|

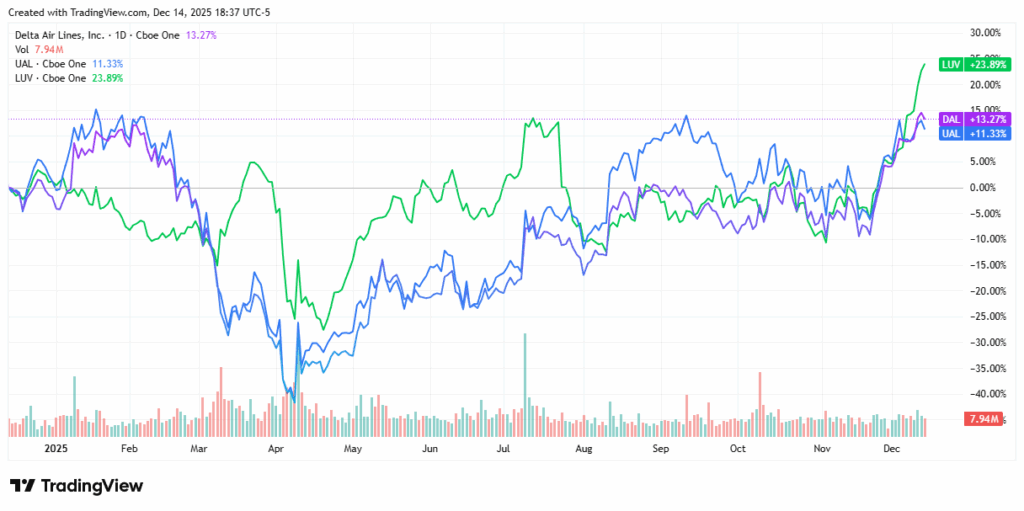

Drones are no longer toys or delivery gimmicks—they are becoming core infrastructure for modern economies. Across AI-driven automation, defense innovation, and high-growth drone services, ZenaTech, Inc. (NASDAQ: ZENA) is quickly becoming a name worth watching. The company reported record 1,225% year-over-year revenue growth in Q3 2025, with total revenue rising 6X over the first nine months of the year, driven primarily by the rapid expansion of its Drone as a Service (DaaS) model. In Q3 alone, DaaS accounted for 82% of total revenue, underscoring the shift toward recurring, scalable service-based income. As U.S. policy increasingly favors domestically built drone systems and restricts foreign components, ZENA is emerging as a timely beneficiary of regulatory tailwinds and accelerating government and enterprise adoption. What sets ZENA apart is its fully integrated ecosystem spanning AI-powered drones, DaaS subscriptions, enterprise SaaS platforms, and defense-ready systems—a combination few competitors can replicate. The company is aggressively scaling through acquisitions, with 13 DaaS acquisitions completed and a target of 25 locations by mid-2026, while expanding its federal footprint with a Washington, D.C. office and U.S.-based manufacturing in Arizona. From defense and infrastructure to agriculture, aviation, and renewable energy, ZENA is positioning itself as the backbone for next-generation autonomous operations—turning drones into an essential service rather than a discretionary tool. Today's editorial pick for you Is DAL Stock Ready to Climb Above the Field in 2026?Posted On Dec 16, 2025 by Chris Markoch Delta Air Lines (NYSE: DAL) stock is up nearly 20% in the 30 days ending December 12. And with DAL stock benefiting from several bullish analyst upgrades in December, Delta could be setting up for a strong year in 2026. However, investors who owned the U.S. Global Jets ETF (NYSEARCA: JETS) saw a 13.7% gain over the same period. Table of ContentsWhen Tiger Woods was at the peak of his dominance, analysts asked the same question before every major championship. Thinking about who's going to win, are you taking Tiger or the field? Heading into 2026, investors can ask a variation of that question. That is, should you invest in Delta stock or take the field? A Sea of Sameness in 2025Airline stocks can be a challenging sector even during the best of times. However, these last five years have been particularly challenging. Demand cratered in 2020, and after operations returned to normal, it took the industry time to regain its footing. That said, demand was strong in 2025 until the government shutdown in November. However, as the following chart shows, investors could have picked Delta, United Airlines (NASDAQ: UAL) or Southwest Airlines (NYSE: LUV), and they would have had a nearly identical return. At any given time, one stock may have been better than the other, but buy-and-hold investors would have wound up in roughly the same place.  But that was then. Savvy investors need to anticipate what could happen to the sector in 2026. In this case, industry dynamics favor a strong performance for Delta. Scarcity Works in Delta's FavorPerhaps learning their lesson from prior slowdowns, airlines are managing slower demand by cutting flights rather than trying to fill their planes with teaser fares. However, that strategy plays into the hands of Delta thanks to its profitable loyalty program and focus on premium seating. Delta also reported high single-digit growth in business travel. And although the company isn't known for international travel, the company's international travel business, particularly to Europe and South America has been growing. Managing Expectations Is a Winning StrategySpeaking at the Morgan Stanley Global Consumer & Retail Conference, Delta chief executive officer (CEO), Ed Bastian, told investors that the impact of the government shutdown would result in the company missing its prior earnings guidance for the fourth quarter by about $200 million, or about 25 cents per share. There are at least two key takeaways for investors. First, it's always a good sign when a company decides to get ahead of the news cycle. In this case, the only risk is if the Delta reports a larger loss in its report on January 9, 2026. Unless the market suffers from a particular black swan event in the next few weeks, that's unlikely. Second, Delta also said that demand remains strong in December and into 2026. That means that the airline is putting its focus on where it should, which is in the future. Risks to the ThesisThe most significant risk facing DAL stock in the short term is a second government shutdown at the end of January. As of this writing, Polymarket put the odds at 34%. That's less encouraging than investors would like to see. Another concern is the broader economy. By the time we get to the first of the year, investors will be getting back to the regular cadence of economic data from the government. Jobs data continues to show a soft job market. If that trend continues, airlines would be one of the sectors to feel it the most. And even though Delta is focused on the premium consumer, it's not without risk. A third risk is if the opposite happens. The economy is already "running hot" by historical GDP standards. What if it runs hotter in 2026. At some point, that will mean higher fuel prices. Delta Air Lines is relatively well protected from higher fuel prices through a combination of selective fuel hedging, ownership of the Trainer refinery, and strong pricing power. However, there would still be a limit to how much travelers are willing to pay. DAL Stock is the Biggest and the BestWhen investors discuss airline stocks, DAL stock is at or near the top of most lists. That sentiment was echoed by CNBC's Jim Cramer, who recently referred to the airline as "kind of the biggest and best in the airlines." The company's dominance in the premium space of the airline industry, its focus and commitment to paying down its debt, and a favorable technical outlook suggest that if investors want exposure to the airline sector, the answer to the DAL stock or the field question is likely to be Delta. This message is a PAID ADVERTISEMENT for ZenaTech, Inc (NASDAQ: ZENA) from Interactive Offers. StockEarnings, Inc. has received a fixed fee of $8000 from Interactive Offers for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Dec 17, 2025 and Dec 23, 2025. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either ZenaTech, Inc (NASDAQ: ZENA) or Interactive Offers. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding ZenaTech, Inc (NASDAQ: ZENA) on EQUISCREEN website for additional information about the relationship between Interactive Offers and ZenaTech, Inc (NASDAQ: ZENA). StockEarnings, Inc |

Wednesday, December 17, 2025

This Drone Stock is Powering a 1,225% Revenue Surge

Subscribe to:

Post Comments (Atom)

Sneak Peek at America's "Big Bang"

Five years of economic growth in 2026? Dear Reader, As a bonus for registering for my upco...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment