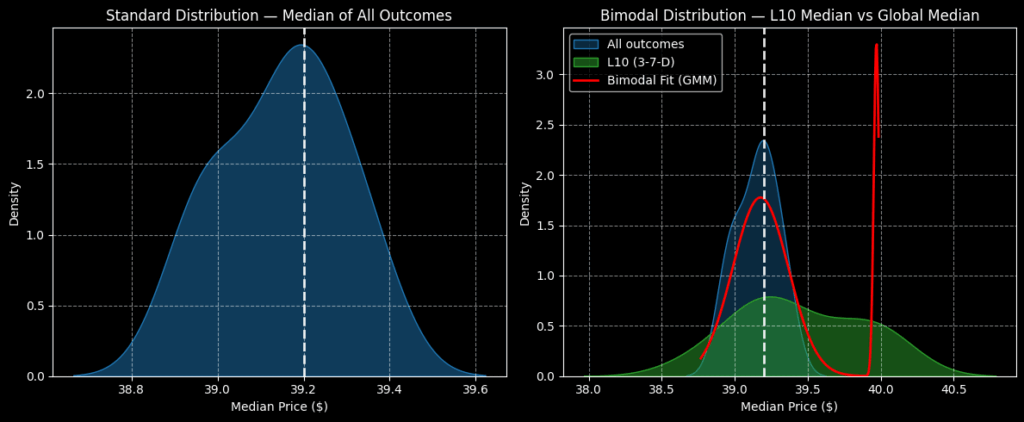

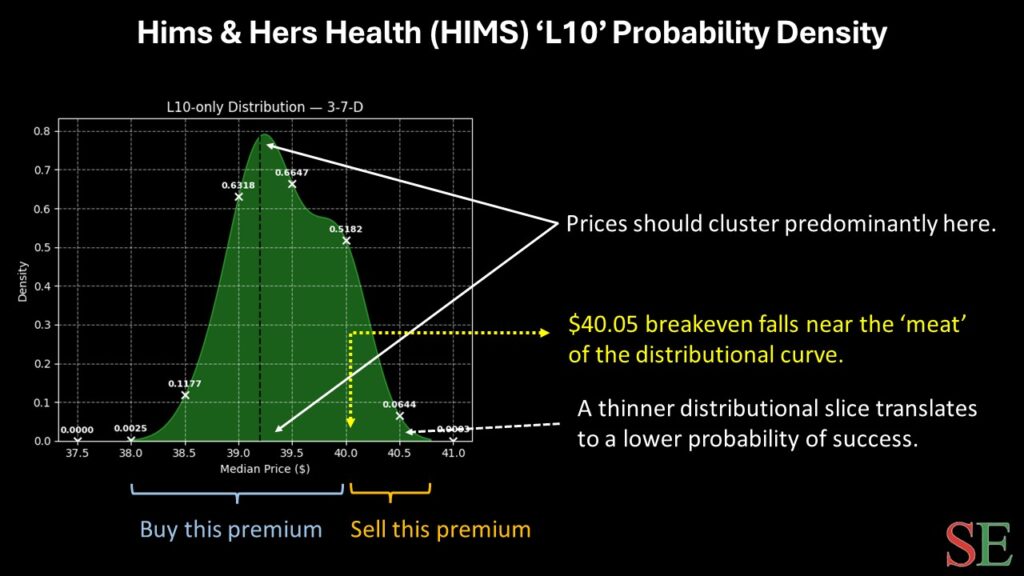

| With AI headlines heating up, BNZI stands out as a top stock investors shouldn't overlook. Banzai International (NASDAQ: BNZI) is redefining marketing technology with its AI-driven platforms that help companies grow faster through seamless integrations and mission-critical solutions across Acquisition, Engagement, and Analytics. In Q3 2025, Banzai posted $2.8 million in revenue, up 163% year-over-year, with gross margins soaring to 81.7%, demonstrating operational efficiency and rapid adoption of its offerings. Annual recurring revenue reached $11 million, reflecting a 168% increase from Q3 2024, while net losses narrowed significantly from $15.4 million to $5.9 million, signaling progress toward profitability. With over 140,000 customers and marquee clients such as Cisco, Hewlett Packard, and New York Life, BNZI proves that its AI-enhanced marketing and sales solutions are in high demand. Strategic acquisitions, including the Superblocks AI platform, strengthen BNZI's SaaS ecosystem by enabling businesses to create launch-ready, SEO-optimized websites and landing pages with ease. Leadership additions—Matt McCurdy as VP of Sales and Dean Ditto as CFO—position the company to accelerate enterprise adoption and expand its customer base further. Supported by a fortified balance sheet, debt reduction, and a new $11 million debt facility, BNZI is executing a disciplined growth strategy that combines AI innovation, customer expansion, and operational efficiency. Investors and marketers alike should watch closely as BNZI leverages technology and scale to dominate the $1.5 trillion marketing technology market. Discover why BNZI is the AI marketing tech growth story to not dismiss in 2026! Today's editorial pick for you HIMS Stock Probability Curve Just Shifted—Here's What It SuggestsPosted On Dec 08, 2025 by Joshua Enomoto Hims & Hers Health (NYSE:HIMS) is among the more intriguing publicly traded enterprises. The telehealth specialist provides prescription and over-the-counter medications, as well as personal care products. What makes the company stand out is its direct-to-consumer model, which helps it destigmatize sensitive health issues through convenient, discreet subscription services. As such, its digital-first approach resonates with younger, tech-savvy demographics. Table of ContentsUndoubtedly, the market has also taken strongly to HIMS stock, as evidenced by the security's 62% year-to-date return. However, the primary concern among both investors and traders is the wildness of the price action. For example, in the trailing month, HIMS is down about 4.5%. In the trailing half-year period, it slipped by 31%. Extreme caution is the order of the day. To be sure, the investment narrative is difficult to decipher. With a forward earnings multiple of over 81, observers most likely don't consider HIMS stock to be cheap. That's not to say that fundamental ratios carry universal truth claims because they don't. However, some of the key profitability metrics have shown a decline in recent quarters, raising concerns for stakeholders. Nevertheless, for those who want to speculate on the near-term fluctuations of HIMS stock, there could be an opportunity for data-driven options traders. Getting Down to the Root of the IssueUltimately, trading in the financial markets is a game of probabilities. When you really study the equities arena, you'll quickly discover that prices evolve around several factors or catalysts, including drift, volatility, regime shifts, feedback loops and institutional flows, to name but a few. Further, random, exogenous events could enter the system and disrupt the paradigm. Such mechanisms force trading to fall under stochastic process theory. By logical deduction, this kinetic environment that is Wall Street also necessarily means that there is no deterministic component that traders can rely on to navigate the market: no chart patterns, valuation ratios or even macro narratives. At the end, results filter through distributional outcomes, not certainties. On a related note, the inherent complexity of the market almost certainly means that trading systems that purport to issue exact buy or sell signals — while also providing terminal price targets at a specific point in time — are almost certainly marketing products, not genuine quantitative or mathematical tools. Still, understanding that trading represents probabilistic frameworks doesn't help us with an empirical anchor; that is, probabilities must be tied to a measurable event. In the market's case, the environment is heteroskedastic, which in technical language means that the variance of errors in a model is not constant across all values of the independent variables. In colloquial language, volatility tends to beget volatility. By logical inference, we can also state that different market stimuli yield different market behaviors or responses. Perhaps the best way to explain heteroscedasticity in the context of financial trading is baseball. All other things being equal, the harder you hit the ball, the further it will fly. In a controlled environment, if we know the barrel rate — or the quality of contact — we can estimate where the ball will land. What most traders don't realize is that, with integrated mathematics, it's possible to measure the stock market's equivalent of the barrel rate. However, the analytical process requires a formatting change. Obviously, HIMS stock or any other security represents a singular journey across time. Such a journey doesn't lend itself to probabilistic analysis due to the sample size being only one. However, what we can do is iterate or break apart price data into multiple rolling trials or sequences. In the field of statistics, this methodology aligns most closely with sliding-window empirical distribution. Basically, the idea here is that a non-random environment like the equities market will exhibit patterns across hundreds (if not thousands) of trials. Moreover, certain price points will feature greater clustering relative to other prices, a statistic known as probability density. As you might imagine, successful trading generally involves targeting profitability thresholds that feature the highest probability density — while also limiting potential opportunity costs. It's this delicate balancing act that separates sophisticated traders from those betting blindly on vibes and emotions. Drilling into the Trading Mechanics of HIMS StockUsing a bespoke algorithm called trinitarian geometry, which combines probability theory (Kolmogorov), behavioral state transitions (Markov) and calculus (kernel density estimation or KDE), the projected 10-week returns of HIMS stock can be arranged as a distributional curve, with outcomes ranging between $38.65 and $39.62 (assuming an anchor price of $39.20, Friday's close). Further, price clustering should occur at about the same price as the anchor.  The above assessment aggregates all trials since Hims & Hers' public market debut. However, we're interested in the current quantitative signal, which is the 3-7-D sequence; that is, in the past 10 weeks, HIMS stock printed three up weeks and seven down weeks, with an overall downward slope. Following this setup, the 10-week distributional outcomes shift conspicuously, with likely results ranging between $38 and nearly $41. Primary price clustering occurs at around $39.30, which admittedly isn't that much different from the baseline cluster. However, the probabilistic mass associated with the 3-7-D sequence is much bigger and leans toward the positive end of the spectrum. As such, secondary clustering exists just short of the $40 level. What's fascinating here is not only the calculation of probability but also the calculation of probability decay. Between $39.50 and $40, the probability density drops by 22% on a relative basis. However, at $40, density is still robust, meaning that there's statistically a decent chance that HIMS stock will land there over the next 10 weeks. Move the lever to $40.50, though, and the density drops exponentially, to the tune of 87.57% relative to $40. In other words, $40 represents the transition point where the price target exponentially turns from realistic to unrealistic. For the high-IQ trader, you would buy the part of the distributional curve that is statistically feasible — and then sell the part that is unfeasible.  Based on the current market situation, the most aggressive options strategy to consider is arguably the 39/41 bull call spread expiring Jan. 16, 2026. This wager requires two simultaneous transactions: buy the $39 call and sell the $41 call, for a net debit paid of $105 (the most that can be lost). If HIMS stock rises through the second-leg strike ($41) at expiration, the maximum profit is $95, a payout of over 90%. Of course, the $41 target represents a very low probability event. Still, the breakeven point for this trade is $40.05, which is right before probability decay worsens exponentially. As such, this trade has a decent chance of breaking even and allows the speculator to reach for the higher target while minimizing potential opportunity costs. This message is a PAID ADVERTISEMENT for Banzai International, Inc (NASDAQ: BNZI) from Sideways Frequency. StockEarnings, Inc. has received a fixed fee of $4000 from Sideways Frequency for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Dec 15, 2025 and Dec 19, 2025. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either Banzai International, Inc (NASDAQ: BNZI) or Sideways Frequency. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding Banzai International, Inc (NASDAQ: BNZI) on Huge Alerts website for additional information about the relationship between Sideways Frequency and Banzai International, Inc (NASDAQ: BNZI). StockEarnings, Inc |

Monday, December 15, 2025

🎯 The Tiny AI Marketing Company Giants Are Turning To

Subscribe to:

Post Comments (Atom)

Can Any Expenses Be Deducted From Capital Gains Tax?

What Expenses Can Be Deducted From Capital Gains Tax? Sponsored ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment