|

|

Semiconductor Weakness Could Doom Micron |

By Brandon Chapman, CMT |

Semiconductor stocks are circling the drain. |

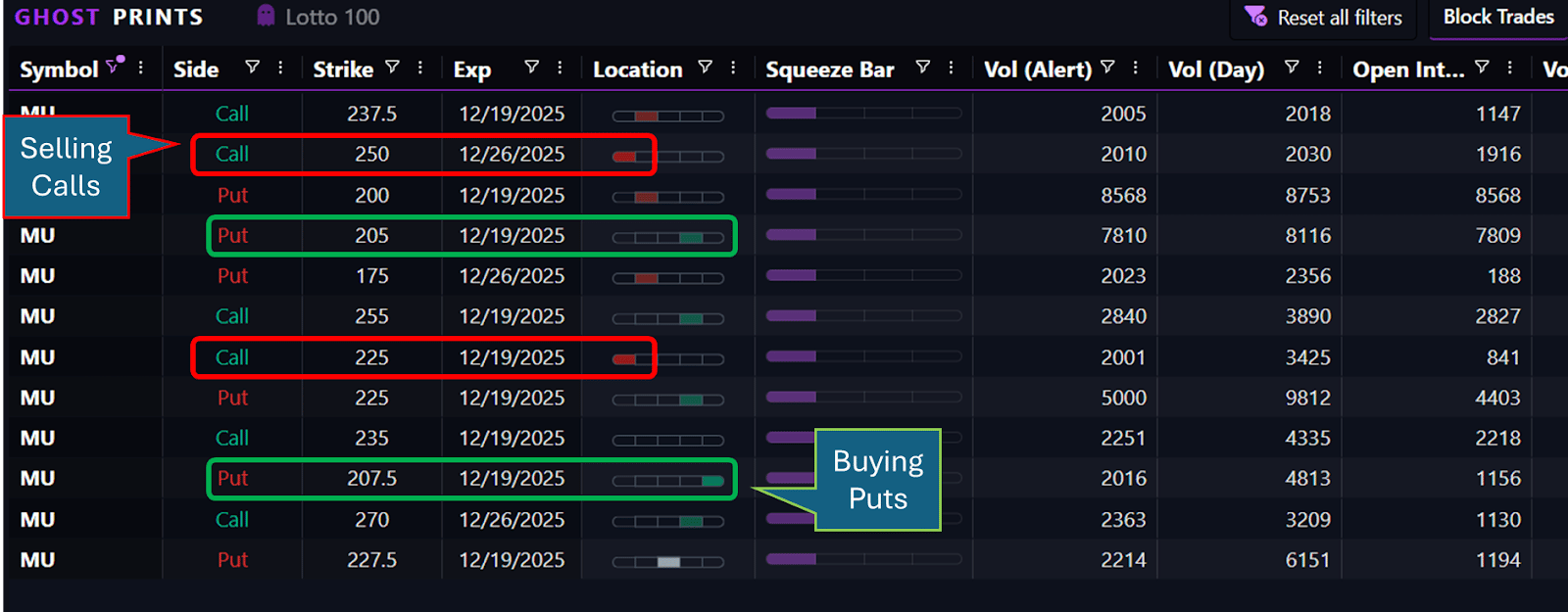

Someone spent the final two hours of yesterday's session buying MU puts. Aggressively. |

It is time to profit from this. |

15,000 contracts at the $215 strike. All filled at the ask price. |

Every single print between 2:31 PM and the close showed up green on the tape—pure buying pressure with zero hesitation. |

This wasn't speculation. This was positioning. |

And it's a great place to find a profitable trade. |

I'll be breaking down setups like this LIVE tomorrow at 7PM EST. |

You'll learn: |

|

Reserve your seat here. |

Now, let's dig into this specific analysis and see why it's so compelling. |

The Dominoes Keep Falling |

Micron's earnings don't really matter. |

Tomorrow could erase it all. It has happened already. |

Look at the other tech names in the space: |

Oracle gapped down 4.5% after disappointing guidance. Broadcom tried to rally at the open yesterday, then reversed hard—down 5.3% by close. Taiwan Semiconductor saw massive put activity days before its breakdown.

|

Now MU flashes the same signal hours before its earnings announcement. |

The pattern is clear: Weakness that started with isolated semiconductor names is spreading across the entire sector. |

These companies are deeply interconnected—when one stumbles on AI infrastructure concerns, the contagion moves fast. |

Market makers now hold 15,000 short put contracts at $215. |

Whether it is tomorrow morning or even a few days after, as Micron drifts toward that strike, those puts move from 11 delta to 50 delta. |

That means the hedging requirement quintuples. This creates mechanical selling pressure that feeds on itself—each dollar lower forces more shorting, which pushes price lower, which increases delta further. We call it gamma. |

Gamma doesn't predict the move. It amplifies whatever move starts. |

The Math on Downside |

The market is pricing a $20 move in either direction. That's the expected move with no directional bias. |

But the options market tells a different story. |

Look at this week's open interest. |

|

Call sold and puts bought at $230, $220, $215—massive size all built yesterday. Compare the potential downward move to the upside. |

The downside pressure is substantially greater than any upside gamma. |

Before earnings, MU closed around $226. A move to $215 would be routine. |

A move to $195—taking out the entire pre-earnings rally—$30 down from current levels–is not at all out of the question. |

What's the upside case? |

In this environment, $20 if earnings are spectacularly positive. More likely $10-15. |

The risk-reward clearly favors the downside. |

This mirrors what we're seeing sector-wide. When AI infrastructure spending shows cracks, when data center growth questions emerge, when Oracle's guidance disappoints—the floor drops out faster than charts predict. |

What Most Traders Miss |

The print we caught yesterday wasn't some hedge fund protecting a long position. |

The timing matters. The size matters. The strike selection matters. |

Two hours before the close, someone deployed serious capital betting MU disappoints. They didn't spread it across multiple strikes. They didn't leg into the position gradually. They hit the ask on 15,000 contracts knowing exactly what they wanted. |

That's not a hedge. That's a directional bet. |

And it's the third major semiconductor name in two weeks where we've seen this exact pattern: massive bearish flow into strikes that seem aggressive, followed by breakdown moves that make those strikes look prescient. |

Oracle's $190 puts. Broadcom's $300 puts. Now Micron's $215 puts. |

The Ghost Prints Console caught all three before the moves materialized. |

The Bigger Picture |

Technology is down 1.8% today. The Mag Seven tried to rally at the open and immediately faded. NVIDIA finally broke support after holding up while everything else sold off. |

Semiconductors lead technology. When chips weaken, software follows. When infrastructure spending questions emerge, cloud names feel pressure. When Broadcom cuts guidance, Microsoft and Google start sweating about their AI capex plans. |

|

This isn't isolated weakness. This is the beginning of sector rotation. |

The prints we're tracking don't show up on charts. Volume spikes don't reveal whether that volume is buying or selling. Price action doesn't tell you if institutions are positioning for more downside or just taking profits. |

But when 15,000 put contracts hit the tape in the final two hours, all filled at the ask, with earnings that same night—that signal is unmistakable. |

Someone knows something. Or at least thinks they do. And they're willing to back it with serious capital. |

The After-Party Trade |

MU reported after the bell Wednesday (but after the time of this writing). The options market was pricing a $20 move. |

If the print we caught yesterday turns out to be right, even if we happen to open higher on Thursday, MU could sell off hard. That $215 strike would suddenly look cheap. The gamma cascade accelerates, and the semiconductor weakness that's been building for two weeks goes from concerning to critical. |

The trade structure to consider is one that captures just the beginning of this move. A vertical put spread which begins with buying a $220 put, followed by selling a lower strike put ($215 or $210) to define your risk and opportunity. You're playing the breakdown to-and-through support with a fraction of the capital required to buy puts outright. |

Maximum risk is the debit you pay. Maximum profit is the width of the spread minus that debit. Simple. Defined. Structured around where institutional flow positioned before the crowd caught on. |

A surprisingly positive earnings report could turn the tide, but it could just as easily delay the inevitable. Those puts expire worthless Friday. But even then, the pattern holds—institutions are betting against this sector heading into the year-end, not for it. |

Watch the reaction tonight and tomorrow morning. |

Not just the price move, but how other semiconductor names respond tomorrow. NVIDIA, AVGO, TSM—they all move together when the trend shifts. |

And do yourself a favor…check out my latest video that explains in detail how I go from big money option signals to trade execution using the Ghost Prints Console. |

Look, the semiconductor weakness isn't over. The question is whether you're positioned for what comes next. |

Brandon Chapman, CMT

Creator of Ghost Prints |

No comments:

Post a Comment