where Governor Mikie Sherrill kicked off her tenure by declaring an emergency on energy costs. AI data centers have become a popular scapegoat for electricity costs across the country, but Liam Denning points out that's an oversimplification. "Power prices are, in simple terms, costs divided by kilowatt-hours, which means it doesn't help when the latter are shrinking," he writes. "New Jersey is a prime example with demand down 12% from its mid-aughts peak." Powell couldn't possibly have rigged the 2024 election. – John Authers China is facing many setbacks in Latin America. – JP Spinetto Google's Deepmind shows AI could be big for medicine. – Lisa Jarvis There's a problem with Carney's Davos speech. – Adrian Woolridge Apple investors worry this is as good as it gets. – Dave Lee Journalist Don Lemon was charged after an episode at Minnesota church. Home Alone actress O'Hara has died at 71. Djokovic to face Alcaraz in Australian Open final. A large tegu lizard turned up in snowy Rhode Island. Trump orders IndyCar race in Washington to market America's birthday. Notes: Please send predictions about how long it will take for Trump to have beef with Warsh to Jonathan Levin at jlevin20@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment